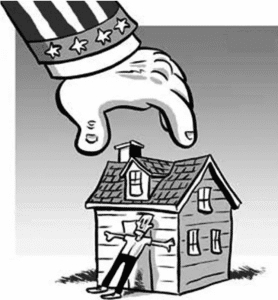

Private property rights are the cornerstone of freedom; and whether it’s tax liens, eminent domain, or squatters the government is not on the side of the property owner.

March 25, 2024

By: Bobby Casey, Managing Director GWP

I own a few properties in the US, so a tax I can’t avoid is property taxes. And one of the saddest things you may see advertised are real estate schemes that involve auctions of homes belonging to those who are delinquent on their property taxes. They are called “tax lien sales”.

Imagine buying a home for $40,000 back in the 70s. Paying it off, and over the decades the value of the house went from $40,000 to $1.5 million. And you were paying $25 per month in property taxes, and now it’s $1,000 per month. But you paid your mortgage and now you’re retired on a fixed income. Imagine losing your house … not to the bank… but to the state, years after you paid it off.

If my parents bought a house in Sherman Oaks, California in the 1970s, this is exactly what they would be experiencing. They’d be house-poor, but by no real fault of their own.

It’s one thing if you mismanage your business or your finances and your assets are liquidated. But the property tax is something that undermines the very core of freedom: property ownership.

Property and other assets can be stores of wealth if not wealth generating. And in some cases, a retirement plan.

If you are delinquent on your property taxes, the lien holder can put your property in foreclosure. In some states, they sell the lien to private organizations.

In eleven states and territories, if and when the property sells, they don’t just take what’s owed. They don’t even take just what’s owed plus interest and fees. They take the full equity of the home even if it well exceeds the owed amount.

The lien holder initiates the foreclosure, and because there is no mechanism to return the balance to the homeowner, the lien holder can legally assume possession of the full amount. It’s literal equity theft. The SCOTUS has ruled on this already on a case out of Minnesota.

Washington D.C., plus the states of Alabama, Arizona, Colorado, Illinois, Massachusetts, Minnesota, New Jersey, New York, Oregon, and South Dakota, are waiting for property owners to take them to court before fixing their policies and procedures.

In the meantime, Epoch Times chronicles several cases where homeowners not only lost their properties to paltry sums of property tax delinquency, but also stand to lose the full equity of their properties that were seized.

What is particularly disturbing, is property taxes are being used as a way to play gotcha against otherwise responsible people, while squatters cannot be evicted from private property.

The squatter situation is not only escalating, but we are quickly realizing how antiquated and inadequate the laws are in helping the property owner remove squatters. To be clear, squatting isn’t the same as trespassing. The former is a civil issue, while the latter is a criminal issue, which protracts the situation and makes it very expensive to litigate.

The problem is, at least in part, attributable to the rent moratoriums during the “pandemic lockdowns”.

But there are other ways to get their foot in the door. The interstice of time during a foreclosure or probate, when a home has no one in it, squatters invade. There are full tutorials online showing them what to do and the paperwork they need to produce. When a property owner calls the police, the officer cannot make the determination on whose documentation is authentic. That’s a matter for the courts. It goes to court, but the squatters don’t show up and that takes the process from an already long 6 months to much longer.

Fox Digital chronicled a few cases. What makes this even more surreal is when the rightful homeowner is arrested criminally for trying to get the squatters to leave the property, as was the case in New York. Her crime? Changing the locks on her doors.

This isn’t much different than eminent domain. It’s a total grab for your property, assets, and/or wealth, and it doesn’t take much to set it off.

In the case of eminent domain, if the city thinks it can get more property taxes out of a development than you having quiet acreage, they argue for the “public good”, and start the process. Most people and small businesses can’t afford to fight back, so they take what the city offers as “fair market value” and move on.

Turns out, you CAN actually fight it. And you can win, or at the very least get the city to back off. Dallas tried to commandeer a property belonging to a man of principle and means, and didn’t realize they weren’t dealing with just an “ordinary person”. It really is a triumphant story of FAFO.

Dallas wanted to expropriate land for a pipeline which affected several land owners. But one hold out said no. Ultimately, the cost to fight him and the very real chance of losing, forced the city to withdraw.

Dallas’ officials arrogantly blame the landowner for the “millions” in taxpayer money they’ve wasted on a prolonged and frivolous court battle. But officials were not forced to fight Bennett. The city’s refusal to negotiate was clearly their choice, as the landowner offered alternative solutions from the onset.

Governments have no incentive to negotiate with landowners because citizens can simply be steamrolled into submission, as [Councilwoman Sandy] Greyson readily admits. After all, governments have unlimited tax-funded war chests to hire high-priced law firms, which most Texans cannot afford. As a result, officials are accustomed to people simply giving up even in cases where the government skirts the law or abuses its authority.

The government is either sleeping on your property rights or actively violating them. Either way, this doesn’t bode well for would-be landlords. If the government can’t even protect something as basic property rights, what exactly are taxpayers paying for? It is critical to protect your assets. There are structures that can help you do that. Like an insurance policy, it’s good to have.

Click here to get a copy of our offshore banking report, or here to become a member of our Insider program, where you are eligible for free consultations, deep discounts on corporate and trust services, plus a host of information about internationalizing your business, wealth and life.