When it comes to protecting wealth, the wealthy rely on proactive, offshore asset protection strategies to safeguard their assets against lawsuits, creditors, taxes, and family disputes. The key is starting early and using tools like offshore trusts, international LLCs, and private foundations. These methods create legal barriers and jurisdictional separation, making it harder for others to claim or seize assets.

Key Takeaways:

- Offshore Trusts: Ideal for shielding wealth from lawsuits, taxes, and inheritance disputes. Jurisdictions like Anguilla and the Cook Islands offer robust legal protections.

- International LLCs: Protect personal and business wealth by limiting creditor access to assets, often using charging order limitations.

- Timing Is Critical: Asset protection structures must be set up before legal threats arise to avoid claims of fraudulent transfers.

- Costs: Initial setup ranges from $15,000 to $500,000, with annual maintenance fees between $3,500 and $150,000, depending on complexity.

- Compliance: U.S. laws require strict reporting (e.g., IRS Forms 3520, FBAR) to avoid penalties.

By planning ahead, selecting the right jurisdictions, and working with independent professionals, high-net-worth individuals can effectively protect their wealth. The article explores real examples, showing how these strategies work in practice.

Case Study 1: Using Offshore Trusts to Transfer Wealth Across Generations

The Problem: Protecting Assets from Inheritance Taxes and Family Disputes

The Irving family faced a daunting challenge: safeguarding their $3 billion estate. Rising family tensions, potential probate litigation, and looming tax changes created a complex web of issues that could derail their plans for passing down wealth.

The Solution: Creating an Anguilla Offshore Trust

To address these concerns, the family turned to an offshore trust solution. They established the trust under Anguilla’s International Trust Act 2007, a process completed in less than 24 hours. This involved appointing a registered agent, setting up a local office, and drafting a Trust Charter that outlined asset management rules and introduced a Protector role to oversee the trust. Anguilla’s tax-neutral environment was a key draw. The jurisdiction imposes no income, capital gains, gift, or inheritance taxes. Additionally, the one-time government registration fee of $250, with no annual renewal costs, made it a cost-effective option.

The Results: Lower Taxes and Protected Family Wealth

By March 2010, the Irving family had successfully restructured their $3 billion estate. This allowed them to bypass probate, avoid forced heirship laws, and reduce their estate tax exposure. Anguilla’s legal framework further bolstered the trust’s security. Creditors were limited to a three-year window to challenge the trust, requiring proof of settlor insolvency. Moreover, the abolition of the Rule against Perpetuities meant the trust could exist indefinitely, ensuring long-term protection for the family’s wealth.

sbb-itb-39d39a6

Case Study 2: Protecting Personal Wealth with a Private US LLC and Offshore Trust

The Problem: Facing Lawsuits and High Tax Bills

This example highlights how structuring offshore trusts for asset protection can protect personal wealth from legal and financial threats.

In 2004, Dr. Ruby, a retired physician from Florida, faced the risk of losing her $1,000,000 retirement savings due to potential malpractice claims. Her U.S.-based assets were exposed to domestic creditors, emphasizing the need for a solution that complied with IRS regulations while offering robust protection.

The Solution: Using a Private US LLC with an Offshore Trust

To safeguard her assets, Dr. Ruby established an irrevocable Liechtenstein trust, which owned 100% of a U.S. LLC. She retained operational control while ensuring the structure’s legal protections. The setup cost her $1,845.

One critical feature was the charging order limitation. This prevented creditors from seizing assets or acquiring voting rights, restricting them to claiming distribution interests only. To add another layer of security, a "poison pill" provision imposed tax liabilities on any gains from charging orders – even if no cash distributions were made.

"The Anguilla LLC act possesses some of the strongest asset protection and privacy regulations of any offshore haven on the planet." – OffshoreCorporation.com

The Results: Better Privacy and Lower Tax Burden

By 2006, a former patient won a judgment against Dr. Ruby in New York and Florida courts. When the creditor attempted to target the trust assets in 2008, Liechtenstein courts ruled that, due to the discretionary nature of the trust, Dr. Ruby had no legal "right" to the assets. This ruling forced the creditor to pay $100,000 in court deposits and ultimately lose the case, leaving her retirement savings untouched.

This structure not only safeguarded her assets but also maintained full compliance with U.S. tax laws through proper IRS disclosures. The annual renewal fees of $2,495 were a small cost for the peace of mind and protection it provided.

"The ultimate lesson here is that despite the legal challenge by a U.S. creditor, the… trust assets remained safe and protected… The U.S. creditor was forced to commence a new action in a foreign jurisdiction." – Gallet, Dreyer & Berkey, LLP

Case Study 3: Protecting Business Assets in High-Risk Industries

The Problem: Lawsuits Threatening Personal Assets

In high-risk industries like real estate, medicine, and corporate ownership, lawsuits are a constant threat. Without a clear separation between personal and business assets, a single legal claim can wipe out personal wealth – homes, savings, and even retirement accounts are at risk.

The situation worsens when creditors use legal tools to freeze assets before a trial even begins. Assets held in personal names are fully exposed to court orders and creditor claims, leaving business owners vulnerable to financial ruin, even from baseless lawsuits.

An offshore company provides a strong way to shield these assets from such risks.

The Solution: Creating an Anguilla Offshore Company

One effective strategy is setting up an offshore company in Anguilla, leveraging jurisdictional separation to create a legal barrier. Under the Anguilla LLC Act, creditors can only secure a charging order on distributions, leaving the company’s assets untouched.

"The judgment creditor (someone who has sued the member and won) is not legally allowed to touch the assets inside of the Anguilla LLC." – OffshoreCorporation.com

Anguilla’s system is efficient, with online registration completed within 24 hours. The government fee is about $250, and management packages typically cost around $3,495. The jurisdiction also offers 0% corporate tax on foreign-sourced income and ensures privacy by maintaining no public registry of shareholders or directors.

For added security, many business owners transfer intellectual property to the offshore company and then license it back. This approach protects valuable assets, even if litigation arises.

The Results: Protected Business and Personal Wealth

This offshore setup not only safeguards personal assets but also discourages legal claims altogether. By creating jurisdictional hurdles, it forces creditors to re-litigate cases in a foreign court, which often involves stricter evidentiary standards and upfront cash bonds. In Anguilla, creditors face additional challenges, including a three-year limitation period and the need to prove insolvency at the time of asset transfer – a tough standard to meet.

"Offshore trusts and companies… are considered the gold standard in asset protection, offering strong legal safeguards against asset seizure, creditor claims, and other threats to financial security." – First Anguilla Trust Company Limited

The high cost and complexity of pursuing assets internationally often deter creditors. Many abandon their claims rather than risk tens of thousands of dollars on uncertain foreign litigation. This structure empowers business owners to focus on their work, confident that their personal wealth is shielded from business liabilities.

Case Study 4: Protecting Assets Before Divorce Proceedings

The Problem: Losing Assets in a Divorce Settlement

With nearly half of all marriages in the United States ending in divorce, high-net-worth individuals face a genuine risk of losing substantial assets during settlements. In community property states, courts generally require an equal split of assets acquired during the marriage. Traditional U.S. financial structures often leave individuals vulnerable, especially when ex-spouses seek alimony or asset division. Once divorce proceedings are underway, moving assets may be classified as a fraudulent transfer, effectively eliminating options for legitimate protection. To avoid this, establishing an offshore trust before any marital discord arises is crucial for keeping assets separate.

The Solution: Timely Establishment of an Anguilla Offshore Trust

The key to shielding assets from division during divorce is setting up an offshore trust well in advance. This proactive step ensures the trust is viewed as part of a long-term financial strategy rather than an attempt to evade legal obligations.

"Planning with assets protection trusts done well in advance of any key events, such as marriage, can be critical." – Alvina Lo, Chief Wealth Strategist, Wilmington Trust

Creating an Anguilla offshore trust involves several steps: selecting an independent professional trustee, drafting a trust deed to define beneficiary rights and terms for asset distribution, and transferring assets into the trust. Anguilla’s legal framework provides strong protections, as its courts do not recognize foreign claims tied to marriage or divorce. Costs for setting up and maintaining such a trust are relatively modest compared to the value of the assets being protected. Initial setup fees typically range from $15,000 to $25,000, with annual maintenance costs between $3,500 and $7,000. Additionally, these trusts include an anti-duress clause, which blocks distributions if the settlor is under legal pressure.

The Results: Robust Legal Protection

A noteworthy example is the 2014 English High Court case, Joy v Joy-Morancho. In this case, Nichola Joy sought a £27 million lump sum from her husband, whose wealth was held in a British Virgin Islands discretionary trust established in 2002. During the proceedings, the trustees removed the husband as a beneficiary, effectively protecting the assets. The court, led by Sir Peter Singer, ruled that the trust was not a nuptial settlement and therefore could not be altered to provide the requested lump sum. This decision safeguarded the trust’s assets.

"Using a trust to protect assets in divorce is a smart move because those assets separate ownership from you, the trustor." – Forbes

Offshore trusts also present significant challenges for creditors. In Anguilla, creditors face a three-year statute of limitations to dispute asset transfers and must prove insolvency at the time of transfer. These strict legal standards, combined with the high cost of international litigation, often deter challenges altogether. When structured properly, an offshore trust not only creates a formidable legal shield but also ensures compliance with all disclosure requirements, making it a powerful tool for protecting wealth.

What These Cases Teach About Asset Protection

What Successful Asset Protection Strategies Have in Common

These cases highlight the importance of planning ahead and creating strong, independent structures to safeguard wealth. The key takeaway? Asset protection works best when established before any legal trouble arises. Courts often scrutinize transfers made after creditor claims, frequently dismissing them as fraudulent conveyances.

One critical aspect is transferring control. For example, in the Anderson case from the 1990s, a Cook Islands trust stood firm even under intense legal pressure and criminal allegations tied to a Ponzi scheme. Why? Because control had been legally handed over to an independent foreign trustee. On the flip side, billionaire Samuel Wyly’s case shows what happens when this principle is ignored. In 2016, a Texas bankruptcy court ruled against him, citing his direct control over 54 offshore entities used for personal and family expenses. The result? A $1.1 billion judgment.

Jurisdiction matters too. Places like the Cook Islands, Anguilla, and Nevis offer unique advantages. These jurisdictions don’t enforce U.S. court judgments, have short statutes of limitations (typically two years), and require creditors to meet a much higher standard of proof – “beyond a reasonable doubt” instead of the usual preponderance of evidence. They also provide robust privacy protections while adhering to international standards.

Another vital factor is using independent trustees. Trustees based in these offshore jurisdictions follow local laws, not U.S. court orders, creating a significant legal barrier for creditors.

Lastly, compliance with reporting requirements is non-negotiable. U.S. individuals must file IRS Forms 3520, 3520-A, and FBAR annually. While offshore trusts offer protection, they don’t erase tax obligations. Failing to report assets can lead to penalties that exceed the trust’s value.

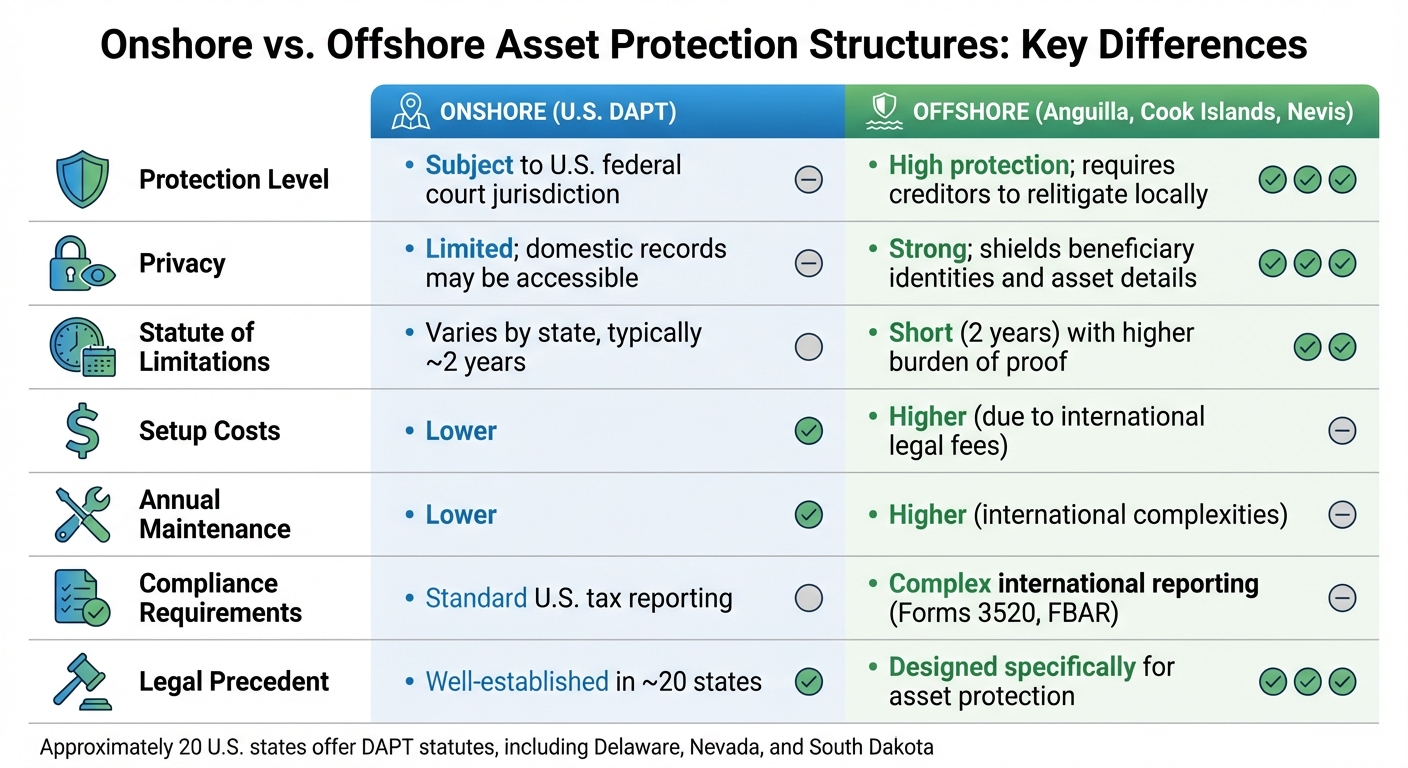

Onshore vs. Offshore Structures: How They Compare

| Feature | Onshore (U.S. DAPT) | Offshore (Anguilla, Cook Islands, Nevis) |

|---|---|---|

| Protection Level | Subject to U.S. federal court jurisdiction | High; requires creditors to relitigate locally |

| Privacy | Limited; domestic records may be accessible | Strong; shields beneficiary identities and asset details |

| Statute of Limitations | Varies by state, typically around two years | Often short (two years) with a higher burden of proof |

| Setup Costs | Lower | Higher due to international legal fees |

| Annual Maintenance | Lower | Higher because of international complexities |

| Compliance Requirements | Standard U.S. tax reporting | Complex international reporting (e.g., Forms 3520, FBAR) |

| Legal Precedent | Well-established in about 20 states | Designed specifically for asset protection |

Roughly 20 U.S. states, including Delaware, Nevada, and South Dakota, have domestic asset protection trust (DAPT) statutes. However, offshore setups often provide stronger safeguards. They operate under foreign laws and don’t recognize U.S. court rulings, avoiding the obligations of full faith and credit.

How to Get Started with Asset Protection

Based on these examples, here’s how to build an effective asset protection strategy:

- Start early. Timing is everything. Structures created after legal issues arise are more likely to be invalidated as fraudulent transfers.

- Pick the right jurisdiction. Your choice should align with your goals. Consider factors like legal protections, privacy, stability, and the availability of experienced professionals. For instance, Anguilla offers strong creditor barriers, tax-neutral treatment of foreign income, and access to skilled trustees.

- Work with independent professionals. Choose trustees and advisors who are not tied to firms promoting the structure. Lack of independence can lead to judgments against your assets.

- Consider layered structures. Combining offshore trusts with offshore companies adds extra layers of protection. In this setup, the trust owns the company, while you retain management control. This approach balances legal safeguards with operational flexibility.

- Stay compliant. File all required IRS forms, such as Forms 3520 and 3520-A, every year. Include spendthrift clauses in your trust documents to block creditors from accessing assets before distribution. Keep detailed records and avoid using trust assets for personal expenses to ensure the structure holds up under scrutiny.

Conclusion: Taking Action to Protect Your Wealth

The case studies make one thing clear: planning ahead is key to effective asset protection. Waiting until a legal dispute arises can leave you vulnerable to claims of fraudulent conveyance.

"Properly drafted and implemented asset protection plans are rarely, if ever, breached by creditors. Notably, breaches are exceedingly rare when plans are properly executed." – Howard Rosen, Donlevy-Rosen & Rosen, P.A.

The statistics tell a compelling story. Fewer than 10% of clients with well-structured offshore asset protection plans ever face creditor claims. Even more striking, less than 1% of those cases result in asset seizure. These numbers highlight how these strategies discourage creditors from pursuing aggressive actions, often leading to minimal settlements instead of expensive international litigation.

However, asset protection isn’t a one-and-done process. It requires ongoing care to adapt to changes in your wealth and circumstances. This means ensuring independent trustees, complying with IRS regulations, and customizing strategies to fit your unique risk profile. Staying proactive is the key to keeping your wealth secure, aligning perfectly with the strategies discussed earlier.

FAQs

What are the main advantages of offshore trusts for protecting wealth?

Offshore trusts are a popular choice when it comes to safeguarding wealth. They’re set up in jurisdictions with laws designed to favor debtors, creating a strong barrier against creditors. One major advantage? These jurisdictions often refuse to enforce foreign judgments, making it much harder for lawsuits to impact the assets held in the trust.

Another key benefit is the privacy they offer. When assets are transferred into the trust, ownership is legally separated from the settlor (the person who establishes the trust). This separation makes it far more challenging for creditors to lay claim to those assets. Plus, when a professional trustee manages the trust in well-known protective locations like the Cook Islands or Nevis, the security of the arrangement is further enhanced.

For individuals looking to protect their wealth and ensure long-term financial stability, offshore trusts provide a solid and reliable solution.

How can international LLCs help protect assets from creditors?

International LLCs, particularly those established in offshore locations like Nevis or Belize, offer a robust way to safeguard assets. These entities operate under local laws designed to make it challenging for creditors to access the assets held within the LLC. Since the LLC itself legally owns the assets – rather than the individual – creditors cannot directly seize personal property, even if they secure a judgment against the owner.

What makes this setup even more effective is that many offshore jurisdictions restrict creditor actions to charging orders. A charging order only grants a lien on potential distributions from the LLC, without transferring ownership rights. This means creditors have no authority to sell the LLC’s assets or take control of the entity. For an added layer of security, combining an international LLC with other structures, such as trusts, can create a more fortified defense against legal claims.

Why is it important to establish asset protection strategies before facing legal risks?

Setting up asset protection strategies ahead of time is crucial to ensure they hold up legally and work as intended. Tools like trusts, LLCs, or offshore accounts are far more effective when established well before any signs of legal trouble. If these measures are implemented after a legal threat appears, they might raise red flags, potentially being viewed as suspicious or even fraudulent, which could lead to them being invalidated in court.

Taking a proactive approach also helps you stay on top of legal and tax obligations, minimizing the risk of penalties or unexpected issues. Acting early allows you to build solid, legitimate safeguards for your wealth, giving you peace of mind long before any potential challenges arise. This forward-thinking strategy ensures your assets are well-protected against future uncertainties.