Exiting a high-tax country can come with significant financial hurdles, particularly exit taxes on unrealized gains. These taxes treat your assets as if sold before departure, targeting wealthier individuals to prevent tax avoidance. Here’s how you can legally reduce or avoid these taxes:

- Plan Early: Start 12–24 months before expatriation. Restructure assets, time income events wisely, and ensure compliance with tax obligations.

- Understand Rules: Exit tax rules vary by country. For example, the U.S. targets "covered expatriates" with a net worth over $2M or high average tax liabilities. Other nations like France, Germany, and Canada impose similar taxes on unrealized gains.

- Restructure Assets: Use strategies like gifting, realizing losses, or setting up trusts to lower taxable gains or net worth.

- Leverage Tax Treaties: Treaties can help avoid dual taxation and clarify residency status.

- Choose a Tax-Friendly Destination: Some countries have lower or no exit taxes, making them ideal for relocation.

Key Takeaway: Early planning, asset restructuring, and professional advice can help you minimize tax exposure while ensuring compliance with legal requirements.

How Exit Taxes Work in High-Tax Countries

Common Exit Tax Rules and Mechanisms

In many high-tax countries, exit taxes operate on a "deemed sale" or "mark-to-market" basis. Essentially, tax authorities treat your departure as if you sold all your assets at their current market value the day before leaving – even though no actual sale takes place. The tax is calculated on the unrealized gains, which is the difference between the asset’s purchase price and its current value.

For instance, if you originally bought stock for $100,000 and its value has risen to $500,000, the $400,000 gain becomes taxable income when you leave. This system is designed to prevent people from moving to low-tax regions to avoid paying taxes on appreciated assets.

Some countries impose additional conditions, such as requiring you to have been a tax resident for a certain number of years before these rules apply. Others use thresholds for net worth or income to determine eligibility. In the U.S., for example, the rules target "covered expatriates" – individuals with a net worth exceeding $2 million or an average annual tax bill above $206,000 over the past five years.

Tax-deferred retirement accounts, like IRAs and 401(k)s, are also affected. They are treated as though you withdrew the full balance before leaving, meaning the entire amount is taxed as ordinary income. In some countries, exit taxes are triggered based on the percentage of company shares you own. Below, we’ll break down how these rules differ across various nations.

Exit Tax Rules by Country

- France: Residents who have lived in France for at least 6 of the last 10 years face exit taxes if they hold company shares worth more than €800,000 or own over 50% of a company. Moving to another EU or EEA country allows for automatic deferral, and the tax may be canceled if the assets remain unsold for 15 years or if the individual returns to France.

- Germany: Exit taxes apply to individuals who held at least 1% ownership in a company during the last 5 years. Starting in 2025, investment funds valued at €500,000 or more will also be taxed. For moves within the EU or EEA, taxes can be paid in installments over 7 years, with interest.

- Spain: If you’ve lived in Spain for 10 of the last 15 years and hold shares worth over €4 million or own more than 25% of a company valued above €1 million, exit taxes apply. A 10-year deferral is available for EU/EEA moves, and the tax is waived if you return within 10 years.

- The Netherlands: The focus is on individuals with at least a 5% substantial interest in a company. For moves within the EU/EEA, deferral is automatic and interest-free, with taxes due only if the assets are sold.

- Norway: Starting in 2025, exit taxes will apply to unrealized gains exceeding NOK 3 million (about $275,000). You can defer payment over 12 years without interest. However, if you receive dividends amounting to 70% of the deferred tax, a proportional share of the tax becomes due. The tax is waived if you return to Norway.

- Canada: When leaving Canada, most assets are treated as though they were sold at fair market value. However, Canadian real estate is specifically exempt from this rule.

- United States: As mentioned earlier, exit taxes apply to "covered expatriates." Worldwide assets, including tax-deferred retirement accounts, fall under this regime, though deferral is possible through an irrevocable election.

- Belgium: Starting January 1, 2026, Belgium will implement a 10% exit tax on company shares. However, if you don’t sell your shares within 24 months of leaving, the tax does not apply.

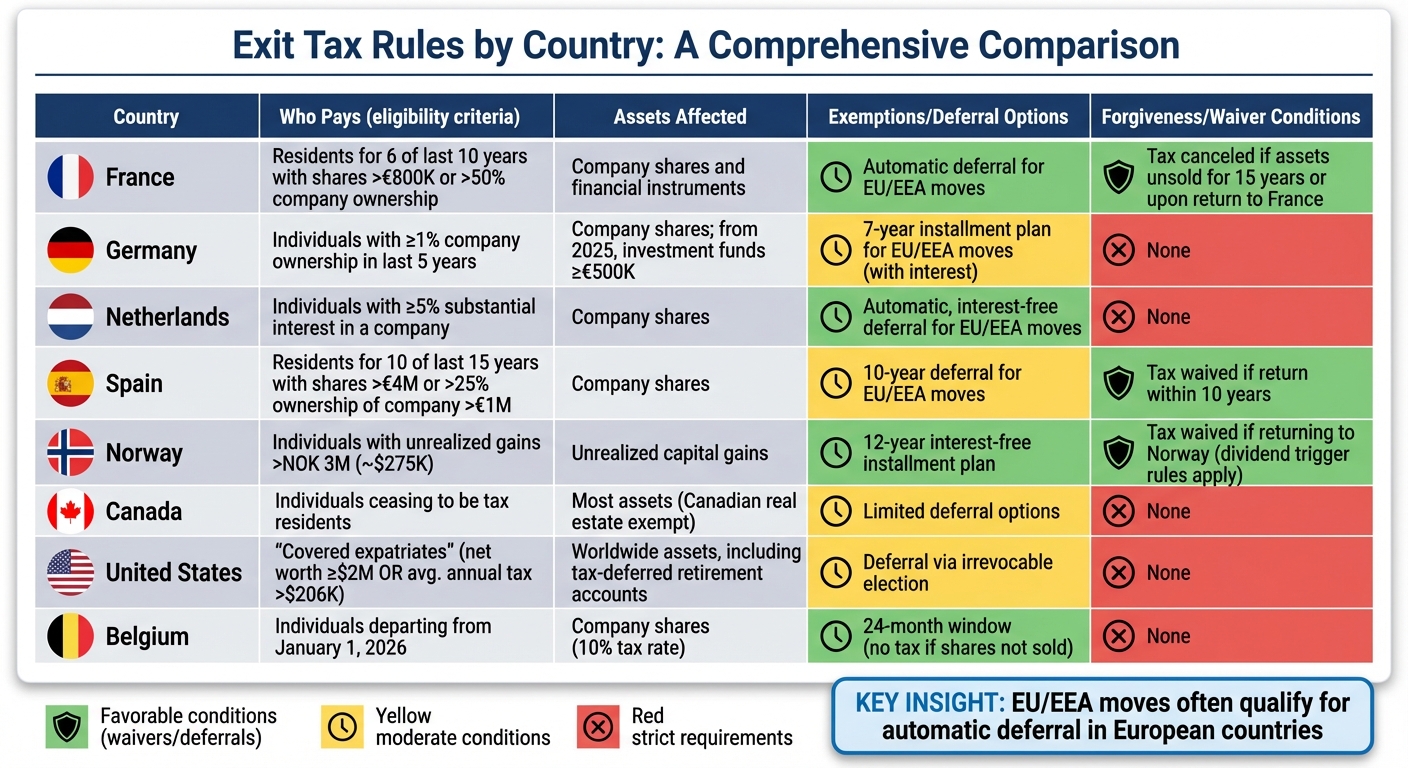

Exit Tax Comparison Table

| Country | Who Pays | Assets Affected | Exemptions/Deferral | Forgiveness/Waiver |

|---|---|---|---|---|

| France | Residents (6 of last 10 years) meeting share/ownership thresholds | Company shares and financial instruments | Automatic deferral for EU/EEA moves | Tax canceled if assets remain unsold for 15 years or upon return to France |

| Germany | Individuals holding ≥1% of a company in the last 5 years | Company shares and, from 2025, investment funds ≥€500K | 7-year installment plan for moves within the EU/EEA | – |

| Netherlands | Individuals with ≥5% substantial interest in a company | Company shares | Automatic, interest-free deferral for EU/EEA | – |

| Spain | Residents (10 of the last 15 years) meeting share/ownership thresholds | Company shares | 10-year deferral for moves within the EU/EEA | Tax waived if the taxpayer returns within 10 years |

| Norway | Individuals with unrealized gains exceeding NOK 3 million | Unrealized capital gains | 12-year interest-free installment plan | Tax waived if returning to Norway (with dividend trigger rules) |

| Canada | Individuals ceasing to be tax residents | Most assets (with Canadian real estate exempt) | Limited deferral options | – |

| United States | "Covered expatriates" (net worth ≥$2M or average annual tax >$206K) | Worldwide assets, including tax-deferred retirement accounts | Deferral via irrevocable election | – |

| Belgium | Individuals departing starting January 1, 2026 | Company shares | 2-year window (no tax if shares not sold within 24 months) | – |

Calculating Your Exit Tax Exposure Before You Move

List and Categorize Your Assets

To get a clear picture of your exit tax exposure, start by compiling a detailed inventory of all your global assets and liabilities as of the day before your planned expatriation date. Be thorough – this means including all types of assets, not just real estate or brokerage accounts.

Organize your assets into categories such as:

- Investment accounts: Stocks, bonds, mutual funds.

- Business interests: Company shares, partnership stakes.

- Retirement accounts: IRAs, 401(k)s, pension plans.

- Real estate: Primary residence, rental properties, vacation homes.

- Intellectual property: Patents, trademarks, royalty rights.

- Tangible personal property: Art, jewelry, vehicles.

Proper categorization is crucial because different asset types are taxed in different ways. If you own a business, make sure to include all your business interests in this inventory. These are considered in your exit tax calculations if you’re classified as a covered expatriate.

Calculate Your Unrealized Gains

After listing your assets, determine the fair market value (FMV) of each asset and compare it to its original cost basis – essentially, what you paid for it. The difference between these two values is your unrealized gain, which is treated as though it’s been realized under the mark-to-market regime applied in the U.S. and similar systems.

In the U.S., as of 2025, the first $890,000 of net unrealized gains is exempt from taxation. Gains exceeding this threshold are taxed at long-term capital gains rates, typically between 15% and 20%, with an additional 3.8% Net Investment Income Tax potentially applied. On the other hand, losses on certain assets can offset your gains before the exclusion is applied, reducing your taxable amount.

Understanding Residency Tests and Tax Triggers

Your liability for the exit tax hinges on specific residency tests that determine whether the tax applies. In the U.S., the exit tax is levied on individuals classified as covered expatriates as of their expatriation date. Other countries have their own rules for triggering exit tax obligations, so it’s essential to understand the regulations in your current country of residence.

Tax treaties can also influence your liability. These agreements often include tie-breaker rules to resolve dual residency issues, considering factors like where your permanent home is located, the strength of your personal and economic ties, and where you usually live. Consulting a qualified tax professional is highly recommended to navigate these complexities and avoid double taxation. A thorough understanding of your assets and the tax triggers will lay the groundwork for legal restructuring strategies discussed in the next section.

Legal Strategies to Reduce or Avoid Exit Taxes

Restructure Your Assets Before Leaving

Planning ahead – ideally 18 to 24 months – can help you lower your net worth below the $2 million threshold for covered expatriates or reduce taxable unrealized gains before expatriation.

One effective approach is strategic gifting, which can decrease both your net worth and tax liability. If you’re married to a U.S. citizen, you can transfer unlimited assets to your spouse without triggering gift taxes. For non-U.S. citizen spouses, the gift tax exemption in 2025 is $190,000. Additionally, you can make annual exclusion gifts of $19,000 per individual – or $38,000 for married couples – to children or other family members without affecting your taxable estate. For larger transfers, you can use your lifetime gift and estate tax exemption, which is $13.99 million per individual in 2025. Structuring these gifts into Generation-Skipping Transfer (GST) tax-exempt trusts may also be a smart move.

Another option is to strategically realize gains before expatriation. For instance, selling assets with unrealized losses to offset gains can reduce your tax burden before applying the $890,000 exclusion. If your net worth is slightly above the covered expatriate threshold, it might make sense to realize some gains while you’re still a resident. This way, you pay regular capital gains tax instead of facing an exit tax on all unrealized appreciation later.

These steps can be part of a broader plan that includes offshore structures and careful timing, creating a more comprehensive strategy for minimizing exit taxes.

Use Offshore Companies and Trusts

After restructuring your domestic assets, you might consider using international legal structures to protect your portfolio while staying within the law.

Offshore trusts and companies can provide asset protection and tax optimization – when set up properly and within legal boundaries. The idea is to transfer ownership of your assets to an irrevocable offshore trust or company before the exit tax is triggered. Once these assets are held by such entities, they are no longer considered part of your personal holdings, reducing their exposure to domestic taxes upon your departure.

Jurisdictions like Anguilla, the Cook Islands, and Nevis are known for strong asset protection laws and privacy safeguards. However, these structures need to be created well in advance to avoid scrutiny under anti-avoidance rules. It’s also crucial that the trust or company serves a legitimate business purpose beyond tax minimization, and you must comply with all reporting requirements, such as filing FBARs and, when applicable, Form 3520 for U.S. taxpayers.

Governments are increasingly monitoring expatriates who claim non-residency but maintain close ties to their home country. To withstand scrutiny, any offshore structure must demonstrate genuine economic substance and comply with international reporting standards like the Common Reporting Standard (CRS).

Timing Your Restructuring and Staying Compliant

Timing is everything when it comes to reducing tax exposure and staying compliant with legal requirements.

Spread asset transactions over 18 to 24 months and ensure all tax filing requirements are met to avoid being classified as a covered expatriate. Every transaction should have a legitimate business or personal justification. If you fail the tax compliance test, you’ll automatically be considered a covered expatriate. This means you must file and pay all federal taxes for the five years prior to expatriation, including income taxes, gift taxes, and required information returns for foreign accounts or entities.

Keep an eye on emerging trends that might affect your plans. Some countries are moving toward taxing unrealized gains immediately, making it harder to defer taxes. Spain and Canada, for example, have proposed wealth taxes targeting high-net-worth individuals. Cryptocurrency holdings are another area of concern, as tax authorities continue to issue inconsistent guidance on how these assets should be treated upon departure. To navigate these complexities, work with experienced tax professionals who understand the rules in both your current country and your destination.

sbb-itb-39d39a6

Selecting a Tax-Friendly Country for Your New Residency

Countries with Low or No Exit Taxes

Once you’ve restructured your assets and planned your departure, the next step is finding a destination with little to no exit taxes to help minimize your overall tax burden.

Countries with low taxes often have reduced rates on income, corporate earnings, capital gains, and inheritance. On the other hand, jurisdictions with no taxes typically rely on alternative systems, like consumption-based taxes, instead of taxing income or corporate profits. Many of these places also offer residency programs tied to investments, making them appealing for individuals looking to optimize their tax situation. Beyond the low tax rates, favorable tax treaties can add another layer of financial relief by reducing liabilities even further.

How Tax Treaties Can Reduce Your Tax Burden

Tax treaties can be a powerful tool for avoiding certain tax complications, especially for U.S. green card holders. For example, these treaties can help you sidestep the classification as a long-term resident, which would otherwise trigger exit tax liabilities. By claiming tax residency in another country under a treaty’s tie-breaker rules and informing the IRS, you can sever your ties with the U.S. before hitting the eight-year threshold that defines long-term residency. This process typically involves filing specific IRS forms, such as Form 8833 and Form 8854, while ensuring you take advantage of applicable treaty benefits.

"Under certain income tax treaties, nonresident individuals may be exempt from being classified as long-term residents." – The Tax Adviser

Tax treaties also include tie-breaker rules to clarify which country has the primary right to tax you if you’re considered a resident in more than one jurisdiction. As mentioned earlier, these provisions are key to navigating dual residency situations. Additionally, some treaties provide favorable terms for pensions and deferred compensation, potentially exempting certain foreign pensions from U.S. taxation.

It’s important to remember that U.S. citizens and residents are required to report and pay taxes on their worldwide income, no matter where they live. However, with proper planning and strategic use of tax treaties, you can significantly lower your overall tax obligations. These treaty benefits are crucial when preparing to establish genuine tax residency, which is covered in the next section.

Steps to Establish Your New Tax Residency

Once you’ve restructured your assets, the next step is ensuring your new residency aligns with a solid tax strategy. Establishing tax residency isn’t just about securing a visa; you need to demonstrate that your life has fully relocated to the new country. Tax residency is usually determined by factors like the number of days spent in the country, the location of your permanent home, and where your key personal and professional ties – such as family, business, or social connections – are based.

To meet these requirements, start by thoroughly researching the residency criteria of your chosen country. This includes understanding the minimum stay requirements and the type of local ties you’ll need to establish. Once you meet these conditions and secure your residency – whether through investment, employment, retirement, or another qualifying route – focus on showing clear commitment to your new home. This could involve opening local bank accounts, securing housing, and actively engaging in community activities. These steps will help solidify your status and ensure you meet all tax residency requirements.

Creating and Executing Your Exit Plan

Exit Plan Implementation Checklist

Breaking your exit plan into three clear phases – assessment (12–18 months ahead), asset restructuring (6–12 months before the exit), and execution (the year of exit) – can help streamline the process over 12–24 months.

During the assessment phase, focus on calculating potential tax liabilities, reviewing asset valuations, and confirming the details of your destination country. In the restructuring phase, put tax-efficient strategies into action. This might include setting up offshore trusts, diversifying investments, or realizing losses to offset gains. Finally, in the execution phase, establish residency in your new jurisdiction, file all necessary final tax returns and exit paperwork, and create frameworks for ongoing compliance.

For U.S. citizens and green card holders, this process includes filing Form 8854 with your final tax return and submitting Form I-407 to officially relinquish Green Card status. If applicable, you can also opt to defer the mark-to-market tax on deemed sold property by making an irrevocable election. However, this comes with interest charges and requires providing adequate security.

Timing plays a huge role in minimizing complications. For example, green card holders who expatriate before reaching eight years of residency may avoid being classified as covered expatriates. Additionally, keeping your net worth under the $2 million threshold for 2025 – through strategies like gifting assets or making charitable transfers – can help you sidestep the exit tax.

Maintaining Proper Records and Documentation

Once your plan is in motion, meticulous record-keeping becomes essential. Document every financial activity to counter potential audits. This includes maintaining detailed records of all transactions, obtaining qualified valuations for your assets, and securing legal documents that support both your exit strategy and your new residency status. Third-party valuations of your worldwide assets can be especially helpful for accurate exit tax calculations and to address any challenges from the IRS.

A key requirement is certifying five years of full U.S. federal tax compliance on Form 8854. This involves filing all required tax returns and FBARs (Foreign Bank Account Reports). If you’re behind on filings, you might consider using the Streamlined Filing Compliance Procedures. This program allows you to submit three years of overdue tax returns and six years of FBARs for non-willful non-compliance, as long as the IRS hasn’t already contacted you.

Additionally, keep a detailed log of your travel and connections to both your former and new jurisdictions. This will help demonstrate a genuine change in domicile if tax authorities require further proof. Proper documentation not only supports your case but also reduces legal and financial risks during your transition.

Managing Legal and Financial Risks

Poor planning can lead to unexpected consequences, like immediate taxation on unrealized gains or turning tax-deferred accounts into instant liabilities. Similarly, failing to comply with residency requirements could result in dual taxation.

To avoid these pitfalls, ensure timely execution of your plan and work with qualified tax and legal professionals in both your current and target jurisdictions. These experts can help ensure that any asset restructuring is backed by legitimate business purposes, rather than appearing as purely tax-driven moves – helping you steer clear of anti-avoidance rules. Thoughtful preparation and expert guidance can significantly reduce your tax exposure and residency risks, ensuring a smoother exit process.

Conclusion: How to Successfully Exit a High-Tax Country

Avoiding exit taxes when leaving a high-tax country requires careful planning, strict compliance, and the right professional advice. Interestingly, most individuals who renounce U.S. citizenship or give up their green card manage to avoid paying any exit tax. As we’ve discussed, the key lies in understanding the rules and starting the process early.

Ideally, you should begin planning 12 to 24 months ahead of your intended expatriation date. Once you’ve officially expatriated, the opportunities to minimize or eliminate exit taxes are no longer available. Focus on critical benchmarks: keeping your net worth under $2 million, ensuring your annual tax liability stays below $206,000, and maintaining five years of tax compliance. Among these, the compliance test is the most common stumbling block – and, thankfully, the easiest to address.

If you’re behind on tax filings, take advantage of compliance procedures to submit overdue tax returns and FBARs without penalties for non-willful non-compliance. This step alone can help you avoid falling into "covered expatriate" status, which brings significant tax burdens.

Lastly, work with cross-border tax advisors who understand the tax laws in both your current and future countries. They can assist in calculating your potential exposure, legally restructuring your assets, and ensuring every required form is filed accurately. For example, failing to properly file Form 8854 could result in a $10,000 penalty. By taking these preparatory steps, you can set yourself up for a smooth and compliant transition.

FAQs

How can I legally reduce or avoid exit taxes when leaving a high-tax country?

To legally reduce or sidestep exit taxes when leaving a high-tax country, it’s essential to start with a clear understanding of your current country’s tax laws and plan well in advance. Thoughtful financial planning can help you stay below the thresholds that trigger these taxes. For instance, gifting assets or restructuring your investments might lower taxable gains.

Timing plays a big role, too. Coordinating your income, deductions, and asset sales at least 18 to 24 months before your move can put you in a better tax position. On top of that, exploring tax treaties or residency options in countries with more favorable tax systems – like Portugal or the UAE – can help reduce or delay your tax obligations.

It’s always a good idea to work with a qualified tax professional who can guide you through the process, ensuring compliance while tailoring a strategy that aligns with your financial objectives.

How can tax treaties affect my tax responsibilities when moving to another country?

Tax treaties are crucial when it comes to easing or even eliminating tax obligations during an international move. These agreements often include measures to prevent double taxation, clarify tax residency rules, and specify which country has the authority to tax different types of income.

Familiarizing yourself with the details of a tax treaty between your current country and your destination can help you plan your relocation effectively. This knowledge can save you from unnecessary tax complications and might even reduce exit taxes. For tailored advice, working with a tax professional who understands these treaties is a smart move – they can guide you through the complexities and help you take full advantage of the treaty’s provisions.

What are some effective strategies to avoid exit taxes when leaving a high-tax country?

To steer clear of or lessen exit tax liability, it’s worth restructuring your assets thoughtfully before making your move. This could involve transferring certain investments or consolidating accounts to bring down your taxable net worth. Timing matters a lot – aim to relocate during a time when your income and net worth fall below the thresholds (set at $2,000,000 for net worth or $206,000 in annual income as of 2023). You should also explore tax treaties between your current country and your new one, as they can help you avoid double taxation or cut down your tax burden.

A tax professional can guide you through the process, ensuring you meet all legal obligations while positioning yourself financially for the best outcome.