If you’re a U.S. citizen or resident earning income abroad, you’re taxed on your worldwide income. However, there are legal ways to reduce your tax burden while staying compliant with U.S. laws. Key strategies include:

- Foreign Earned Income Exclusion (FEIE): For 2024, you can exclude up to $126,500 of foreign earned income.

- Foreign Housing Exclusion: Deduct housing costs over a base amount of $20,240 (location-dependent).

- Foreign Tax Credit (FTC): Avoid double taxation by claiming credits for taxes paid to foreign governments.

- Double Taxation Treaties: Use treaties to reduce withholding tax rates on income like dividends and royalties.

- Offshore Entities: Set up businesses in tax-friendly jurisdictions for asset protection and tax deferral.

- Residency in Low-Tax Countries: Move to countries with minimal or no income tax, such as the UAE or Panama.

Each strategy requires strict compliance, including filing forms like FBAR, FATCA Form 8938, and IRS Forms 3520 or 8833. Missteps can lead to penalties or even passport revocation. Professional guidance is crucial to ensure compliance while optimizing your taxes.

Use Double Taxation Treaties

What Are Double Taxation Treaties

Double taxation treaties are agreements between two countries designed to ensure that the same income – like business profits, dividends, interest, and royalties – isn’t taxed twice, both abroad and in the U.S. These treaties outline which country has the primary right to tax specific types of income, creating a clear framework for taxpayers to follow.

For U.S. taxpayers, these treaties can provide credits, deductions, or exemptions for foreign taxes paid. In practical terms, this means if you earn income overseas and pay taxes on it there, you might be able to reduce or even eliminate your U.S. tax liability on that income. The U.S. currently has treaties with about 65 countries worldwide.

Most treaties include a "saving clause", which prevents U.S. citizens or residents from using treaty provisions to completely sidestep U.S. taxes on their global income. Additionally, modern treaties often include "Limitation on Benefits" clauses to ensure only legitimate residents with substantial ties to the treaty country can claim benefits.

If you intend to claim treaty benefits in a foreign country, you’ll need to prove your U.S. tax residency by obtaining Form 6166 (Certification of U.S. Tax Residency) via Form 8802, filed with the IRS. Also, if you take a treaty-based tax position, you must disclose it on Form 8833. Failure to file this form when required can result in steep penalties – $1,000 for individuals and $10,000 for corporations.

Major U.S. Double Taxation Treaties and Their Benefits

One of the most significant advantages of these treaties is the reduction in withholding tax rates. Without a treaty, foreign jurisdictions often impose a standard 30% withholding tax on passive income like dividends, interest, and royalties. Treaties can bring these rates down significantly – sometimes to 15%, 10%, 5%, or even 0%, depending on the income type and the specific treaty.

For example, treaties with the United Kingdom and Switzerland frequently reduce withholding taxes to 0% on certain types of interest and dividends for qualifying entities. The treaty with Canada provides extensive relief for cross-border trade and lowers withholding taxes on royalties. Recently, in February 2024, the U.S. entered into a new comprehensive tax treaty with Chile, which became effective for withholding taxes on February 1, 2024, and for other taxes starting January 1, 2024.

However, not all treaty updates are favorable. The U.S.-Hungary income tax treaty was officially terminated on January 8, 2023. Additionally, on August 16, 2024, the U.S. suspended key provisions of its treaty with the Russian Federation, affecting articles related to business profits, dividends, interest, and royalties.

It’s also important to note that not all U.S. states honor federal tax treaties. Some states may still tax income that is exempt under a treaty at the federal level. Always check with local tax authorities before relying on treaty benefits.

Next, we’ll look at how offshore entities in tax-friendly jurisdictions can work alongside these treaty benefits.

sbb-itb-39d39a6

Set Up Offshore Entities in Tax-Friendly Jurisdictions

Benefits of Offshore Entities

Offshore entities offer more than just tax advantages – they can serve as a powerful tool for wealth management and financial security. For instance, they provide asset protection, shielding your wealth from domestic lawsuits and economic instability. Holding assets in stable offshore regions also diversifies your financial portfolio, acting as a safeguard against political or economic turbulence at home.

Another key advantage is tax deferral. Many multinational companies use offshore setups to delay paying domestic taxes on foreign earnings. However, it’s important to note that U.S. citizens are taxed on their worldwide income, no matter where their business is incorporated. As U.S. tax attorney Stewart Patton puts it:

Moving just your business offshore doesn’t work to reduce your US tax liability, but moving you and your business offshore most certainly does.

Financial privacy is another draw. While global transparency initiatives like the Corporate Transparency Act and CRS have reduced the confidentiality once associated with offshore banking, many jurisdictions still offer flexible incorporation laws and privacy protections. Additionally, offshore entities can provide access to international markets. Financial hubs like Hong Kong and Singapore are prime examples, facilitating global trade and investment.

However, the compliance requirements shouldn’t be underestimated. For example, foreign assets exceeding $200,000 may trigger the need to file FATCA Form 8938. Furthermore, offshore strategies can attract regulatory scrutiny. As Brinen & Associates warns:

If not managed carefully and transparently, offshore tax strategies can lead to audits, investigations, and serious civil or criminal consequences.

With these benefits and risks in mind, selecting the right jurisdiction becomes a critical step in maximizing the advantages of offshore entities.

Best Jurisdictions for Offshore Companies

The best jurisdiction for your offshore entity depends on your goals – whether it’s tax optimization, access to banking, or ease of compliance. Here are some popular options:

- British Virgin Islands (BVI): Known for its International Business Companies (IBCs), BVI offers zero corporate tax and operates under English common law.

- Cayman Islands: A top choice for hedge funds and multinationals, the Cayman Islands impose no direct taxes on corporations, income, or capital gains. However, incorporation and compliance costs can be higher.

- Seychelles: Offers quick and affordable incorporation – sometimes within 24 hours – with minimal reporting requirements.

- United Arab Emirates (UAE): With 0% corporate tax (except for certain activities), strong banking infrastructure, and residency options like the Golden Visa, the UAE is a growing favorite.

- Singapore: Known for its territorial taxation system, Singapore only taxes local-source income, making it ideal for fintech firms and holding companies.

- Belize: Offers fast incorporation processes and robust asset protection laws for non-resident entities.

- Nevis and the Cook Islands: These jurisdictions are renowned for their strong asset protection laws, particularly for offshore trusts and LLCs.

When choosing a jurisdiction, consider factors like double taxation treaties, setup and maintenance costs, ease of opening corporate bank accounts, and local economic substance requirements (such as having a physical office or employees). Political and economic stability, along with global reporting obligations under FATCA and CRS, should also influence your decision. Opening a corporate bank account is another critical step – select jurisdictions that cooperate effectively with financial institutions.

For an added layer of privacy and protection, you might also consider forming a private U.S. LLC.

How to Form a Private U.S. LLC for Privacy

A U.S. LLC, especially in states like Wyoming or Delaware, can provide strong privacy and asset protection benefits. These entities use "pass-through" taxation, meaning profits are taxed only at the individual level.

For non-U.S. residents, a U.S. LLC is particularly appealing since foreign-source income isn’t subject to U.S. corporate tax. This structure combines liability protection with operational flexibility, making it a valuable addition to international tax strategies. However, U.S. residents should note that forming a domestic LLC alone doesn’t lower U.S. tax liability on worldwide income. The real advantage comes when combining the LLC with legitimate international operations – or even relocating abroad to leverage benefits like the Foreign Earned Income Exclusion (FEIE), which allows for the exclusion of around $100,000 in earned income annually.

To ensure compliance, maintain detailed records and prioritize full disclosure. Properly managing an offshore structure requires ongoing oversight to avoid crossing the line into unlawful tax evasion. Consulting a qualified tax attorney early in the process is essential to design a strategy that aligns with your financial goals while staying within legal boundaries.

Use Offshore Trusts and Foundations

Offshore Trusts vs. Private Interest Foundations

Offshore trusts and private interest foundations are two tools often used for asset protection, estate planning, and tax deferral. While they serve similar purposes, they operate under very different legal systems. Trusts are based on English common law and involve three key players: the settlor (who sets up the trust), the trustee (who manages the assets), and the beneficiaries (who receive the benefits). Foundations, however, come from civil law traditions, commonly found in Europe and Latin America, where strict "forced heirship" rules often dictate how assets are distributed.

For U.S. citizens, taxation is a critical consideration. Most offshore trusts established by Americans are classified as "grantor trusts" under IRC sections 671‑679. This means the trust’s income is taxed as though the settlor still owns the assets. As Roger Healy, MBA, CFP®, EA, TEP from Creative Planning explains:

U.S. transfer taxes apply no matter where a U.S. citizen lives, gifts property, or dies.

To stay compliant, you’ll need to file Form 3520 annually and Form 3520‑A by March 15 to report foreign trust transactions. Failure to do so could result in penalties as high as $10,000 or 5% to 35% of the trust’s gross value. If the trust holds foreign bank accounts exceeding $10,000, you’ll also need to file FinCEN Form 114 (FBAR) and possibly Form 8938 under FATCA.

One major distinction between these structures is how they handle estate taxation. In common law jurisdictions, the estate is taxed before assets are distributed to heirs. In contrast, civil law countries tax the heirs when they receive their inheritance. This difference can lead to immediate tax liabilities in civil law jurisdictions for U.S. trust structures due to conflicting timing rules.

| Feature | Offshore Trust (Common Law) | Private Interest Foundation (Civil Law) |

|---|---|---|

| Legal Origin | English Common Law | Roman/Civil Law (Napoleonic Code) |

| Primary Method | Will or Trust document | Statutory succession/Forced heirship |

| Taxation Target | Estate taxed before distribution | Heirs taxed upon receipt |

| U.S. Reporting | Forms 3520, 3520‑A, 8938, FBAR | Varies; often treated as foreign entities |

| Flexibility | High discretion for choosing heirs | Limited; forced heirship rules apply |

These differences play a crucial role in how you structure an offshore trust, which we’ll explore further.

How to Set Up an Offshore Trust

Once you understand the legal frameworks, the next step is setting up an offshore trust that aligns with your goals, whether they include asset protection, tax planning, or estate management. Choosing the right jurisdiction is key. Popular options include the Cook Islands and Nevis, both known for their strong asset protection laws. For example, the Cook Islands enforces a short statute of limitations for creditors (1 to 2 years), while Nevis requires plaintiffs to prove their case "beyond a reasonable doubt", a much higher standard than in U.S. courts. Belize and the Cayman Islands are also attractive choices, offering tax neutrality and robust legal protections.

After selecting a jurisdiction, the next step is appointing a trustee. Most people opt for professional trust companies or attorneys based in the chosen jurisdiction, as they bring expertise in local laws and provide impartiality in any disputes. While you can name friends or family members as trustees, professionals are often better equipped to handle complex cross-border issues. Many U.S. citizens also establish an LLC owned by the trust to simplify asset management.

The trust deed is the cornerstone of the arrangement. This legally binding document spells out the terms of the trust, the powers of the trustee, and the rights of the beneficiaries. It’s essential to work with qualified legal counsel familiar with both U.S. tax law and the regulations of the foreign jurisdiction. Once the deed is finalized, you’ll fund the trust by transferring assets like cash, real estate, or LLC interests into its name. Keep in mind that under IRC Section 684, transferring appreciated assets to a foreign non-grantor trust can trigger capital gains taxes for U.S. citizens.

Compliance is critical. Form 3520‑A must be filed by March 15, while Form 3520 is due by April 15. Importantly, an income tax extension does not extend the Form 3520‑A deadline. You’ll also need an Employer Identification Number (EIN) for the trust, as using your Social Security Number is not allowed for these filings. Be cautious of any claims suggesting offshore trusts eliminate U.S. tax liability – the IRS actively scrutinizes these arrangements.

Offshore trusts require a significant investment of time and money. Between legal fees, trustee costs, and ongoing compliance, they are not a quick or cheap solution. However, for high-net-worth individuals, the benefits – such as enhanced asset protection and advanced estate planning – can outweigh the costs. Notably, around 20% of the top 1% of earners in the U.S. hold assets in foreign trusts.

Get Residency or Citizenship in Low-Tax Countries

Benefits of Low-Tax Residency and Citizenship

Relocating to a low-tax country can dramatically reduce your tax obligations while granting you the flexibility to live and travel more freely. Many of these countries follow a territorial taxation system, meaning they only tax income earned within their borders. If you’re working remotely for a U.S. company or earning investment income from abroad, countries like Panama, Costa Rica, and Paraguay only tax locally earned income.

Some nations take it a step further by imposing no personal income tax at all. Residents in places like the UAE, Bahamas, St. Kitts and Nevis, and Vanuatu can keep 100% of their earnings. For U.S. citizens, however, this doesn’t erase your federal tax obligations – you’re still taxed on worldwide income. That said, you can take advantage of tools like the Foreign Earned Income Exclusion (FEIE), which rises to $132,900 for the 2026 tax year. Interestingly, about 62% of U.S. expats end up owing zero U.S. taxes after leveraging available exemptions and credits.

Certain countries also offer special tax schemes to attract newcomers. For instance, Greece provides retirees with a flat 7% tax rate on all foreign income for 15 years. Similarly, Portugal’s Non-Habitual Residency (NHR) program offers substantial tax exemptions on foreign income for qualifying professionals. Beyond tax benefits, many of these jurisdictions eliminate wealth, gift, and inheritance taxes, making them appealing for long-term estate planning. On top of that, acquiring residency or citizenship in countries like Malta or Greece can unlock visa-free travel to numerous destinations, serving as a safety net in case of political or economic uncertainty back home.

As Mike Wallace, CEO of Greenback Expat Tax Services, explains:

The ideal retirement destination should combine three key elements: favorable tax treatment, high-quality healthcare, and reasonable living costs.

Let’s explore some of the best countries that offer low taxes alongside attractive residency and citizenship programs.

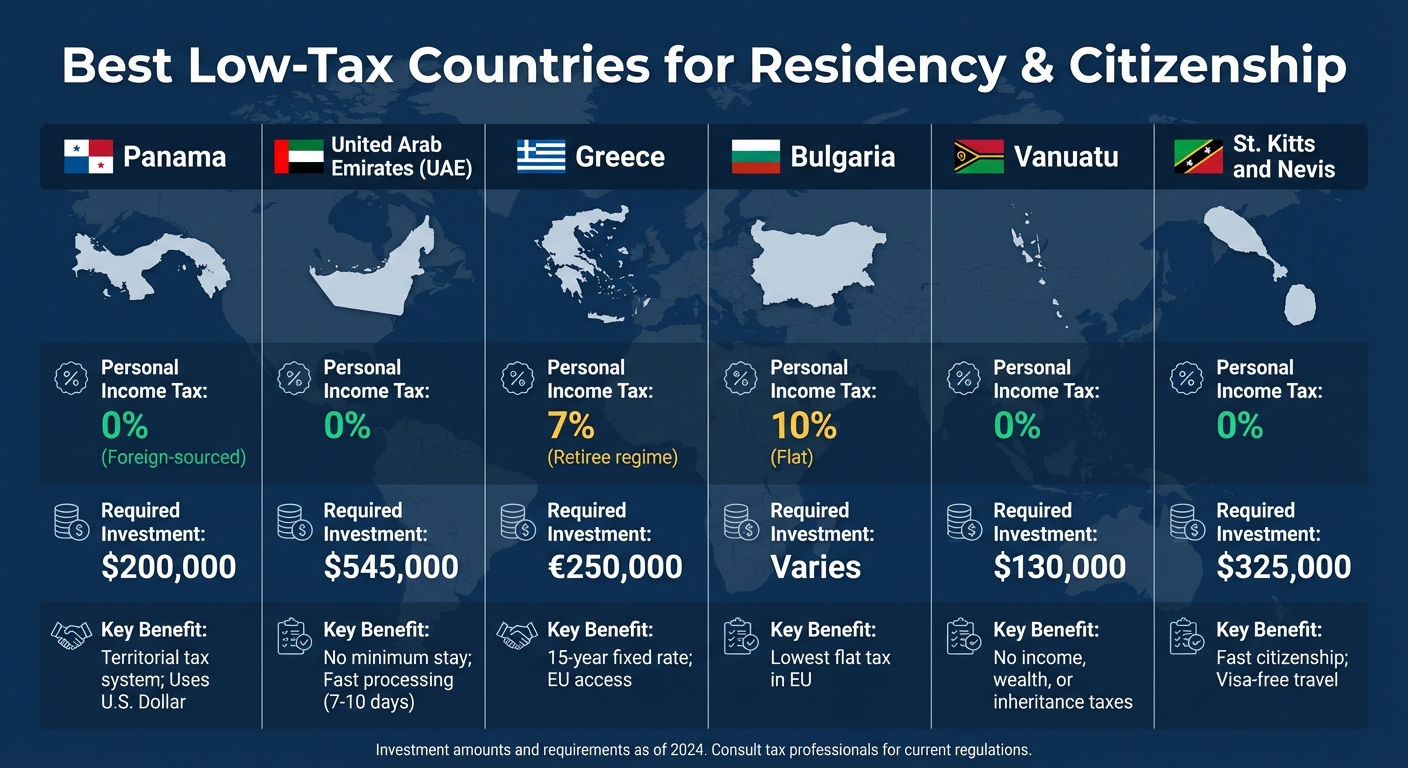

Best Low-Tax Countries for Residency and Citizenship

The right destination for you depends on factors like your income sources, lifestyle, and financial goals. Here are some standout options:

- Panama: Known for its territorial tax system, Panama taxes only local income, leaving foreign-sourced income untouched. The Friendly Nations Visa requires a $200,000 investment in real estate or a three-year bank deposit. To maintain residency, you only need to visit once every two years. Plus, using the U.S. dollar simplifies financial planning for Americans.

- United Arab Emirates (UAE): With zero personal income tax and cutting-edge infrastructure, the UAE appeals to high earners. The Golden Visa – available with a $545,000 (AED 2 million) real estate investment – offers 10 years of residency with no minimum stay requirement. Processing times are impressively fast, typically 7–10 business days. Remote workers can also apply for a one-year visa if they earn at least $5,000 per month.

- Greece: Perfect for retirees, Greece offers a 7% flat tax on all foreign income for 15 years. The Golden Visa program requires a minimum property investment of €250,000 and provides access to the European Union.

- Bulgaria: With a flat 10% tax rate on both personal income and corporate profits, Bulgaria boasts the lowest tax rate in the European Union.

- St. Kitts and Nevis: Citizenship here requires a minimum real estate investment of $325,000, reduced in October 2024. The country imposes no personal income tax and offers visa-free travel to many destinations.

- Vanuatu: Citizenship starts at $130,000, and residents enjoy zero income, wealth, and inheritance taxes.

| Country | Personal Income Tax | Required Investment | Key Benefit |

|---|---|---|---|

| Panama | 0% (Foreign-sourced) | $200,000 | Territorial tax; uses U.S. Dollar |

| UAE | 0% | $545,000 | No minimum stay; fast processing |

| Greece | 7% (Retiree regime) | €250,000 | 15-year fixed rate; EU access |

| Bulgaria | 10% (Flat) | Varies | Lowest flat tax in EU |

| Vanuatu | 0% | $130,000 | No income, wealth, or inheritance taxes |

| St. Kitts and Nevis | 0% | $325,000 | Fast citizenship; visa-free travel |

These countries provide excellent opportunities for those seeking a low-tax lifestyle with added perks like global mobility and financial freedom.

Global Escape Hatch Strategies

Planning a successful move to a low-tax country involves more than just packing your bags. You’ll need to understand tax residency rules, stay compliant with U.S. tax regulations, and prepare for practical considerations. Most countries require you to spend at least 183 days per year to qualify as a tax resident, though some, like Cyprus, offer "60-day rules" under specific conditions. Also, be aware that certain U.S. states, such as California and New York, are aggressive about taxing former residents even after they leave.

Even in a low-tax country, U.S. citizens must file annual tax returns and report foreign accounts. As Katelynn Minott, CPA & CEO of Bright!Tax, points out:

Living in a low tax country doesn’t mean skipping your U.S. tax return. The IRS still expects to hear from you every year, no matter how far you roam.

You’ll need to file FinCEN Form 114 (FBAR) if your foreign accounts exceed $10,000 at any point during the year, as well as Form 8938 under FATCA, depending on the value of your foreign holdings. To qualify for the FEIE, you must meet either the Bona Fide Residence Test (living in a foreign country for a full tax year) or the Physical Presence Test (spending 330 days abroad in a 12-month period).

Healthcare is another crucial consideration. Many low-tax countries, such as Belize and the Bahamas, lack robust public healthcare systems. It’s wise to invest in private international health insurance with medical evacuation coverage to ensure you’re fully protected. Finally, think about your long-term goals. Are you looking for a temporary tax break, a retirement haven, or a second passport for greater global mobility? Your objectives will shape the best strategy for your relocation.

Get Help with GWP Insiders Membership and Private Consultations

Global Wealth Protection (GWP) offers tailored membership and consultation services to simplify the complexities of international tax planning. These services are designed for location-independent entrepreneurs and investors looking to optimize their tax strategies legally and effectively.

Benefits of GWP Insiders Membership

Navigating international tax laws can feel overwhelming, but the GWP Insiders membership program provides the tools and expertise you need. Members gain access to step-by-step strategies for legally reducing tax liabilities, including guidance on selecting jurisdictions with favorable tax treaties. For instance, the U.S. has tax treaties with around 68 countries, and knowing which ones align with your financial goals requires specialized insight.

Membership also includes personalized reviews of your financial structures to ensure they meet "economic substance" requirements. This involves verifying elements like having a physical address and valid contracts, which are crucial for compliance. Professional tax planning ensures you stay within the bounds of legal tax avoidance while steering clear of illegal tax evasion. These benefits set the stage for more tailored strategies that align with your unique needs.

Private Consultations for Custom Tax Planning

For those seeking a more individualized approach, GWP’s private consultations offer bespoke solutions tailored to your financial situation. These one-on-one sessions with tax experts provide clarity on managing cross-border income and understanding how taxes apply across jurisdictions.

Consultants will evaluate your tax residency using tools like the Green Card Test, Substantial Presence Test, or tie-breaker rules to determine which country holds the primary right to tax your income. They’ll also guide you through choosing the best approach for foreign income taxation, whether it’s the Exemption Method (excluding income already taxed abroad) or the Tax Credit Method (offsetting U.S. taxes with foreign taxes paid). Additionally, they’ll identify treaty benefits, such as reduced withholding rates or exemptions for dividends, interest, royalties, and pensions. For example, nonresidents typically face a 30% tax rate on dividends, but certain treaties can reduce this to 15%.

For individuals from states with aggressive tax collection practices – often referred to as "sticky states" – professional consultations are especially valuable. These states actively pursue tax revenue from residents living abroad. GWP experts can help you navigate "Streamlined Filing Procedures" to address overdue filings and employ "tie-severing" strategies to legally end state residency. They’ll also ensure compliance with reporting obligations, helping you avoid severe financial or legal penalties.

Conclusion

Lowering your tax burden through international strategies is entirely legal, but it comes with strict rules that must be followed. As a U.S. citizen or resident alien, you’re taxed on your worldwide income. This makes tools like double taxation treaties and the Foreign Earned Income Exclusion (set at $126,500 for 2024) essential for reducing your liability. These options can help ease your tax obligations, but they don’t eliminate the need to file tax returns or report foreign assets. Understanding these tools is just the beginning of navigating compliance and enforcement.

"Living abroad doesn’t exempt U.S. citizens from their tax obligations to the U.S. government."

– Thomson Reuters

The IRS takes compliance seriously, and non-compliance can lead to hefty penalties. For example, failing to file forms like the FBAR or Form 8938 can result in severe consequences, including the possibility of losing your passport. State-level tax requirements and the complexities of tax treaties further complicate the process, making it critical to avoid errors.

This is where professional guidance becomes invaluable. Tax treaty benefits, for instance, require precise filings to be effective. A tax expert can design strategies tailored to your situation – whether that involves setting up offshore entities, navigating residency options, or managing cross-border investments. These personalized approaches not only ensure compliance but also help protect your wealth for the long term.

To stay compliant, determine your residency status, understand relevant tax treaties, and report all foreign accounts and assets under FATCA requirements. If you’re behind on filings, programs like the Streamlined Foreign Offshore Procedures can help you catch up without facing criminal penalties. By taking proactive steps and applying the strategies discussed here, you can safeguard your wealth while staying fully compliant with U.S. tax laws.

FAQs

What are the potential risks of using offshore entities to reduce taxes?

Using offshore entities to reduce taxes might seem appealing, but it comes with notable risks that demand careful consideration. One major issue is regulatory scrutiny. U.S. authorities, like the IRS, keep a close eye on foreign-owned entities. If income or assets aren’t properly disclosed, the consequences can be severe – think hefty penalties, accumulating interest, or even criminal charges. On top of that, changing tax laws and anti-abuse regulations could retroactively erase any perceived benefits, potentially leaving you with unexpected financial burdens.

Another challenge is the cost and administrative burden of managing an offshore entity. Staying compliant requires filing intricate forms such as 5471, 8865, and FBAR. Add to that the need for legal and accounting professionals, and you might find that the expenses eat into any potential savings. Then there’s the matter of reputation. Offshore accounts often carry a stigma, and public perception can impact your personal or corporate image, possibly affecting business relationships or career prospects.

To steer clear of these risks, it’s crucial to work with experienced professionals and ensure you fully comply with all reporting requirements before considering offshore strategies.

How do double taxation treaties help reduce my U.S. taxes on foreign income?

Double taxation treaties are agreements between the United States and other countries that help ensure you’re not taxed twice on the same income. These treaties can either exclude certain types of foreign income from U.S. taxes or reduce the withholding tax rate in the foreign country where the income originates. To take advantage of these benefits, you’ll need to report the income on your U.S. tax return and submit the correct forms, like Form 8833, to inform the IRS about the specific treaty provisions you’re using.

These treaties often complement the Foreign Tax Credit (FTC), which lets you offset U.S. taxes with the foreign taxes you’ve already paid. If the treaty lowers or eliminates foreign taxes on certain income, your FTC will be based on the reduced amount – or you might not need the credit at all if the income is entirely exempt. Using treaty benefits alongside the FTC correctly ensures you won’t pay taxes twice on the same income while staying within U.S. tax regulations.

Accurately documenting and claiming treaty benefits is essential, as mistakes could lead to unnecessary double taxation. For guidance, it’s a good idea to consult IRS resources or seek advice from a tax professional to navigate these rules with confidence.

What factors should I consider when choosing a low-tax country for residency?

When considering a low-tax country for residency, it’s essential to start with a deep dive into its tax policies. Look for options with little to no personal income tax, ensure there’s a clear double taxation treaty with the U.S., and check if the country’s residency rules align with how you plan to live. Beyond taxes, think about the bigger picture – political stability, a reliable legal framework, and the quality of public services. These factors contribute to long-term security and a comfortable lifestyle.

Practical aspects matter just as much. Investigate the cost of living, the standard of healthcare, the presence of international schools if you have children, potential language challenges, and how straightforward it is to secure residency or citizenship. As a U.S. citizen, remember that you’re still required to file U.S. tax returns and report worldwide income. That said, you might be eligible for benefits such as the Foreign Earned Income Exclusion or the Foreign Tax Credit, which can help lower your U.S. tax obligations.

Don’t overlook compliance requirements like FBAR or FATCA, especially if you’re moving to a country with strict banking secrecy laws. Weighing these financial, legal, and lifestyle elements carefully will guide you in choosing a destination that aligns with your personal and financial goals while meeting U.S. tax regulations.