May 9, 2016

By: Bobby Casey, Managing Director GWP

For eons human beings have passed on information for the next generation, and each generation has generally been greater than its predecessor. But recently… and by recent, I mean in the past couple hundred years, the line on that chart has been flattening out. Rather than acknowledge mistakes and improve, societies have learned the art of making excuses and denial. So we don’t improve, we just cover up and coast along.

You and I can say on an individual level that we learn and grow, that our lots have improved, or that we have a plan. And private industry still practices this vital human tradition. But societies aren’t as lucky. Governments are homogenizing their policies. Nearly every country in the world has a central banking system now. Nearly every currency in the developed world is either barely backed or unbacked entirely. Nearly every country is in debt.

Why was it NEWS that Iceland convicted its criminal bankers and politicians? That shouldn’t be NEWS. That should be normal. It’s news because that’s not how business is done. Cronies get pardons.

Why was it news that Estonia was basically streamlining its government services by putting everything online? Because governments aren’t typically streamlined and efficient!

Why was the bail-in of Cypriot banks so shocking? Because for the first time in modern European history, private bank accounts were raided for the sole purpose of bailing out banks.

Why was Watertown, MA so shocking? Because no government in the United States has ever unleashed nearly 10,000 men in uniform onto one of its own small towns, violated the quartering act, and turned an entire city into a temporary prison.

Why were the revelations of Edward Snowden so shocking? It wasn’t just finding out that the government was spying on us needlessly. It was that deep down, government sees its own people as the enemy. How else can you call Snowden’s revelations to the people of the US treason?

Not all of this is indicative of bad things per se. These are simply challenges to what most people have come to accept as normal. Some of these challenges were tests to see if people would sit back and tolerate the unlawful actions of the state if they were scared enough… and they would… and they did.

The EU is moving closer and closer to a cashless society, having ended the production of the 500 Euro note. I told you about this back in February. Now it’s official. Maybe it’s from watching countries like Venezuela that can’t print money fast enough to keep up with its own inflation? It’s too late for Venezuela to go digital, so they are desperately trying to print up the money needed to pay for basic imported necessities. They can’t.

“[T]he sheer amount of bills needed for basic transactions. Venezuela’s largest bill, the 100-bolivar note, today barely pays for a loose cigarette at a street kiosk.”

“As early as 2013, the central bank commissioned studies for 200 and 500 bolivar notes, former monetary officials say. Despite repeated assurances, no new denominations have been ordered, pushing Venezuela into uncharted territory by its refusal to produce larger bills while not fully paying providers.” (Source: Bloomberg)

Had Venezuela the foresight, they could’ve prepared for this by going cashless. Then their money problems would be solved with a mere keystroke: something I see the EU and the US preparing for. Imagine being so broke you can’t afford to make the money you need to have an economy. I imagine Greece would have found itself in a similar predicament had it not been an EU member state.

Here we are three years after the Cypriot bail-in, and what do we know?

We know that it was absolutely a template for future bank crises.

We know that the United States FDIC would NEVER be able to handle a true run on the banks.

We know that the aside from going cashless other capital controls are slowly being put into place.

But here is some new information:

“In a bankruptcy of a major bank now, one considered too big to fail, the banks are going to be promptly recapitalized with unsecured debts. Well, that sounds fine. I don’t own any unsecured debt. But, yes, you do, if you have a bank account with a bank,” says Chris Martenson, co-founder of PeakProsperity.com.

Remember how we told you that when you deposit money in a bank, that money technically is no longer yours? At that same time, we told you that it was actually a loan that the bank must honor in good faith at your behest. If you write a check or use your debit card, and authorize a sum be paid to someone, they must honor it as the sum you hold in their bank is really their debt to you. That’s the unsecured debt Dr. Martenson speaks of.

In the event of a banking crisis, the account holders will be “recapitalizing” the banks. Their debt to you gets wiped clean. Your money is not your money, and it is then used to pay off the derivatives first. Are you curious as to how many derivatives your bank holds? You should be, considering they are all in line waiting for YOUR money in front of you in the event of a banking crisis.

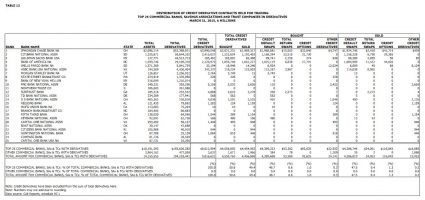

Below is a chart from the Office of Comptroller of the Currency (OCC) of the top 25 banks with the highest amount of derivatives as of 2015:

(You can make this image bigger by clicking on it.)

I think the first order of business is to see if your bank is in that top 25. If it is, get out of it. Find a small local bank or a credit union. If you have multiple bank accounts, that’s fine. You can find other financial institutions that won’t put your assets on green at the roulette table.

The second order of business is to set up an appointment with me. Let me show you how you can maintain control over your assets, regardless of the economic climate. Click here to schedule your appointment.

But I say this the economical likely of those countries may maximise once these ladies are freed from their chattel

lifetime.

I can’t get the chart to enlarge by clicking on it.

Thanks