Tax havens are often misunderstood and surrounded by myths. They are not inherently illegal but are jurisdictions offering low or zero tax rates to foreign individuals and businesses. While they can be used for legitimate tax planning and asset protection, they are also linked to concerns about tax evasion and revenue loss for governments.

Key takeaways:

- Tax havens legally reduce tax liabilities but differ from illegal tax evasion.

- Modern regulations like FATCA and CRS have reduced secrecy, requiring transparency and compliance.

- Common myths include that all tax havens are tax-free or operate without oversight – both are incorrect.

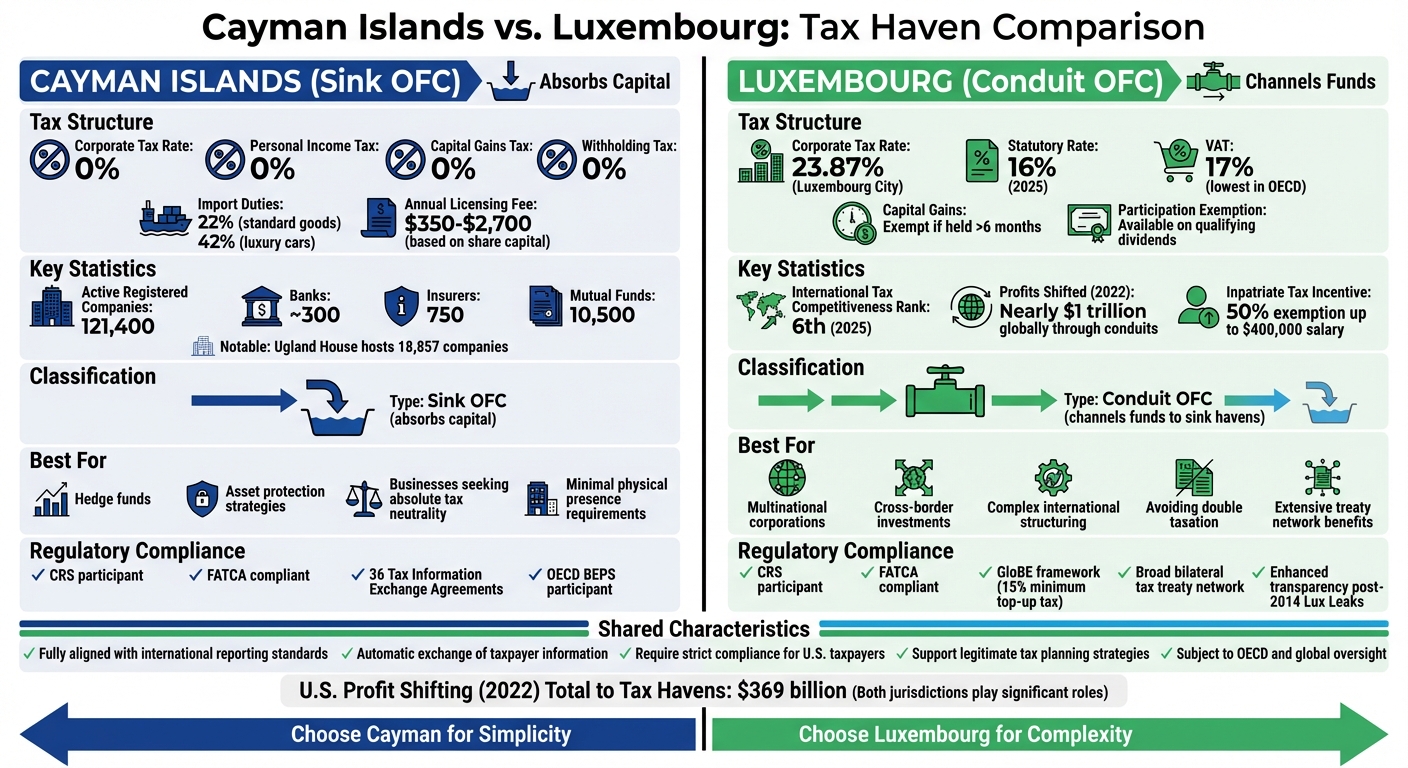

- Examples like the Cayman Islands and Luxembourg show varying approaches: the former offers zero taxes, while the latter uses incentives within a regulated framework.

For businesses or individuals considering tax havens, compliance with home-country laws is critical, and professional guidance is essential to navigate complex regulations.

Common Myths vs. Facts About Tax Havens

Let’s clear up some common myths about tax havens and replace them with the facts. Misconceptions often muddy the waters, so here are four myths debunked to provide clarity.

Myth #1: All tax havens offer zero taxes.

Not every tax haven eliminates taxes entirely. While some jurisdictions have low or even zero official tax rates, many use strategies like BEPS (Base Erosion and Profit Shifting) tools to reduce effective tax liabilities. Additionally, certain havens utilize non-resident structures, meaning companies operating in places like the British Virgin Islands or Cayman Islands often pay no local taxes on offshore activities. Even within the U.S., states such as Florida, Texas, and Nevada act as domestic tax havens by not imposing state income taxes. The myth that all tax havens are tax-free oversimplifies a much more nuanced reality.

Myth #2: Using tax havens is illegal.

This is a common misunderstanding. Using tax havens is legal – as long as you follow the rules. As Investopedia explains:

Tax havens aren’t necessarily illegal; it’s when they are exploited or taken advantage of beyond the regulatory framework that frames them that it becomes a problem.

The difference lies in tax avoidance, which is legal, and tax evasion, which is not. For instance, U.S. taxpayers are allowed to deposit money in tax havens, provided they meet reporting requirements like those outlined in FATCA (Foreign Account Tax Compliance Act). Under FATCA, Americans must report foreign holdings exceeding $50,000.

Myth #3: Tax havens operate without regulatory oversight.

This outdated belief doesn’t hold up anymore. Modern tax havens are subject to significant oversight thanks to frameworks like CRS (Common Reporting Standard), TIEAs (Tax Information Exchange Agreements), and AML (Anti-Money Laundering) practices. Jurisdictions such as Ireland, Singapore, and the Netherlands, while offering tax advantages, maintain high levels of transparency and compliance with OECD standards. The days of unchecked secrecy in tax havens are largely behind us.

Myth #4: Tax havens exist solely for money laundering.

While tax havens are sometimes associated with illegal activities like money laundering, they also serve legitimate purposes. These include avoiding double taxation, protecting assets, and facilitating international trade. Offshore financial centers currently hold approximately 10% of global GDP. However, governments do lose substantial revenue – around $200 billion annually in individual income taxes and over $600 billion in corporate income taxes – due to both legal tax planning and illegal evasion. Understanding this distinction is crucial for anyone considering these jurisdictions for lawful financial strategies.

Dispelling these myths helps shed light on how tax havens can be used responsibly and in compliance with global regulations.

sbb-itb-39d39a6

1. Cayman Islands

The Cayman Islands stands out as a premier offshore financial hub, hosting around 121,400 active registered companies. But what draws businesses and investors to this jurisdiction, and how does it maintain its appeal while adhering to modern regulatory standards?

Tax Policies

The Cayman Islands operates a zero direct taxation system. This means no corporate taxes, personal income taxes, capital gains taxes, payroll taxes, or withholding taxes. Instead, the government generates revenue through alternative means, such as import duties (22% on most goods, with luxury cars taxed as high as 42%), work permit fees, stamp duties on real estate transactions, and annual registration fees. This approach creates a tax-neutral environment, ensuring that businesses and investors are only taxed in their home countries.

Additionally, there are no tax filing obligations for individuals or corporations, and foreign property ownership is unrestricted. Offshore companies pay an annual licensing fee based on their authorized share capital, with incorporation costs typically ranging from $350 to $2,700. These policies make the Cayman Islands an attractive option for those seeking simplicity and efficiency in their financial dealings.

Regulatory Environment

While the Cayman Islands once had a reputation for secrecy, it has since embraced a regulatory framework that aligns with international standards. The jurisdiction has implemented robust transparency measures, including participation in the OECD’s Common Reporting Standard (CRS) and compliance with the U.S. Foreign Account Tax Compliance Act (FATCA). These initiatives enable the automatic exchange of financial information with foreign tax authorities. Furthermore, the Cayman Islands has signed tax information exchange agreements with 36 jurisdictions.

A notable example of its unique structure is Ugland House, which serves as the registered address for 18,857 international companies, as highlighted in a 2008 Government Accountability Office (GAO) report. This demonstrates how companies can leverage the jurisdiction’s tax benefits without maintaining a significant physical presence.

Legitimate Uses

Despite strict oversight, the Cayman Islands supports a variety of legitimate financial strategies. For instance, investment funds often use the jurisdiction to ensure that taxes are applied only at the investor level in their home countries, avoiding double taxation. Multinational corporations also establish subsidiaries in the Cayman Islands to manage intellectual property or patents and to implement legal profit-shifting strategies. Additionally, the jurisdiction offers strong asset protection, allowing individuals to safeguard wealth from potential creditors through carefully structured entities.

This thriving financial ecosystem is supported by a well-established sector, including nearly 300 banks, 750 insurers, and 10,500 mutual funds.

Global Oversight

The Cayman Islands actively adheres to international transparency standards. In addition to CRS and FATCA compliance, the jurisdiction participates in the OECD’s Inclusive Framework on Base Erosion and Profit Shifting (BEPS) and has introduced economic substance requirements to meet global expectations. Mutual Legal Assistance Treaties, in place since the 1980s, further enable cooperation in criminal investigations.

However, challenges persist. For example, in 2022, U.S. companies shifted an estimated $369 billion in profits to tax havens, including the Cayman Islands. Additionally, the 2024 Corporate Tax Haven Index by the Tax Justice Network continues to rank the jurisdiction among those most involved in facilitating multinational tax avoidance.

2. Luxembourg

Luxembourg holds a distinct position in Europe, ranking 6th on the 2025 International Tax Competitiveness Index. Unlike jurisdictions that rely solely on offering zero taxes, Luxembourg strikes a balance between attractive tax policies and strong regulatory oversight. This combination, along with its advanced financial infrastructure, makes it a prime destination for wealth management and corporate structuring.

Tax Policies

In 2025, Luxembourg lowered its statutory corporate tax rate to 16%, resulting in an overall rate of 23.87% in Luxembourg City when surcharges and municipal taxes are included. While it’s not a zero-tax jurisdiction, Luxembourg offers significant incentives, including a participation exemption regime. This regime exempts qualifying dividends, liquidation proceeds, and capital gains from taxation.

For capital gains, Luxembourg provides exemptions on movable assets if they are held for more than six months. It also boasts the lowest VAT in the OECD at 17%, applied to most consumer goods. Additionally, the country attracts top talent through inpatriate tax incentives, allowing a 50% exemption on total gross annual salaries (up to $400,000) for qualifying individuals who have not been residents in the past five years.

Regulatory Environment

Since the revelations from the 2014 "Lux Leaks" investigation, Luxembourg has worked to enhance transparency. It now participates in the Common Reporting Standard (CRS) for the automatic exchange of taxpayer information and has implemented the Global Anti-Base Erosion (GloBE) framework, which includes a 15% qualified domestic minimum top-up tax starting with fiscal years after December 31, 2023.

Modern classifications identify Luxembourg as a "Conduit OFC" – a jurisdiction that facilitates the movement of significant financial value toward "sink" tax havens. The country also maintains a broad network of bilateral tax treaties aimed at reducing or eliminating withholding taxes and preventing double taxation. These measures strengthen Luxembourg’s role as a hub for international wealth management while addressing global concerns about transparency.

Legitimate Uses

With its transparent frameworks, Luxembourg supports multinational operations and cross-border investments effectively. Many multinational companies use Luxembourg subsidiaries to avoid double taxation when conducting transactions across borders, ensuring they don’t pay taxes twice on the same income. The jurisdiction also plays a key role in facilitating international investment deals and provides U.S.-based companies with affordable access to credit for acquisitions and other corporate activities.

"Companies often say shell companies encourage foreign investment and facilitate transactions that might not be possible otherwise. They also incorporate offshore… to avoid paying taxes twice on the same pot of money." – International Consortium of Investigative Journalists (ICIJ)

Global Oversight

Luxembourg continues to face scrutiny from international organizations. In 2022, multinational corporations shifted nearly $1 trillion in profits to tax havens worldwide, with Luxembourg serving as a major conduit. Its financial practices are closely monitored by the OECD and subject to U.S. regulations like FATCA for American citizens. Increasing pressure from the OECD and G-20 has led Luxembourg to adopt more transparency measures, including Tax Information Exchange Agreements (TIEAs) and Mutual Legal Assistance Treaties (MLATs).

Advantages and Disadvantages

When comparing the Cayman Islands and Luxembourg, the decision hinges on your specific business needs, risk tolerance, and operational structure. Each jurisdiction brings its own strengths and challenges to the table.

The Cayman Islands stands out for its absolute tax neutrality. With 0% taxes on corporate profits, income, capital gains, and withholding, it’s a top choice for hedge funds and asset protection strategies that value simplicity above all else. However, the flip side is high import duties – up to 42% on luxury cars and 22% on standard goods – which help offset the lack of direct taxes. Another benefit is the minimal local presence requirement, allowing businesses to operate with limited physical infrastructure.

Luxembourg, on the other hand, offers a more complex but equally appealing option. While it does have a corporate tax rate, its sophisticated tax planning tools and extensive network of bilateral tax treaties can significantly reduce effective rates. This makes it particularly attractive for multinational corporations managing cross-border operations. The trade-off? Complexity. Navigating its participation exemption regime and treaty benefits requires expert advice and entails ongoing compliance costs. Seeking private consultations can help clarify these requirements.

Both jurisdictions are fully aligned with international reporting standards, including the automatic exchange of taxpayer information with foreign tax authorities. This shift has eroded the "secrecy" often associated with tax havens. For U.S. taxpayers, compliance with foreign reporting rules is mandatory, and non-compliance can lead to severe penalties.

A key distinction lies in how these jurisdictions function. The Cayman Islands operates as a "Sink OFC", absorbing capital, while Luxembourg acts as a "Conduit OFC", channeling funds to sink jurisdictions. In 2022 alone, U.S. companies transferred $369 billion to tax havens, with both jurisdictions playing unique yet complementary roles in this global movement. The choice between them depends on whether you prioritize straightforward tax elimination or need a more sophisticated international structuring solution.

Ultimately, these pros and cons demonstrate that legal tax planning and strict regulatory compliance can coexist, challenging the outdated notion that all tax haven activities operate outside legitimate frameworks.

Conclusion

Tax havens are often misunderstood. While they offer favorable tax structures, they are tools for legal tax planning when used correctly – not for illegal tax evasion.

The era of banking secrecy has mostly been replaced by frameworks like the Common Reporting Standard (CRS) and the Foreign Account Tax Compliance Act (FATCA), which facilitate automatic information exchange. For U.S. taxpayers, compliance is crucial. If your foreign investments exceed $50,000, you’re required to file Form 8938. Similarly, foreign bank accounts holding more than $10,000 must be reported via Form 114 (FBAR). Ignoring these obligations can lead to serious consequences, as highlighted by the 2022 Danske Bank case. In that instance, the bank pleaded guilty to fraud and forfeited $2 billion after allowing illicit funds to flow through its Estonian branch.

Given these regulatory changes, it’s worth weighing the benefits of domestic tax-deferred options – like 401(k) plans or traditional IRAs – before venturing into offshore strategies. These options provide tax-deferred growth without the added complexity and reporting burdens of international arrangements.

For those who do decide to explore offshore planning, working with a qualified professional is non-negotiable. The regulatory landscape requires expertise in both your home country’s laws and the rules of the jurisdiction you’re considering. As Investopedia aptly states:

Depositing money in a tax haven is legal as long as the depositor pays the taxes required by their home jurisdiction.

FAQs

What are the legitimate ways to use tax havens?

Tax havens, when used correctly, can serve several legitimate purposes, such as strategic tax planning, asset protection, and international business structuring. The key is ensuring that all activities are fully disclosed to U.S. tax authorities. For instance, individuals and businesses may deposit funds or establish entities in jurisdictions with low or no taxes to optimize their tax obligations – provided they report everything to the IRS and pay any required taxes.

Many companies rely on tax havens to centralize earnings, avoid being taxed twice on the same income, or manage cross-border investments. This is often done through holding companies, subsidiaries that manage intellectual property, or financing entities. Similarly, individuals and families might turn to offshore trusts or foundations to shield assets from risks like political upheaval, lawsuits, or creditors. As long as these strategies are properly reported, they remain within legal boundaries.

In addition to tax benefits, tax havens can offer financial stability, especially in regions where economies are unpredictable or legal systems are weak. High-net-worth individuals often use these jurisdictions to protect their wealth, plan their estates, or even facilitate charitable donations. The cornerstone of legality in these practices is full transparency. This means filing required forms such as FBAR or Form 8938 and complying with all U.S. disclosure rules.

How have regulations like FATCA and CRS impacted the use of tax havens?

Regulations like the U.S. Foreign Account Tax Compliance Act (FATCA) and the OECD’s Common Reporting Standard (CRS) have brought a new level of openness to offshore financial systems. FATCA, introduced in 2010, compels foreign financial institutions to disclose accounts held by U.S. taxpayers to the IRS. Failure to comply results in a hefty 30% withholding tax on U.S.-sourced payments. Similarly, CRS, launched in 2014, requires more than 100 countries to automatically exchange financial account information with one another’s tax authorities.

These initiatives have made it much harder to use tax havens for hiding assets, as the era of offshore secrecy has been replaced with stringent reporting rules. While concealing personal assets has become less common, legal avenues for tax planning and corporate structuring are still available – provided they adhere to the law. However, taxpayers now face more complex reporting requirements, such as filing Form 8938 under FATCA or the FBAR for foreign accounts. The stakes for non-compliance are higher than ever, with increased risks and financial penalties.

How are the Cayman Islands and Luxembourg different as tax havens?

The Cayman Islands and Luxembourg are both known as tax havens, but their approaches and areas of focus set them apart. Nestled in the Caribbean, the Cayman Islands stand out by imposing no direct taxes – this means no corporate, income, capital gains, or withholding taxes. This makes it a go-to destination for hedge funds, investment managers, and trusts. Its legal system, rooted in English common law, is straightforward, and it offers strong confidentiality protections, which further enhances its appeal.

Luxembourg, a member of the European Union, takes a different route. It provides low effective corporate tax rates and favorable rulings, particularly for intellectual property and intra-group financing. The country also offers advanced investment vehicles, such as SICAVs and SOPARFIs, which are particularly attractive to multinational corporations handling corporate structuring and cross-border financing. However, being part of the EU means Luxembourg adheres to stricter transparency and information-sharing rules compared to the Cayman Islands.

In essence, the Cayman Islands are often favored for asset protection and fund structuring, while Luxembourg caters to businesses focused on EU-based corporate strategies and financial operations.