Philanthropy and asset protection can work together to help you support causes you care about while safeguarding your wealth. By using specific strategies and legal tools, you can reduce taxes, protect assets from lawsuits or creditors, and ensure your charitable goals are met. Key methods include:

- Charitable Trusts: Irrevocable trusts like Charitable Remainder Trusts (CRTs) or Charitable Lead Trusts (CLTs) offer tax benefits, income streams, and asset protection.

- Donor-Advised Funds (DAFs): Simplify giving, gain immediate tax deductions, and avoid capital gains taxes on appreciated assets.

- Offshore Foundations: Provide strong legal protections for international philanthropy, especially in jurisdictions like the Cook Islands or Cayman Islands.

- Asset Protection Trusts (APTs): Shield assets while reducing taxable estates.

- Donating Appreciated Assets: Avoid capital gains taxes and maximize tax deductions.

- Planned Giving: Use strategies like gift bunching or directing IRA distributions to charities for tax efficiency.

Early planning is essential to protect assets effectively. Combining these tools with expert legal and financial advice ensures you can give generously while securing your financial future.

Legal Structures for Charitable Giving and Asset Protection

Choosing the right legal structure can amplify the impact of your charitable giving while safeguarding your assets. For high-net-worth individuals, three main options stand out: charitable trusts, donor-advised funds (DAFs), and offshore foundations. Each serves different purposes based on your philanthropic goals and financial strategy.

Charitable Trusts: Flexible and Protective

Charitable trusts are irrevocable structures that transfer ownership of assets, shielding them from lawsuits and creditor claims. As Investopedia puts it:

"Once an asset is transferred to a trust, it is owned by the trust to benefit its beneficiaries. Therefore, it is safe from legal judgments and creditors since the trust won’t be a party to any lawsuit."

There are two primary types of charitable trusts:

- Charitable Remainder Trusts (CRTs): These allow you to donate assets like stocks or real estate while receiving an income stream for life or up to 20 years. The trust can sell these assets without triggering capital gains taxes, offering significant tax benefits. However, the annual payout must be between 5% and 50% of the trust’s initial value, with at least 10% of the initial fair market value ultimately benefiting the charity . If you can’t use all your deductions in one year, you can carry them forward for up to five years. CRTs also bypass probate, keeping your estate planning private and efficient.

- Charitable Lead Trusts (CLTs): These work in reverse. A CLT provides income to a charity for a set period, after which the remaining assets transfer to your heirs. This structure can reduce or even eliminate gift and estate taxes. Garrett Harbron, J.D., CFA, CFP®, of Vanguard, highlights their dual benefits:

"Using charitable trusts enables donors to achieve significant tax savings while supporting causes they care about. With the right planning, these trusts can be a win-win for families and the charities they support."

Donor-Advised Funds (DAFs): Simplicity and Control

For those seeking immediate tax benefits and ease of use, donor-advised funds (DAFs) are an excellent option. When you contribute assets to a DAF, you receive an immediate tax deduction, and the assets grow tax-free until distributed as charitable grants. DAFs accept a wide range of assets, including cash, appreciated securities, real estate, and even cryptocurrency. This means you can avoid capital gains taxes, which can reach up to 23.8% federally.

Lawrence M. Kaplan, a financial advisor at Morgan Stanley, explains:

"By donating the securities to a DAF, you will not owe the potential capital gains tax on the appreciation and can give yourself time to decide when and where to make your charitable gifts."

Once assets are contributed, they become the legal property of the sponsoring charity, removing them from your taxable estate and shielding them from personal liability. DAFs also offer the benefit of anonymity, which is increasingly valued. Joe Milligan from the Mackinac Center notes:

"A donor advised fund adds a layer of anonymity. Today’s world of wokeness and cancel culture has driven many donors to value their privacy more than ever."

You can even designate successors to continue recommending grants, ensuring your charitable goals live on. For example, Morgan Stanley’s Global Impact Funding Trust requires a $25,000 minimum initial contribution, while Fidelity Charitable offers accounts with no minimum . For those with global philanthropic interests, some DAFs can be structured to support cross-border giving.

Offshore Foundations: Asset Protection with a Global Reach

Offshore foundations are ideal for international philanthropy and offer robust asset protection, particularly for individuals with complex liabilities. Jurisdictions such as the Cook Islands, Nevis, and the Cayman Islands have strong asset protection laws. These structures use foreign trustees who are not subject to U.S. court orders, providing an added layer of security. Additionally, many of these jurisdictions impose shorter statutes of limitation for creditor claims and require a higher burden of proof for fraudulent transfers.

However, timing is critical. These structures must be established before any legal disputes arise to avoid potential breaches. While offshore solutions can be expensive, consulting specialized legal counsel ensures proper setup and IRS compliance. This strategy works well alongside global tax and regulatory planning.

sbb-itb-39d39a6

Methods to Protect Assets While Supporting Charities

When it comes to preserving assets while contributing to charitable causes, how you fund your efforts is just as important as the legal structures you choose. By employing certain funding strategies, you can safeguard your wealth and reduce tax liabilities, all while supporting the causes you care about.

Using Asset Protection Trusts for Charitable Purposes

Asset protection trusts (APTs) are a powerful tool for shielding assets. These trusts are irrevocable, meaning you transfer ownership of your assets to a trustee, effectively removing them from your personal estate. This not only protects your assets from creditors but also reduces the value of your taxable estate. As Investopedia explains:

"The purpose of an irrevocable trust is to move assets from the grantor’s control and name to that of the beneficiary. This protects the assets from creditors and reduces the value of the grantor’s estate."

Timing is critical here – establishing and funding these trusts before any legal disputes arise is key to avoiding claims of fraudulent transfer. For those in high-risk professions or facing complex liabilities, offshore APTs in jurisdictions like the Cook Islands or Nevis offer an extra layer of protection. White and Bright, LLP highlights the benefits:

"Offshore trust jurisdictions are typically friendly to debtors – foreign trustees are not subject to the laws of the United States and they are not required to comply with any orders issued by domestic courts."

Donating Appreciated Assets Instead of Cash

Another effective way to maximize tax efficiency is by donating appreciated assets – such as stocks, real estate, or cryptocurrency – directly to charity. This approach eliminates capital gains taxes, which can reach as high as 23.8% for high-income earners (20% federal plus 3.8% net investment income tax). The Indiana University Foundation explains the advantage:

"By donating long-term appreciated assets instead of selling them, donors can turn a tax liability into a meaningful opportunity to do good and make a difference while also enjoying significant tax advantages."

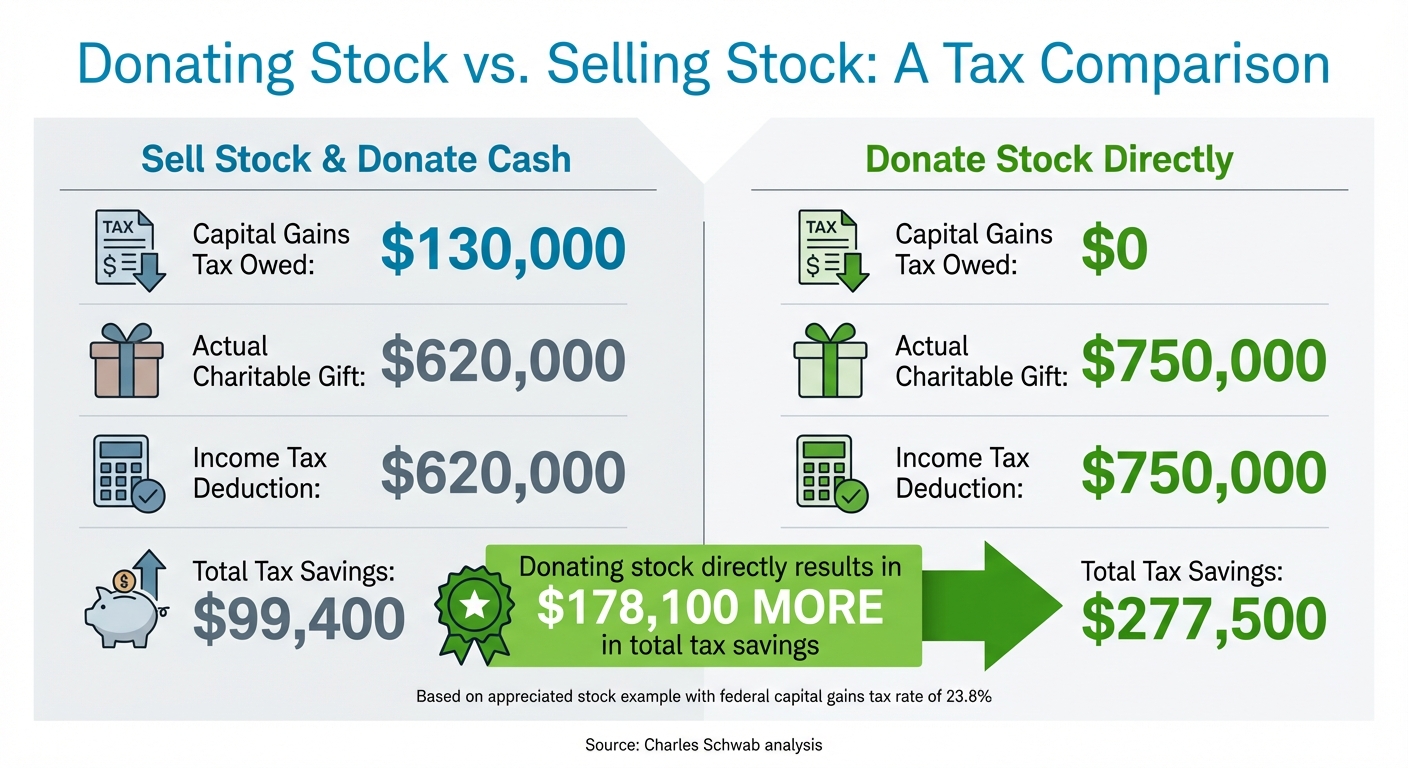

Here’s a practical example, courtesy of Charles Schwab, comparing two scenarios: selling stock and donating the cash versus donating the stock directly:

| Category | Sell Stock & Donate Cash | Donate Stock Directly |

|---|---|---|

| Capital Gains Tax Owed | $130,000 | $0 |

| Actual Charitable Gift | $620,000 | $750,000 |

| Income Tax Deduction | $620,000 | $750,000 |

| Total Tax Savings | $99,400 | $277,500 |

In this example, donating stock directly results in $178,100 more in tax savings. You can deduct the full fair market value of the asset (up to 30% of your adjusted gross income for non-cash gifts) and carry forward any unused deductions for up to five years. For non-cash gifts exceeding $5,000, make sure to obtain a qualified appraisal no more than 60 days before the donation to support your deduction.

A smart move? Donate appreciated shares and then repurchase the stock with cash. This resets your cost basis, potentially lowering future tax liabilities. Just be careful not to trigger the IRS’s "step transaction" rule – don’t sign a letter of intent to sell the stock before donating it, or you could still be taxed on the gains.

Reducing Taxes Through Planned Charitable Giving

Planned giving strategies can also help reduce your tax burden. One popular method is gift bunching, where you consolidate several years’ worth of charitable contributions into a single year. By using a Donor-Advised Fund (DAF), you can claim a larger deduction in high-income years while distributing grants to charities over time.

For those aged 72 or older, there’s another option: direct your IRA custodian to transfer your Required Minimum Distribution (RMD) directly to a charity. This move lowers your taxable income. Similarly, naming a charity as the beneficiary of your IRA or retirement plan ensures the funds go to the charity tax-free, avoiding the steep taxes (up to 24% or more) that heirs would otherwise face. The federal gift and estate tax exemption for 2025 is $13.99 million per person ($27.98 million for married couples). Transferring assets to an irrevocable charitable trust can also remove them from your taxable estate, reducing or even eliminating estate tax liability.

A creative approach gaining traction is the wealth-replacement strategy. Here’s how it works: Use the income generated by a Charitable Remainder Trust (CRT) to purchase life insurance held in a separate trust. This ensures your heirs receive a death benefit equivalent to the value of the assets you donated, allowing you to support your charitable goals without diminishing your family’s inheritance.

International Considerations for Charitable Giving

Selecting Jurisdictions for Offshore Charitable Structures

Choosing the right offshore jurisdiction is a key step in safeguarding assets. Locations like the Cook Islands, Nevis, and the Cayman Islands are popular for their strong asset protection laws, offering benefits that domestic trusts often cannot match. One major advantage is that many of these jurisdictions don’t recognize U.S. court orders. This means trustees in these locations are not obligated to comply with rulings from U.S. courts. As White and Bright, LLP explains:

"Offshore trust jurisdictions are typically friendly to debtors – foreign trustees are not subject to the laws of the United States and they are not required to comply with any orders issued by domestic courts."

These jurisdictions often enforce shorter statutes of limitations and require a higher standard of proof for claims involving fraudulent transfers. Additionally, creditors face logistical hurdles, such as hiring local attorneys and initiating legal proceedings abroad, which can involve costly overseas travel. However, timing is critical – these structures should be established and funded well before any legal disputes arise. Transferring assets to avoid creditors after litigation begins can be deemed illegal. These legal protections provide a strong foundation for managing intricate tax obligations.

Meeting US and International Tax Requirements

Once an offshore strategy is in place, understanding tax rules is vital for proper compliance. While offshore charitable structures can protect assets, they are still subject to U.S. tax laws and rigorous IRS oversight. For U.S. taxpayers to claim deductions for charitable contributions, donations generally need to go to U.S.-based organizations. There are only three exceptions – Canada, Mexico, and Israel – where deductions may apply if the donor has income sourced in those countries. For instance, a contribution to an Israeli charity is typically deductible up to 25% of the donor’s adjusted gross income from Israeli sources. To ensure eligibility, donors can confirm an organization’s status through the IRS Tax Exempt Organization Search tool.

Offshore structures also come with additional reporting requirements. Charitable Remainder Trusts (CRTs) or similar split-interest arrangements require filing Form 5227 (Split‐Interest Trust Information Return) and Schedule K-1 (Form 1041). To qualify as a CRT, the charity must receive a remainder interest worth at least 10% of the property’s initial net fair market value. Private foundations, on the other hand, are subject to a 1.39% excise tax on investment income and must distribute 5% of their assets annually. While offshore trusts offer creditor protection, U.S. citizens must still meet federal tax reporting obligations. Working with knowledgeable legal professionals is essential to ensure compliance with both U.S. and international laws.

Conclusion: Balancing Generosity with Financial Security

Key Considerations for Donors Prioritizing Protection

Philanthropy thrives when donors can safeguard their assets while supporting causes they care about. Tools like Charitable Remainder Trusts (CRTs) and Charitable Lead Trusts (CLTs) allow donors to split assets between charitable and personal beneficiaries, offering income streams and efficient wealth transfer. These strategies also help reduce taxable estates and protect assets from creditors. As Garrett Harbron, J.D., CFA, CFP®, from Vanguard, explains:

"Using charitable trusts enables donors to achieve significant tax savings while supporting causes they care about. With the right planning, these trusts can be a win-win for families and the charities they support."

Timing is critical. Asset protection structures, such as offshore trusts, must be established well before any legal challenges arise. Delaying could leave assets vulnerable to claims or be considered a fraudulent transfer. While offshore trusts offer robust protection, they come with higher costs and complex reporting requirements.

Another effective strategy is donating appreciated assets, which avoids capital gains taxes. Donor-Advised Funds (DAFs) provide immediate tax benefits and give donors flexibility in distributing funds over time. CRTs, meanwhile, can generate income for up to 20 years or even for life, provided at least 10% of the initial trust value is designated for the charity.

To ensure long-term protection, combine thoughtful asset titling, liability insurance, and offshore trusts and private interest foundations. Collaboration with tax and estate attorneys is essential to navigate U.S. and international regulations. By planning early and strategically, donors can safeguard their financial well-being while leaving a meaningful legacy. This approach underscores a simple truth: thoughtful generosity and financial security go hand in hand.

FAQs

What tax advantages do Charitable Remainder Trusts (CRTs) offer?

Charitable Remainder Trusts (CRTs) come with several tax perks that make them a go-to option for those looking to combine generosity with smart financial planning. By transferring appreciated assets into a CRT, you can defer paying capital gains taxes on the growth of those assets. On top of that, you might qualify for an immediate income tax deduction, calculated based on the present value of the charitable portion of the gift.

Another advantage? CRTs can help lower estate taxes. How? The assets you donate are removed from your taxable estate, allowing you to support the causes you care about while ensuring more of your wealth is preserved for your heirs. Essentially, CRTs offer a way to give back meaningfully while maintaining your financial stability.

What are the benefits of using Donor-Advised Funds (DAFs) for charitable giving?

Donor-Advised Funds (DAFs) offer a smart way to give while keeping your financial and charitable goals aligned. One standout benefit is the opportunity for immediate tax savings. By contributing to a DAF, you might qualify for a federal income tax deduction in the same year, subject to certain limits. This feature makes DAFs a practical option for those looking to optimize their taxes while supporting causes they care about.

Another advantage is the flexibility and control DAFs provide. You can recommend grants to eligible charities at your own pace, whether they’re based in the U.S. or abroad. This gives you time to plan your giving thoughtfully. Plus, donating appreciated assets like stocks can help you avoid capital gains taxes. That means your contribution can grow tax-free, potentially increasing its impact over time.

Finally, DAFs take the hassle out of charitable giving by simplifying administrative tasks. The sponsoring organization handles the paperwork, record-keeping, and compliance, allowing you to focus on the joy of giving. For anyone aiming to give generously while managing their finances effectively, DAFs offer an appealing solution.

How do offshore foundations help protect assets internationally?

Offshore foundations serve as a dependable method for safeguarding assets on an international scale by establishing a legal framework that is more difficult for creditors to penetrate. They are especially useful for protecting wealth from lawsuits or claims, particularly when set up in regions known for their strong asset protection laws.

These foundations work by separating ownership from personal assets, creating an extra layer of security. At the same time, they allow individuals to retain control over how their assets are managed and distributed. This makes offshore foundations an effective option for protecting wealth while also supporting philanthropic endeavors or planning for long-term financial stability.