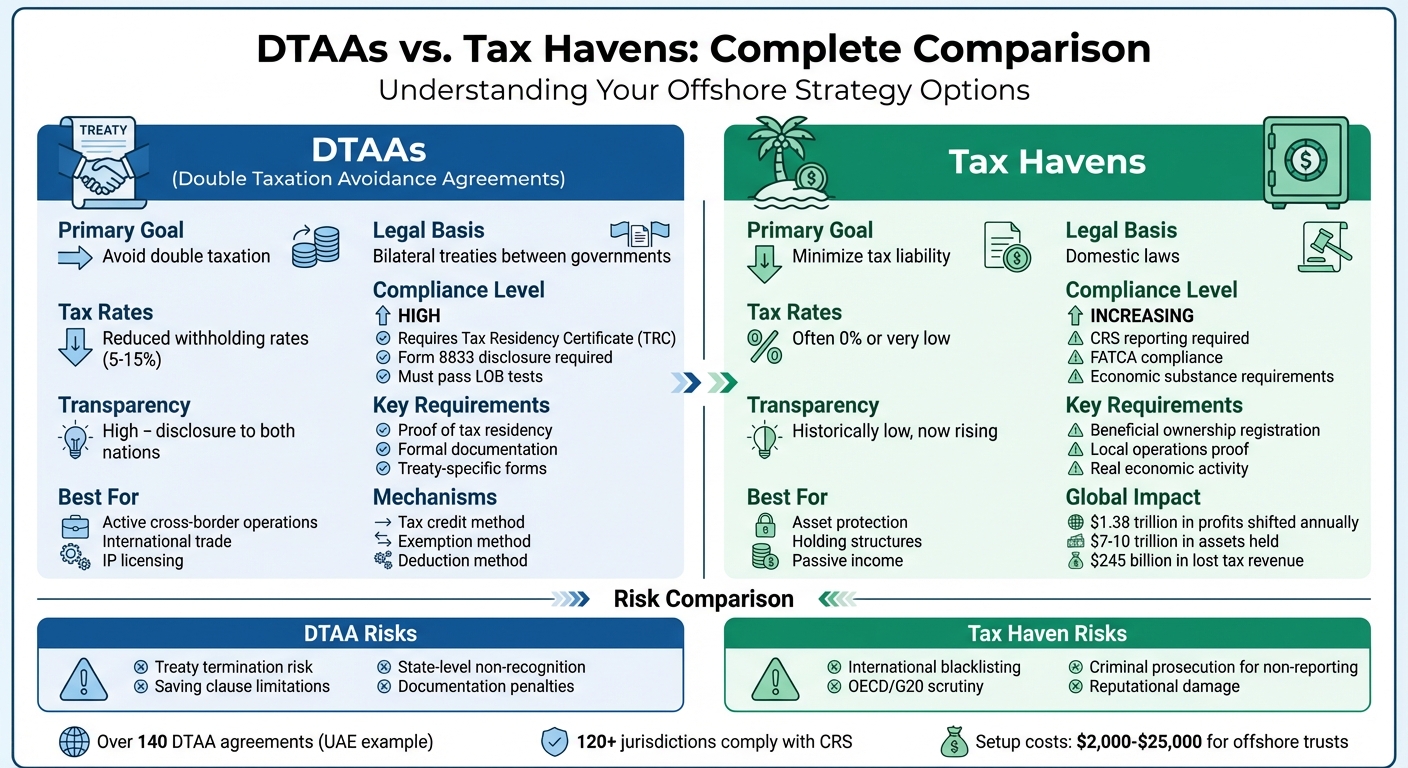

When structuring offshore entities, you’re likely to encounter two main strategies: Double Taxation Avoidance Agreements (DTAAs) and tax havens. While both aim to reduce tax burdens, they operate differently. DTAAs are formal treaties between countries to avoid double taxation, offering benefits like tax credits, exemptions, and reduced withholding rates. Tax havens, on the other hand, are jurisdictions with low or zero taxes, minimal reporting requirements, and privacy protections. Here’s a quick breakdown:

- DTAAs: Focus on preventing double taxation through treaties, requiring proof of tax residency and compliance with strict documentation.

- Tax Havens: Minimize taxes by offering low rates and privacy, but face growing scrutiny due to global transparency initiatives like CRS and FATCA.

Quick Comparison

| Feature | DTAAs | Tax Havens |

|---|---|---|

| Primary Goal | Avoid double taxation | Minimize tax liability |

| Legal Basis | Bilateral treaties | Domestic laws |

| Compliance | Requires tax residency proof | Increasing transparency rules |

| Tax Rates | Reduced withholding rates | Often zero or very low |

| Transparency | High | Historically low, now rising |

Both approaches come with unique benefits and challenges. DTAAs provide legal clarity and structured benefits but require strict compliance. Tax havens offer lower taxes but face increased regulation and reputational risks. Your choice depends on your business goals and operational needs. For more clarity, explore our frequently asked questions regarding offshore structures.

Legal Framework and Compliance Requirements

DTAAs (Double Taxation Avoidance Agreements) and tax havens operate under entirely different legal systems. DTAAs are formal bilateral agreements between governments, establishing clear rules that both countries must follow. Tax havens, however, function under domestic laws crafted to attract foreign investments through low taxes and minimal disclosure obligations.

These core differences impact everything from proving eligibility to maintaining records. Understanding these compliance structures is crucial when deciding on an offshore strategy, as each path comes with its own set of requirements.

DTAA Compliance Standards

To benefit from a tax treaty, you must first prove tax residency in a country that is part of the agreement. This isn’t automatic – it requires formal documentation. Most countries demand a Tax Residency Certificate (TRC) issued by your home government. For example, U.S. residents need to file Form 8802 to obtain Form 6166, which confirms they filed an income tax return as a resident.

Beyond residency certification, you’ll also need to complete treaty-specific disclosure forms. U.S. taxpayers use Form 8833 (Treaty-Based Return Position Disclosure) to inform the IRS of their claims under the treaty. Similarly, India requires Form 10F for such disclosures. Failing to submit these forms can result in losing treaty benefits, even if you meet all other qualifications.

"Most income tax treaties contain what is known as a ‘saving clause’ which prevents a citizen or resident of the United States from using the provisions of a tax treaty in order to avoid taxation of U.S. source income." – Internal Revenue Service (IRS)

This "saving clause" is a standard feature in most modern DTAAs. It ensures that your home country retains the right to tax you as if the treaty didn’t exist, preventing individuals from using treaties to completely escape domestic taxes. Treaties are designed to avoid double taxation, not eliminate taxation altogether.

Tax Haven Regulatory Environment

Tax haven regulations, on the other hand, have undergone significant changes due to global efforts to increase financial transparency. Historically, tax havens offered minimal reporting requirements and high levels of privacy. They were known for allowing "brass plate" companies – entities that existed only on paper, with no real operations or employees. But this is no longer the norm.

Initiatives like CRS (Common Reporting Standard), FATCA (Foreign Account Tax Compliance Act), and economic substance laws have reshaped the tax haven landscape. Today, these jurisdictions must identify beneficial owners, automatically share financial data with global tax authorities, and enforce rules requiring companies to demonstrate real business activity. Anonymous offshore banking has largely become a thing of the past.

Many tax havens now require businesses to show actual economic substance, such as having local employees, offices, and active operations. Shell companies without genuine activity risk being labeled as "harmful tax jurisdictions", which can lead to blacklisting and serious trade consequences. For instance, when Brazil blacklisted Ireland, Irish companies faced higher taxes and tighter scrutiny.

| Feature | DTAA Compliance | Tax Haven Compliance |

|---|---|---|

| Legal Basis | Bilateral international treaty | Domestic statutory law |

| Key Documentation | Tax Residency Certificate (TRC) | Beneficial ownership registration |

| Disclosure Requirements | Treaty position forms (e.g., Form 8833) | CRS and FATCA reporting |

| Transparency Level | High – requires disclosure to both nations | Historically low, now increasing |

| Substance Requirements | Focuses on residency status | Requires economic substance and local operations |

The compliance demands for DTAAs and tax havens are vastly different. DTAAs require clear proof of residency and income classification within a transparent and predictable framework. Tax havens, while offering attractive statutory benefits, now come with stricter local regulations and international transparency obligations. Businesses must also maintain real operational substance to avoid reputational damage and regulatory penalties.

sbb-itb-39d39a6

Tax Treatment and Reduction Mechanisms

Building on the basics of compliance and legal frameworks, let’s dive into how different mechanisms help reduce taxes. Double Taxation Avoidance Agreements (DTAAs) and tax havens approach this goal in distinct ways. DTAAs focus on coordinating taxing rights between two countries to avoid taxing the same income twice. On the other hand, tax havens attract foreign capital by imposing near-zero corporate tax rates. One aims to prevent overlap, while the other focuses on minimizing the total tax burden. Each approach comes with unique legal and operational considerations. For high-net-worth individuals, these structures often integrate into a broader asset protection and private family office strategy.

Every year, multinational corporations shift around $1.38 trillion in profits to tax havens, costing governments an estimated $245 billion in lost corporate tax revenue. Meanwhile, tax haven jurisdictions reportedly hold assets totaling between $7 trillion and $10 trillion. These figures set the stage for understanding the trade-offs between these two methods.

How DTAAs Prevent Double Taxation

DTAAs work by ensuring income isn’t taxed twice, using three main methods:

- Tax credit method: This allows taxpayers to offset taxes paid abroad against their domestic tax liability. For example, if foreign taxes exceed part of the domestic obligation, foreign tax credits can reduce the overall liability.

- Exemption method: One country gets exclusive taxing rights on specific income, while the other country exempts that income entirely.

- Deduction method: Foreign taxes are deducted from total taxable income. However, this method typically provides less relief than a direct tax credit.

DTAAs also help reduce withholding taxes on cross-border payments. Without a treaty, dividends, interest, and royalties might face withholding rates as high as 25–30%. Treaties often lower these rates to 5–15% or even eliminate them entirely. For example, the UAE has established an expansive DTAA network, with over 140 agreements in place as of 2025.

To benefit from these agreements, taxpayers need a Tax Residency Certificate (TRC) to prove they are tax-resident in a treaty country. Additionally, DTAAs protect business profits from being taxed in a foreign country unless a "Permanent Establishment" (like a fixed office or branch) exists there. Some jurisdictions even allow "treaty override", which lets taxpayers choose the more favorable terms between domestic law and treaty provisions.

Tax Minimization in Tax Havens

Tax havens take a completely different approach. Instead of coordinating with other nations, these jurisdictions impose minimal or zero taxes without requiring proof of foreign tax payments.

Profit shifting is the primary strategy that draws capital to tax havens. The Paradise Papers exposed how companies use intellectual property registrations to shift profits offshore, avoiding significant tax burdens. Back in the 1990s, U.S. corporations were achieving effective tax rates as low as 4% in these jurisdictions. A striking example occurred in 2015 when Apple moved about $300 billion in intellectual property to Ireland. This move was so impactful that it earned the nickname "leprechaun economics" due to its dramatic effect on Ireland’s GDP figures.

| Feature | DTAAs | Tax Havens |

|---|---|---|

| Primary Goal | Avoid double taxation | Minimize or eliminate tax liability |

| Mechanism | Tax credits, exemptions, and reduced withholding taxes | Zero corporate tax and profit-shifting strategies |

| Legal Basis | Bilateral treaties | Domestic tax policy |

| Compliance | Requires Tax Residency Certificates and disclosures | Historically low, now increasing with CRS and FATCA |

| Withholding Rates | Reduced to 5–15% | Often 0% |

DTAAs offer legal clarity and mechanisms like the Mutual Agreement Procedure for resolving disputes. However, they require significant compliance efforts and are under increasing scrutiny to prevent abuse. Tax havens, while offering substantial tax savings with minimal paperwork, come with risks such as blacklisting and limited treaty protection. Global transparency initiatives like CRS and FATCA have also pressured tax havens to adopt stricter standards. While traditional banking secrecy is largely a thing of the past, some jurisdictions now focus on providing low effective tax rates through complex profit-shifting tools rather than maintaining anonymity. These approaches highlight the trade-offs between structured treaty benefits and the simplicity of low-tax regimes.

Operational Suitability for Offshore Entities

When deciding between DTAAs (Double Taxation Avoidance Agreements) and tax havens, businesses must weigh tax benefits against everyday operational needs. The level of administrative work, compliance demands, and long-term feasibility varies significantly between these two options. Recognizing these operational differences is key to aligning your offshore strategy with your business objectives. These considerations complement the earlier discussion on legal and tax factors, helping to shape a well-rounded approach.

Comparison of Operational Aspects

The operational trade-off between DTAAs and tax havens boils down to substance versus simplicity. DTAA arrangements require detailed documentation but provide greater legal clarity. On the other hand, tax havens have historically been favored for their minimal paperwork and quick setup. However, global transparency initiatives are now pushing tax havens to adopt stricter compliance measures.

For businesses leveraging DTAA benefits, formal proof of tax residency is essential. For instance, U.S. entities need IRS Form 6166 to confirm residency. Additionally, companies must pass Limitation on Benefits (LOB) tests – anti-abuse measures designed to ensure the business isn’t a mere shell company exploiting treaty advantages. Many modern DTAAs include objective criteria to confirm that the business engages in genuine economic activities rather than existing as a mailbox operation.

Tax havens, once appealing due to their low physical presence requirements, are adapting to new norms. For example, structuring offshore trusts can cost anywhere from $2,000 to $25,000. Jurisdictions like Bermuda, the British Virgin Islands, and the Cayman Islands now enforce Economic Substance Requirements (ESR), mandating that businesses demonstrate real, income-generating activities within the jurisdiction. This shift makes it increasingly difficult for "paper-only" entities to remain compliant.

| Operational Criterion | DTAA Jurisdictions | Tax Havens |

|---|---|---|

| Compliance Focus | Proof of residency and LOB compliance | Economic substance requirements |

| Setup | High; requires legal substance and documentation | Low to moderate; growing complexity with ESR |

| Reporting Level | High; treaty disclosures required (e.g., Form 8833) | Moderate to high; CRS and FATCA compliance |

| Treaty Access | Extensive bilateral agreements | Limited for traditional havens; broader for corporate havens |

| Typical Use Case | Active trade, services, IP licensing | Asset protection and holding structures |

| Long-term Viability | High; internationally recognized | Variable; depends on OECD compliance |

The operational suitability of each option also depends on how well it aligns with your business model. For example, DTAA users face higher reporting obligations, such as disclosing treaty positions on tax returns – U.S. taxpayers must file Form 8833 for this purpose. Conversely, while tax havens have traditionally required less local reporting, over 120 jurisdictions now adhere to the Common Reporting Standard (CRS), which mandates automatic sharing of financial account information. Between April 2020 and March 2025, audits linked to the Panama Papers in Canada alone led to over $119 million in federal taxes and penalties, underscoring the growing enforcement of transparency.

Multinational corporations often favor DTAA structures for their legal clarity and reduced withholding taxes. Meanwhile, passive holding entities may still lean toward tax havens, provided they comply with evolving substance rules. Modern corporate havens, such as Ireland, Luxembourg, the Netherlands, and Singapore, offer a hybrid appeal: low effective tax rates paired with extensive treaty networks and adherence to OECD standards. These jurisdictions frequently act as "conduit" locations, channeling value to traditional "sink" havens where assets are ultimately held.

Risks and Considerations for Offshore Structures

Offshore strategies, whether through DTAAs or tax havens, come with their fair share of risks. Missteps can lead to costly errors, regulatory headaches, and even penalties. Let’s break down some of the key challenges.

DTAA Abuse and Double Non-Taxation Issues

DTAAs, while beneficial, don’t let you sidestep all domestic tax responsibilities. Thanks to their built-in "saving clause", U.S. citizens are still on the hook for domestic taxes, even when leveraging offshore entities. In short, these treaties aren’t a free pass.

Another common pitfall? Failing to file the right paperwork. For instance, if you’re claiming treaty benefits that alter standard tax rules, you’re required to submit IRS Form 8833 with your tax return. Skipping this step can attract regulatory attention and penalties. Plus, some treaty exemptions come with time limits – miss those, and you could face retroactive taxation for prior years. And here’s the kicker: not all U.S. states honor federal tax treaties. So, even if you qualify for federal exemptions, state-level taxes might still apply.

Treaty instability is another risk. Geopolitical shifts can lead to treaties being suspended or terminated without much warning. For example, the U.S. recently ended its treaty with Hungary and partially suspended agreements with Russia and Belarus. Once a treaty is gone, so are any reduced tax rates or exemptions.

Tax haven structures aren’t immune to scrutiny either, with global enforcement efforts ramping up significantly in recent years.

Tax Haven Scrutiny and Enforcement Challenges

Tax havens, much like DTAA-based structures, are under the microscope as international efforts to curb tax avoidance gain momentum. Initiatives like the OECD/G20 Base Erosion and Profit Shifting (BEPS) project and the global minimum tax aim to chip away at the advantages these jurisdictions once offered. As the United Nations Conference on Trade and Development (UNCTAD) puts it:

"DTTs aim to prevent instances of their improper use for the purpose of tax evasion and avoidance".

Gone are the days of offshore anonymity. Tools like TIEAs (Tax Information Exchange Agreements) and FATCA (Foreign Account Tax Compliance Act) give authorities the ability to track offshore accounts with precision. Even long-standing tax havens like the British Virgin Islands now share account information with foreign governments. The IRS, for its part, treats failure to report offshore funds as a criminal offense, and entities using tax havens risk being flagged on the "Dirty Dozen" scams list, which invites aggressive enforcement actions.

Here’s a quick comparison of the risks tied to each structure:

| Risk Factor | DTAA-Based Structures | Tax Haven-Based Structures |

|---|---|---|

| Regulatory Risk | Treaty abuse scrutiny and "saving clause" overrides | International blacklisting and global minimum tax (BEPS) |

| Reporting Requirement | Specific treaty-based disclosures (e.g., Form 8833) | Transparency mandates (FATCA, TIEAs) |

| Stability | Subject to treaty termination or suspension | Subject to changing international compliance standards |

| Local Tax Risk | Sub-national governments may not honor the treaty | Generally low local tax, but high risk of "top-up" taxes |

To navigate these challenges, staying proactive is key. Regularly check for updates on treaty statuses, as suspensions or terminations can happen without much notice. Keep detailed documentation, including residency certifications like Form 6166, to support your claims. If double taxation occurs despite a treaty, you can seek help from the "Competent Authority" to resolve disputes between treaty countries. The bottom line? Anticipate changes and adapt quickly to avoid getting caught off guard.

Conclusion: Choosing the Right Strategy for Offshore Entities

Deciding between DTAAs and tax havens boils down to your business goals and operational needs. If your company deals with active cross-border operations and faces genuine double taxation issues, DTAAs are the way to go. They provide reduced withholding taxes on dividends, interest, and royalties, along with formal dispute resolution mechanisms like the Mutual Agreement Procedure (MAP). For businesses that prioritize legal certainty and structured frameworks for international trade, DTAAs offer the clarity and support needed to navigate complex tax landscapes.

On the other hand, tax havens are ideal for minimizing tax burdens and protecting assets. Traditional havens often feature little to no tax rates, while modern corporate havens such as Ireland and Singapore combine compliance with OECD standards and robust treaty networks, enabling strategies like profit shifting. With an estimated $7 trillion to $10 trillion in assets parked in tax havens – accounting for up to 10% of global wealth – authorities worldwide have ramped up enforcement efforts. The introduction of the Common Reporting Standard (CRS) has largely dismantled banking secrecy, even in long-established havens.

To ensure compliance, establish your tax residency with proper documentation, such as Form 6166. Keep in mind that certain U.S. states may not recognize federal treaty provisions. When considering a tax haven, it’s essential to check its status against G20 or EU blacklists. Being linked to a blacklisted jurisdiction can lead to trade setbacks and heightened audit risks.

The global trend is shifting from traditional "sink" havens to OECD-compliant "conduit" havens, which offer extensive treaty networks and advanced tools for base erosion and profit shifting (BEPS). As experts highlight:

"The legality depends on full transparency and adherence to tax laws. It’s crucial to differentiate between lawful tax avoidance and illegal tax evasion".

Ultimately, your choice should align with the specific tax and compliance goals of your business. Whether you opt for the structured benefits of DTAAs or the tax advantages of havens, maintaining transparency and adhering to regulations is non-negotiable. Select the approach that strengthens your offshore strategy while keeping you firmly within the bounds of the law.

FAQs

What are the key compliance requirements for using DTAAs?

To take advantage of a Double Taxation Avoidance Agreement (DTAA), offshore entities must meet certain compliance criteria. First, they need to establish their residency status as defined by the treaty and show that their income originates from the relevant source. They must also adhere to limitation-on-benefits (LOB) or anti-abuse provisions, which are designed to prevent treaty exploitation. Maintaining proper documentation – such as certificates of residence and evidence of economic substance – is essential, especially for potential audits.

For U.S. taxpayers, claiming DTAA benefits involves filing Form 8833 with their federal tax return if the treaty alters their tax liability or changes the classification of income. Additionally, entities are required to comply with reporting standards like FATCA and the Common Reporting Standard (CRS) by providing account details to the IRS or appropriate foreign authorities. Accurate record-keeping is critical, as these records might be reviewed during the statutory audit period.

What impact have global transparency initiatives had on tax havens?

Global efforts to improve financial transparency, like the U.S. Foreign Account Tax Compliance Act (FATCA), the OECD’s Common Reporting Standard (CRS), and the Base Erosion and Profit Shifting (BEPS) framework, have made it much harder for tax havens to operate in secrecy. These initiatives compel financial institutions to report detailed account information to tax authorities, creating stricter compliance demands for both businesses and individuals.

This increased oversight has led to fewer new registrations in many traditional tax havens. In response, some jurisdictions have adjusted by offering structures that meet reporting standards while still providing certain tax advantages. The heightened scrutiny has also reshaped offshore activity, with many investors now favoring locations that adhere to global transparency rules. Although offshore entities still serve legitimate purposes, the rising costs of operating in non-compliant jurisdictions are pushing more investors and businesses toward regulatory compliance.

What are the risks of using a tax haven instead of a DTAA?

Using a tax haven instead of leveraging a Double Taxation Avoidance Agreement (DTAA) can bring about serious risks for businesses. These risks include potential legal troubles, such as investigations into tax evasion or money laundering, which could result in hefty penalties and damage to the company’s reputation.

On top of that, businesses might miss out on the advantages offered by DTAAs, like lower withholding tax rates and access to structured mechanisms for resolving disputes. Tax havens are often criticized for their lack of transparency and limited information-sharing agreements, which can draw increased regulatory scrutiny and lead to more compliance hurdles.