The US faces a desperate economic situation that could lead straight to UBI and rationing as they compound their poor choices.

March 21, 2022

By: Bobby Casey, Managing Director GWP

Like many first world countries, the US preoccupied itself with such privileged issues as culture wars and environmentalism. So much so, it forgot there was the rest of the world to consider, who really couldn’t give a rip about either.

Western leaders are trying to run their high production countries on literal sunshine. And the apparent theory is, if they take fossil fuels, natural gas, and nuclear off the table, everyone will just default to the “preferred” green energy.

But it’s a lot like trying to get a newborn to walk. That takes time and development. If you run and expect your newborn to keep up, you’re basically abandoning the kid and sentencing them to death. And that’s more or less what these G8 countries are doing.

The hypocrisy of these countries is that they ultimately have less savory countries be the bad guy. Germany would NEVER frack. But totally fine for Russia to do it and export to Germany. The US will not drill anymore. But totally okay to put our hands out to Venezuela, Saudi Arabia, and Iran and ask that they drill and sell it to the US.

It’s not even an elaborate ruse. It’s more like hiring a hit man to do your dirty work.

What is more elaborate is how the US dollars has maintained its dominance as a global reserve currency.

The US came off the gold standard under President Franklin Roosevelt around 1933. In 1971, under President Richard Nixon, he put the final nail in the gold standard’s coffin by ending US dollars convertibility into gold.

The dollar’s value was in a veritable free fall, so in 1974, the US and Saudi Arabia entered into a bilateral agreement which standardized the sale of oil in US dollars in exchange for US influence and military assistance.

Given the high demand for oil, this facilitated all sorts of irresponsible fiscal policy, including but not limited to unchecked spending and monetizing the debt to “pay” for it.

Well the last 48 years has been a hoot! The US’s status as the premiere reserve currency in the world has largely gone unchallenged. And the US has become very complacent about that fact.

Now the US has over $30 trillion in debt. Its citizens are the largest carriers of this debt. China is a distant second. And … oh yes… Saudi Arabia has a wandering eye for a new petro currency:

Saudi Arabia is in active talks with Beijing to price some of its oil sales to China in yuan, people familiar with the matter said, a move that would dent the U.S. dollar’s dominance of the global petroleum market and mark another shift by the world’s top crude exporter toward Asia.

The talks with China over yuan-priced oil contracts have been off and on for six years but have accelerated this year as the Saudis have grown increasingly unhappy with decades-old U.S. security commitments to defend the kingdom, the people said.

The mere fact that the Saudis are having these discussions is enough to make the US dollar slip. But the prospect of a Saudi Arabia, China, and Russia alliance is something the US better wrap its head around quickly.

The dark cynic in me thinks it might be deliberate. Here’s what Speaker of the House, Nancy Pelosi (third in line for the Presidency should something befall both President Joe Biden and Vice President Kamala Harris) had to say about ten days ago:

“When we’re having this discussion, it’s important to dispel some of those who say, well it’s the government spending. No, it isn’t. The government spending is doing the exact reverse, reducing the national debt. It is not inflationary.”

If this were true, how come with each increase in spending, the debt goes up, not down? It’s statements like these that make me think this is all by design and not by accident or sheer ignorance.

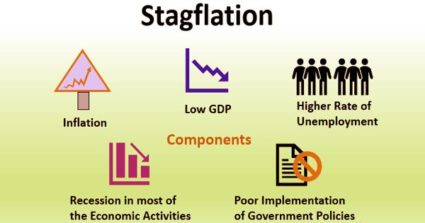

I saw a recent article positing if we hit a point of stagflation (i.e. low productivity and high inflation) it could usher in either or both a Universal Basic Income (UBI) and/or rationing.

The desperation would leave people vulnerable if not susceptible to relinquishing their freedoms for the promise of subsistence. The rhetoric was clear during the pandemic: if you want your normal life back, if you want your freedoms back, wear a mask, get vaccinated, follow the conditions and terms the government has instituted.

And many not only eagerly complied, but shamed those who wouldn’t, accusing them of holding normal hostage. That people would stunt the economy for two years over a cold was all these despots needed to know. It wasn’t even very difficult to get people to go along.

If people can be scared into economic despair over a cold, there’s no reason why they couldn’t be compelled into a Universal Basic Income scheme under enough economic strain.

A UBI would be an easy sell to those suffering under the weight of a comatose economy. To pay for that and make it work, rationing would become inevitable.

The UBI would incur out of control inflation. Price-controls would be the only way to offset that. Price-controls lead to shortages, which leads to rationing. That’s how close the US is to becoming Venezuela.

Will people be talking about the prosperity of the United States in the past tense in the same way they do of Venezuela’s?

Click here to schedule a consultation on how you can protect your assets from overreaching governments, or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.