When setting up an offshore trust, two key roles come into play: trustee and protector. Here’s what you need to know:

- Trustee: Manages the trust’s assets daily, holds legal ownership, and has fiduciary duties to act in the beneficiaries’ best interest.

- Protector: Oversees the trustee, ensures the trust aligns with the settlor’s intent, and can veto decisions, replace trustees, or relocate the trust.

Quick Overview:

- Trustees handle administration, while protectors provide oversight.

- Trustees always have fiduciary duties; protectors may or may not, depending on the trust deed.

- Protectors offer flexibility to address changes without court involvement.

Key takeaway: Trustees manage, protectors supervise. Together, they strengthen the trust’s structure and ensure its goals are met.

The Trustee’s Role in Offshore Trusts

Legal Authority and Definition

In an offshore trust, the trustee holds legal ownership of the trust assets, while the beneficiaries enjoy the benefits derived from those assets. This arrangement places a significant fiduciary responsibility on the trustee to act exclusively in the best interests of the beneficiaries. As Forsters LLP puts it:

A trustee is the legal owner of the trust assets. The trustee has day-to-day control of the trust property.

Typically, offshore trusts appoint foreign trustees, often professional trust companies based in jurisdictions like the Cook Islands or Nevis. These trustees are usually not U.S. citizens or linked to U.S.-based businesses. This legal structure establishes the framework for the trustee’s daily responsibilities.

Main Responsibilities of Trustees

Trustees play a central role in managing and safeguarding trust assets. Their duties include ensuring asset security, conducting valuations, maintaining proper insurance, and adhering to the prudent investor rule by diversifying investments. Additionally, they are responsible for maintaining detailed financial records, ensuring tax compliance by filing necessary forms, and managing distributions as outlined in the trust deed.

Tax-related responsibilities extend to obtaining tax identification numbers and filing fiduciary income tax returns. Beyond these technical tasks, trustees must maintain open communication with beneficiaries by providing regular financial reports and being available to address questions about the trust’s management.

Benefits and Limitations of Trustees

Professional trustees bring a wealth of expertise to the table, particularly in asset management, tax compliance, and legal administration. Their role as a foreign entity in offshore trust structures helps maintain the trust’s offshore status and strengthens offshore asset protection measures.

However, the role is not without its challenges. Trustees are bound by the terms of the trust deed, which can limit their ability to adapt to changing circumstances. They also face potential personal liability for errors or mismanagement of the trust. As the American Bar Association cautions:

Your errors or mismanagement of a trust or estate can subject you to personal liability.

Managing specialized or concentrated assets, such as closely-held businesses, can further increase risks for trustees. In these cases, splitting responsibilities among multiple parties may be necessary. Lastly, trustees who fail to meet their fiduciary obligations or are deemed unfit can be removed by courts or beneficiaries.

sbb-itb-39d39a6

The Protector’s Role in Offshore Trusts

Definition and Purpose

A trust protector is an independent third party appointed through the trust document to oversee the trustee and ensure the trust operates according to the settlor’s intentions and for the benefit of the beneficiaries. This role became more common in the 1980s as U.S. settlors sought additional oversight for foreign trustees. The trust protector’s authority is strictly defined by the trust deed and applicable laws. As the Grand Court of the Cayman Islands has clarified, protectors only possess the powers explicitly granted in the trust deed.

Christopher Holtby, Trust Educator and Co-Founder of Wealth Advisors Trust Company, highlights the essence of this role:

The trust protector’s role is to supervise the trustee… The trust protectors’ job is to protect beneficiaries from trustees.

Typical Powers of Protectors

Protectors are granted specific powers that complement the trustee’s administrative responsibilities. These powers generally fall into four main categories:

- Personnel powers: These include removing or replacing trustees, appointing successors, or adding co-trustees.

- Jurisdictional powers: Protectors can change the trust’s governing law, relocate its situs, or modify its administrative forum. In offshore trusts, "flight clauses" allow the trust to be moved if creditors or foreign courts attempt to access its assets.

- Substantive powers: These powers enable protectors to amend trust terms, such as adjusting provisions to align with tax law changes, adding or excluding beneficiaries, or modifying powers of appointment. For example, Missouri law allows protectors to set trustee compensation and claim reasonable fees.

- Veto powers: Protectors can block certain trustee decisions, such as those involving investments or distributions.

Fiduciary Duties and Practical Implications

Unlike trustees, who always owe fiduciary duties, a protector’s obligations depend on the trust deed and local laws. Protectors may have "fiduciary powers", requiring them to act in the beneficiaries’ best interest, or "personal powers", which allow decisions based on their own discretion.

In the U.S., 36 jurisdictions have adopted variations of the Uniform Trust Code (UTC), which generally assumes protectors are fiduciaries unless explicitly stated otherwise in the trust document. Additionally, 15 states – including Florida, Ohio, and Pennsylvania – have adopted UTC Section 808, which creates a rebuttable presumption that third-party power holders are fiduciaries. This legal framework allows offshore trusts to adapt to changing situations – such as tax law updates, political instability, or family dynamics – without resorting to expensive court proceedings.

However, settlors must exercise caution when assigning themselves excessive control as protectors. If a settlor retains too many powers, such as blocking distributions to anyone but themselves, courts may declare the trust a "sham", undermining its asset protection or tax benefits.

Under the Common Reporting Standard (CRS), protectors are treated similarly to settlors, requiring disclosure of their personal and financial information. This careful balance of powers and responsibilities highlights the distinct yet complementary roles of trustees and protectors in managing offshore trusts.

Trustees vs. Protectors: Main Differences

Roles and Responsibilities Compared

Trustees are responsible for holding the legal title to trust property and managing its daily operations. This includes tasks like handling investments, maintaining accounts, and making distributions. On the other hand, protectors act as supervisory figures, stepping in only when specific events or circumstances arise. Unlike trustees, protectors do not hold legal title to the trust property.

Stephen Abletshauser from Bayern Legal clarifies this distinction:

The protector of a trust is not a trustee; a protector is someone who has some control over how trustees exercise their powers.

Another key difference lies in fiduciary duties. Trustees are always bound by fiduciary obligations, meaning they must act in the best interest of the trust and its beneficiaries. For protectors, however, fiduciary responsibilities depend on the terms outlined in the trust deed and the applicable legal framework.

Christopher Holtby elaborates:

Trustees differ from trust protectors because of their fiduciary duty to follow the trust rules, while a trust protector can modify the trust document when necessary.

These distinctions are critical when it comes to how the trust operates and the level of oversight required, as each role serves different but complementary purposes.

Impact on Asset Protection and Control

When trustees and protectors work together effectively, they can significantly bolster a trust’s ability to protect assets, a strategy often employed by a private family office. Protectors play a key role in safeguarding the trust from risks such as excessive fees, poor investment decisions, or deviations from the settlor’s original intent. They can also activate "flee clauses", which allow the trust to relocate to a different jurisdiction in response to political or economic instability, offering an additional layer of protection.

However, if the protector’s powers are too broad or poorly defined, they can weaken the trust’s asset protection. A notable example is the case of JSC Mezhdunarodniy Promyshlenniy Bank v. Pugachev. In this instance, the courts determined that overly extensive and "personal" powers granted to the protector effectively made them the beneficial owner of the trust assets. This underscores the importance of carefully balancing a protector’s authority to ensure they do not function as a "shadow trustee."

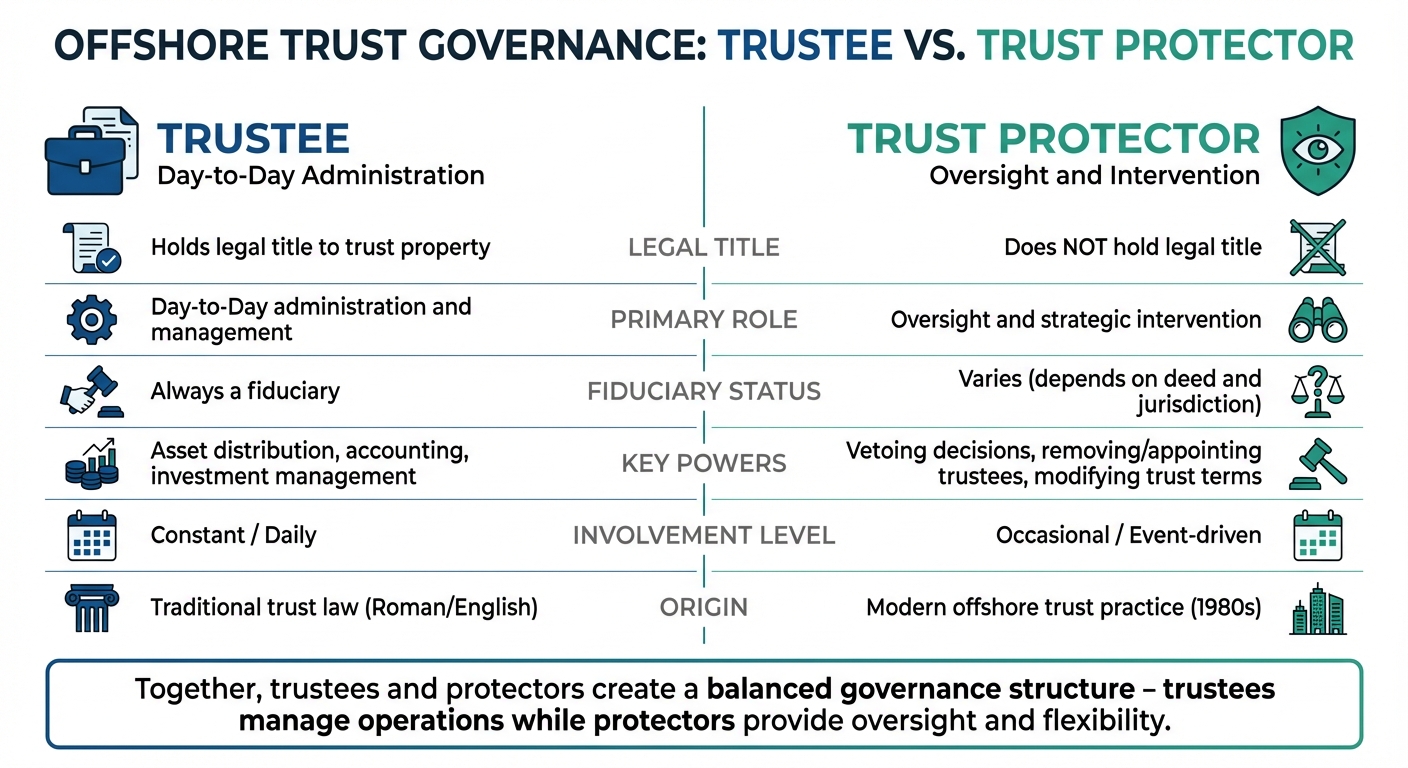

Comparison Table

Here’s a side-by-side look at the key differences between trustees and protectors:

| Feature | Trustee | Trust Protector |

|---|---|---|

| Legal Title | Holds legal title to trust property | Does not hold legal title |

| Primary Role | Day-to-day administration and management | Oversight and strategic intervention |

| Fiduciary Status | Always a fiduciary | Varies (depends on the deed and jurisdiction) |

| Key Powers | Asset distribution, accounting, investment | Vetoing decisions, removing/appointing trustees |

| Involvement | Constant/Daily | Occasional/Event-driven |

| Origin | Traditional trust law (Roman/English) | Modern offshore trust practice |

Building an Effective Offshore Trust Governance Structure

Choosing the Right Trustee

When selecting a trustee, focus on their licensing, expertise, and reputation. Offshore trustees are often professional firms based in well-regulated financial hubs like Jersey or Guernsey. These jurisdictions offer a stable regulatory framework, which is critical for trust management.

If your trust holds specialized assets, choosing a trustee with experience in managing those specific asset types is essential. For families wanting more involvement in trust administration, a Private Trust Company (PTC) can be a smart option. This structure allows family members to serve as directors alongside professional advisors, creating a balance between personal involvement and expert guidance.

It’s also important to consider the trustee’s experience with cross-border planning. For U.S. persons, this includes understanding tax reporting obligations like IRS Form 3520 and Form 3520-A, as well as compliance with FATCA regulations. A trustee with a strong track record in these areas can help you navigate the complexities of international trust management efficiently.

Choosing the Right Protector

Independence is the cornerstone when selecting a protector. The protector must be an impartial third party and should never serve as the trustee simultaneously. This separation ensures that the protector can provide unbiased oversight without any conflicts of interest.

Ideal candidates for this role include professionals like CPAs, estate planning attorneys, or wealth advisors who bring objectivity and a deep understanding of trust structures. If your trust involves a family business, consider appointing someone familiar with the industry or the specific dynamics of your family.

The jurisdiction where your trust is established also plays a significant role in shaping the protector’s responsibilities and liability. For example, in South Dakota, protectors are typically classified as non-fiduciaries, offering more flexibility and reduced personal liability. On the other hand, states like Delaware and Florida default to fiduciary status, holding protectors to stricter standards similar to those of trustees. Choose a jurisdiction that aligns with your preferences for accountability and flexibility.

This clear separation of roles between trustee and protector forms the foundation for a well-coordinated governance structure.

Coordinating Trustee and Protector Roles

Once the trustee and protector are selected, their roles must be clearly defined to ensure effective governance. Start by outlining specific powers in the trust document. Don’t rely on job titles alone – list precise responsibilities like the ability to remove trustees, approve major distributions, or make adjustments for tax law changes. This level of detail minimizes misunderstandings and ensures both parties know their boundaries.

A Letter of Wishes can be a helpful tool for coordination. While not legally binding, it provides guidance on your long-term goals and values, helping the trustee and protector make decisions that align with your intentions. Additionally, the trust document should grant the protector full access to trust records, financial statements, and other relevant documents to facilitate effective oversight.

Deadlock resolution mechanisms are another critical, yet often overlooked, element. Include provisions in the trust document to address disagreements between the trustee and protector. Without these, disputes can lead to administrative gridlock. One solution is to establish a "Protector Committee" that includes both family members and professionals, ensuring balanced oversight.

To avoid governance gaps, always name successor protectors in the trust document. This ensures continuity during transitions and minimizes vulnerabilities during critical times. Finally, explicitly define the protector’s fiduciary status in the trust deed. This helps set clear liability expectations and establishes the standards of care required for the role.

Conclusion

In offshore trusts, the trustee takes charge of day-to-day operations and holds the legal title, while the protector offers strategic oversight. This might include removing trustees, modifying trust terms, or even shifting the trust’s jurisdiction when necessary.

To ensure smooth governance, it’s essential to involve qualified professionals. The trustee should have the expertise to manage the trust’s assets – whether those are real estate, businesses, or digital assets. Meanwhile, an independent protector, such as a CPA or estate planning attorney, provides impartial oversight. This separation of responsibilities helps the trust stay adaptable and responsive to changing circumstances.

Starting with solid governance prevents costly disputes down the line. As US Law Explained noted:

The trust protector was the perfect solution… how can a document written today possibly account for the world a century from now?

Without clearly outlined powers, succession plans for both roles, and effective coordination, a trust risks becoming bogged down in administrative issues or failing to adapt to new tax laws and shifting family needs.

For U.S. investors and entrepreneurs, expert guidance is a must. Global Wealth Protection specializes in offshore trust formation – primarily in Anguilla – offering comprehensive trust administration and asset management strategies tailored for high-net-worth clients navigating the complexities of cross-border planning.

FAQs

What risks arise when a trust protector has excessive power?

Granting a trust protector excessive authority – like the power to remove or appoint trustees, change the trust’s governing law, modify beneficiaries, or override trustee decisions – can disrupt the independence of trustees and create risks of power being misused. This kind of centralized control could lead to unintended tax or regulatory complications, conflicts of interest, or even compromise the trust’s main purpose: protecting assets.

To avoid these pitfalls, it’s crucial to clearly outline the protector’s role and set limits on their authority. This helps preserve the trust’s integrity and ensures the interests of all parties are protected.

How does the jurisdiction of a trust affect the roles of trustees and protectors?

The location where a trust is established significantly influences the roles and responsibilities of both trustees and protectors. Each jurisdiction comes with its own set of legal rules, which shape how these roles function and the authority they hold.

In many offshore locations, like the Cayman Islands or Abu Dhabi Global Market (ADGM), protectors often wield considerable authority. They may have powers such as vetoing trustee decisions, appointing or removing trustees, or approving distributions – all without being classified as trustees themselves. In some cases, these jurisdictions even require protectors to hold specific licenses to perform their duties. On the other hand, in onshore jurisdictions like the United States or England, the protector’s role isn’t formally outlined by law. Instead, their powers are entirely dictated by the trust document, with additional attention given to tax and reporting obligations.

For trustees, the jurisdiction also defines the extent of their fiduciary duties and the level of regulatory oversight they face. Offshore trustees typically operate under laws designed to emphasize privacy and protect assets. Conversely, onshore trustees are subject to stricter fiduciary standards and more rigorous disclosure requirements. Selecting the right jurisdiction is a critical decision, as it directly impacts the balance between flexibility, privacy, and regulatory compliance for both trustees and protectors.

What should I consider when choosing a trustee or protector for an offshore trust?

Choosing the right trustee or protector is crucial to ensuring your offshore trust achieves its goals, whether that’s safeguarding assets, managing taxes efficiently, or maintaining long-term stability. When evaluating potential candidates, focus on their experience in offshore fiduciary roles, their reputation for independence and integrity, and whether they meet the regulatory requirements of the trust’s jurisdiction. In some cases, specific licenses or approvals may be mandatory, depending on local laws.

Another key consideration is their fee structure. Make sure it’s both transparent and reasonable for the services they’ll provide. Additionally, review the scope of powers outlined in the trust deed – such as the ability to approve distributions or appoint trustees. These powers should be clearly defined to minimize the risk of conflicts of interest. Don’t overlook the tax and reporting obligations tied to their appointment, as well as their potential liability exposure, to ensure their role aligns with your trust’s overall objectives.

Taking the time to assess these factors can help you choose a trustee or protector who will support the success of your trust. If you need assistance, Global Wealth Protection can help evaluate candidates and draft provisions to protect your assets and streamline trust management.