Whatever the original intention, Obamacare is creating criminals out of thin air

October 10, 2016

By: Bobby Casey, Managing Director GWP

If there is ONE thing the government is good at, it’s exacerbating a problem and creating criminals out of thin air. One of the most effective ways of doing that is by an elaborate 75,000+ page system of codes known as taxes.

If there is ONE thing the government is good at, it’s exacerbating a problem and creating criminals out of thin air. One of the most effective ways of doing that is by an elaborate 75,000+ page system of codes known as taxes.

It’s not just criminalizing you, there’s more to it. The stigma of being “non-compliant” with tax laws and codes can come with some heavy consequences. In some cases, your freedom to travel is on the line.

Nowhere is this clearer than in observing the roll-out of the Affordable Care Act (ACA, a.k.a. Obamacare). 16% of Americans were uninsured. We aren’t sure how many of those 16% actually WANTED or NEEDED insurance, but they didn’t have it, and that was enough to declare it a national crisis.

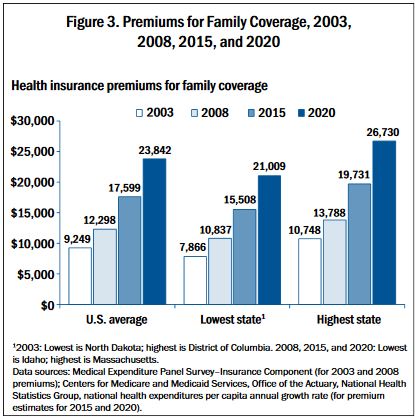

Enter Obamacare, which basically told people, “Buy health insurance… or else…” We were TOLD we could keep the same policies and doctors if we already had insurance, but that was false. Premiums have gone up considerably, and are projected to continue:

It should go without saying that this is putting a tremendous hardship on the working middle class who, once again, is too rich to be poor, but too poor to be rich. What should they do when the prognosis is that, with premiums growing at a rate exceeding that of the rate of inflation, they could soon be looking at family premiums exceeding $20,000 per year? How can that be okay? And at that point, what’s the point in having insurance? Premiums like that aren’t worth it. If you can afford $20,000/year in premiums then you can afford $20,000 in medical costs. What are you paying for exactly?

Everyone falls into one of four categories:

- You’re exempt. There are plenty of exemptions to this law, so if you fall into that category, fantastic!

- You can afford insurance. Either you pay for it out of pocket or you have some help from your employer. Either way, you have full coverage and you’re all set.

- You can’t afford health insurance, but you qualify for Advance Premium Tax Credits (or APTC). That’s when the government pays some money toward your healthcare premiums in advance based on your income.

- You can’t afford health insurance, so you don’t buy it.

The bottom line is that the ACA has made health insurance affordable for different people because essentially it’s only moved the needle by about 5%. In 2008, the uninsured rate was between 15% – 16%. It’s 2016 – 8 years later – and the uninsured rate is now around 11%.

Here’s how the bottom two categories are shaking out so far:

“Nearly 8.1 million taxpayers paid $1,694,088,000 in Obamacare penalties for not having health insurance in 2014, the first year the penalty was in effect.”

“Around four million individuals are estimated to pay $4 billion in penalties this year, according to the Congressional Budget Office. The budget office projects that $5 billion will be collected each year from 2017 to 2024.”

(Source: Freebeacon)

It’s not a tax! It’s a “Shared Responsibility Payment”. Aaaaw, that’s so cute! And because it’s not a tax, it’s so much more affordable and palatable. These same people who can no longer afford health insurance are still uninsured, but now they pay for the privilege.

People who don’t have insurance despite the mandate… are those insurance evaders? In the same way people who don’t pay taxes are tax evaders? Yes, they are. And they are penalized with their annual fines which have gone up since 2014. It’s not a jailable offense, but I’m curious if at some point, if people fall far enough behind on their “Shared Responsibility Payments”, will they have their passports or driver licenses confiscated?

Then you have those who were eligible for APTCs.

“The advanced amount is mainly based on the person’s estimated income and family size for that year. In order to reconcile the amount received by the insurer on their behalf with the amount they were legally entitled to receive, people must file Form 8962 when they file their regular Form 1040 tax return.” (Source: FEE)

Of all the people who received this advance, only 8% received the correct amount, just over 50% of recipients underestimated their income and owed on average $860, and the remaining 41% over estimated their income and are due an average of $640.

Approximately 1.4 million households have not correctly reconciled their APTCs as of a year ago. Either they didn’t file a return at all – which was the case for about 1/3 of them – or they filed a return but failed to file Form 8962. This leaves about $4.2 billion unreconciled and to date there’s been no update from the IRS on the status of these outstanding advances.

The whole thing is a hot mess. The people who fail to file properly are technically breaking the law. What’s more is, they are over compensating with these advances, and even sending advances to people who should’ve been disqualified for not filing properly in previous years.

“The bureaucracy also appears to be failing at its legal requirement to cut off individuals’ 2016 APTC if they did not file a 2014 return. The Government Accountability Office found that four-out-of-four fictitious applicants who failed to file a tax return in 2014 were approved for an APTC again in 2016.” (Source: FEE)

The worst part of all of this is that those who do qualify for these APTCs, there is no incentive to earn more. For every $1000 more they make, they stand to lose approximately $150 in subsidies. We saw this in Seattle when the minimum wage went up, and people stopped picking up shifts because they would be disqualified from other government programs if they made too much.

This is, as I said, a huge burden for the middle class. This is also going to become an impossible task for small and mid-sized businesses who struggle to offer health insurance, but aren’t in any better a position to pay the fines. Premiums going up doesn’t just hurt individuals, it hurts businesses. And in the midst of all this, there is still a steady call for an increase in minimum wage? How is our economy supposed to handle this? How are these tax violations going to be used in the future to leverage control against those people?

Concerned doesn’t begin to describe how I feel about this. I don’t live in the US long enough to be caught up in the ACA dragnet. I actually have a pretty sweet deal in Latvia. For those of you thinking about a more location-independent lifestyle, Obamacare is absolutely a fantastic reason to shift that goal into high gear.

Click here to schedule a consultation or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.

It wasn’t meant to work. It was designed to fail and force us into a single-payer system.

I would tend to agree with that. I do believe it was an intentional failure left to drive the healthcare system to a single payer system. It was built to fail in order to blame the insurance companies, doctors and pharmaceutical companies in the failure so “big brother” can step in and save the day.

what are we paying for exactly?

the privilege of not being punished any more! (more taxes, more fines, future jail time, passports revoked, etc)

We pay the slavemasters for the perception of freedom.

I guess finding useful, reliable inmtifaoron on the internet isn’t hopeless after all.