Offshore life insurance policies, often tailored for ultra-high-net-worth individuals, offer unique benefits like tax-deferred growth, asset protection, and streamlined estate planning. These policies, issued outside the U.S. in jurisdictions like Bermuda or the Cayman Islands, allow for broader investment options, including yachts, artwork, and private businesses. However, they come with strict compliance rules, high costs, and regulatory scrutiny. Here’s a quick breakdown:

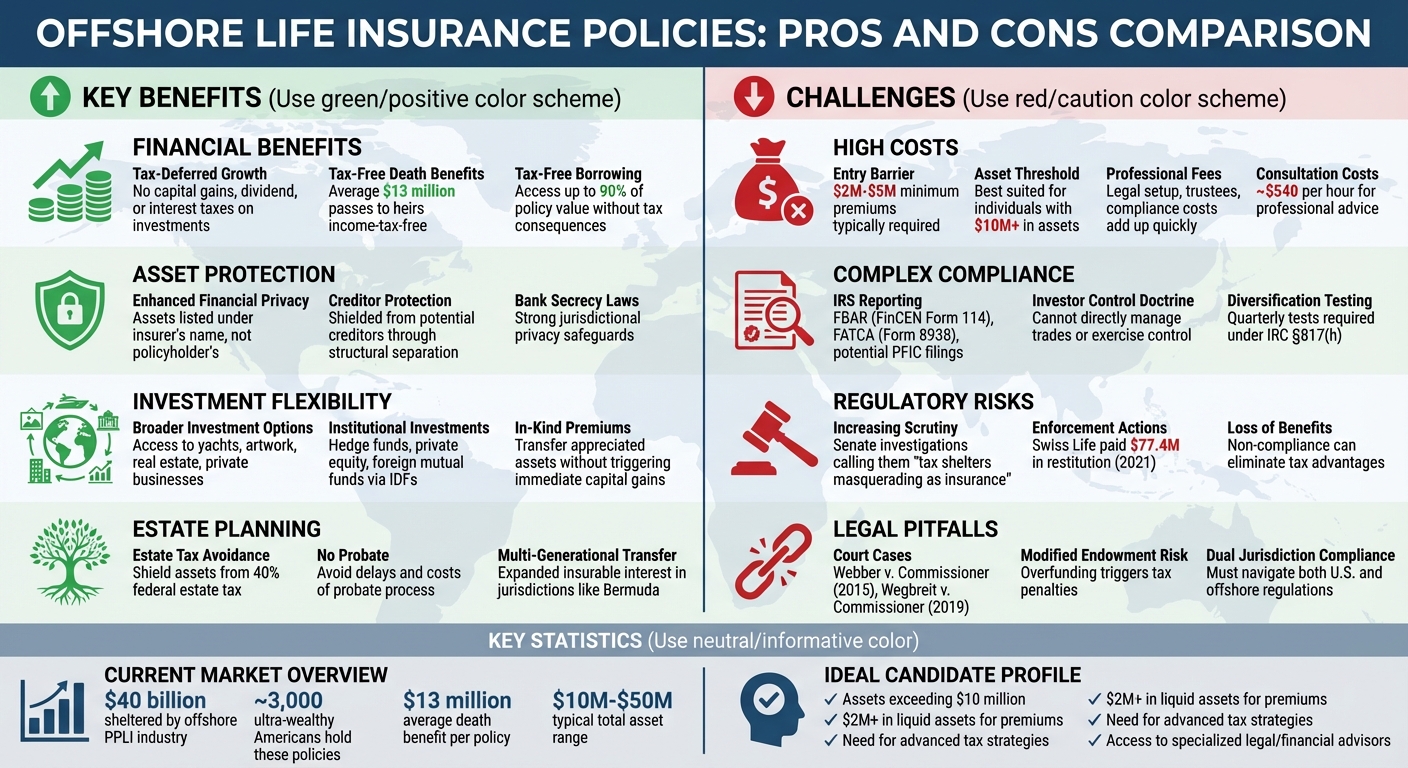

- Key Benefits:

- Tax-deferred growth and avoidance of capital gains taxes.

- Enhanced financial privacy and creditor protection.

- Effective estate planning with tax-free death benefits.

- Challenges:

- High entry costs (premiums typically $2M–$5M).

- Complex compliance with IRS regulations (e.g., investor control and diversification rules).

- Increasing U.S. regulatory oversight and potential legal risks.

While these policies can be powerful tools for wealth management, they are best suited for individuals with assets exceeding individuals with assets exceeding $10 million0 million who can navigate the associated complexities with the help of legal and financial advisors.

1. Asset Protection Policies

Offshore life insurance policies provide a layer of financial privacy through their unique structure. For U.S. taxpayers, the IRS generally requires reporting only the total cash value of a foreign life insurance policy – not the specific assets contained within it. This setup works by separating the assets from public records, listing them under the insurer’s name instead of the policyholder’s. As a result, these holdings are shielded from potential creditors. This structural privacy is further reinforced by stringent jurisdictional safeguards.

Many offshore jurisdictions enforce strict bank secrecy laws, creating significant challenges for regulators. Wealth advisor Michael Malloy highlights how clients appreciate this robust privacy, especially in regions where financial exposure could pose serious risks. For families in areas like Latin America or the Middle East, where corruption can threaten wealth, this added layer of protection is particularly appealing.

To retain these asset protection benefits, policyholders must follow strict investment protocols. Compliance is critical – policyholders cannot directly manage trades or exercise "investor control" over the assets. Instead, all investment decisions must be handled by an independent manager. Additionally, policies require quarterly diversification testing to ensure they meet IRC §817(h) guidelines. Failing these tests can result in losing both privacy and tax advantages.

The regulatory landscape also poses risks. For instance, in May 2021, Swiss Life Holding AG and three subsidiaries entered into a deferred prosecution agreement with the U.S. Department of Justice. The company was accused of using over 1,600 offshore PPLI policies to hide $1.4 billion in assets from the IRS. As part of the agreement, Swiss Life paid $77.4 million in restitution and penalties. The IRS has flagged offshore insurance products as susceptible to "abusive tax schemes" due to their complex and tailored nature, making enforcement a challenge. While these policies offer benefits, they also come with substantial costs.

The financial barriers to accessing offshore PPLI are steep. These policies often require an upfront premium of $5 million, with total assets typically ranging from $10 million to $50 million. Maintaining compliance adds to the expense, as it involves hiring a team of attorneys, investment managers, custodians, and tax advisors. Professional consultations alone can cost around €500 (approximately $540) for a one-hour session. However, unlike many domestic policies that impose heavy surrender charges, offshore policies often allow for cancellation without significant fees, offering greater liquidity.

sbb-itb-39d39a6

2. Tax Optimization Policies

Offshore life insurance policies offer a unique avenue for tax-deferred growth combined with broader investment options. Unlike U.S.-based insurers, which typically limit policyholders to cash premiums and a narrow range of investments, offshore carriers in places like Bermuda and the Cayman Islands accept in-kind premiums. These can include assets like real estate, yachts, artwork, or even privately held businesses. This setup allows high-net-worth individuals to transfer appreciated assets into the policy without triggering immediate capital gains taxes. Once inside the policy, these assets grow free from both income and capital gains taxes, creating opportunities for access to institutional-level investments.

Through Insurance-Dedicated Funds (IDFs), policyholders can invest in hedge funds, private equity, and foreign mutual funds without running afoul of Passive Foreign Investment Company (PFIC) rules, which can result in steep tax penalties. The offshore Private Placement Life Insurance (PPLI) industry currently shelters an estimated $40 billion for around 3,000 ultra-wealthy Americans, with the average death benefit for these policies reaching approximately $13 million per policy. Wealth advisor Michael Malloy highlights the appeal of these policies:

"PPLI is a completely different animal… the assets become stickier and get more alpha because the client pays less tax".

However, to maintain these tax advantages, strict regulatory compliance is essential.

Adhering to the rules is non-negotiable for preserving the tax benefits. As with asset protection strategies, policyholders must avoid direct involvement in managing investments within offshore policies. In the 2015 case Webber v. Commissioner, venture capitalist Jeffrey T. Webber lost his tax-deferred status after the U.S. Tax Court ruled that his use of an intermediary to direct specific investment decisions violated the investor control doctrine. Furthermore, policies must meet the diversification requirements outlined in IRC §817(h). This includes adhering to the "55/70/80/90 rule", which ensures no single investment dominates the portfolio.

The costs associated with these policies can be steep. For example, professional consultations alone often run around $540 for a comprehensive session. Additionally, regulatory scrutiny is intensifying. Senate Finance Committee Chairman Ron Wyden has voiced concerns about the potential misuse of these insurance vehicles:

"I am concerned that these insurance vehicles are being used, without a genuine insurance purpose, to invest in hedge funds and other investments while avoiding billions of dollars in federal taxes".

Legislative proposals aimed at limiting PPLI’s tax advantages are actively being discussed, adding further uncertainty to these financial structures.

3. Estate Planning Policies

Offshore life insurance policies provide estate planning opportunities that often go beyond what domestic U.S. carriers can offer. One notable advantage is the ability to accept in-kind contributions – such as yachts, artwork, real estate, or business shares – allowing for the transfer of appreciated assets without triggering immediate capital gains taxes. At the same time, these assets are removed from the taxable estate, offering a dual benefit.

Some jurisdictions, like Bermuda, have expanded the concept of insurable interest through legislative measures known as "Private Acts." These laws allow policies to be taken out on a wider range of individuals, including grandparents, great-grandparents, employees, and even directors of an entity that holds the policy. This expanded flexibility opens the door for multi-generational wealth transfer strategies that are often unavailable with domestic policies. When paired with an offshore trust, these policies can shield assets from the hefty 40% federal estate tax, which applies to estate values exceeding $13.61 million for individuals and $27.22 million for married couples. Additionally, the death benefit – averaging nearly $13 million among the roughly 3,000 Americans with Private Placement Life Insurance (PPLI) policies – passes to beneficiaries free of income tax, avoiding the delays and costs associated with probate.

However, these benefits come with strict compliance requirements. Policies must adhere to the rules outlined in IRC Section 7702 and meet diversification standards under IRC §817(h). Overfunding a policy can result in its classification as a Modified Endowment Contract, which carries tax consequences and penalties on loans and withdrawals. Transparency is also critical, as regulatory frameworks demand accurate reporting through measures like FATCA and FBAR. Regulators closely monitor these structures, making compliance essential to maintaining their estate planning benefits. To ensure everything is above board, working with reputable carriers and adhering to all reporting and regulatory requirements is absolutely crucial.

Pros and Cons

This section dives into the upsides and downsides of offshore life insurance policies, touching on their role in asset protection, tax planning, and estate management.

Offshore life insurance policies come with a mix of appealing benefits and notable challenges. On the plus side, they offer enhanced financial privacy, tax-deferred growth, and access to exclusive institutional investments not typically available domestically. For example, jurisdictions like Bermuda, the Cayman Islands, and Switzerland often waive annual income reporting requirements, such as K-1s and Schedule B filings. Additionally, these policies allow investments to grow without being subject to capital gains, dividend, or interest taxes. Policyholders can also borrow up to 90% of the policy’s value tax-free. The death benefit, which averages nearly $13 million for the roughly 3,000 Americans holding Private Placement Life Insurance (PPLI) policies, passes to heirs without income tax. However, these advantages come with significant regulatory and financial hurdles.

Regulatory compliance is one of the biggest challenges. U.S. taxpayers must adhere to strict reporting requirements, including FBAR (FinCEN Form 114), FATCA (Form 8938), and occasionally PFIC filings. Failing to comply can result in severe penalties. Another major concern is the investor control doctrine. If the IRS determines that a policyholder has too much influence over investment choices, the policy could lose its tax benefits and be treated as a personal investment account instead. Past regulatory cases have shown how costly non-compliance can be.

The costs involved are another significant drawback. Many advisors recommend these structures only for clients with at least $10 million in assets, given their complexity. While offshore policies avoid the hefty commissions and surrender charges seen in retail products, the legal setup fees, trustee expenses, and ongoing compliance costs can add up quickly. These financial considerations are critical when evaluating whether offshore life insurance fits into a broader wealth management plan.

| Factor | Asset Protection | Tax Planning | Estate Management |

|---|---|---|---|

| Financial Privacy | High – offshore accounts offer strong privacy protections | Moderate – subject to FBAR/FATCA reporting | High – avoids the public probate process |

| Tax Benefits | Tax-deferred growth when compliant with §7702 | No taxes on capital gains, dividends, or interest | Death benefits pass to heirs income-tax-free |

| Investment Options | Access to global alternatives like art and yachts | Includes institutional hedge funds and private equity | Can use in-kind premiums like business interests or real estate |

| Regulatory Risks | Potential exposure to fraudulent transfer claims | Risk of triggering the investor control doctrine | Dual compliance challenges across U.S. and offshore jurisdictions |

| Primary Costs | High legal and trustee fees | Minimum premiums of $2M+ | Costs tied to medical underwriting and policy fees |

Adding to the complexity, Senate Finance Committee Chair Ron Wyden has been investigating offshore PPLI since 2022, referring to these structures as "tax shelters masquerading as insurance". With increasing political scrutiny, seeking advice from skilled attorneys, tax advisors, and asset managers is more important than ever for anyone considering these policies.

Conclusion

Offshore life insurance combines asset protection, tax deferral, and estate planning into one cohesive financial strategy. It’s particularly well-suited for high-net-worth individuals with over $2 million in liquid assets who require advanced tax strategies and robust asset protection measures. These policies are especially appealing for holding non-traditional assets like yachts, artwork, or stakes in closely held businesses. They also offer advantages when investing in foreign funds, helping to minimize the impact of punitive PFIC taxation.

However, success hinges on strict compliance. To stay on the right side of regulations, it’s wise to appoint an independent investment manager and conduct regular diversification audits.

That said, offshore life insurance isn’t for everyone. Heightened regulatory scrutiny, as seen in recent enforcement actions, underscores the risks of non-compliance. Cases like Webber v. Commissioner (2015) and Wegbreit v. Commissioner (2019) further illustrate the potential pitfalls of poor structuring or excessive control.

For those considering this approach, it’s essential to work with specialized tax advisors, attorneys, and asset managers who understand U.S. tax laws and offshore regulations. While the costs and compliance demands are significant, offshore life insurance remains a powerful solution for individuals with complex, cross-border financial needs.

"Offshore life insurance is powerful when it’s a real life insurance policy with the right structure and discipline. It isn’t a loophole, a trading account in disguise, or a magic wand." – Offshore Pro Group

Ultimately, a disciplined, well-informed approach is critical for leveraging offshore life insurance effectively as part of a comprehensive wealth management strategy.

FAQs

What are the main compliance challenges with offshore life insurance policies?

Offshore life insurance policies come with their fair share of compliance challenges, largely because of their intricate nature and potential for misuse. One major hurdle for U.S. authorities is determining whether these policies meet the criteria for legitimate insurance under federal tax laws. This gray area can sometimes open the door to misuse, such as wrongly claiming tax deductions or failing to adhere to IRS reporting obligations.

Adding to the difficulty is the lack of a clear federal definition of what constitutes insurance. This ambiguity has led to concerns that some offshore policies are being used as tools to sidestep estate or income taxes rather than serving genuine insurance purposes. To steer clear of legal and financial trouble, it’s essential to fully comply with U.S. tax laws and ensure complete transparency when dealing with offshore life insurance policies.

How can offshore life insurance policies improve financial privacy?

Offshore life insurance policies offer a way to enhance financial privacy by placing assets in jurisdictions known for their strict confidentiality laws. These laws typically restrict the sharing of personal and financial information, making it more difficult for unauthorized individuals or authorities to gain access to details about your investments.

This extra privacy can be especially appealing for those aiming to safeguard their wealth while keeping their financial matters discreet. That said, it’s crucial to stay compliant with U.S. tax and reporting regulations to steer clear of any legal complications.

Who might benefit from offshore life insurance policies?

Offshore life insurance policies can be an appealing option for high-net-worth individuals aiming to safeguard their assets, maintain financial privacy, or explore legitimate ways to minimize tax obligations. These policies are also well-suited for those with international investments or complex estate planning needs that extend beyond U.S. borders.

For individuals seeking broader investment choices, potential tax benefits, or an opportunity to diversify their wealth management approach, offshore life insurance might be worth exploring. That said, it’s essential to carefully evaluate the potential benefits against the risks – such as compliance complexities and higher costs – to ensure they align with your overall financial objectives.