July 14, 2014

By: Kelly Diamond, Publisher

Well, first a brief refresher on who the Troika is: The European Commission, The European Central Bank, and The International Monetary Fund.

The stated purpose of the Troika is to manage the Eurozone’s financial affairs, including, but not limited to, bailout situations.

The world watched as Italy, Ireland, Portugal, Spain, Greece, and Cyprus hit rock bottom. Slovenia was my guess for the next to collapse, but there is still France who is looking a little shaky as well. With all this instability, the Troika is empowered. They are the economic triad that comes up with all the bailout policies and brokers the deals between the various nations to keep the Eurozone afloat.

In a preemptive, and totally predictable, move, The IMF is exploring the idea of making expropriation the default setting for all EU banks. This should scare every single Eurozone citizen right out of their boots! For now… as if this is any consolation whatsoever to anyone… pensioners are on the hit-list.

Many government or public jobs have pension plans that are invested in the respective countries’ treasuries. I don’t know to what extent that is true in the United States, but it’s not to say that the US is above dipping into its government employees’ pensions to keep the banks going either.

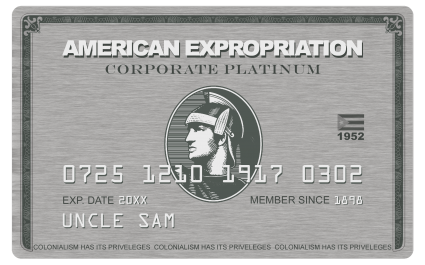

Expropriation is a rather soft term for what basically amounts to theft. It’s not much different than eminent domain. It is the taking of property for the gain of government or perhaps its cronies.

This is what happened to Cyprus. This is what can happen to anyone… especially in the EU if this is what they are currently discussing at the IMF. There were concerns last year when the “bail in” for Cypriot banks happened, and now this is slowly becoming the policy for all of the EU.

“The paper is nothing more than an orderly liquidation of government debt – at the expense of bondholders who can be forced pensioners without their knowledge. The focus is on countries that either have no access to the financial market, or ‘whose debt is considered sustainable, but not with a high probability.’” – Zerohedge.com

Various discussions and options are on the table right now, ranging from the direct expropriation of funds, to percentages of those funds, to fudging the maturity rate of the bonds they buy. And by fudging I’m not talking about

While I’m not advocating that we all put our money under our mattresses, I do think it is worth reevaluating where we store it. Right now, a good number of people believe that a bank is where you store your money to keep it safe. In the US, the bank is really an interest free loan so that banks can capitalize and lend out your money for profit. If you read the fine print, your bank account is just a mark. They agree, for the most part, to make good on financial commitments you make outside the bank with things such as transfers, checks, and the use of your debit card.

If it should ever happen that they cannot make good on your mark and they do go bankrupt, in theory, the FDIC comes to the rescue for up to $250,000. Remember, there is a reason why there are very strict rules surrounding cash withdrawals. It caps out at a couple hundred dollars at the ATM. And you typically cannot cash checks at banks where you aren’t an account holder without a fee. Banks, especially in the United States, are poorly capitalized. They can’t afford for everyone to take out cash… but at the same time they have to tow the political line of encouraging everyone to spend, spend, spend!

Governments both in the US and in other countries have set the precedent that banks are “too big to fail”. Sadly, government and even many individuals, put all their faith and eggs into the same fiscal basket and expect a different result.

The idea that a government can just get together with its favorite appointees and cronies and decide that your money isn’t yours anymore is a frightening prospect, but not an unrealistic one. Remember, when this happened in Cyprus, the Troika vehemently denied this would set any precedent! And yet, here they are, discussing this very thing for other countries… And yet the US has already done this at least once before when the debt ceiling was still hanging in the balance.

Asset protection isn’t some silver bullet cookie-cutter notion. It’s not a one-trick pony. It is a custom strategy that involves planning and knowing your options and your markets. Mostly, it’s about straying from everything you’ve been told to do. I honestly hate reading or reporting these tragic stories of honest people getting their hard earned savings stolen… AGAIN (don’t forget their taxes were the first round of theft). I will hate it just as much when that story inevitably unfolds here in the United States.

Everyone can afford for me to be wrong. No one can afford for me to be right.

If you are interested in setting up a consultation, click here.