The way assets are protected is evolving fast. Rising litigation, economic uncertainty, and tighter regulations are reshaping strategies for safeguarding wealth. Here’s what you need to know:

- Offshore Trusts: Jurisdictions like the Cook Islands and Anguilla offer strong legal barriers against creditors, but compliance with global reporting standards like FATCA and CRS is essential.

- Blockchain Integration: Tools like multi-signature wallets and smart contracts make digital assets harder to seize while enhancing security.

- AI in Risk Management: AI helps detect threats and streamline compliance, reducing false positives and improving monitoring.

- Regulatory Changes: Transparency is now mandatory. Frameworks like the OECD’s Crypto-Asset Reporting Framework (CARF) are set to impact crypto-asset reporting by 2027.

- Cybersecurity for Digital Assets: With crypto-related cyberattacks on the rise, strategies like cold storage and jurisdictional diversification are critical.

To protect your wealth, it’s crucial to act early, combining legal safeguards with modern technology. Offshore trusts, blockchain tools, and AI-driven compliance can form a resilient defense against emerging risks.

Offshore Trusts and New Jurisdictions

Offshore trusts have shifted from being secretive financial tools to becoming legal structures that rely on the strengths of specific jurisdictions. With global transparency initiatives like the Common Reporting Standard (CRS), hiding assets is no longer a viable option. Instead, the focus now lies on the procedural benefits a jurisdiction can offer when creditors attempt to challenge asset transfers.

Why Use Offshore Trusts

Offshore trusts create significant hurdles for creditors by requiring them to re-litigate claims under the laws of the trust’s jurisdiction. For instance, countries like the Cook Islands and Nevis do not acknowledge U.S. court judgments. Creditors must restart legal proceedings locally and meet a much higher burden of proof – "beyond a reasonable doubt" – for fraudulent transfer claims. This is in stark contrast to the lower "clear and convincing" standard used in the U.S.. Additionally, foreign trustees operate outside U.S. legal authority, meaning they are not obligated to enforce U.S. court orders. This combination of legal barriers can make pursuing claims both costly and time-consuming.

These jurisdictions also impose shorter time limits for fraudulent transfer claims – typically 1 to 2 years, compared to 2 to 4 years in the U.S.. While setting up a Cook Islands trust costs around $25,000, a domestic asset protection trust typically costs about half as much. However, the higher initial expense of an offshore trust often translates to stronger legal protections.

"The value of an offshore trust today is no longer in secrecy, but in the legal strength and procedural advantages a specific jurisdiction offers."

– Raea Khan, International Estate Planning Lawyer, PBL Law Group

Anguilla: A Growing Offshore Jurisdiction

Anguilla is gaining traction as a modern and reliable offshore jurisdiction. As a British Overseas Territory governed by English Common Law, it provides a familiar and well-established legal framework. Recent updates, such as the International Trust Act and the International Business Companies Act, have brought flexibility for creating various trust types, including discretionary, charitable, and non-charitable purpose trusts.

Anguilla’s asset protection laws are specifically designed to shield assets from foreign judgments and forced heirship claims, ensuring they remain governed by local laws. Additionally, the jurisdiction imposes no local income tax, capital gains tax, inheritance tax, or gift tax on international trusts. However, beneficiaries must still comply with tax obligations in their home countries.

The Anguilla Financial Services Commission enforces international standards like FATF, CRS, and FATCA while maintaining confidentiality through closed registers and limited public access. High-net-worth individuals often pair Anguilla trusts with corporate entities such as International Business Companies (IBCs) or Limited Liability Companies (LLCs) to separate assets and limit liability. For U.S. taxpayers, compliance involves filing IRS Forms 3520 and 3520-A annually to avoid penalties.

As offshore trust structures continue to evolve, emerging technologies like blockchain are starting to reshape how asset protection is managed.

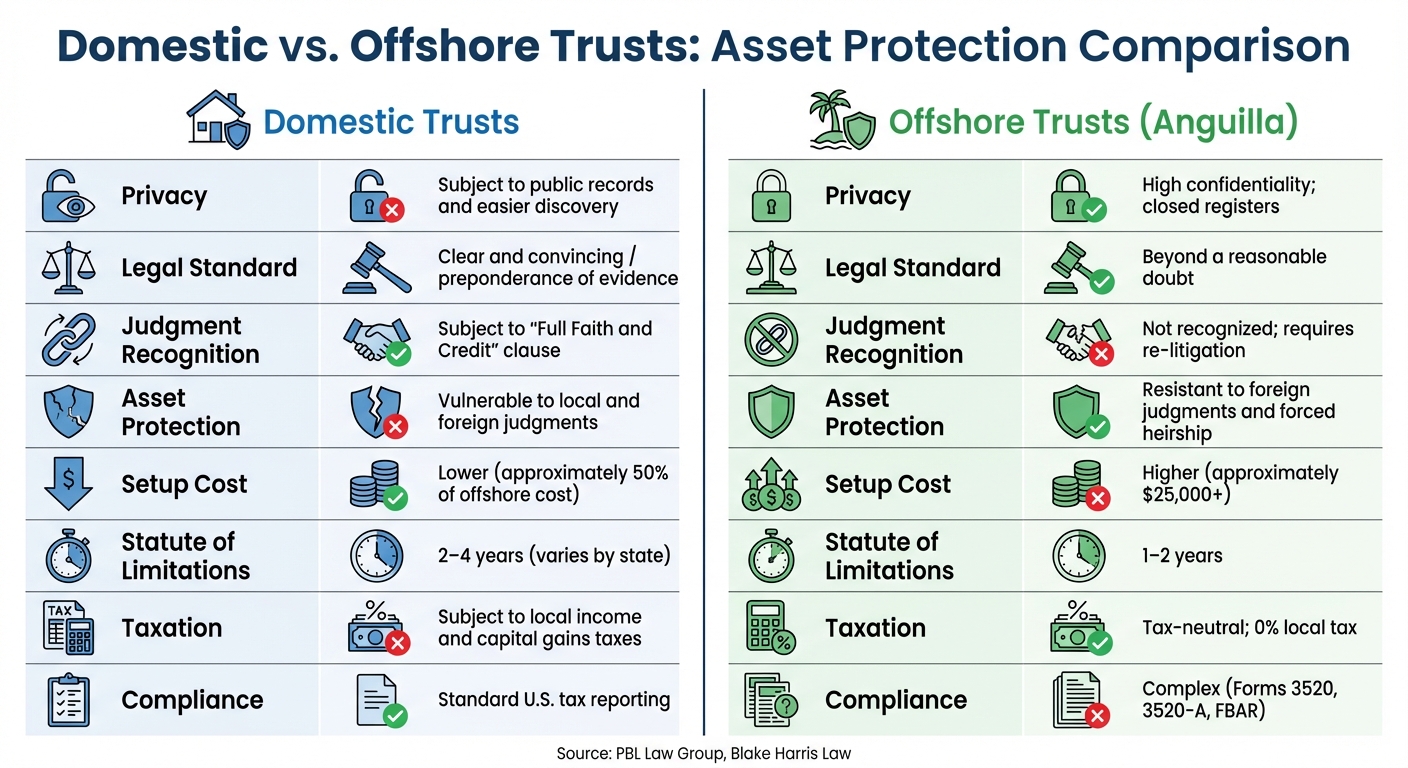

Comparison Table: Domestic vs. Offshore Trusts

| Factor | Domestic Trusts | Offshore Trusts (e.g., Anguilla) |

|---|---|---|

| Privacy | Subject to public records and easier discovery | High confidentiality; closed registers |

| Legal Standard | Clear and convincing / preponderance of evidence | Beyond a reasonable doubt |

| Judgment Recognition | Subject to "Full Faith and Credit" clause | Not recognized; requires re-litigation |

| Asset Protection | Vulnerable to local and foreign judgments | Resistant to foreign judgments and forced heirship |

| Setup Cost | Lower (approx. 50% of offshore) | Higher (approx. $25,000+) |

| Statute of Limitations | 2–4 years (varies by state) | 1–2 years |

| Taxation | Subject to local income and capital gains taxes | Tax-neutral; 0% local tax |

| Compliance | Standard U.S. tax reporting | Complex (Forms 3520, 3520-A, FBAR) |

Blockchain Technology in Asset Protection

Blockchain is moving beyond its roots in cryptocurrency speculation to become a powerful tool for safeguarding assets. Its ability to provide tamper-proof verification and automated execution makes it a game-changer. With blockchain, you can trace an asset’s entire transaction history on an unchangeable, permanent record – something traditional paper-based systems simply can’t rival. This evolution is setting the stage for safer and more transparent asset management on a global scale.

By 2025, 241,700 people worldwide hold over $1 million in crypto assets – a 40% jump in just a year. Among them are 36 crypto billionaires and 450 centi-millionaires with holdings exceeding $100 million each. This trend highlights a growing preference for cryptographically secured, jurisdiction-independent asset control. Digital wallets secured with multisignature (multisig) or Multi-Party Computation (MPC) technology across different jurisdictions are proving to be nearly impossible to seize.

"A properly secured Bitcoin wallet, particularly one using multi-signature technology spread across multiple jurisdictions, becomes effectively unseizable."

– Dominic Volek, Group Head of Private Clients, Henley & Partners

On the legal side, progress is being made to align with blockchain’s capabilities. The adoption of UCC Article 12 has introduced the concept of "Controllable Electronic Records" (CERs), giving digital assets a defined role in trust law. This shift allows digital assets to be legally titled to a trust while still being controlled through cryptographic keys. However, the stakes are high – crypto hacks cost $2.17 billion in the first half of 2025 alone, and the DOJ froze over $15 billion in crypto assets between 2024 and 2025.

Smart Contracts for Asset Management

Smart contracts, programs that self-execute when predefined conditions are met, are transforming asset management. They cut out intermediaries like banks or escrow agents, reducing costs and minimizing risks of human error or fraud.

In asset protection, smart contracts are particularly useful for Delivery-versus-Payment (DvP) settlements. This ensures that assets are delivered only once payment is confirmed. For example, Santander Group issued a $20 million tokenized bond on Ethereum in September 2019, and the European Investment Bank followed with a 100 million euro digital bond in April 2021. Both used smart contracts to execute DvP settlements in single, atomic transactions.

For offshore trusts, smart contracts can include "flight clauses" that automatically transfer management authority or move assets to another jurisdiction if a legal threat arises. When combined with multisig governance – where multiple parties, such as the settlor, offshore trustee, and protector, must approve transactions – these structures create a "legal impossibility of compliance." This means no single party can be forced by a court to surrender assets, shielding beneficiaries from legal risks.

"Offshore trustees simply do not comply with U.S. instructions to surrender private keys or transfer crypto, and U.S. courts have no power to compel them."

– Blake Harris Law

To protect high-value digital assets, experts recommend avoiding U.S.-based exchanges, as they are vulnerable to subpoenas and freezing orders. Instead, consider a multisig setup where an offshore trustee holds one of the keys, and store 95–99% of assets in air-gapped cold storage to reduce hacking risks. These blockchain-based solutions integrate seamlessly with offshore structures, offering flexible and secure asset protection.

Decentralized Trusts and Privacy

As legal systems adapt, decentralized structures are reshaping how privacy and control over assets are managed. These systems create what experts call "provable, mathematical distance", where assets exist in a cryptographic space rather than being tied to a specific geographic location. This marks a departure from traditional offshore trusts, which still rely on physical jurisdictions and banking systems.

The Cayman Islands has become a leader in creating legal frameworks for decentralized structures. In 2023, the Grand Court of the Cayman Islands ruled in In the Matter of Atom Holdings Ltd (Cause No. FSD 54 of 2023) that digital assets are "property of the Company" and classified as "choses in action" capable of ownership and legal remedies. This ruling allows Decentralized Autonomous Organizations (DAOs) to use Cayman foundation companies as legal "wrappers", providing legal recognition and liability protection while maintaining decentralized governance.

While privacy benefits are substantial, they come with regulatory challenges. Modern frameworks like FATCA, CRS, and the upcoming OECD Crypto-Asset Reporting Framework (CARF) require transparency and compliance. The focus is no longer on hiding assets but on creating structures that are legally robust and difficult to challenge.

"The blockchain may be decentralized – but the law is not."

– Brian T. Bradley, Esq., Bradley Legal Corp

Tokenization of traditional assets is also gaining momentum. For example, the market cap of tokenized gold hit $1 billion in April 2023. Financial institutions are increasingly tokenizing securities like bonds and money funds to enhance liquidity. Meanwhile, AI-powered blockchain forensics can now trace transactions 55% faster across numerous tokens. This helps authorities track illicit activities while giving legitimate asset holders better tools for compliance and due diligence.

AI and Automation in Asset Protection

Artificial intelligence is transforming asset protection from a reactive process into a proactive, data-driven approach. With AI and machine learning, organizations can now monitor vast amounts of transactions and customer behavior in real time, identifying anomalies that would otherwise go unnoticed by humans. These tools use pattern recognition to detect emerging threats – like intricate money-laundering operations or crypto-asset layering – often before regulators even become aware of them.

One major advantage of AI is its ability to drastically reduce false positives, allowing compliance teams to focus on genuine high-risk activities instead of wasting time on dead ends. This is especially crucial given the scale of financial crime, which is estimated to account for 2% to 5% of global GDP, or nearly $1.87 trillion annually. AI-powered blockchain analytics also play a key role in tracking illicit financial flows and investigating automated crimes. By shifting to proactive detection, AI sets the stage for automation to further bolster cybersecurity efforts.

"Predictive analytics allows compliance teams to anticipate potential money-laundering schemes rather than simply react to them."

– Nuno Soares da Veiga, Lawyer, DLA Piper

Automation takes this a step further by streamlining cybersecurity processes. For example, in 2025, the cybersecurity firm HWG Sababa adopted Torq Hyperautomation to handle its SOC alerts. This system now autonomously processes 55% of their monthly alerts, reducing response times by up to 95%. Similarly, Agoda, a travel platform, used Torq and ChatGPT to automate incident reporting and cloud risk management. This cut the time needed for incident reports from 6–7 hours to under 40 minutes and reduced missed Service Level Objectives (SLOs) for cloud risks by 47%.

AI for Threat Detection and Risk Prediction

AI’s ability to detect vulnerabilities before they escalate is one of its strongest assets. Anomaly detection algorithms can process data at speeds far beyond human capability, identifying deviations from normal patterns almost instantly. Generative AI further enhances this by summarizing complex datasets into actionable insights, while AI-powered virtual assistants allow investigators to query these datasets using plain language.

Meanwhile, the threat landscape is evolving rapidly. Organized cybercriminals are leveraging tools like AI, deepfakes, and stablecoins to target digital assets. For instance, incidents involving deepfake-related fraud surged by 700% in 2023. AI tools combat these sophisticated attacks by continuously monitoring for unusual activity and predicting potential vulnerabilities. For individuals holding significant digital assets, working with blockchain analytics firms can help trace illicit flows and maintain transaction integrity.

"Financial crime in crypto is becoming more advanced, more automated and harder to detect. Organized threat actors are now using everything from AI and deepfakes to stablecoins."

– Elliptic

To stay ahead, financial institutions and wealth managers should move away from rule-based systems and adopt machine learning models capable of identifying complex asset movement patterns. High-net-worth individuals, for example, may benefit from structuring offshore trusts before re-establishing residency in high-tax regions, as AI-driven compliance tools used by tax authorities could otherwise trigger unnecessary liabilities. The key is to implement AI-powered solutions early, before threats have a chance to develop.

Comparison Table: AI Tools for Asset Protection

| Feature | Traditional Rule-Based Systems | AI-Driven Asset Protection |

|---|---|---|

| Detection Method | Fixed parameters and manual thresholds | Machine learning and pattern recognition |

| Response Time | Reactive (post-event analysis) | Proactive (real-time and predictive) |

| Accuracy | High rate of false positives | High accuracy; detects subtle anomalies |

| Scope | Limited to known typologies | Identifies emerging and complex threats (e.g., crypto-asset layering) |

| Availability | Limited to business hours or periodic checks | 24/7 continuous monitoring and response |

| Compliance | Manual data collection; prone to gaps and audit stress | Continuous monitoring with automated, audit-ready reporting |

Understanding International Regulations

Asset protection today hinges on three key pillars: transparency, structure, and compliance. As James G. Bohm, Attorney at Bohm Wildish & Matsen, explains:

"It’s still possible, but you can’t hide money offshore anymore – it has to be transparent and legal"

.

The Shift in Regulations

Regulatory bodies worldwide are tightening their grip. For instance, the Financial Action Task Force (FATF) updated Recommendation 25 in February 2023 to enhance the transparency of beneficial ownership for trusts and similar legal entities. This update requires nations to ensure accurate and up-to-date records of express trust ownership. Meanwhile, the OECD’s Crypto-Asset Reporting Framework (CARF) is set to roll out in 2026, with mandatory reporting starting in 2027 to monitor crypto-assets in a manner akin to traditional financial accounts.

Tax authorities are also stepping up their game. Offshore succession plans, particularly those involving informal control or where beneficiaries have implied access to assets, are under intense scrutiny. Informal arrangements no longer meet the evolving regulatory standards, forcing a complete overhaul of asset protection strategies.

Transparency and Compliance Trends

Transparency has become the cornerstone of modern offshore strategies. High-net-worth individuals are now required to disclose offshore accounts and trusts through mechanisms like FBAR and Form 8938 to avoid penalties. On March 11, 2024, the FATF released updated risk-based guidance to help authorities identify those using complex structures or trusts to conceal illicit assets.

Offshore arrangements must now be designed with professional precision and adhere to strict compliance standards. For example, Switzerland continues to manage assets worth approximately CHF 2.1 trillion (about $2.4 trillion) for foreign clients, but these holdings are now subject to rigorous reporting requirements. Jurisdictions are also shifting focus, competing to attract wealth by offering regulatory clarity rather than relying on banking secrecy. Dubai’s Virtual Assets Regulatory Authority (VARA) and Portugal’s forward-thinking frameworks for digital assets exemplify this trend.

"Offshore strategies for high-net-worth individuals are no longer defined by secrecy or tax avoidance – they are defined by compliance, structure, and long-term planning."

– OVZA Legal Affairs

Wealthy individuals are also rethinking jurisdictional choices. Instead of chasing the lowest tax rates, they now aim for "jurisdictional alignment", where their place of residence aligns with asset-holding locations. This approach optimizes tax efficiency while ensuring compliance across different regulatory systems.

Building Structures That Adapt to Regulatory Changes

Given the evolving regulatory landscape, creating robust and adaptable asset protection structures is more important than ever. These frameworks must include formal documentation and professional oversight to stand up to regulatory scrutiny. Offshore succession plans, for example, should involve registered trustees and clearly define beneficiary rights to withstand audits by tax authorities.

The FATF is set to assess how well countries implement beneficial ownership requirements during upcoming evaluations. Non-compliance could result in "grey-listing", which carries significant reputational and operational risks for jurisdictions.

Timing is also critical. Establishing asset protection structures before legal claims arise can prevent them from being dismantled through fraudulent conveyance claims. Jurisdictions like the Cayman Islands and British Virgin Islands maintain strong reputations for compliance and transparency. The most effective strategies combine legal separation with full transparency, ensuring that beneficial ownership is properly reported to the individual’s home country.

Some jurisdictions, such as Nevis and Belize, offer robust "firewall" laws that do not recognize foreign judgments, forcing creditors to re-litigate claims locally. However, these protections only hold up if the underlying structures are legally sound and fully compliant.

The Digital Asset Landscape

The digital asset space is evolving at a rapid pace. By 2025, the number of individuals holding over $1 million in crypto assets is projected to reach 241,700 – a 40% increase in just one year. These individuals face the dual challenge of navigating traditional reporting requirements while adapting to emerging crypto-specific regulations. For sophisticated wealth managers, selecting jurisdictions with clear digital asset frameworks has become a top priority.

| Jurisdiction | Primary Use Case | Reputation | Regulatory Framework |

|---|---|---|---|

| Cayman Islands | Fund structuring, institutional wealth | Very High | Strict compliance, CRS/FATCA aligned |

| British Virgin Islands | Holding companies, family trusts | High | Strong substance requirements |

| UAE (Dubai) | Digital assets, crypto-friendly | High | Clear VARA regulations for virtual assets |

| Nevis | Asset protection trusts | Moderate | Firewall protections, flexible substance |

| Cook Islands | "Gold standard" asset protection | High | Non-recognition of foreign judgments |

sbb-itb-39d39a6

Cybersecurity for Digital Assets

As technology transforms asset management, digital assets are increasingly exposed to cyber risks, making strong and integrated protection essential.

In 2025, cyber threats targeting digital assets reached alarming levels. Web3 security incidents alone racked up losses of $3,352,850,816 with the average hack costing $5,321,935 – a staggering 66.64% jump from the previous year. High-net-worth individuals holding cryptocurrency face dangers ranging from advanced phishing schemes to even physical kidnapping attempts designed to coerce asset transfers.

Supply chain attacks emerged as a major concern, accounting for about 50% of stolen funds in 2025. These attacks led to losses of $1,450,914,902 across just two significant incidents. The largest of these was the May 2025 Bybit hack, when North Korean state-sponsored hackers stole over $1.46 billion from a cold wallet. This incident triggered a 20% drop in Bitcoin’s price. Blake Harris, Attorney, explains the importance of controlling private keys:

"If you control the keys, you remain insulated from court orders, as judges cannot compel offshore trustees to relinquish them"

.

Family offices are particularly at risk. 43% reported experiencing a cyberattack in the 12–24 months leading up to 2024, with phishing accounting for 93% of these incidents. Despite these threats, 31% of family offices still lack a formal cyber incident response plan.

Cyber Resilience for Offshore Structures

Building resilience requires blending technical safeguards with legal protections. Multi-signature (multisig) wallets are a key solution, dividing signing authority among clients, offshore trustees, and third-party vaults. This setup ensures no single party can independently authorize asset transfers. Dominic Volek, Group Head of Private Clients at Henley & Partners, describes this as creating a "provable, mathematical distance" between individuals and their wealth.

Offshore trustees in jurisdictions like the Cook Islands or Nevis add another layer of protection. These regions are beyond U.S. court jurisdiction, meaning trustees cannot be forced to hand over private keys. Some structures even include "flight clauses", which automatically shift management authority when legal or cyber threats arise.

Technical safeguards are equally critical. Cold storage – keeping 95–99% of holdings in air-gapped, offline environments – remains a cornerstone of cybersecurity, as it prevents remote hacking. However, technical defenses alone are not enough. Only 34% of family offices conduct regular cybersecurity maturity assessments, and 68% have yet to adopt "know your vendor" protocols to secure their supply chains. Simple measures like multi-factor authentication (used by 85% of family offices) and encrypted communications for trust administration are now standard practices.

Regulations are tightening as well. The EU’s Digital Operational Resilience Act (DORA) now requires crypto-asset service providers to conduct Threat-Led Penetration Tests. Kroll Cyber Threat Intelligence emphasizes the risks of non-compliance:

"Failure to establish compliance protocols for crypto services can expose financial institutions and organizations to serious legal repercussions, including fines, sanctions and reputational damage"

.

Combining cybersecurity measures with traditional asset protection strategies is essential for creating a strong framework to safeguard wealth in an increasingly digital world.

Global Wealth Protection‘s Asset Protection Services

In today’s complex financial landscape, safeguarding your wealth requires both traditional expertise and modern strategies. Global Wealth Protection (GWP) specializes in crafting custom offshore solutions that incorporate cutting-edge techniques, such as blockchain-integrated trusts and comprehensive asset management systems. By aligning these strategies with the latest regulatory developments, GWP provides a forward-thinking framework for protecting assets.

Tailored Offshore Trusts and Foundations

GWP offers offshore Asset Protection Trusts (APTs) in jurisdictions like the Cook Islands, Nevis, and Belize. These locations are known for their strong legal protections, as they do not recognize U.S. court judgments. This means creditors must initiate legal action locally, facing stricter requirements to pursue claims – a significant deterrent.

For clients with digital assets, GWP designs trust-owned offshore LLCs. This hybrid structure allows clients to retain operational control, such as managing cryptocurrency trades, while incorporating "flight clauses" that transfer control to offshore trustees if legal threats arise. Attorney Blake Harris highlights the importance of controlling private keys to prevent forced asset transfers.

Anguilla is another popular choice for GWP’s offshore services. The jurisdiction offers charging order protection, which restricts creditors to collecting a portion of LLC income rather than seizing assets outright. This process is slow and often discourages litigation. Additionally, offshore LLCs in Anguilla provide enhanced privacy, keeping ownership details off public records – an advantage that’s becoming harder to achieve within the U.S..

GWP emphasizes the importance of proactive planning. Waiting until a lawsuit is filed can expose assets to "fraudulent transfer" claims, which allow courts to reverse asset protection measures. Each structure is tailored to the client’s specific needs. For example, using a foreign trust to hold U.S. real estate could lead to unnecessary tax burdens without adding meaningful protection.

To complement these customized solutions, GWP offers a membership program for clients seeking ongoing access to advanced strategies.

GWP Insiders Membership for Advanced Strategies

The GWP Insiders Membership extends GWP’s asset protection services by providing continuous updates and expert guidance on the latest regulatory trends. Members gain insights into sovereign arbitrage, which involves strategically choosing jurisdictions based on legal, tax, and regulatory advantages.

This program is particularly suited for high-net-worth individuals who need to adapt quickly to shifting compliance requirements. Members receive advice on navigating frameworks like the OECD’s Common Reporting Standard (CRS) and FATCA, as well as access to advanced tools such as Private Placement Life Insurance (PPLI). PPLI offers both creditor protection and tax-deferred growth, making it an attractive option for clients with at least $2 million in investable assets.

Through personalized consultations, members can build multi-layered protection systems that integrate offshore trusts, LLCs, and digital asset management. GWP ensures these structures are legally sound by maintaining operational formalities, including annual filings, separate bank accounts, and proper documentation – key elements for withstanding legal scrutiny.

Conclusion: Preparing for the Future of Asset Protection

The landscape of wealth protection is shifting rapidly. With 590 million crypto users worldwide and the U.S. national debt surpassing $31 trillion, traditional strategies are no longer enough. High-net-worth individuals face mounting challenges, including a 57% increase in liability claims over the past decade, stricter transparency requirements like the OECD’s Crypto-Asset Reporting Framework set for 2027, and diminishing privacy protections.

To safeguard assets effectively, it’s crucial to act before legal threats emerge. Delaying can expose your wealth to fraudulent transfer claims, potentially dismantling even the most carefully planned strategies. As Blake Harris advises, the key lies in establishing strong, diversified protections early – leveraging tools like offshore trusts and multi-signature blockchain wallets to create both legal and technical barriers that discourage creditor claims.

This modern approach blends traditional offshore strategies with cutting-edge digital safeguards. Offshore trusts in jurisdictions like the Cook Islands or Nevis provide legal protections that are difficult for U.S. courts to breach. Meanwhile, multi-signature blockchain wallets offer what some experts call "mathematical distance", adding another layer of security against creditors.

Today’s wealth protection also requires full transparency with tax authorities. Proper compliance with FBAR and FATCA filings is non-negotiable, but it can coexist with strategic asset positioning that keeps your wealth secure from creditors. Combining tax compliance with smart legal structures is the cornerstone of modern asset protection.

To navigate this complex environment, proactive and diversified strategies are essential. By integrating offshore trusts with digital asset safeguards, you can build a layered defense system that adapts to regulatory changes. Collaborating with specialists who understand both domestic and international law ensures your strategy remains effective. Take action now to secure your financial future.

FAQs

What makes offshore trusts more effective than domestic trusts for asset protection?

Offshore trusts stand out as a solid option for asset protection because they are set up in locations with laws specifically designed to protect assets. These jurisdictions often have regulations that make it difficult for creditors to reach trust assets – for example, by not recognizing U.S. court judgments.

Another key advantage of offshore trusts is their shorter time limits for filing fraudulent transfer claims. They also place heavier legal burdens on creditors trying to challenge the trust. Together, these legal safeguards create a strong defense against financial, legal, and even political uncertainties.

How does blockchain technology improve asset protection?

Blockchain technology strengthens asset protection by providing secure, transparent, and decentralized methods for managing digital assets. Through this technology, cryptocurrencies and tokenized assets can be created and stored in digital wallets safeguarded by cryptographic keys. These keys ensure that only authorized individuals can access the assets, minimizing risks like hacking or theft.

Beyond storage, blockchain introduces smart contracts and blockchain-based trusts to automate asset transfers and management. By eliminating the need for traditional intermediaries, these tools simplify processes, lower legal risks, and improve overall efficiency. Moreover, blockchain’s transparency helps businesses and individuals adhere to international regulations such as anti-money laundering (AML) and know-your-customer (KYC) standards, making it an essential component of modern strategies for protecting wealth.

How is AI changing the way compliance and monitoring work in asset protection?

AI is transforming how compliance and monitoring work in asset protection, making these processes faster and more precise. By analyzing massive amounts of financial data in real time, AI can spot patterns and anomalies that traditional methods often overlook. This means risks like money laundering can be identified more accurately, with fewer false alarms. As a result, compliance teams can concentrate their efforts on truly high-risk cases.

Another game-changer is predictive analytics, which allows organizations to foresee and address potential threats before they grow into bigger issues. AI helps simplify monitoring tasks and keeps pace with the constantly changing tactics of financial criminals. This not only improves asset protection but also ensures that companies stay on top of regulatory requirements while safeguarding wealth in today’s increasingly complex financial landscape.