April 27, 2015

By: Kelly Diamond, Publisher

Some people say that America was the great experiment, founded on liberty and freedom. I think America has proven to be on some horrible Groundhog’s Day loop founded on the tragic, famous last words, “This time it’ll be different”.

Some people say that America was the great experiment, founded on liberty and freedom. I think America has proven to be on some horrible Groundhog’s Day loop founded on the tragic, famous last words, “This time it’ll be different”.

This phrase resurfaces every single election cycle. It resurfaces every time an old idea is recycled and rebranded either from a previously failed policy or a currently failing policy in some other country.

Wars being used as economic “stimulus” and the moral wars on abstract ideas like poverty and terror are all examples of abject economic failures that keep coming back and somehow are received with open arms by the general public. Perhaps I should call them “Zombie Polices”: you think they are dead, but they keep coming back as indestructible brain suckers.

Another such example of “zombie policies” is economic bubbles due to government market manipulations. You’re going to think you read this before. I’m going to say, “Yes, you have, but the time stamp is a different year.” You’re going to ask, “So this is old news?” I’m going to respond, “Well, it happened before, but it’s happening again now.” A sort of de ja vu all over again situation.

You already know about the student loan bubble. The price tag of a four-year degree has skyrocketed. Capitalism of course is the scapegoat. But this isn’t because of any supply and demand impasse in the market. This is due to vast amounts of readily available funds being lent out to underqualified 18 year old liabilities. If they were turned down for loans, then the market price of education would have to go down because otherwise, the seats would remain empty in all the universities.

Of course this is the benevolence of the federal government and its politicians that insists everyone is entitled to a four-year university degree. This benevolence has also spilled over into home ownership. Since the enactment of the Community Reinvestment Act of 1977 when Jimmy Carter was in office, until now, this bill has been like herpes to our economy: you think it’s gone away, but then it flares right back up.

2008 was the Great American Bailout. TARP (Toxic Asset Relief Program) threw money around to the biggest failures in the country: irresponsible banks and mortgage financers, and over unionized car companies. Opening the lending market to a high risk subprime demographic makes a LOT of sense when it’s ultimately at no risk to the bank or the mortgage financers Freddie Mac and Fannie Mae.

While people got indignant over the bailouts, they didn’t lose their sense of entitlement for higher education and home ownership. Apparently, the vast majority see them as mutually exclusive. Instead, their resolve for free education and a house only amped up even more.

Brace yourselves for some repackaged failure! That’s right! Your friends at Fannie Mae have a new program: the HomePath Ready Buyer Program!

Did you hear that? Sure you did. “This time it’ll be different!”

Freddie Mac and Fannie Mae recently announced that they will be buying 30 year mortgage backed securities with as little as 3% down. Apparently, we’re supposed to find some solace in the fact that this program is not available to jumbo or interest only loans. I don’t know why, considering the interest only loans are largely utilized by house flippers who invest in real estate to improve them and make them better. Heaven forbid someone were to go into a deteriorating neighborhood, buy up homes, improve them and sell them back better than they were! That might actually IMPROVE a community and IMPROVE property values in a more organic way.

The claim is that the first time homebuyer would be helped by this 3% rebate because it is contingent upon taking a course on homeownership. It’s roughly a four-hour course online with a quiz at the end. The claim is that it could save someone up to $4,500 on a $150,000 home.

Let’s take that $150,000 home.

3% down is $4,500.

Let’s say, for the sake of round numbers, the loan amount is if $145,000.

30 year, fixed rate mortgage at about 4% leaves a monthly payment of about $610 per month on $120,000, and $25,000 at a higher rate of say 7% to make up for the MPI/PMI which comes out to about $165 per month. The approximate total monthly payment would be something like $775 per month.

Over the life of the loan, the homeowners are looking at something close to $120,000 to $130,000 in interest. If they just borrowed $145,000 as 80% of the price of a home, that same amount would cost about $690 per month. They would also save about $20,000 to $30,000 in interest.

Of course these numbers carry a lot of assumptions about the borrower and the rates, but there is a larger point… several in fact.

- If money wasn’t so cheap and easy to borrow, there wouldn’t be the same large demand for houses.

- If that demand wasn’t there, there wouldn’t be so many houses being built to meet that undeserving demand.

- If that demand wasn’t there, the price of housing would not inflate in response to this false (never mind unsustainable) level of demand.

- If the housing prices weren’t manipulated upward by false demand, the price of housing would be lower overall. Lower by more than 3%, which is what the rebate is for.

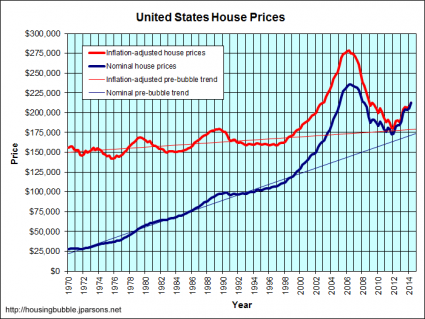

How would you know, Kelly? History is my best indicator. From 1981 to 2010 housing prices shot up nearly 4.5 times their value. That’s a 450% increase in median pricing. Nothing else has gone up in such extreme increments over the same time frame. I don’t deny that real estate would naturally increase in value over time, but after the crash, the market clearly wanted to correct itself.

Despite the fact that there are already loans backed with as low as 5% down and the interest rates are still lower than 4%, first time homebuyers are sitting it out. There has been a considerable drop in mortgage lending. Fannie Mae is still sitting on a LOT of foreclosed homes that need to be sold and moved off their books.

In an attempt to appeal to the one sector of potential borrowers that are walking away, this Ready Buyer program was launched. There’s a part of me that is holding out hope that the younger generations are getting wiser toward the consumer schemes the government regularly launches to get their Keynesian cohorts to BUY BUY BUY and stimulate the economy. There’s another part of me that wonders if the federal government didn’t shoot itself in the foot with the student loan schemes. If you saddle 18 to 25 year olds with insurmountable student loans, how on earth are they going to buy a home when they are in their late 20’s or early 30’s? Their debt to income ratio alone would preclude any such thing. So what on earth is 3% going to do for first time home buyers? Saddle them with more debt and have them paying more interest on an inflated house, which is hardly compensated for by 3% at closing.

Lending to people with no skin in the game is not the answer to economic problems. The default rate will be as it was before: high and crippling. Is it wrong that banks are going along to get along? Yes. But are they doing anything different than anyone else being offered free money at no risk? I don’t think so. There is no difference between some working class blue collar worker and the “1%” banker. If they can avoid risk and make money, they will.

The issue remains, then, that government would cater to that at all. All this for a temporary blip in the charts and populist applause, the ability to show that people are buying homes again and more people are attending university. Fannie and Freddie were bailed out to the tune of $187.5 billion. Is that going to be chump change in contrast to the next crisis?