December 18, 2013

By: Mark Morgan Ford

Technically, inflation is “a rise in the general level of prices of goods and services in an economy over a period of time.”

Is that bad?

It’s good if you have a fixed-rate mortgage or loan. It’s usually good if you are in the business of selling oil and gas, timber, precious metals, etc. Inflation is usually good, too, if you own real estate, art, and other physical property.

But it’s bad if you are a bondholder or own any sort of fixed-interest debt. It’s bad if you run a freight company. Or if you own any sort of fuel-dependent business in an industry in which it’s tough to raise rates.

And if you are like most retired people—living off a fixed income—inflation can be flat-out malicious.

Imagine, for example, that you have $1 million hidden under your mattress. And let’s say that the inflation rate spikes to 10%. We expect it will stay at that level for 10 years.

At the end of that period, you still have that $1 million. But by then you will be able to buy only 39% of what you could have bought today.

In other words, your $1 million would have depreciated by 61%.

Why Inflation Is Invisible to Some People

Most North Americans don’t worry about inflation. That’s because (a) it’s relatively modest today, compared with other times in history, and (b) because the government tells us that it is half of what it really is.

The Bureau of Labor Statistics says the inflation rate has averaged 2.6% since 1990. In fact, it’s at least twice that much. And could be four times that much.

You see, in 1990, the government changed the way it calculates inflation. It conveniently removed certain costs from the CPI calculations. Those included the prices of fuel and other commodities.

[“CPI” stands for “Consumer Price Index.” The Bureau of Labor Statistics defines this as “the measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.”]

The government did this to fool us. It didn’t want us to understand the damaging effects of putting more dollars into circulation. You see, the CPI is the most widely followed metric of inflation.

By printing or creating money, prices of everyday goods we use go up. The CPI would show large increases. This would tip people off that inflation was getting bad.

But by removing certain items or weighing them differently, the CPI can read lower than it actually is.

If you use the older, more credible government calculation, inflation for the last 20 years would average 6.5% per year. And according to the American Institute for Economic Research, it is actually closer to 8%!

An inflation rate of 8% means that $100,000 in cash today will be worth only $46,319 in 10 years, $21,455 in 20 years, and an abysmal $9,938 in 30 years.

Or to put it differently, it means that every 8-10 years, inflation cuts the wealth you have in cash by half.

Inflation may seem invisible or unimportant right now, but if you take a longer-term perspective, you can see how dangerous it really is.

What About Hyperinflation?

You may have heard the term “hyperinflation.” Hyperinflation is basically inflation on steroids.

In Germany after World War I, for example, inflation hit 29,500% in October 1923. (You read that right: twenty-nine thousand five hundred percent.) This made the German currency worthless and gutted the German economy. It also set the stage for the rise of Hitler (who believed Germany’s inflation woes were due to, among other things, capitulating to Jewish bankers at the Treaty of Versailles).

I wasn’t around after World War I. But I was alive from 1975-1991, when Argentina experienced soaring inflation, hitting 12,000% in 1989. As it did in Germany, hyperinflation made Argentina’s peso worthless and destroyed the fortunes of tens of thousands of wealthy Argentineans.

The negative effect in Argentina is still present: If you want to buy a house there today, you will have to buy it with a suitcase full of cash. I’m not kidding.

Over the past 10 years, I’ve read numerous essays arguing that the U.S. is primed for a period of hyperinflation. I’ve found those essays to be credible, but what do I know?

Happily, my approach to wealth building does not require me to know what will happen in the future. What I must do is be aware of future risk and “buy” insurance against it.

Inflation in the U.S. today is definitely not 2.6%. It is higher than that. And there are many reasons it could go higher—and possibly much higher. It doesn’t have to hit hyperinflation levels to destroy my future wealth. Moving up into the 15% range would be enough to make me a lot poorer.

I’d be a fool to ignore this as a possibility.

The “Wall Street” Way to Protect Against Inflation

What all of this means is that the question isn’t “How much inflation can we expect over the next 10-20 years?” but “What can you do to protect yourself from the damaging effects of the inflation we already have?”

The most commonly talked-about way (i.e., the “Wall Street” way—what all the pundits tell you) is buying inflation-sensitive assets. These investments tend to appreciate along with rising trends of goods and services.

Hard assets are such investments. Hard (meaning tangible) assets include precious metals, real estate, and collectible art. As a Palm Beach Lettersubscriber, you’ve read my recommendations regarding investing in gold coins and income-producing real estate. In the future, I’ll be telling you about collectibles too.

I’ve also said that certain stocks—such as the kind we recommend in our Legacy Portfolio—tend to keep pace with inflation. That’s because the types of blue-chip, safe companies we recommend can usually charge more for their products as their cost of goods increase with inflation.

Wall Street, your typical money managers, and other financial professionals will point you to investing or allocating your savings into these types of inflation hedges.

That’s their answer to beating inflation.

But investing in inflation-protected assets is just one small part of a three-part strategy I’m recommending today.

Why Investing Alone Won’t Protect You From Inflation

When most people think about arming themselves against inflation, they think in terms of investing: investing in hard assets and Legacy-type stocks, as just discussed above.

They are great inflation hedges. But will they really help you?

Sure, but not nearly as much as Wall Street would have you think. That’s because they protect only a tiny part of your overall cash flow.

Let me ask you this: What percentage of your income do you save every month?

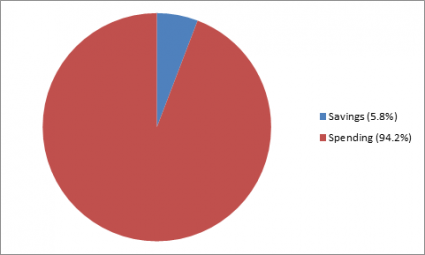

If you are like most U.S. citizens, you save a paltry 5.8% of your income. If you are Japanese, you save a bit more: 6.5%. And if you are British, you save even less: a measly 4.6%.

Put differently, Americans spend an astonishing 94.2% of their income. The Japanese spend 93.5%. And the British: 95.4%!

Some nationalities did better. Germans, traditional savers, put away 10.9% of their income in 2010. The Spanish and French saved more, at 13% and 16%, respectively. And it may surprise you to know that the Irish saved 19.3%.

But even at 19.3%, Irish people are spending 80.7% of their income on goods and services and taxes (the government again).

Americans: Average Spending Dwarfs Savings

Americans save only 5.8% of their income

When you are spending 80%-plus of your income every year, it is difficult to protect yourself against inflation. This is because investment hedges (such as the ones I described) benefit only the cash you put into them. And your savings is less than 20% (or, if you’re American, 5%) of your wealth.

Let’s use some numbers as an example to make the point clearer.

Say you earn $100,000 of income. And let’s say you’re fortunate enough to save 20%. You put it in a traditional inflation hedge, such as gold or real estate.

Next, let’s say inflation spikes 10% in one year. We’ll assume that means your inflation hedge will increase by the same amount. If your inflation hedge rises 10%, it will increase your overall net worth only 2%.

[$20,000 in an inflation hedge such as gold that goes up 10% means your investment increases by $2,000. But $2,000 of your overall income—$100,000—is just 2%.]

I hope you’re beginning to see how Wall Street’s laser focus on nothing but inflation-hedge investments is incomplete. It’s kind of like going to the emergency room for a broken leg, but the doctor insists everything will be okay if he just Band-Aids the scratch on your leg.

The bottom line is this: Only putting a small portion of your money in inflation hedges isn’t enough to protect you from inflation. Even though Wall Street focuses on investing in inflation hedges, Americans don’t save enough—and therefore invest enough—to make investments alone the solution to beating inflation.

What else can you do then?

I have two strategies for you.

Anti-Inflation Strategy Part I: An Old, Ugly Secret

When you first joined The Palm Beach Letter, I told you something that—at least until I said it two years ago—I’d never heard anyone else in the investment world say.

“You cannot hope to get wealthy by investing alone.”

I said that you need to base your foundation of true wealth building on (a) increasing the proportion of your income that you save (b) and increasing your income.

These same strategies are also the solution to beating inflation.

Think about it: How can you grow wealthy when 80%-plus of your costs are going up because of inflation, yet only 5% of your income is in an inflation-protected asset? How can you grow wealthy when your boss gives you only 3% yearly cost-of-living wage increases, but inflation is rising at 5%?

The truth—the boring-yet-powerful truth—is that the two most effective ways to combat the pernicious effects of inflation are to decrease the amount of money you spend every year and to increase the amount of money you earn.

Let’s talk about saving first.

Nobody talks about this. I don’t know why. Perhaps it is because the financial media and investment industry know that their customers don’t want to think about spending and saving. Where’s the fun in that?

But we must talk about it. When it comes to inflation, it is the big, smelly elephant that we can’t ignore.

Every extra $1,000 that you save by spending less (in an inflation-protected investment) will give you $1,000 more protection against inflation.

Spend less. Save more. There is no better strategy than that.

Practical Ways to Spend Less

In order to save more, you need to spend less. It’s that simple. But how do you do this, when most Americans spend an astounding 94.2% of their income?

Lifestyle changes.

You must make certain lifestyle changes that will substantially reduce your needto spend money, thereby increasing your ability to save it.

Let me begin with the biggest and most powerful thing you can do: moving into a smaller house.

Not everyone has the option of sizing down—people with growing families, for example. But retirees usually can sell their homes and move into smaller and less expensive abodes. This will radically decrease your need to spend.

Big homes are expensive. And not just because they carry larger mortgages (or rents). They’re also more expensive because all the upkeep—utilities, maintenance, repairs, etc.—tend to be much more expensive.

I’ve discussed this in depth in my essay titled “The Cost of Possession.” You can review that here.

My second recommendation relates to the first. Consider moving to a different part of the country. Move someplace where living expenses are less costly than they are in New York, Chicago, California, etc.

I’m spending a month in the Big Apple as I write this. My bacon-and-eggs breakfast every morning costs me $15 with the tip. I get the same thing at the Green Owl, my favorite breakfast place in Delray Beach, Fla., for $8.

[And if you do live in a less-expensive state now, you can move to a less-expensive part of the state. If I wanted to reduce my breakfast costs to below $8, I could do that by moving north, toward the center of Florida. You see what I mean.]

A third strategy, if you are not yet retired, is to locate your house within a mile or two of your office. Again, many people can’t do this, but many retired people can. By living close to your place of work, you can drastically reduce or even eliminate gas expenses. You might even be able to get rid of that extra car.

A fourth strategy—are you ready for this?—eat less, but eat better. You’d be amazed at how you can knock down the cost of feeding yourself and your family if you restrict your caloric intake. Lower your consumption to healthy levels and make fresh vegetables (they don’t have to come from fancy “green” stores) a big part of your food supply.

Other strategies, depending on your circumstances, might include:

|

• |

Clothing: Buy vintage clothes for ten cents on the dollar. (If you are a Wealth Builders Club member, you can find details from the “Living Rich” essays.) |

|

• |

Throw the TV in the garbage. Cancel your cable or satellite contract. Use Netflix on your computer and read. |

|

• |

Shop around for cheaper health insurance (another big inflation item). Increase the deductible. See Bob Irish’s essay on that here. |

|

• |

Keep the car you have for 10 years, instead of three. |

These are just a few ideas. Spend a few hours this week thinking about it. I’m sure you will come up with a dozen more.

Think of the difference these ideas could make…

Anti-Inflation Strategy Part II: Increase Your Income

Follow me for a moment as I use an analogy: Imagine a water faucet pouring into a bucket. Your goal is to fill the bucket. But in the bottom of the bucket, there is a hole that’s leaking water.

You probably know where I’m going with this. The faucet is your income—filling the bucket (your wallet)—and the hole in the bottom of the bucket is inflation—draining it.

The first strategy we just talked about—spending less and saving more—would be like trying to put duct tape over the hole in the bucket to stop the leaking. All the strategies I just gave you will help plug that hole.

But what if it’s not enough? What if the bucket is still leaking too much water? What if you’re still losing ground to inflation?

Then we turn to the second strategy: In our analogy, that means focusing on how much water is pouring out of the faucet.

In other words, you need to increase your active income. You need to make sure it’s increasing at the same rate as the inflation rate, if not faster. For every drop of water leaking out of the hole, you need at least a drop—if not more—pouring in from the faucet.

But your boss doesn’t want to protect you against inflation. That’s because the only way he can do that is to give you raises every year that match or surpass the actual rate of inflation. (I’d guess that fewer than 1% of companies worldwide give their employees wage hikes that match or exceed the true inflation rates.)

If the true inflation rate is 6.5% and you are getting a 3.5% cost-of-living increase every year, you are getting 3% poorer.

You can put a sensible percentage of your savings into an inflation hedge. And it may protect those savings from the ravages of inflation. But it won’t protect you from making less (in real money) every year and seeing all of your expenses continually go up.

There are two primary ways around this.

One, you become so valuable at your current job that your bosses reward you with a higher salary.

To achieve this, do everything in your power to become the most valuable person in your company. Arrive early. Work hard and work smart. Volunteer for projects. Take initiative. Become the “go-to” person for ideas and solutions. Become indispensable.

I’ve written about this idea several times, including here and here. Also be sure to check out Chapter 5 of my book, Automatic Wealth. That way, your boss (or even your boss’s boss) will reward you with bigger raises and compensation (pay raises that are at least as much as the annual increase in inflation).

But if increasing your salary from your primary job isn’t a possibility for whatever reason, you must focus on the second way of earning more income: finding or creating a new stream of income.

There is any number of ways to generate extra income. Working a second job. Freelancing… consulting… blogging… copywriting… the possibilities abound.

Here at The Palm Beach Letter, we’ve designed a unique program, the Extra Income Project. It provides ideas for ways you can earn a second or even a third stream of income. As I have explained many times, “There is no faster or surer way to become wealthy than by creating extra income and allocating it toward one’s investments.”

It features essays on my favorite extra-income opportunities. These include ideas for making extra income from your current career, plus many great ideas for accessing extra income from side businesses, freelancing, investment “jobs,” and so on.

How You Can Start Fighting Inflation Right Now

Wall Street declares that you can beat inflation by simply investing in the right kind of assets. And yes, while that is important, that strategy alone will not beat inflation.

The best way to combat and beat inflation is to spend less and earn more.

Here’s what I want you to do right now to tackle this problem.

First, sit down with your bank ledger and credit card statement. Look at what you’re spending your money on. Identify ways you can cut back. Come up with 10 ways to spend less right now, and start doing them immediately.

Second, think hard about your job. What could you do that would set you apart from the other employees? What could you do that would truly add value for your boss or the company? What actions could you take today that will get you noticed as valuable and irreplaceable?

I’ll give you a hint. Your job is to produce long-term profits. In other words, your job is to help your company make more money.

The secret to getting above-average raises each year is to accept that as your fundamental responsibility—and to transform the work you are doing now in such a way that it will produce those long-term profits. The better you can do it, the more money you will make. It’s as simple as that.

Third, consider new ways to create extra income. As I wrote above, there are countless possibilities. But the key is to begin looking right now. Start a Google search. Make a phone call to ask questions. Set up an informational interview to learn more about a possibility. The point is, take action.

If the idea of thinking about spending less or acquiring extra income is depressing, please make sure you go back and reread the Living Rich series or reread the cash flow ideas I’ve collected in the Extra Income Project series.

I can promise you this: A month after you start implementing these three strategies, you will feel much better about the threat of inflation. And as time passes, you will be able to sleep comfortably at night. You’ll know that you are immune to inflation’s malicious effects.

Best,

Mark

P.S. Here’s one idea we’ve spent a lot of time and money researching… it’s an idea your broker will never tell you about because he (or she) doesn’t make a commission on it. That’s too bad, because this investment compounds your wealth tax-free at a rate 4-5 times higher than long-term CDs. In fact, my partner Tom Dyson has made this his single-largest investment and will put another $400,000 of his own money into this over the next four years. Click here for all the details…