Yes, but it depends on your lifestyle and financial goals. Puerto Rico’s Act 60 offers U.S. citizens substantial tax savings, including a 4% corporate tax rate and 0% on Puerto Rico-sourced capital gains, dividends, and interest. However, strict residency requirements and compliance costs make it a better fit for high earners ready to settle in Puerto Rico rather than those constantly on the move.

Key Takeaways:

- Tax Perks: 4% corporate tax, 0% on Puerto Rico-sourced capital gains, dividends, and interest.

- Residency Rules: Must spend at least 183 days/year in Puerto Rico, buy property within 2 years, and donate $10,000 annually to local charities.

- Compliance Costs: Over $10,000/year, including legal and accounting fees.

- Eligibility: Only Puerto Rico-sourced income qualifies; work done outside the island is taxed normally in the U.S.

- Challenges: Infrastructure issues, hurricane risks, and potential changes to tax laws.

Who It’s For:

- High-income earners with Puerto Rico-sourced income.

- Entrepreneurs willing to establish residency and invest in the local economy.

- Professionals seeking long-term financial planning and tax efficiency.

Act 60 is ideal for those ready to commit to Puerto Rican residency, but its requirements may not suit highly mobile lifestyles.

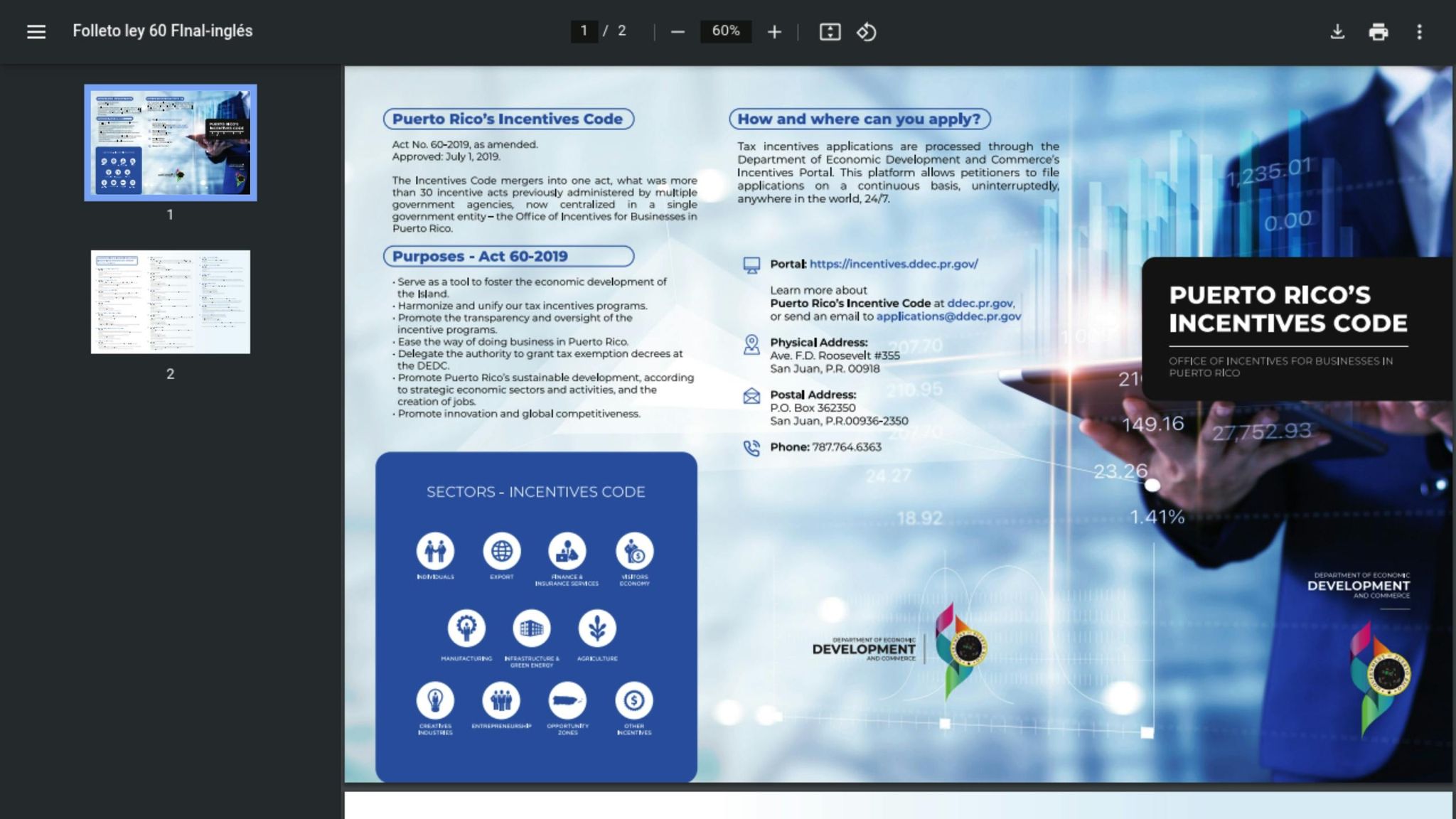

What Is Act 60: Main Provisions and Tax Breaks

Act 60 provides a range of tax benefits aimed at attracting digital nomads, investors, and service-based businesses to Puerto Rico. This legislation, effective through December 31, 2035, consolidates some of the island’s most appealing tax incentives to stimulate economic growth. Since its launch, Act 60 has issued tax decrees to over 3,000 individuals and businesses, created more than 75,000 jobs, and generated $650 million in government revenue. Below, we’ll break down the key tax advantages for individuals and businesses, along with the eligibility requirements.

Tax Breaks for Individuals

For U.S. citizens, the individual investor component of Act 60 offers substantial tax relief. Qualifying residents enjoy a 100% tax exemption on capital gains earned after establishing Puerto Rican residency. Additionally, dividends and interest income are fully exempt from Puerto Rico income taxes. For example, $100,000 in capital gains would be taxed at 0% under Act 60, compared to the standard federal rate of up to 20%. These benefits are particularly appealing for digital professionals with fluctuating income sources.

Business Tax Rates

Act 60 also offers a range of tax advantages for service-based businesses, making it especially attractive to digital nomads. Businesses focused on exporting services with annual revenues exceeding $3 million are taxed at a flat 4% rate on net income. Smaller businesses – those earning $3 million or less annually – pay just 2% for the first five years, with the rate increasing to 4% thereafter. Certain "Novel Pioneer Activities" can qualify for rates as low as 1%.

The law covers a wide variety of service sectors popular among digital professionals, including:

- Creative and digital services: Design, art, music, app development, and creative education

- Professional services: Consulting, legal work, accounting, engineering, and project management

- Technology services: Software development, cloud computing, and blockchain-related work

- Marketing and communications: Advertising, public relations, and marketing operations

In addition to income tax savings, Act 60 provides other incentives. Dividend distributions from exempt operations are entirely tax-free in Puerto Rico. Property tax exemptions range from 75% to 100%, and municipal license tax exemptions offer savings between 50% and 100%. These benefits are granted for an initial 15-year period, with the possibility of extending for another 15 years.

Who Qualifies for Act 60

Eligibility for Act 60 is based on specific residency and economic engagement requirements. Applicants must have lived outside Puerto Rico for at least 10 years and must pass three residency tests:

- Presence test: Spend at least 183 days in Puerto Rico each tax year

- Tax home test: Establish Puerto Rico as the primary location for business or employment

- Closer connection test: Demonstrate stronger personal and economic ties to Puerto Rico than to any other location

Participants are also required to contribute to Puerto Rico’s economy. This includes an annual $10,000 donation to approved nonprofit organizations and the purchase of residential property within two years of receiving the tax decree.

The application process involves submitting formal documentation and adhering to compliance requirements. Initial fees include a $5,005 application fee and a $105 acceptance fee, while annual compliance involves a $5,005 filing fee and detailed reporting to local authorities.

In 2021, the IRS launched an enforcement campaign reviewing over 2,300 individuals who claimed benefits under Act 22 and Act 20 between 2012 and 2019. The investigation found that 647 individuals had collectively paid $557,978,112 in federal income taxes during the five years before relocating to Puerto Rico. This underscores the importance of maintaining proper documentation and compliance.

It’s important to note that the tax benefits under Act 60 apply exclusively to Puerto Rico-sourced income, making careful income planning essential to fully leverage these advantages.

Does Act 60 Work for Digital Nomads?

Act 60 offers enticing perks for digital nomads, but it comes with specific rules that might not align with a constantly mobile lifestyle.

Which Income Gets Tax Benefits

To make the most of Act 60, it’s crucial to know which types of income can benefit. Only income sourced within Puerto Rico qualifies for the tax breaks. Earnings from outside Puerto Rico remain subject to standard U.S. federal taxes.

For example, if you’re working on a project in San Juan for a client in New York, that income counts as Puerto Rico–sourced. However, work done outside Puerto Rico doesn’t qualify.

The tax perks are substantial. As a resident under Act 60, you enjoy a 0% tax rate on dividends, interest, and capital gains stemming from Puerto Rican sources. For business income, the Export Services Tax Incentive allows eligible businesses to pay a flat 4% corporate tax on services provided to clients outside Puerto Rico.

Tax Comparison: Act 60 vs. Regular U.S. Taxes

The savings under Act 60 can be dramatic, especially for those with high earnings, passive income, or capital gains. Here’s a comparison:

| Income Type | Act 60 Rate | U.S. Federal Rate | Annual Savings on $100,000 |

|---|---|---|---|

| Capital Gains (Puerto Rico–sourced) | 0% | Up to 20% | $20,000 |

| Business Income (Export Services) | 4% | Up to 37% | $33,000 |

| Dividends (Puerto Rico–sourced) | 0% | Up to 20% | $20,000 |

| Interest Income (Puerto Rico–sourced) | 0% | Up to 37% | $37,000 |

For instance, a digital nomad earning $500,000 annually from qualifying business income would owe about $20,000 in Puerto Rico corporate taxes. Compare that to the $185,000 they might pay under U.S. federal rates, and the potential savings soar to $165,000. However, any income earned outside Puerto Rico still needs to be reported to the IRS if you’re a U.S. citizen.

Living in Puerto Rico as a Digital Nomad

Puerto Rico offers a blend of U.S. convenience and Caribbean lifestyle, making it an attractive home base for remote workers. Major areas like San Juan boast reliable internet, and the island operates on Atlantic Standard Time, which aligns with Eastern Standard Time for half the year. Plus, U.S. citizens don’t need a passport or visa to live and work remotely from Puerto Rico.

The cost of living here is often lower than in major U.S. cities, though it depends on the area. Housing options range from city apartments in San Juan to upscale villas in places like Bahia Beach. Getting around is manageable with rental cars, taxis, and public buses, though renting a car is usually the best option for exploring beyond urban areas.

One challenge for digital nomads is meeting the 183-day residency requirement to secure tax benefits. This means committing to spending most of the year on the island. However, Puerto Rico has a growing community of entrepreneurs and remote workers who’ve relocated under Act 60, offering plenty of opportunities to network and build connections. For those willing to establish a home base while taking shorter trips, Puerto Rico strikes a balance between stability and tropical living.

Beyond the tax benefits, stable residency also opens doors to asset protection under Act 60. Healthcare access is convenient, with domestic health insurance plans often accepted, and the island’s expanding tech scene creates new professional opportunities. For digital nomads ready to commit, Puerto Rico offers a compelling mix of financial, professional, and lifestyle advantages.

How to Use Act 60 as a Digital Nomad

Making the most of Act 60 takes careful planning. Whether you’re looking to lower your personal tax rate or set up a qualifying business, there are three main steps to focus on: establishing genuine residency in Puerto Rico, securing your tax decree, and creating a business structure that meets the requirements.

Meeting Puerto Rico Residency Rules

To access the benefits of Act 60, you need to prove you’re a bona fide resident of Puerto Rico. This means making Puerto Rico your primary home. Here are some key requirements:

- Spend at least 183 days per year in Puerto Rico, buy a primary residence within two years, and relocate your family, business, and social ties to the island.

- Ensure you haven’t been a resident of Puerto Rico in the past 10 years.

If you’re a business owner, you’ll also need to set up a registered office on the island.

Here’s a practical tip: If you hold investments like cryptocurrency, consider selling and repurchasing them after establishing residency. This move could help ensure that future capital gains count as Puerto Rico–sourced income.

Once your residency is in place, the next step is applying for your tax decree.

Filing for Act 60 Tax Decrees

Getting your Act 60 tax decree involves a detailed application process. It starts with submitting Form 480.20, along with proof of residency, a business plan, and financial statements. The fees for processing vary depending on the type of incentive. For instance, applying for the Act 60 Investor Resident Individual Tax Incentive costs $2,495, while the Export Services Tax Incentive application costs $3,995.

Once your application is approved, you’ll receive a tax decree that outlines your specific exemptions, the standard 15-year grant period (with the possibility of an extension), and your compliance obligations. Because this process can be complicated, working with tax professionals familiar with Act 60 can be incredibly helpful. It’s also critical to keep detailed records of your travel, residency, income sources, and other compliance-related documents for audits and annual reviews.

With your tax decree secured, you can focus on structuring your business to meet Act 60 requirements.

Creating a Business That Qualifies

If your goal is to use Act 60 for your business, you’ll need to establish a structure that qualifies under the Export Services Tax Incentive. This means offering services from Puerto Rico to clients outside the territory. Eligible services include software development, consulting, financial services, marketing and advertising, educational services, and creative industries.

To qualify, your services must be delivered from a legitimate office in Puerto Rico, and your clients cannot have any connection to the island. For example, a digital marketing consultant based in San Juan serving clients in New York would likely meet these criteria.

Revenue also plays a role in determining your tax benefits. Businesses earning more than $3 million annually are taxed at a 4% rate on net income, while those earning $3 million or less can enjoy a reduced 2% rate for the first five years before moving to 4%. Larger businesses may qualify for additional perks, such as:

- A 75% exemption from property taxes.

- A 50% reduction in municipal license taxes.

- A requirement to employ at least one full-time Puerto Rico resident working directly in the business.

Additionally, dividend distributions from qualifying businesses are completely exempt from Puerto Rico income tax. Regular audits by the Office of Industry Tax Exemption (OITE) ensure ongoing compliance, and the 15-year decree period – with the option to extend – provides long-term stability for your tax planning.

sbb-itb-39d39a6

Combining Act 60 with Asset Protection Methods

Act 60 offers attractive tax incentives, but pairing it with asset protection strategies adds an extra layer of security for your wealth. For digital nomads, blending these methods can lead to a well-rounded financial plan that not only reduces taxes but also safeguards assets.

Using LLCs for Privacy and Tax Savings

Setting up a Puerto Rico LLC is a smart way to tap into Act 60’s 4% tax rate while enhancing privacy. The cost to form an LLC in Puerto Rico is just $250, making it an affordable addition to your financial strategy.

By incorporating an LLC in Puerto Rico as part of your Act 60 plan, you create a business entity eligible for the 4% corporate tax rate on income sourced from Puerto Rico under the Export Services Act. This setup works particularly well for digital nomads offering services like consulting, software development, or creative work to clients outside the territory.

Beyond tax benefits, LLCs provide privacy and asset protection. They shield personal assets from business liabilities, and Puerto Rico’s business-friendly environment further strengthens this protection. To make the most of these benefits, ensure your LLC operates genuinely within Puerto Rico.

"Act 60 isn’t just another tax loophole – it’s a legitimate pathway to reducing your tax burden by hundreds of thousands of dollars annually." – George Dimov, President & Managing Owner

However, be aware that the IRS has increased scrutiny on these arrangements. Proper documentation and compliance are essential when combining LLCs with broader tax strategies.

Offshore Trusts and Estate Planning

Adding trust structures to your plan can elevate your asset protection strategy. Puerto Rico offers unique trust options that align well with Act 60 benefits, making them ideal for long-term wealth planning. These trusts – whether irrevocable, revocable, charitable, generation-skipping, or special needs – provide opportunities for asset protection, tax planning, and estate management.

The tax advantages are substantial. Puerto Rico trusts can eliminate federal estate taxes, lower gift tax obligations, and offer competitive income tax rates along with estate tax credits. Operating under a blend of Civil and Common Law, Puerto Rico allows for flexible trust arrangements that may not be available elsewhere.

Timing is critical for digital nomads with significant assets. Establishing these structures before major income events can maximize tax benefits. For instance, combining Act 60’s 0% tax on capital gains (for investments made after establishing Puerto Rico residency) with a well-structured trust can create a powerful wealth preservation strategy.

Puerto Rico’s status as a U.S. territory also simplifies compliance for U.S. citizens, offering many of the benefits of offshore trusts without the complications of foreign jurisdictions.

Asset Protection Options Compared

Here’s a breakdown of how different strategies complement Act 60:

| Strategy | Tax Benefits | Asset Protection | Complexity | Annual Costs |

|---|---|---|---|---|

| Act 60 Residency Only | 4% corporate tax, 0% capital gains | Limited personal protection | Moderate | $10,000+ professional fees |

| Act 60 + Puerto Rico LLC | Same tax benefits plus business privacy | Enhanced business asset separation | Moderate | $250 filing fee plus compliance costs |

| Act 60 + Puerto Rico Trust | Tax benefits with estate planning perks | Strong multigenerational protection | High | Varies by trust complexity |

| Act 60 + Combined Structures | Maximum tax savings | Comprehensive asset protection | Very High | Higher annual costs |

While Act 60 alone provides excellent tax benefits, it offers limited protection for your personal assets. Incorporating LLCs or trusts adds layers of security, shielding your wealth from potential risks.

For digital nomads with substantial assets, combining these strategies is often the best approach. Act 60’s tax benefits – which can last up to 30 years – work seamlessly with asset protection structures like LLCs and trusts. However, this approach demands careful planning and consistent compliance to ensure all elements function effectively.

The right strategy ultimately depends on your financial situation, risk tolerance, and long-term goals. Many find that the added complexity and costs are well worth the peace of mind and financial security they provide.

Problems and Risks with Act 60 for Digital Nomads

Act 60 might seem like a dream come true for digital nomads with its enticing tax breaks, but it comes with some serious strings attached. The program’s strict rules and high compliance costs can be a dealbreaker for those who prioritize a flexible lifestyle.

Residency Rules and Compliance Duties

To qualify for Act 60, you need to spend at least 183 days per year in Puerto Rico, purchase a primary residence within two years, and donate US$10,000 annually to local charities. These requirements can limit your mobility and tie up your finances.

On top of these commitments, there are ongoing costs to maintain compliance. Legal and accounting fees alone typically exceed US$10,000 per year, and you’ll also need to pay a US$300 annual report fee. There’s even a one-time filing fee to get started.

Staying compliant doesn’t end there. You’ll also need to prove your Puerto Rican residency with local documentation and demonstrate active participation in the community. This means keeping detailed records of your time spent on the island.

Legal and Economic Risks

The challenges don’t stop at compliance. Puerto Rico’s economic situation introduces additional uncertainties. After restructuring US$74 billion in bond debt and US$50 billion in unfunded pension liabilities, the territory exited bankruptcy in 2018. Yet, fiscal concerns remain, making long-term tax benefits less predictable.

There are also practical hurdles. Infrastructure issues, like power outages and poorly maintained roads, can disrupt your work. And let’s not forget Puerto Rico’s hurricane season, which demands a level of emergency preparedness that some may find overwhelming. Additionally, the cost of living can be steep, as many imported goods are more expensive than in mainland U.S. cities.

Perhaps the biggest wild card is the potential for tax law changes. Though Act 60 offers benefits for up to 30 years, future administrations might alter or even repeal these incentives due to economic or political pressures. The influx of over 1,500 mainlanders since 2012 has already sparked local concerns, which could shape future policy decisions.

Act 60 Pros and Cons for Digital Nomads

Here’s a closer look at what Act 60 offers – and what it demands in return:

| Advantages | Disadvantages |

|---|---|

| 4% corporate tax rate on qualifying business income | 183+ days annually required in Puerto Rico |

| 0% tax on capital gains for investments made after residency | US$10,000+ annual compliance costs |

| 0% tax on dividends and interest from Puerto Rican sources | One-time filing fee plus US$300 annual reports |

| 5% reduced tax on pre-residency assets after 10 years | US$10,000 annual donation requirement |

| U.S. territory status simplifies tax compliance compared to offshore setups | Property purchase required within two years |

| No foreign reporting requirements like FBAR | Applies only to Puerto Rico–sourced income |

| Long-term benefits (up to 30 years) | Higher IRS scrutiny and audit risk |

| English-speaking environment with U.S. legal protections | Infrastructure issues and hurricane risks |

While Act 60 offers undeniable tax perks, it’s not for everyone. The program is best suited for digital nomads with high incomes who can absorb the compliance costs and are ready to settle into life in Puerto Rico. For those with lower incomes or a preference for constant travel, the required donations, fees, and commitments might outweigh the tax savings.

In short, Act 60 can be a great fit for entrepreneurs looking to plant roots in Puerto Rico, but it’s less ideal for those who crave the freedom to roam or aren’t prepared for the financial and lifestyle demands. These trade-offs are worth considering alongside the tax benefits discussed earlier.

Conclusion: Should Digital Nomads Choose Act 60?

Act 60 offers enticing tax perks, like a 4% corporate tax rate on eligible business income and potentially no capital gains tax under certain conditions. But it’s not a one-size-fits-all solution for digital nomads. The program comes with lifestyle and financial obligations that might not align with everyone’s goals.

For high-earning digital nomads who can handle compliance costs – around $20,000 annually – and are willing to commit to Puerto Rican residency, the benefits could outweigh the challenges. On the other hand, those with lower incomes or businesses that don’t qualify may find the program less appealing.

Compliance risks also deserve attention. From 2012 to 2019, 2,331 individuals who took advantage of Act 22 benefits faced IRS audits scrutinizing their residency claims. These audits involve detailed information requests, with over 20 questions about Puerto Rican residency status. Similarly, high-tax states like New York conducted 15,000 residency audits between 2013 and 2017, recovering over $1 billion during that period.

Another key consideration is the 183-day residency requirement. For many digital nomads, this restriction can feel like a significant compromise, as it limits the freedom to move around. Additionally, Act 60 demands a long-term commitment – typically 3 to 5 years – to avoid steep tax penalties, making it unsuitable for short-term strategies.

Ultimately, Act 60 works best for those ready to embrace island life, establish a business presence in Puerto Rico, and maintain meticulous records. U.S. citizens, in particular, might find its tax advantages appealing. But for nomads who value flexibility and mobility above all, the residency demands could feel too restrictive.

FAQs

What do digital nomads need to do to qualify for Puerto Rico’s Act 60 tax incentives?

To take advantage of the tax benefits under Puerto Rico’s Act 60, digital nomads need to meet a few important criteria. First, they must spend at least 183 days each year in Puerto Rico. Beyond that, they are required to establish Puerto Rico as their primary residence, which means showing stronger personal and financial connections to the island than to any other place.

Another key requirement is that applicants must not have been residents of Puerto Rico during the 10 years leading up to their application. Additionally, they are obligated to purchase residential property on the island within two years of receiving the tax exemption decree. Following these steps is essential to qualify for the tax perks offered by Act 60.

Can digital nomads still enjoy their flexible lifestyle while benefiting from Puerto Rico’s Act 60?

Yes, Puerto Rico’s Act 60 gives digital nomads a chance to keep their travel-focused lifestyle while benefiting from generous tax breaks. As U.S. citizens, they can move to Puerto Rico without needing a local work visa or passport, making the relocation process straightforward. Under Act 60, nomads can claim residency in Puerto Rico while still traveling often, provided they meet certain conditions – like spending at least 183 days a year on the island.

This arrangement allows nomads to fine-tune their tax plans without being locked into one place. For those who prioritize flexibility and financial savvy, Act 60 offers a way to blend a mobile lifestyle with significant tax savings and other perks.

What are the risks and challenges of using Puerto Rico’s Act 60 for long-term tax planning?

Puerto Rico’s Act 60 presents appealing tax incentives, but it’s important to consider the potential challenges it entails for long-term planning. The island grapples with ongoing economic issues, such as substantial public debt and income inequality, which could affect the reliability of these incentives in the future. On top of that, outdated infrastructure and steep energy costs may create additional obstacles for both businesses and residents.

Careful evaluation of these factors is essential when considering Act 60 as part of your financial strategy. Working with a knowledgeable advisor and keeping up with Puerto Rico’s economic landscape can help you navigate these risks and ensure your approach aligns with your overall financial objectives.