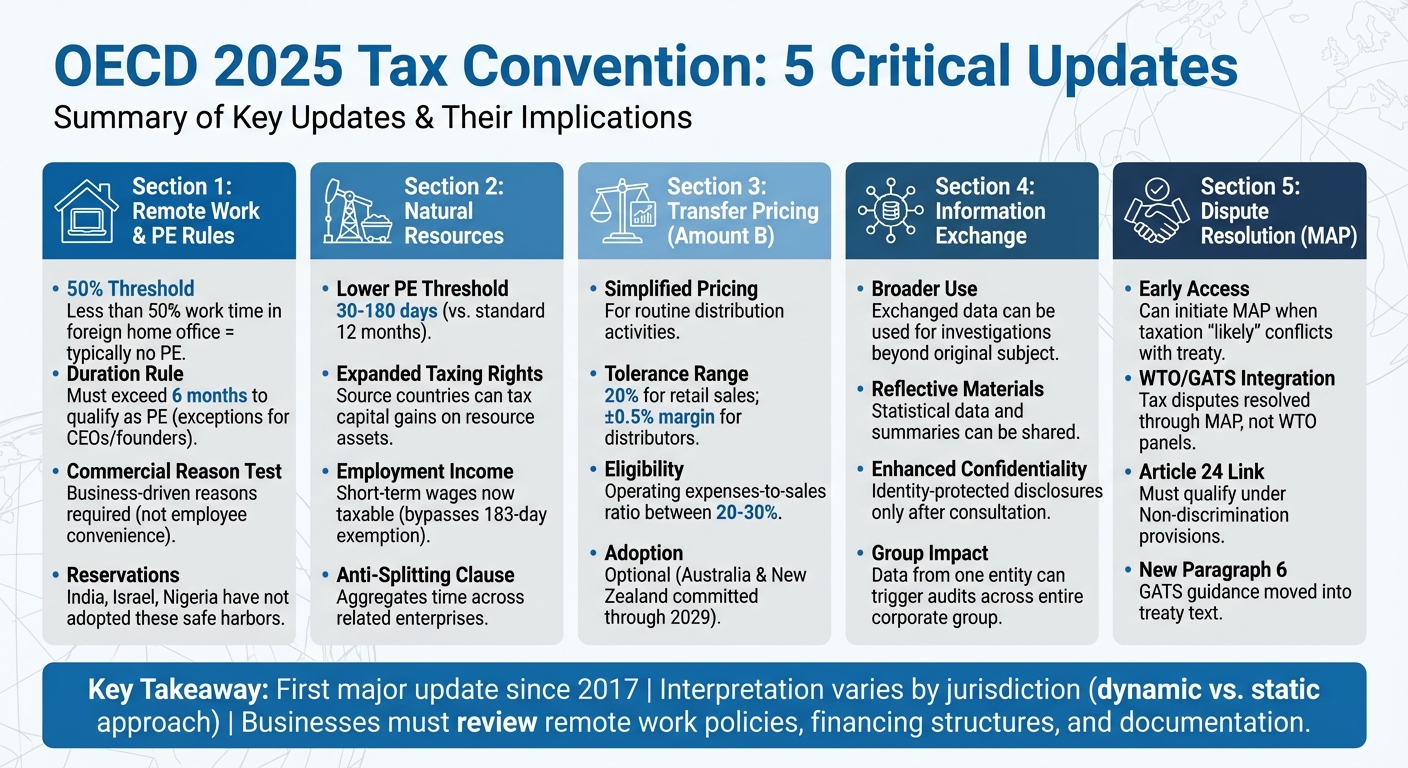

The OECD‘s 2025 updates to its Model Tax Convention (MTC) bring new clarity to international tax rules, particularly for remote work, natural resource taxation, and transfer pricing. Here’s what you need to know:

- Remote Work: A new 50% threshold clarifies when a home office creates a Permanent Establishment (PE). Less than 50% of work time in a foreign home office typically avoids PE risks. However, exceeding the threshold depends on business-driven reasons.

- Natural Resources: Lower PE thresholds for extractive industries (30–180 days) and expanded taxing rights for source countries now cover capital gains and employment income tied to resource activities.

- Transfer Pricing: The introduction of "Amount B" simplifies pricing for routine distribution activities, but inconsistencies across jurisdictions may require careful documentation.

- Information Sharing: Broader data-sharing rules allow tax authorities to use exchanged data for wider investigations, though confidentiality protections have been strengthened.

- Dispute Resolution: Updates to Mutual Agreement Procedures (MAP) enable earlier resolution of cross-border tax disputes, especially for issues tied to WTO/GATS obligations.

These changes reflect a shift in global tax practices, emphasizing remote work, resource taxation, and streamlined dispute resolution. Businesses must monitor local laws and maintain thorough records to manage risks effectively. This includes evaluating offshore asset protection strategies to safeguard wealth against evolving international tax liabilities.

Remote Work and Permanent Establishment Rules

When Remote Work Creates PE Risks

The 2025 update introduces a new approach to determine when remote work leads to a permanent establishment (PE). Instead of relying on the old "at the disposal" test, the updated framework uses a "facts and circumstances" analysis, focusing on how much time an employee spends working remotely.

One key element of the update is a 50% working time threshold. If an employee spends less than half of their total working time over a 12-month period working from a home office or another non-company location, it typically doesn’t result in a PE. However, exceeding this threshold doesn’t automatically mean a PE is established. The framework includes a "commercial reason" test to assess whether the remote work is driven by local business needs, such as maintaining customer relationships, managing suppliers, or addressing time-zone-specific requirements.

"The new commentary moves away from the concept of being ‘at the disposal’ of the company, considering the facts and circumstances of the working arrangements and whether there is substance to contend a corporate presence should be considered to exist." – Richard Tonge, Partner and Global Mobility Services Practice Leader, Grant Thornton

Importantly, if remote work arrangements are based solely on employee convenience, talent retention, or reducing office costs, they don’t create a PE. This distinction ensures that companies offering flexible work options for internal purposes aren’t penalized with unexpected tax obligations.

These updated rules provide a clearer framework for addressing remote work scenarios, setting the stage for further discussion on post-pandemic work trends.

Post-COVID Work Trends and Tax Consequences

The guidance also reflects how hybrid work patterns have evolved since the pandemic. By establishing clearer criteria, the updated OECD framework aims to prevent the emergence of minimal permanent establishments (micro-PEs) from routine remote work arrangements that lack substantial business activity.

For a fixed place to qualify as a PE, it must generally be in use for at least six months. Short-term setups, like three-month workations or temporary stays in hotels or rental properties, typically don’t meet this threshold. For those pursuing these lifestyles, understanding tax and residency solutions for digital nomads is essential to avoid unintended liabilities.

An exception applies to certain individuals, such as founders, CEOs, or independent consultants, whose home offices may qualify as a PE regardless of the duration of use.

"The OECD’s updated guidance now provides clarity: remote work from another country will most often not lead to unexpected tax consequences for the employer." – Jessica Silver, Certified Tax Advisor, KPMG in Sweden

It’s worth noting that not all countries have adopted these guidelines consistently. For example, India has formally disagreed with the 50% threshold and commercial reason tests, meaning multinational companies with remote workers in India cannot rely on these safe harbors. Similarly, countries like Israel and Nigeria have expressed reservations. Businesses should carefully review local tax rules before approving long-term remote work arrangements to ensure compliance.

Natural Resource Exploration and Exploitation (Article 5 Commentary)

Lower PE Thresholds for Extractive Activities

The 2025 update introduces a new optional provision specifically aimed at oil, gas, and mineral extractors. Under this provision, a Permanent Establishment (PE) is considered to exist if "relevant activities" surpass a bilaterally agreed duration – typically ranging from 30 to 180 days within a 12-month period. This marks a clear shift from the usual 12-month rule.

"The revised commentary on article 5 offers contracting states an optional mechanism to ensure that income derived from natural resource activities is taxed in the jurisdiction where those activities occur." – Linda Peter, BDO in South Africa

This provision applies to a wide range of activities, both offshore and onshore. It includes specialized services such as seismic surveys, engineering consultancy, and the installation of mining infrastructure. However, auxiliary functions like transportation, towing, anchor handling, and general vessel operations are excluded. Additionally, the update includes an anti-contract-splitting clause, which aggregates time spent across related enterprises to prevent projects from being artificially divided to evade tax obligations.

Expanded Taxing Rights for Source Countries

Building on the revised PE thresholds, the update also strengthens the taxing rights of source countries. It grants these countries primary taxation rights over capital gains derived from extractive activities. This includes gains from the disposal of exploration rights, immovable property, and shares where over 50% of their value is tied to such assets. This approach diverges from the standard OECD Model, where capital gains are generally taxed in the residence state unless connected to immovable property.

"For businesses in the energy, mining and oil & gas sectors… this development will likely encourage resource rich countries to push for this alternative article in new treaties and renegotiations." – Ravi Ahlawat, Partner, DLA Piper

The update also introduces optional provisions for taxing employment income. Source countries are now allowed to tax wages linked to extractive activities, even in short-term arrangements that would typically qualify for the standard 183-day exemption. For companies operating in this sector, this means carefully reviewing holding structures and tax liabilities when exiting resource projects. Effective time-tracking for exploration campaigns will be critical to managing tax risks.

Transfer Pricing and Business Profits (Articles 7, 9, 24 Commentary)

Amount B for Routine Distribution Activities

The 2025 update brings a new addition to the Article 25 Commentary: Amount B, a framework designed to simplify how baseline marketing and distribution transactions are priced. This approach aims to streamline the application of the arm’s length principle, offering a 20% tolerance for retail sales and a margin tolerance of ±0.5% for qualifying distributors.

"Amount B is a simplified and streamlined approach to apply the arm’s length principle to baseline marketing and distribution activities." – KPMG

Starting January 1, 2025, jurisdictions can choose to adopt Amount B. Eligibility hinges on an operating expenses-to-sales ratio falling between 20% and 30%. Notably, Australia and New Zealand have already embraced this proxy for the arm’s length principle, with plans to use it until December 31, 2029. However, since adoption is optional, multinational companies might face scenarios where this framework applies in one country but not in another. This inconsistency could increase the need for Mutual Agreement Procedures to resolve disputes. To navigate this, distribution entities should maintain thorough financial records to justify their matrix-based returns. Additionally, any functions that fall outside the framework’s scope must be clearly documented and separately priced.

Thin Capitalization and the Arm’s Length Principle

The 2025 update also sheds light on how profit allocation methods under transfer pricing rules interact with domestic laws governing expense deductions.

A key clarification in the update is the distinction between profit allocation under Article 9 and the calculation of taxable income under local regulations. While Article 9 ensures that intercompany transactions are priced at arm’s length, domestic laws may impose limits on expense deductions without requiring corresponding adjustments in the other jurisdiction. This means that domestic thin capitalization rules and interest limitation measures can coexist with treaty-based profit allocation principles without violating Article 9.

As the OECD Commentary explains:

"Article 9 does not deal with the issue of whether expenses are deductible when computing the taxable income of either enterprise."

This duality can lead to economic double taxation. Compounding the issue, countries differ in how they classify debt and equity. Some jurisdictions use the "accurate delineation" principles outlined in the OECD Transfer Pricing Guidelines, while others – like the United States – rely on domestic judicial doctrines and thin capitalization rules. For multinational companies, this means cross-border financing structures must be evaluated twice: once for compliance with Article 9 and again under local expense deductibility rules. If foreign-owned entities face stricter limitations on expense deductions, companies may need to seek relief under Article 24 (Non-discrimination). These updates highlight the ongoing efforts to create a more consistent framework for handling cross-border tax issues.

Mutual Agreement Procedures (MAP) and WTO/GATS Interaction

Simplified Access to MAP for Tax Disputes

The 2025 update to the OECD Model Tax Convention brings notable changes to dispute resolution, particularly in addressing tax measures tied to trade. A key addition is paragraph 6 to Article 25, which moves guidance on how tax treaties align with the General Agreement on Trade in Services (GATS) from the Commentary directly into the treaty text itself. This shift highlights the growing importance of factoring in GATS obligations when applying tax rules.

One major change allows taxpayers to initiate the MAP process as soon as there’s a likelihood that taxation may conflict with treaty provisions. This proactive approach lets multinational companies engage tax authorities early – before disputes escalate. For instance, if a jurisdiction enacts a digital services tax or introduces new interest limitation rules that may contradict treaty terms, businesses can seek resolution without waiting for the issue to worsen.

This early access to MAP aligns with clarified rules on how tax measures fit within the scope of WTO/GATS obligations.

WTO/GATS Scope Clarifications

Under the revised framework, a tax measure will only fall under GATS obligations if it is covered by Article 24 (Non-discrimination) of the tax treaty. This means disputes over whether a tax measure violates treaty terms should be resolved through MAP between the treaty partners, rather than through the WTO’s binding dispute resolution system.

"Any dispute between the treaty partners about whether a measure falls within that scope must be resolved under the MAP (Article 25), rather than via GATS dispute settlement." – DLA Piper

This approach ensures tax disputes are handled by tax experts, avoiding overlapping jurisdictions with trade-focused panels. However, not every country is on board with the change. For example, India and Nigeria have expressed reservations about fully adopting the new paragraph 6. Businesses operating in these regions should carefully track local interpretations and ensure they can substantiate claims of non-discrimination under Article 24 to qualify for MAP.

The update also ties MAP procedures with Amount B, ensuring all jurisdictions maintain access to effective dispute resolution mechanisms. This integration offers a clearer and more flexible framework for resolving cross-border tax conflicts.

sbb-itb-39d39a6

Exchange of Information and Confidentiality (Article 26 Commentary)

Information Use and Sharing Protocols

The 2025 update introduces new flexibility for tax authorities in how they use shared data. Now, information exchanged under Article 26 can be applied to tax matters involving individuals or entities beyond the original subject of the request.

This means tax authorities can use data provided for one purpose to investigate other tax matters without needing prior approval. For example, information disclosed for a single entity could potentially lead to audits across an entire corporate group – or even extend to unrelated parties.

"A Contracting State may use the information received on the basis of a request in relation to any person. The receiving Contracting State is not required to inform or to request authorisation from the sending Contracting State regarding such use." – State Secretariat for International Finance SIF

Additionally, the update introduces a new category of "reflective" non-taxpayer-specific material. This includes statistical data, notes, summaries, and memoranda derived from exchanged information. Such materials allow tax authorities to conduct broader analyses and apply insights to administrative purposes.

While these updates expand the scope of data use, they also pave the way for enhanced confidentiality measures, which are detailed below.

Enhanced Confidentiality Protections

Despite the broader sharing rules, the 2025 update strengthens safeguards around confidentiality. Reflective materials can only be disclosed to third parties if they are stripped of any details that might reveal a taxpayer’s identity. Before sharing, the involved states must consult and document their agreement to ensure the disclosure does not undermine tax administration.

Taxpayers maintain limited rights to access exchanged information. They or their representatives can only view details that directly impact their specific tax matter.

"Reflective material may be disclosed to third parties only if it cannot directly or indirectly reveal a taxpayer’s identity and after the sending and receiving states consult, keep a written record and conclude that disclosure will not impair tax administration." – EY Global Tax Alert

Businesses should be aware that once information enters the exchange system, it may circulate more freely among tax administrations. This makes it crucial to maintain consistent documentation and positions across all jurisdictions, as data shared in one country could appear in audits elsewhere without additional authorization steps.

These changes aim to balance the expanded use of data with stricter confidentiality protocols, aligning with the evolving needs of multinational tax strategies.

How the Updates Affect Treaty Interpretation and Multinational Strategies

Ambulatory Approaches to Existing Treaties

The 2025 Commentary introduces the first major overhaul of the OECD Model Tax Convention since 2017. The impact of these updates on existing treaties will vary depending on the jurisdiction. In jurisdictions that follow an ambulatory or dynamic approach, the updated Commentary will be used to interpret treaties that were signed years – or even decades – ago. On the other hand, in static jurisdictions, the interpretation will stick to the guidance that was in place when the treaty was originally signed. This difference in approach creates a unique challenge for planning, as the same treaty provision can be interpreted differently depending on the country involved.

"Whether the changes in the Commentary will be applied to existing treaties (dynamic approach) or only to new treaties (static approach) will depend on the specific jurisdictions involved." – EY Global Tax Alert

Some jurisdictions have expressed reservations about the new guidance, so it’s essential to confirm local positions before making any operational changes. These interpretative differences pave the way for the strategic adjustments discussed below.

Planning Recommendations for Multinational Enterprises

With these varying interpretations, multinational enterprises need to reassess their strategies. Start by mapping out remote work patterns across your organization. Pay close attention to remote work durations and flag any cases where employees exceed the 50% threshold. Tax authorities are increasingly focused on where work is actually performed rather than the formal terms of employment contracts.

If employees do exceed this threshold, document clear business reasons for their remote work locations. Acceptable justifications include activities like customer meetings, supplier management, or aligning with time zones for operational efficiency. However, reasons like employee convenience or talent retention won’t hold up under scrutiny. Keep detailed records to demonstrate the business benefits of these arrangements.

Review your financing structures in light of Article 9 transfer pricing rules and domestic interest limitation rules. Even if intercompany debt pricing complies with the arm’s length standard, domestic rules on thin capitalization and BEPS Action 4 could still deny deductions. This could lead to economic double taxation, a risk that wasn’t as pronounced under the previous Commentary.

"Taxpayers can no longer argue that Article 9 prevents the application of domestic expense deductibility limitations once arm’s length profit allocation has been determined." – Eversheds Sutherland

Ensure that tax documentation is consistent across all group entities, as information shared in one jurisdiction can have implications in another. Using the Mutual Agreement Procedure (MAP) early can help avoid double taxation risks. Under the updated guidance, MAP can now be initiated as soon as it becomes "probable" that taxation conflicts with treaty provisions – there’s no need to wait for a formal assessment. If domestic laws conflict with treaty protections, take a proactive approach by engaging with MAP processes.

"For large multinationals, it is therefore prudent to treat this update as an early warning of where treaty practice and audits are heading." – Ravi Ahlawat, Sorina van Kommer, and Juan Pablo Osman Moreno, DLA Piper

Conclusion

The 2025 OECD Commentary update introduces notable changes in how multinational enterprises navigate tax treaty interpretation. With fresh guidance on remote work, transfer pricing, and information exchange, tax authorities are already incorporating these updates into audits and disputes.

One significant shift is the separation of profit allocation from domestic deductibility under Article 9, which introduces a new risk of economic double taxation – something not typically seen in earlier interpretations. Adding to the challenge, expanded information-sharing rules now enable tax authorities to analyze data across multiple group entities, making compliance more demanding than ever. This heightened complexity highlights the importance of proactive international tax planning, as outlined in our strategic recommendations.

These updates don’t just alter technical standards – they also influence how treaties are applied in practice. Whether the changes affect existing treaties depends on whether jurisdictions adopt a dynamic or static interpretative stance. Notably, countries like India, Israel, and Nigeria have already expressed formal reservations to some of the key provisions.

The key takeaway? Keeping up with these changes is essential. Businesses that fail to adapt their remote work policies, financing structures, and documentation to align with these new standards could face increased audit risks and potential double taxation. While the Commentary itself is not binding law, tax authorities worldwide are actively using it to challenge established practices.

Stay vigilant as global tax regulations continue to evolve.

FAQs

How does the new 50% threshold for remote work affect Permanent Establishment (PE) status?

Under the updated 2025 OECD guidance, remote work that constitutes less than 50% of an employee’s total working time will not result in the creation of a Permanent Establishment (PE). However, if an employee’s remote work accounts for 50% or more of their total duties, it could be classified as a fixed place of business, which might lead to PE status.

This update highlights the importance for businesses to closely track remote work arrangements to prevent unexpected tax obligations in the jurisdictions where employees perform their duties.

How do the updated permanent establishment (PE) rules affect natural resource industries?

The 2025 OECD Model Treaty introduces a lower threshold for permanent establishment (PE) when it comes to activities like exploring or extracting natural resources. For industries such as oil, gas, and mining, this means non-resident companies might now meet the criteria for a PE – and become subject to source-country taxes – after a shorter, bilaterally agreed period of operations. Gone are the days when only long-term or large-scale projects triggered tax obligations.

Because of this shift, businesses operating in the U.S. or across borders need to brace for earlier tax liabilities. This could mean restructuring current projects, renegotiating treaty terms, or even seeking advance rulings to sidestep unanticipated tax burdens. Additionally, these updates bring heightened compliance and reporting requirements, making it essential for companies to carefully track the length of their onshore and offshore activities to ensure they stay within the new limits.

What impact will ‘Amount B’ have on transfer pricing for routine distribution activities?

The introduction of Amount B is set to simplify how businesses handle transfer pricing for routine marketing and distribution activities. It does so by offering a standardized, matrix-based pricing framework. The goal? To cut down on compliance costs, reduce the chances of disputes, and give businesses more clarity and certainty when it comes to taxes.

By creating a more straightforward approach to pricing routine distribution activities, Amount B seeks to make tax compliance smoother while promoting consistency in how tax treaties are applied.