Gold and silver have been trusted for centuries as a way to protect wealth, especially during economic uncertainty. In today’s climate of inflation, currency devaluation, and geopolitical risks, these metals are increasingly popular for their ability to maintain value over time. Gold, for instance, has delivered nearly 11% annual returns from 1971 to 2021, while silver’s dual role as both an investment and an industrial metal offers unique growth potential.

Key Takeaways:

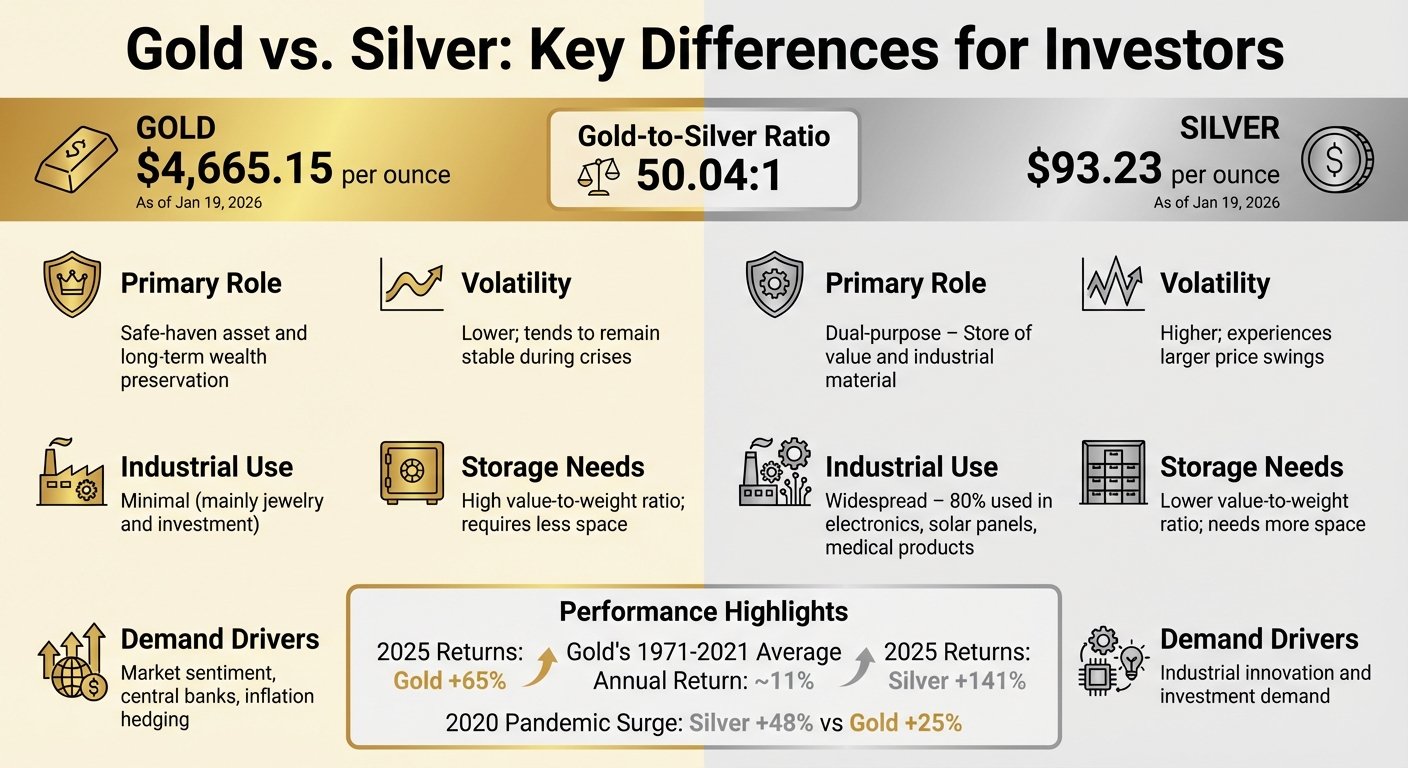

- Gold: A stable safe-haven asset with low volatility, ideal for long-term wealth preservation. As of January 19, 2026, gold trades at $4,665.15 per ounce.

- Silver: More volatile but affordable, with strong industrial demand driving growth. It’s priced at $93.23 per ounce.

- Performance During Crises: Both metals have historically gained value during recessions and high inflation periods, with gold rising 65% and silver 141% in 2025 alone.

- Portfolio Allocation: Experts recommend dedicating 5%–20% of your portfolio to precious metals, depending on your financial goals and risk tolerance.

To safeguard your investment, focus on reputable dealers, understand storage options (private vaults, safe-deposit boxes), and weigh the pros and cons of physical versus paper assets. Whether you’re hedging against inflation or diversifying your portfolio, gold and silver remain reliable tools for preserving wealth.

What Makes Gold and Silver Effective for Wealth Preservation

Gold and silver have long been trusted for preserving wealth, thanks to their scarcity and enduring value – qualities that set them apart from fiat currencies, which can be printed endlessly by central banks, reducing their worth over time. Unlike paper money, physical bullion doesn’t rely on the solvency of governments, banks, or corporations, meaning it carries no counterparty risk. Gold, in particular, resists rust and corrosion, maintaining its integrity for centuries. Both metals are widely recognized worldwide and often show low or even negative correlation with traditional investments like stocks and bonds, making them excellent tools for reducing portfolio risk. These traits solidify gold’s position as the go-to safe-haven asset, with silver playing a unique complementary role.

Gold: The Primary Safe-Haven Asset

Gold is often considered the ultimate safe-haven asset, especially during economic uncertainty. Its relatively steady price movements make it an appealing choice when markets are volatile. The United States, for instance, holds the largest gold reserves globally, with 8,133.5 tons as of August 2024, highlighting its strategic importance. Historical data reinforces gold’s value during crises. Take the 1970s stagflation era: gold prices skyrocketed by over 1,500%, climbing from around $35 per ounce to more than $800 per ounce. Similarly, during Weimar Germany’s hyperinflation between 1919 and 1923, the price of gold soared from 170 marks to an astonishing 87 trillion marks as fiat currency became worthless. Today, central banks are buying gold at record levels, using it to diversify reserves and hedge against geopolitical risks. As of January 19, 2026, gold is trading at $4,665.15 per ounce. These historical and current trends emphasize gold’s enduring role in wealth preservation, paving the way to explore silver’s unique dual-purpose function.

Silver: A Dual-Purpose Precious Metal

Silver stands out for its dual role as both a store of value and a critical industrial material. Around 80% of its industrial applications include electronics, solar panels, and medical products. This dual demand can lead to significant price fluctuations. For example, during the 2020 pandemic, silver prices surged nearly 48%, far outpacing gold’s 25% gain. Its industrial importance has gained even more attention, with silver now being viewed as a national security asset due to its essential role in supply chains. Emerging markets are further fueling demand for silver, particularly in green energy technologies, superconductors, and electrical appliances. As of January 19, 2026, silver is trading at $93.23 per ounce, making it a more affordable option for smaller investors while still offering strong growth potential. This dual functionality sets silver apart from gold, as detailed below.

Gold vs. Silver: Key Differences for Investors

To build a balanced strategy for asset protection, understanding the differences between gold and silver is essential.

| Factor | Gold | Silver |

|---|---|---|

| Primary Role | Safe-haven asset and long-term wealth preservation | Dual-purpose: Store of value and industrial material |

| Volatility | Lower; tends to remain stable during crises | Higher; experiences larger price swings |

| Industrial Use | Minimal (mainly jewelry and investment) | Widespread (electronics, solar panels, medical products) |

| Storage Needs | High value-to-weight ratio; requires less space | Lower value-to-weight ratio; needs more space |

| Demand Drivers | Influenced by market sentiment, central banks, and inflation hedging | Driven by industrial innovation and investment demand |

| Current Price | $4,665.15 per ounce (Jan 19, 2026) | $93.23 per ounce (Jan 19, 2026) |

The gold-to-silver ratio, currently at 50.04, means it takes about 50 ounces of silver to equal the value of one ounce of gold. This ratio shifts with market conditions, offering potential opportunities for investors to capitalize on the relative value between the two metals.

sbb-itb-39d39a6

How Gold and Silver Performed During Past Economic Crises

History has shown that precious metals like gold and silver have a knack for protecting wealth when traditional financial systems face turbulence. Take gold, for example – it gained value during five of the last six major U.S. recessions since 1970, proving itself a reliable hedge during economic downturns. A pivotal moment came in 1971 with the "Nixon Shock", when President Nixon ended the U.S. gold standard. This decision turned gold into a top-tier investment asset and a safeguard against the erosion of fiat currency. Since then, major global currencies have lost over 90% of their value compared to gold in the 21st century alone.

The 2008 financial crisis is a textbook case of gold’s protective role. As the S&P 500 nosedived by 37%, gold prices soared 25%, as investors sought refuge in tangible assets amid collapsing equity markets. This stark contrast highlighted the value of holding precious metals to preserve wealth. During periods of high inflation – when the U.S. Consumer Price Index exceeded 5% – gold prices delivered an average gain of 27%, comfortably outpacing inflation’s bite on purchasing power.

Fast forward to more recent events, and the story remains consistent. In 2025 and early 2026, geopolitical instability triggered record-breaking returns for precious metals. Gold prices skyrocketed by 65% in 2025, while silver surged an astonishing 141%, marking their best performance since 1979. By January 14, 2026, gold had climbed 22%, while silver gained 29%, driven by what analysts dubbed the "debasement trade" – a mass shift away from U.S. Treasuries and the dollar due to ballooning deficits. The situation escalated further in January 2026, following U.S. military actions in Venezuela and threats against Iran. On one dramatic day, silver prices jumped over 6% to exceed $90 per ounce, while gold edged up nearly 1% to surpass $4,600.

"Gold is a traditional safe haven against inflation, mounting deficits, geopolitical tensions and general economic concerns." – David Goldman, CNN

Over the long haul, gold has consistently proven its value. Between 1971 and 2021, it delivered an average annualized return of nearly 11%, cementing its status as a cornerstone for long-term wealth preservation. These historical trends highlight why holding precious metals is a smart move for anyone serious about safeguarding their assets, especially when paired with secure acquisition and storage strategies.

How to Acquire and Store Precious Metals

Preserving your wealth often involves acquiring and securely storing precious metals like gold and silver. Here’s how to navigate the process effectively.

Physical vs. Paper Precious Metals

When incorporating precious metals into your financial strategy, you’ll need to decide between holding physical metals or investing in paper-based alternatives like ETFs or mining stocks. Each choice comes with its own set of advantages and challenges.

Owning physical bullion – such as bars and coins – means you possess the metal directly, eliminating counterparty risk. This independence from fund managers or mining companies can be reassuring. However, physical metals require secure and insured storage, which can add to your costs. Liquidity can also pose a challenge; for instance, large bars may need purity verification before a dealer agrees to buy them.

On the other hand, paper assets like ETFs are easier to trade and don’t require storage. But they come with counterparty risk since your investment depends on the provider’s reliability. Mining stocks may provide dividends, but their performance is tied to the company’s success, not just metal prices. It’s also worth noting that if you hold physical metals in a Self-Directed IRA, they must be stored in an approved depository rather than at home.

"Precious metals dealers often times are not licensed or registered to provide investment or trading advice to retail customers. They are typically salespeople who are paid commissions based on the products they sell."

– Commodities Futures Trading Commission (CFTC)

Costs are another important factor. Commissions on physical metals can reach 15% or more, and collectible coins can carry premiums of 40% to 200% above the spot price. In some extreme cases, fraudulent dealers have charged spreads exceeding 300%. Over the past decade, the CFTC has uncovered over $500 million in fraudulent precious metals sales.

Once you’ve acquired your metals, the next step is ensuring their secure storage.

Secure Storage Options

Protecting your physical metals is essential to preserving their value. Here are some storage options to consider:

- Private specialist vaults: These facilities offer top-tier security, including motion sensors, reinforced structures, full insurance coverage, and independent audits. They are particularly suited for large holdings.

- Bank safe-deposit boxes: While secure, these lack insurance and may have restricted access.

- Home storage: This option provides immediate access but comes with higher theft risks. Standard home insurance may not fully cover high-value items, so check if additional coverage is needed.

Additionally, you’ll need to decide between allocated and unallocated storage. Allocated storage ensures you own specific, identifiable bars or coins, while unallocated storage pools your holdings with others, introducing counterparty risk if the provider faces financial trouble.

With storage sorted, it’s time to focus on purchasing your metals wisely.

Best Practices for Purchasing Gold and Silver

To avoid scams and make informed decisions, follow these tips:

- Verify dealer credentials: Use the U.S. Mint‘s database to find authorized coin sellers and check the National Futures Association‘s BASIC system for disciplinary records. Start with established local dealers and check with your state attorney general for complaints.

- Understand markups: Multiply the metal’s weight by its spot price and compare it to the dealer’s price. Legitimate dealers typically charge spreads under 20%. Be cautious of excessive markups, which can exceed 300% in fraudulent cases. Always request written documentation of fees and total costs.

- Beware of high-pressure tactics: Avoid dealers who rush you or claim limited availability. Terms like "semi-numismatic" may be used to justify inflated prices for coins that aren’t rare. Before committing, ask about the dealer’s buy-back price to gauge liquidity.

"No reputable investment professional should push you into making an immediate investment decision or tell you to ‘act now.’"

– FINRA

Finally, steer clear of unsolicited offers via email, phone, or social media. These are common scam tactics. Ensure that investment-grade gold bullion bars have a purity of at least 99.5%, and verify authenticity with proper documentation or independent assaying if needed. By following these steps, you can protect your investment and build a solid asset protection plan.

Adding Gold and Silver to Your Asset Protection Plan

Incorporating precious metals into a well-rounded wealth protection strategy can provide stability and diversification.

Recommended Allocation by Investor Profile

Financial analysts often suggest dedicating 5%–20% of your portfolio to precious metals. Allocations under 5% may not offer enough protection, while exceeding 30% is rarely advised.

"The ‘sweet spot’ for the percentage of gold in portfolio is 20%. On a long-term basis this provides the best balance between risk and reward."

– CPM Group

Your ideal allocation depends on factors like age, risk tolerance, and financial goals. For example, younger investors with longer time horizons might lean toward silver, which has more price volatility but offers growth potential. Retirees, on the other hand, often prefer gold for its stability and suitability for estate planning. A 53-year CPM Group study revealed that portfolios optimized for maximum returns typically allocated 20% to 30% to gold.

| Investor Profile | Recommended Allocation | Primary Metal Focus | Rationale |

|---|---|---|---|

| Growth-Oriented (Young) | 5% – 10% | Silver | Higher volatility for potential growth; longer time horizon to ride out dips. |

| Balanced / Moderate | 10% – 15% | 50/50 Gold & Silver | Balances stability, growth potential, and liquidity. |

| Conservative / Retiree | 15% – 25% | Gold | Prioritizes wealth preservation, estate planning, and protection from inflation. |

| High-Net-Worth (Crisis Hedge) | 20% – 30% | Gold | Maximum protection against systemic risks or hyperinflation; optimal risk/reward balance. |

Before committing a large portion of your portfolio to metals, ensure you have an emergency fund covering three to six months of essential expenses in cash. This safety net prevents you from needing to sell metals during market downturns. For additional legal protection, structuring offshore trusts may be worth exploring.

Using Precious Metals for Offshore Asset Protection

Offshore asset protection can enhance the safety of your wealth by adding legal safeguards. High-net-worth investors often use offshore structures to shield their assets. For example, placing precious metals in irrevocable trusts located in jurisdictions like the Cook Islands, Nevis, or Belize can protect them from U.S. legal judgments. These jurisdictions do not recognize U.S. court orders, offering strong legal barriers.

Allocated offshore accounts are another option, allowing you to maintain direct legal ownership of specific bars or coins. In cases of bankruptcy, creditors cannot claim your bullion since it remains your property and is not considered part of the bank’s assets. However, unallocated accounts may classify you as a general creditor, which carries more risk.

Combining physical metal ownership with structures like LLCs or Asset Protection Trusts can further separate personal liabilities from your assets. Domestic Asset Protection Trusts are more affordable but may not stand up to federal court orders involving alimony or child support. Offshore trusts, while costlier, provide stronger privacy and are beyond the reach of U.S. authorities.

"Creating trusts after an investigation has begun is like closing the barn door after the horses have escaped."

– Marty Burbank, Elder Law Attorney

One real-world example comes from May 2025, when an elder law attorney shared the story of Margaret, a retired teacher. At age 67, she set up an irrevocable trust for her home and investments. Five years later, when she needed skilled nursing care, the trust protected her assets, allowing her to qualify for Medicaid. This preserved approximately $300,000 for her family that would have otherwise been spent on care costs.

Conclusion

This guide has explored how to acquire, store, and allocate precious metals like gold and silver to protect and grow your wealth. These metals have long been trusted for their ability to hold value during economic instability, inflation, and political uncertainty. For instance, between 1971 and 2021, gold achieved average annual returns of almost 11%, all while enhancing portfolio diversification.

Allocating 6% to 10% of your portfolio to gold can significantly enhance its performance over time. Physical gold ownership gives you direct control and eliminates counterparty risk, though it requires secure storage solutions. Alternatively, ETFs and mining stocks provide easier liquidity but come with their own set of risks.

"Gold consistently outpaces inflation, too." – Reuters Plus

When investing, always confirm the legitimacy of dealers by checking their registration through the National Futures Association’s BASIC database. Be meticulous about premiums – reasonable spreads typically fall between 5% and 10%, while fraudulent dealers may charge spreads exceeding 300%. These precautions can safeguard your strategy and ensure precious metals play a solid role in your financial plan. It’s also wise to consult a licensed financial or tax advisor, especially if you’re considering moving retirement funds into precious metals, as high commissions and fees could reduce your returns significantly.

Gold and silver remain powerful tools for preserving wealth, thanks to their intrinsic value, ability to diversify portfolios, and reliable performance over time. Whether you’re looking to hedge against inflation, protect assets during volatile periods, or secure long-term financial stability, these metals offer a level of security that paper assets simply cannot provide. Use these insights to strengthen your wealth protection strategy and achieve greater financial resilience.

FAQs

How do gold and silver help protect wealth during inflation and currency devaluation?

Gold and silver stand out as physical assets with finite availability, making them reliable options for protecting wealth against inflation and currency instability. When inflation rises, these metals often see their value climb, helping to safeguard purchasing power. Take gold, for instance – it has a track record of performing well during inflationary periods, frequently outpacing the rate of price increases. Similarly, silver, which also plays a key role in various industries, tends to experience notable price surges during times of economic instability.

Unlike fiat currencies that can lose value due to excessive printing or financial turmoil, gold and silver have long been recognized worldwide as dependable stores of value. They also bring balance to investment portfolios, as their price movements generally differ from those of stocks and bonds. On top of that, these metals are easy to trade, offering high liquidity at transparent market prices. This combination of reliability and flexibility makes them a solid choice for preserving wealth over the long term.

What are the advantages and disadvantages of investing in physical gold and silver versus paper-based options?

Investing in physical gold or silver gives you a tangible asset you can actually hold in your hands. This makes it a solid option for protecting your wealth against inflation and currency devaluation, especially during economic instability. However, owning physical metals comes with its own set of challenges. You’ll need secure storage, insurance, and be prepared to pay higher dealer premiums. Plus, unlike stocks or bonds, physical metals don’t generate income like dividends or interest. Selling them can also take time since you’ll need to find a buyer willing to pay a fair price.

On the other hand, paper-based investments – like ETFs, mutual funds, or mining stocks – offer a more convenient alternative. They’re easier to buy and sell, come with lower transaction costs, and don’t require you to worry about storage or insurance. These options also allow for fractional ownership, making them accessible even if you’re starting small. But they’re not without drawbacks. Paper investments carry counter-party risks, management fees, and sometimes fail to track the spot price of metals accurately.

A smart strategy might involve combining both: holding physical metals for long-term stability and using paper assets for liquidity and ease of access. This way, you can balance security with flexibility.

How much of my portfolio should be allocated to gold and silver?

For U.S. investors, it’s often suggested to dedicate 5%–15% of your portfolio to precious metals like gold and silver. This allocation can act as a buffer against inflation and market swings while adding variety to your investments.

A practical example might be setting aside 10%–12% for gold and silver combined. You could split it into 8% for gold, known for its stability as a safe-haven asset, and 4% for silver, which has the potential for growth thanks to its industrial uses.

The exact percentage depends on your personal financial goals and how much risk you’re comfortable with. However, it’s usually smart to keep precious metals under 20% of your portfolio to maintain a balanced, long-term investment strategy.