July 10, 2013

By: Paul Seymour, Director of Client Services

I was recently asked to start doing a periodic radio broadcast on Radio Free Latin America (RFLA), called Offshore Re-education Camp. It’s being piped in to the USSA from a secret location south of the border via short wave radio signals. The aim of RFLA is to offer a ray of hope to our poor countryman still trapped behind the curtain with apparently, no way out.

The show, hosted by Paul Seymour, Director of Client Services at Global Wealth Protection, will provide the truth about offshore entities and bank accounts to those peoples who are continuously bombarded with the party line, and have no access to the truth outside of RFLA.

For those of you who are unable to catch the live broadcasts, we’ll be periodically printing a transcript of the show here at GWP. Please inquire about how to make donations to keep RFLA, this glimmering fountain of hope for freedom, alive at [email protected]

Lead-in tune in case you missed it: Sting, who wrote the NSA theme song 30 years ago said, “It sounds like a comforting love song. I didn’t realize at the time how sinister it is. I think I was thinking of Big Brother, surveillance and control.” He’s also often stated that he doesn’t understand why people think it’s a love song. Baaah.

Today, we just have a relatively light review of current events. In addition, I’d like to mention that I’ve started writing a series of pieces on my past 20 years of international travel and living, and it will be included in GWP Insiders: currently in the works, and coming soon. Also, in October, I’ll be setting out on an ill-defined journey of indefinite duration (or goals/ideals for that matter), throughout the rest of South America by motorcycle. I hope to have 2 or 3 interesting anecdotes to share, along with some compare and contrast exercises involving the cultures I stumble across vis a vis the US and Colombia. I toss in, free of charge, my quick assessments of the local economies so don’t touch that dial!

On to this week’s news… First, I gladly chuckle as I report that another country – in a long line of countries – went ahead and stuck its finger in Uncle Sam’s beady little eye. Switzerland’s Parliament has rejected a tax deal with the US designed to resolve a dispute over undeclared bank accounts held by U.S. citizens, potentially setting the stage for American prosecution of the country’s banks. Members of parliament’s lower house voted 123 to 63 against the bill. Not only does it make me feel good in the present, but as I see this starting to take shape, it’s going to be mighty fun to follow in the future too. I mean, that’s gonna be fun to watch. The US Attorney General, trying to prosecute executives of Swiss banks for not following Amerikan “principles”. I can’t wait. These guys have dealt with fascists before, you know.

Remember that the Smirking Chimp had to cancel a proposed speaking engagement in Switzerland back in 2011 because the principled Swiss people (with a “p”) were gathering political momentum to have him arrested upon landing in Swiss territory, a la Pinochet, for violating international laws regarding torture and war crimes. In fact, I think he’s basically only welcome in Amerika, Saudi Arabia and Israel nowadays.

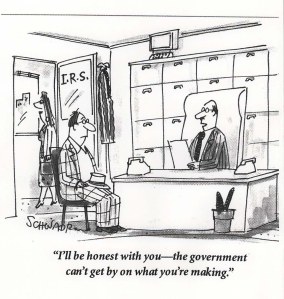

Therefore, we see a sharp contrast between the Swiss Parliament, and the US Congress. The Swiss Parliament, actually representing the wishes of their people, have basically said, go sue and/or prosecute the slimy bastards. If they’ve broken the law, and you can prove it through due process, take their money and put them in jail. By no means shall we abrogate our principles to the likes of the US government, nor give a get-out-of-jail-free card to unscrupulous bankers by changing our basic human rights, and privacy-respecting laws to satisfy the Nazis at the IRS. The Swiss people have decided to take a possible further hit to their economy, rather than change their principle-based banking secrecy laws (which is what Uncle Sam thought they could strong-arm them into doing). Dozens of Swiss banks have already gone under in this tiny country of 7 million, due to IRS intervention into the privacy-respecting Swiss culture. Do you think the Swiss people are going to be supporting US policy any time soon? There’s no sheeple mentality over there in the freezing Alps, I can assure you.

Here’s another case of giving credit where credit is due. In an article inexplicably titled Congress Considers Cracking Down on Corporate Profit Shifting and Tax Haven Abuse, “Ways and Means Chairman Dave Camp (R-Mich.) noted that the U.S. has the highest statutory tax rate in the industrial world of up to 35 percent. He has heard comments about that fact ever since the committee issued a discussion draft of international tax reform proposals in October.”

“Nearly all have offered a universal observation—having the highest corporate rate in the developed world along with an outdated international tax system is a barrier to success that leaves our country falling further behind our foreign competitors,” he said in his opening statement. “Academics and economists agreed, and also cautioned, that any solution to these challenges must protect against erosion of the U.S. tax base through the shifting of profits to low-tax jurisdictions. Their concern is not without merit. Oftentimes, multinational businesses reduce their tax liability by separating the jurisdiction in which income is booked for tax purposes from the jurisdiction in which the economic activity occurs. The result of these practices is ‘erosion’ of the tax base in a jurisdiction where the activity takes place.”

Camp acknowledged that there is no perfect system for taxing corporate income. “But it is also important to bear in mind, that these activities are the consequence of bad laws, not bad companies,” he said. “In my mind, the fact that the current Tax Code allows companies to achieve these tax results strengthens the case for comprehensive tax reform. Whether a country has a hybrid system similar to the current U.S. worldwide system or a dividend exemption system like that of our major trading partners, it is important to develop strong base erosion rules that protect against aggressive transfer pricing, anti-migration of intangible property overseas and foreign earnings stripping.”

I’m not really sure how it could possibly be legal – “separating the jurisdiction in which income is booked for tax purposes from the jurisdiction in which the economic activity occurs”, but that’s the corrupt US system for you. Evidently large corporations can do that, but if you or I wish to do something similar, it’s off to jail we go.

It’s not rocket science. Taxation based on residency, rather than being the only country in the world to tax based on citizenship, first of all, needs to be implemented. Immediately. Secondly, have a flat tax without deductions, nor loopholes. Every natural or legal entity pays 20% on gross salaries or business net income. Probably even more practical, efficient, and ultimately, more fair, would be a tax on gross business revenues of 1-2%. Let’s face it, it’s all passed on to the consumer anyway, whether a business makes a profit or not. This way, all incentives to screw around with expenses goes away. Then the only dodge remaining would be under-the-table sales, which already exists, along with the myriad of other dodges. That’s it. Period. Nada más. A tax code of a hundred pages maximum, rather than volume after volume. It’d put a lot of tax attorneys, tax preparers, CPA’s and IRS agents out of business, but tough luck. They’ll have to find something to do that’s actually productive for a change. Meanwhile, you and I have every moral and ethical justification to also minimize our tax liabilities by any means available.

You could try my iron-clad method for example. Just convert all of your hard and liquid tangible assets into intangibles. You know, sell your houses and cars, furniture etc. and get the proceeds offshore immediately. Then convert the cash into things like; lifelong memories of unbelievable adventures around the world, and knowledge of foreign languages and cultures. Life, in other words. I’m not sure I could recommend that for everyone, though. I suddenly hear the pitter patter of thousands of tiny feet, like cockroaches, as the IRS scrambles to convene meetings in order to pass laws on how to define, value, and tax the stored, cherished memories of US expats who’ve voted with their feet… Have they done away with the old wherewithal-to-pay concept? I imagine so.

Believe it or not, there’s another piece of positive news I’m happy to report. We’ve gotten a lot of inquiries by worried clients and potential clients about FATCA here at GWP, and its obvious negative implications regarding people’s basic human rights regarding personal privacy surrounding their own finances. I’ve been trying to say, I think the IRS and Treasury have bitten off more than they can chew this time. If I had to bet, I’d bet it’s going to eventually choke on its own pork barrel fat. Now, in addition to Rand Paul, who needs no de-programming due to being raised properly, another one of my listeners up there behind the curtain has seen the light.

“Rep. Bill Posey, R-Fla., has written a letter to Treasury Secretary Jack Lew questioning regulations that would require U.S. banks and credit unions to collect and report information on nonresident aliens, urging him to cease enforcement of the Foreign Accounting Tax Compliance Act, or FATCA, and stop negotiating intergovernmental agreements with other countries for FATCA enforcement.” You see, the flip side of having all banks in all jurisdictions around the world report to the IRS in violation of their own countries’ laws, is that FATCA will also require every US bank to do the same for every government around the world regarding balances held in US financial institutions. That just ain’t gonna happen. I suppose that US financial institutions could turn away all of the Saudi sheiks’ billions in order to avoid compliance with the draconian reporting requirements. Yeah, right.

He also pointed out to the Treasury Department that they don’t have the legal authority to unilaterally start negotiating reciprocal reporting agreements with other nations. It’s that pesky Constitution again, raising its head to complicate the lives of unelected bureaucrats with such silly concepts as separation of powers. You’d think that such high level functionaries would be more aware of the law. I assume they are, they just know laws have been passed making them exempt from prosecution, so what the hell.

Posey called for repeal and replacement of FATCA by Congress and urged Lew to delay FATCA enforcement and impose a moratorium on further negotiation and signing of IGAs. “It is difficult to avoid the conclusion that the flaws evident in the IGAs being negotiated to implement FATCA are reflective of flaws in the law itself,” he wrote. “It is clear that substantial modification of FATCA is in order or, more likely, its outright repeal and possible replacement with a cooperative scheme that pursues actual tax evasion without harming the innocent. I note that legislation to repeal FATCA was recently introduced in the Senate, and I would expect a companion bill to be introduced in the House of Representatives shortly. I expect these broader questions to be more fully aired by the Committee in its examination of the anticipated request for enhanced legislative authority. In the meantime, I suggest a further delay in FATCA enforcement and a moratorium on negotiating and signing additional IGAs is in order.”

Finally, a lead in to our next de-programming lesson which will focus on scare tactics and governmental propaganda: Maryland Man Pleads Guilty to Hiding Assets from IRS in Israeli Bank. “Alexei Iazlovsky of Potomac, MD, pled guilty Tuesday in the U.S. District Court for the Central District of California to filing a false tax return for tax year 2008. According to court documents, Iazlovsky, a U.S. citizen, maintained an undeclared bank account held in the name of a foreign corporation at the Luxembourg branch of an unidentified Israeli bank. Iazlovsky owned a corporation that produced documentaries for Russian television stations.”

See? He actually earned income in Russia, and presumably paid taxes there too, but the US government thinks it has some right to know that, and get a piece of what’s left? Remember up above where giant corporations are legally shifting revenues, actually generated in the US, to other jurisdictions for tax purposes, and not paying any taxes on those revenues, and that’s somehow legal? Poor Alexei doesn’t have a lobbyist in Washington, nor does he have the ability to contribute millions to his local senators’ re-election campaign. Let’s see what the unscrupulous whores have done to this unfortunate, job-producing guy.

“Iazlovsky has agreed to pay a civil penalty of 50 percent of the high balance of his undeclared account to resolve his civil liability with the IRS for failing to file FBARs. Iazlovsky faces a maximum prison term of three years and a maximum fine of $250,000”. Well, I guess that seems fair. Only half of his highest balance of savings off the top, and the prospect of 3 years in jail, and an additional $250,000 in fines. All for doing business in a foreign nation, and putting his own hard-earned money in the bank of his choice, and daring not tell a group of proven liars, and sociopaths, who work for us, all about it.

Then, after this disgusting virtual perp walk, and disclosing that our servants have completely wiped out this guy for having the gall to go and make a buck by providing a product for which there’s apparent demand, they go on to inform the readers: “Offshore tax evasion is a top priority for IRS-CI, and the facts in this case are clear,” said IRS Criminal Investigation chief Richard Weber in a statement. “Earned income was placed into foreign bank accounts for the purpose of committing offshore tax fraud. Through our efforts, we are gaining access to more and more information on institutions and individuals involved in offshore tax fraud, and you can expect us to use all of our enforcement tools to stop this abuse.” AND “Individuals who evade their tax obligations cheat their country and their fellow citizens,” said Kathryn Keneally, Assistant Attorney General for the Justice Department’s Tax Division, in a statement. “The Department of Justice is committed to using all of the many available tools to find and prosecute those who hide income and assets in offshore bank accounts, and to pursue the taxes and penalties that are due.”

Next week we’ll address these scare tactics, and the obvious hypocrisy involved.

Hasta la próxima muchachos, y mucha suerte.

Paul is an escaped Big 4 CPA (F/S auditor), and Corporate Controller/CFO who found a natural home in the offshore industry with Bobby Casey and the gang at GWP. Contact him at [email protected] to learn more about the realities of economical offshore asset protection.

An offshore company and bank account can be established for as little as $1,797, including my advice and assistance throughout both processes, and in both privacy-respecting jurisdictions, apostilles required to open bank accounts, and courier charges to send original documents to you. There’s never any need to visit the jurisdictions personally, although they’re very nice places, and I recommend a visit. With our established agency agreements, we can do everything via e-mail. We maintain long-term relationships with our clients, and remain available for consultation on an ongoing basis.

Hey Paul,

Thank for bring us up to speed on the latest Orwell story. I feel a little peace knowing the Swiss are not bowing before the big dog on top of the hill. I do feel it is still such a small hole in the wall where the light come through compared to the bigger compliance’s out there with FATCA. How do you feel about that?

In liberty,

G

I truly don’t think FATCA will be implemented, at least not in any where near the form that it currently exists. In order for it to be meaningfully amended, will take 2-3 more years, and by then, the USD may well no longer be the international reserve currency. In that scenario, Treasury loses its strong arm bargaining chip which is disallowing non-participating FFI’s the ability to trade in dollars.

When US FFI’s clue in to the fact that they too will have to reciprocate to all other tax agencies around the world, suddenly big corporate cash, which currently runs Amerika after the http://en.wikipedia.org/wiki/Citizens_United_v._Federal_Election_Commission Supreme Court case, will go berserk, and therefore I don’t see US banks ever complying, which would void any reciprocal reporting agreement.

Just my predictions.

Flat tax is the answer , but so many hangers on rely on the current system which will make it an up hill battle , unless the greater public demand it on mass . Im afraid it wont happen.The only way to get at the system is threaten the elected members with moving your vote away from them . That’s the revolution that’s needed.

Shifting revenue to another country for better tax treatment, damn why didn’t I think of that!

“Individuals who evade their tax obligations cheat their country and their fellow citizens”, man shit like this really makes me want to puke. What really has to change is the false belief in the authority of government to do whatever the hell it wants, and justify it as being for ‘the greater good’, oh and by the way..steal our money to finance the scheme. This illegitimate force for evil called government has somehow, through the ages, obtained the power to do things that are considered illegal and immoral when done by mortal humans. Worse, they consider their actions virtuous because ‘it’s the law of the land’! Unfreakingbelievable. I tried to explain it simply to a relative on the 4th; ‘Everyone agrees (non politicians anyway) that politicians are the scum of the earth, psychopaths that get off on controlling other people. Even if they are only slightly scummy on the way in they will be fully immersed in the muck before long. Not only do we elect these vermin but we give them the power over the life and death of the rest of us!!” This was said after hearing her lecture her 15 year old son on the sanctity of the law, I gagged. Her response was, ‘I don’t care, he needs to keep to the straight and narrow in order not to jeopardize his ability to get into a good school’. I had to walk away….Yesterday I read someones final comment in a post that said, ‘and these zombies walk among us’..yeah, no shit.

That’s the sheeple mentality that got us here, Patrick. Stick to the straight and narrow…..You already no where I’m heading with all that, so I’ll spare you.

Keep living well. It’s the best revenge.