Investing in global real estate offers a way to protect wealth during economic uncertainty. By diversifying property holdings across countries, investors can spread risk, reduce reliance on a single economy, and benefit from steady rental income. Unlike stocks, real estate provides a physical asset with consistent demand and low correlation to traditional investments, making it a reliable option in volatile markets.

Key Takeaways:

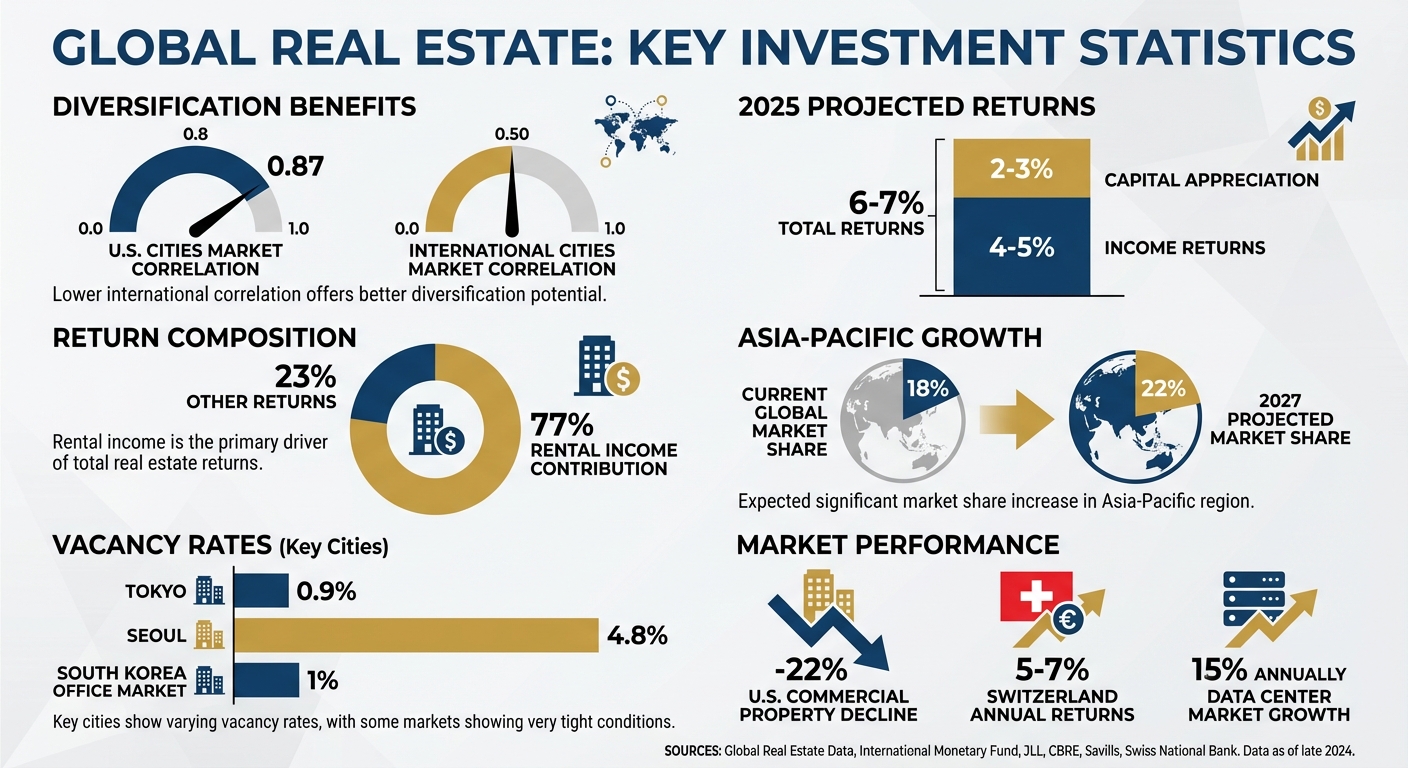

- Diversification: Spreading investments across regions mitigates localized risks. For example, U.S. cities have a higher market correlation (0.87) compared to international cities (0.50).

- Stability: Rental income contributes 77% of real estate returns, offering predictable cash flow even during market downturns.

- Currency and Inflation Hedge: Owning properties in different currencies protects against exchange rate fluctuations and rising inflation.

- Emerging Markets: Regions like Asia-Pacific and Latin America present growth potential, with Asia expected to represent 22% of the global real estate market by 2027.

Global real estate remains a dependable strategy for long-term wealth protection, offering income stability, inflation protection, and opportunities in high-growth markets. For success, research, diversification, and local expertise are essential.

Key Advantages of Global Real Estate Investments

Reducing Risk Through Geographic Diversification

Investing in real estate across multiple countries helps cushion against localized economic downturns. Real estate markets in different regions often operate on independent cycles, meaning they don’t all rise or fall simultaneously. If one market faces challenges, another might be thriving, which can help stabilize an investor’s overall portfolio.

Recent data underscores this point. By late 2023, the UK led the way in market repricing, followed by Europe, the U.S., and finally the Asia-Pacific region, which showed slower movement. Inflation pressures significantly impacted valuations in U.S. and European markets, while Asia-Pacific economies, like Japan, benefited from more favorable conditions for real estate.

"Investing in U.S. real estate equity and credit would have resulted in the highest absolute returns over the last 10 years, but adding assets from Asia and Europe would have resulted in higher risk-adjusted returns."

- Ralph F. Rosenberg and Billy Butcher, KKR

Protection Against Currency Fluctuations and Inflation

Owning real estate in multiple currencies offers a natural hedge against U.S. dollar devaluation. When the dollar strengthens, it boosts purchasing power for overseas acquisitions. Conversely, properties in currencies that gain value over time can deliver higher returns when converted back to dollars.

Real estate also provides protection against inflation. Rental incomes often rise with inflation, thanks to long-term leases that include escalation clauses tied to inflation indexes. With global real estate capital values expected to grow by 2% to 3% in 2025 and income returns projected at 4% to 5%, total returns could reach 6% to 7%. This yield remains attractive compared to government bonds. These factors make global real estate a reliable option for preserving and growing wealth, even in uncertain economic conditions.

Opportunities in High-Growth Emerging Markets

Emerging markets bring an added layer of growth potential to global real estate investments. Asia-Pacific economies, for instance, are projected to outpace other regions in growth, creating opportunities for strong returns. Countries like India and Saudi Arabia are reshaping global travel and hospitality demand, driven by demographic shifts and expanding economic influence.

Key cities in Asia are particularly appealing. Tokyo boasts a vacancy rate of just 0.9%, while Seoul sits at 4.8%, making both cities attractive for investors. By 2027, emerging Asia is expected to increase its share of the global institutional real estate market from 18% to 22%, largely at the expense of North America. Although China’s growth has slowed to 4.6% year-over-year, it remains one of the largest real estate investment markets globally. Meanwhile, Southern Europe, especially Spain, offers compelling opportunities in residential and student housing sectors, fueled by persistent housing shortages and migration-driven demand.

sbb-itb-39d39a6

Best Global Real Estate Markets for U.S. Investors

Developed Markets: Europe and North America

Switzerland stands out with consistent annual returns of 5–7%, thanks to strong industries like pharmaceuticals, consumer staples, and financial services. Its political stability and transparent legal system make it a reliable choice for safeguarding wealth, especially during uncertain economic times.

Germany and the UK are prime destinations for industrial and logistics real estate, offering robust legal protections and straightforward transactions. Japan presents opportunities across multiple sectors, with high demand in office and multifamily properties. This demand is supported by the Bank of Japan‘s favorable interest rate of 0.25% as of July 2024. South Korea’s office market is another bright spot, boasting a remarkably low 1% vacancy rate, a stark contrast to the 22% decline in U.S. commercial property values. These established markets provide a solid foundation for investors looking to expand into regions with higher growth potential.

Growing Markets: Asia and Latin America

For those seeking diversification beyond traditional markets, Asia and Latin America offer attractive opportunities. In Asia, major cities face supply constraints that drive demand, making these markets resilient even during economic downturns. The global data center market is also booming, with an expected annual growth rate of 15%. Additionally, the "living" sectors – such as residential, student housing, and senior living – are gaining traction in both developed and emerging economies. These sectors benefit from structural undersupply and shifting demographics, creating defensive investment opportunities.

Countries with Favorable Tax Policies for Real Estate

Investing in international real estate can provide U.S. investors with notable tax advantages, including access to a 30-year depreciation schedule. Mortgage interest and depreciation are deductible, allowing investors to build equity in appreciating foreign assets. Some countries further sweeten the deal by reducing withholding taxes on rental income or offering exemptions on capital gains. However, it’s crucial to consult local tax advisors to ensure compliance with U.S. and foreign tax regulations. Keep in mind that earning rental income from overseas properties for more than 15 days a year triggers U.S. tax reporting obligations. Leveraging these tax benefits can help investors enhance their wealth protection strategies by optimizing returns while keeping tax liabilities in check.

Practical Strategies for International Real Estate Investing

Researching Foreign Real Estate Markets

Before diving into international real estate, start by defining your investment goals. Are you looking for personal use, tax benefits, or purely financial returns? Once your objectives are clear, take a close look at the macroeconomic, political, legal, and tax landscape of your target market. These factors heavily influence the long-term value and stability of your investment.

"Political and economic stability can be predictive of the long-term value of your property. Unstable regions can experience volatility, making it harder to manage or resell your asset."

Dig into specific market fundamentals, such as supply-and-demand trends and vacancy rates. For example, South Korea boasts an impressively low 1% office vacancy rate, while the U.S. sees higher vacancies due to the rise of remote work. Don’t overlook the legal and tax environment – research property ownership laws, withholding taxes, and reporting requirements. Exchange rates are another critical factor, as currency fluctuations can affect both your purchasing power and rental income.

Creating a Diversified International Property Portfolio

Once you’ve done your research, focus on building a diverse portfolio. Spreading your investments across multiple regions – such as the U.S., Europe, and Asia – can help balance risks and improve returns compared to concentrating in one area.

Diversify not just geographically but also by property type and investment strategy. Options include direct ownership (buying property outright), private indirect investments (like joint ventures or commingled funds), or public REITs, which offer liquidity. You can also focus on specific investment themes, such as senior housing to cater to aging populations or hospitality properties in tourist hotspots like Europe and Japan. Keep an eye on key economic indicators like inflation, interest rates, and even climate resilience, as these factors increasingly impact property values and insurance costs.

Partnering with Local Professionals

Even with extensive research and a diversified portfolio, local expertise is essential for navigating the complexities of international real estate. Work with seasoned legal advisors both at home and in your target country to stay compliant with ownership laws and tax obligations. Local real estate agents and property managers can provide valuable insights into zoning laws, tenant preferences, and rental regulations – details that could make or break your investment.

International real estate requires more than just market knowledge; it demands on-the-ground expertise. Specialized tax advisors can guide you through foreign ownership structures and U.S. reporting requirements, including Forms 5471, 8858, and FBAR. Before committing to a purchase, have a local agent confirm that zoning laws align with your intended use, whether it’s short-term rentals or long-term leases. And since fixed-rate, 30-year mortgages are uncommon outside the U.S., consult financial advisors about alternatives like securities-backed loans.

Conclusion: Building Long-Term Wealth with International Real Estate

International real estate serves as a reliable way to safeguard wealth, especially during times of economic uncertainty. By investing across multiple countries and regions, you can tap into markets that operate independently of your domestic investments. This reduces concentration risk and opens doors to growth opportunities that might not be available at home. The diversification benefits become even more apparent when markets move differently from one another.

Right now, global markets are undergoing repricing, which creates promising opportunities for disciplined investors. Looking ahead to 2025, global real estate is expected to deliver total returns of 6–7%, with 4–5% coming from steady income and 2–3% from capital appreciation. This income-focused return profile not only cushions against market volatility but also provides inflation protection through rising rents and property values. These dynamics signal a shift from passive holding strategies to active, value-driven approaches.

"In an increasingly uncertain environment, we believe investors should be more selective, prioritizing investments that can offer durable income and seek to perform even in flat or faltering markets." – John Murray, Managing Director and Global Head of Private Real Estate at PIMCO

To succeed in this evolving landscape, operational expertise and local partnerships are more important than ever. Investing in international real estate requires a combination of capital, in-depth research, and trusted local knowledge to navigate complex legal and tax systems. The days of relying solely on low interest rates for passive returns are gone. Instead, returns now come from strategic asset selection, maintaining strong tenant relationships, and operational improvements. Partnering with experienced local professionals and specialized advisors is critical to understanding foreign markets, legal frameworks, and tax regulations.

As part of a broader wealth protection strategy, international real estate offers multiple benefits. Whether you’re hedging against currency fluctuations, exploring emerging markets, or diversifying beyond domestic investments, global property provides a tangible, income-generating asset. Historically, it has performed well during economic downturns. With the right guidance and a diversified approach, international real estate can be a cornerstone of long-term wealth preservation.

FAQs

How can investing in global real estate help protect wealth during economic downturns?

Investing in real estate beyond your home country can act as a strong safety net during economic slumps. Why? Because global real estate tends to behave differently from domestic stocks and bonds, offering a way to balance your portfolio and keep its overall volatility in check. Plus, by spreading your investments across various countries, you lessen the risk tied to economic troubles in any one region.

Another advantage? Consistent income. Rental properties abroad often provide regular income streams, with rents frequently tied to inflation. This means your purchasing power is better protected as prices rise. On top of that, tapping into different markets allows you to benefit from varying economic cycles, creating a more stable flow of returns over time. These combined benefits make global real estate a smart choice for shielding and growing wealth, even when times are uncertain.

What are the advantages of diversifying real estate investments across different regions?

Investing in real estate across different countries and regions is a smart way to spread risk. Property markets in various economies often move independently, so if one market faces a downturn, it’s less likely to drag down your entire portfolio. This kind of geographic diversification helps smooth out overall portfolio volatility and shields you from the full impact of an economic slowdown in any single country.

On top of that, investing internationally opens the door to markets at different stages of growth. This can mean better risk-adjusted returns, steadier income streams, and some protection against inflation. By exploring global real estate opportunities, you can create a portfolio that not only weathers economic uncertainty but also has the potential for long-term growth.

Why is the Asia-Pacific region appealing for real estate investment?

The Asia-Pacific (APAC) region has become a prime destination for real estate investment, thanks to its strong economic momentum, favorable demographic trends, and diversification opportunities. Markets such as Australia, Japan, Singapore, and New Zealand are particularly attractive, offering a combination of transparency, liquidity, and access to emerging sectors like life sciences and data centers – areas that are still maturing compared to their counterparts in the U.S. and Europe.

Urban migration, aging populations, and increasing wages across APAC are fueling demand for properties such as multifamily housing, healthcare facilities, and logistics hubs. These factors, paired with the region’s improving market transparency and economic stability, position APAC real estate as a solid choice for investors looking to safeguard against economic uncertainties while tapping into long-term growth opportunities.