March 8, 2013

By: Kelly Diamond, Editor

Individuals have best friends. Your assets need one too: the Cook Islands.

The Cook Islands are your assets’ best friend, because they constantly evaluate and fortify the measures by which they protect your wealth.

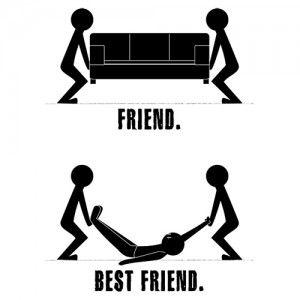

Ever hear the adage, “A friend will help you move, a best friend will help you move the body.” Well, when it comes to asset protection, you want the latter. You want the unshakeable “friend” who clams up and calmly replies, “What assets?” when interrogated. When we think of safe havens for wealth, many default to Switzerland or the Grand Caymans… probably because those two get the most publicity in movies. Turns out, deep in the South Pacific, due south of Hawaii, there exists an archipelago poised as your assets’ “best friend”: The Cook Islands.

The Backstory

While I hold no penchant for laws or legalities, this particular situation is an anomaly. The impetus behind the International Trust Amendment Act (ITAA) in the Cook Islands has its beginnings in American medical tort laws! In 1988, a group of U.S. attorneys watched as their medical practitioner clients got buried in onerous litigation proceedings. They decided to collaborate with a Cook Islands trust company, in hopes that trusts could be used as the mechanism to shelter the assets of these defendants, thus providing some protections in the event of otherwise devastating claims.

The passing of the ITAA in the Cook Islands is a testament to beautiful market forces! Prohibitive laws in the U.S. beget a demand for an asset safe-haven. The Cook Islands provide a supply for said demand, with nothing but economic advantages to gain from this arrangement, and voila! Political and legal minds alike criticize it, but if imitation is indicative of flattery, then eight of the United States (who are sadly subject to the supremacy clause of the U.S. federal courts) and sixteen other countries adopted this act, emulating the Cook Islands, in one form or another. While this offers some choice and competition, nothing touches the Cook Islands in terms of enforcement and protection.

Proof is in the Puddin’

Unlike the U.S. courts, where a lawyer need but perform a little semantic tap dance to get around any legal provisions which threaten to protect an individual, the Cook Islands’ judges remain less than impressed with such demonstrations.

1. Pacific Heritage Bank v Radke

Radke establishes his trust in the Cook Islands in October of 1992, defaulting on his loan December of that same year. PHB discovers his trust in January of 1994, and requests to collect from it. They claimed the intent of that account was to deliberately defraud the bank. With a one-year statute of limitations to bring such claims against a trust, the bank missed it by one year and three months.

PHB tried to manipulate the meaning of some of the verbiage in the statute, but, the Cook Islands judges held fast, and did not budge.

2. The Irrevocable Trust: The Anderson Case

In July of 1995, the Andersons set up a trust with a Cook Islands trust company. In May 1998, they were brought up on charges, whereby the U.S. Federal Trade Commission (FTC) requested an accounting and repatriation of all their assets.

In June 1998, the Cook Islands trust company DENIED the request! It refused to comply with the request on the following grounds: a.) the trustees were under duress, whereby making them NO LONGER co-trustees of the trust and b.) to comply would be in direct violation of two clauses stipulated in the trust agreement; one of which prevents those NOT included as beneficiaries from acquiring any assets held in that trust. Andersons are held in contempt of court and placed in jail.

In July of 1998, Anderson makes a plea to the trust company that if he acquires the consent of his children to repatriate the funds, will they comply? Request, again, DENIED!

In November 1998, Anderson’s lawyers decide to create a new trust, making the FTC the sole beneficiary and holder. In December, they went to remove the funds, relieve the existing trust company as trustee, and make the other trust company the new trustee. Request, DENIED, as invalid!

Later in December, the Andersons tried to remove themselves as protectors, making the new trust the substitute protector. Upon review, the Cook Island judge determined two things: a.) the Andersons were in fact operating under duress, and b.) the purpose of the other trust was to benefit an excluded party (in this case the FTC, an administrative body). Therefore, in accordance with the ITAA: request DENIED!

The FTC later tried to sue the Cook Islands to recover the assets, but the courts remained steadfast and refused on the grounds that they won’t entertain laws of foreign states.

3. Bank of America v Weese

In this case, the Cook Islands courts ultimately conceded. However, the courts defended the trust initially against mere “allegations” of fraud. They demanded, in accordance with the ITAA, that a strong case and a preponderance of evidence be provided to demonstrate intent to defraud by use of a Cook Islands trust. That burden was sufficiently met, but it highlights the onus upon anyone attempting to access a Cook Islands trust, and the stalwart defense of these protections outlined in the ITAA.

Bottom line

1. In the Cook Islands, the burden of proof is on the ones after your money: beyond a reasonable doubt. And the only grounds under which they will crack is fraud.

2. Cook Islands trust companies answer to Cook Islands law. With the exception of New Zealand, all other laws are not recognized by their courts. Moreover, it all goes down in their courts, with their lawyers. NO contingency fee counselors.

3. If you are under duress, protocols are in place to where your trustee will NOT relinquish the funds.

4. The costs associated with retrieving your funds through the Cook Islands court system are prohibitive to mere “fishing expeditions”.

5. Your assets will not be taxed. The Cook Islands realizes they stand to make more from your patronage, than from taxing your wealth.

It’s one thing to have the laws, it’s another to have the authority to enforce it, and it’s still another to have judges with the courage to do just that. Often imitated, but never duplicated, the Cook Islands meet all three criteria. Please don’t think this is a praise to any state. Like all governments, the Cook Islands are looking out for their own best interests and protecting their own reputation in being the best and most trust-worthy in offshore asset protection. But where there is mutual benefit, a symbiotic relationship is possible.

Given the precedent and the stakes involved for the Cook Islands, they are contenders for, if not deserving of, “best friend” status for your assets. The Cook Islands offer such services as Limited Liability Corporations (LLC), International Business Corporations (IBC), and Asset Protection Trusts (APT). The Cook Islands both understand and reap the benefits of defending individual wealth. They deliver on a promise long forgotten and lost here in the United States.

We can help you navigate the waters of offshore asset protection, and provide more information regarding the benefits of a Cook Islands trust. Set up an appointment by clicking here.

what are the approximate costs of a Cook Island Trust.

i.e, Set-up. Legal. Continuing admin fees. etc.

an approximation will do fine here as I realize there are many intangibles associated

Bobby or Paul should be contacting you with some answers. Thank you for your interest!

Hey Tom-

I have many of the same questions – have you found any answers? Thanks

Does one need to visit the Cook Islands to move one’s assets to that location? What proofs are required when opening an account in the Cook Islands? Is there a vault available for physical precious metals in Cook Islands?

What is the annual cost of same?

If I wish to visit my money in Cook Islands, are there reasonably priced accommodations available nearby? By reasonable I mean less than luxurious and more than backpacker.

I would like to move IRA’s to the Cook Islands from the USA. How can I do that without huge tax consequences? What are the maintenance fees for accounts like that?

Can one buy land fee simple in Cook Islands or is it all leasehold?

What is the route to Cook Islands from Hawaiian Islands where I live? I do not see anything direct by air.

Aloha,

Tom Beach