The UK has overhauled its non-dom tax system as of April 6, 2025. The new Foreign Income and Gains (FIG) regime replaces the old domicile-based system with a residence-based approach, introducing several important updates:

- FIG Relief: Tax-free foreign income and gains for the first 4 years of UK residence, but only for those who’ve been non-UK residents for 10+ years. Personal tax allowances are forfeited when claiming this relief.

- Inheritance Tax (IHT): Now based on residency, not domicile. Long-Term Residents (10 out of 20 years in the UK) face a global IHT liability. A new "IHT tail" applies for up to 10 years after leaving the UK.

- Offshore Trusts: Protections have been reduced, with residency now determining tax treatment.

- Transitional Reliefs: Temporary Repatriation Facility (TRF) and Rebasing Relief offer short-term tax benefits for foreign income and long-held assets.

- Compliance: Greater disclosure requirements for foreign income and gains.

These changes simplify some rules but introduce new challenges, especially for high-net-worth individuals and expats. Planning is critical to avoid unexpected tax liabilities.

The Foreign Income and Gains (FIG) Regime: What You Need to Know

This section dives into the practical details of the FIG regime, explaining its role in global asset protection and tax planning.

The FIG regime marks a major shift from the UK’s traditional domicile-based tax system to a simpler residence-based model. Instead of relying on the often-complicated concept of domicile, eligibility now depends solely on whether you are a UK tax resident. This change eliminates much of the ambiguity that used to surround domicile status and reduces the need for costly legal advice.

Under the FIG regime, funds brought into the UK from foreign income and gains are tax-free. Previously, under the remittance basis, foreign income was taxed when brought into the UK, requiring meticulous tracking of mixed funds.

To benefit from FIG relief, taxpayers must claim it annually through their Self Assessment tax return and disclose the exact foreign income and gains they wish to exempt.

Who Qualifies for FIG and How It Works

To take advantage of the FIG regime, you must have been a non-UK tax resident for at least 10 consecutive years before moving to the UK. Once eligible, you can claim full relief on your foreign income and gains for your first four tax years as a UK resident. Franck Sidon explains:

"The FIG regime essentially provides a time-limited exemption for qualifying newcomers on their foreign income and gains, replacing the indefinite remittance basis with a shorter, residence-focused relief."

This regime applies to both non-UK domiciled individuals and UK-domiciled returnees who meet the 10-year non-residence requirement.

However, there’s a trade-off: claiming FIG relief means you lose your personal income tax allowance ($15,800 for 2025/26) and capital gains tax exemption ($3,800). For someone with moderate foreign income, such as $25,000, this could result in higher overall taxes. Tax advisors strongly recommend private consultations to crunch the numbers carefully before deciding to claim FIG relief.

The four-year relief period begins with your first year of UK residence and doesn’t pause if you temporarily leave the country. Even if you arrive partway through a tax year and qualify for split-year treatment, that partial year still counts as one of your four years.

Next, we’ll explore how these changes impact non-UK domiciled individuals.

How FIG Affects Non-UK Domiciled Individuals

For non-UK domiciled taxpayers, the FIG regime brings both simplifications and new challenges.

Those who previously used the remittance basis may appreciate the streamlined approach. The FIG regime removes the need for detailed tracking of offshore accounts and transactions. As HM Revenue & Customs notes:

"Under the new regime individuals will not be required to track the movement of their FIG through investments in the way they are required to do now under the current regime. This will make the new 4-year FIG regime much simpler than the remittance basis regime."

However, the four-year limit introduces a significant planning challenge. Once the relief period ends, all foreign income and gains become taxable, creating a sharp transition that requires careful preparation.

Even though foreign income is exempt during the FIG period, it must still be calculated and reported on your tax return, which adds to compliance work. Katherine Ford, Technical Manager at ICAEW, highlights:

"The FIG regime record-keeping requirements will no doubt deter some individuals from making a claim, especially given that it is only available for a maximum of four consecutive tax years."

Additionally, foreign losses incurred during a FIG year cannot be carried forward for UK tax purposes. Certain assets – like offshore life assurance and investment bonds – are excluded from FIG relief and remain taxable as income arises.

These factors are crucial for expats and investors as they refine their tax strategies.

sbb-itb-39d39a6

Inheritance Tax Reforms: Moving to Residence-Based Taxation

Starting April 6, 2025, the UK is shifting from its traditional domicile-based inheritance tax system to a residence-based framework, aligning tax liability with residency status.

This change eliminates the complexities tied to determining domicile, which often relied on subjective criteria. As Wedlake Bell highlights:

"A UK domicile of origin is said to be adhesive and difficult to lose… These problems are resolved by the reforms and the move to a more factually-based residence test."

For global investors and expatriates, this overhaul demands a fresh look at estate planning strategies.

New Residence-Based IHT Rules Explained

Under the new residence-based system, long-term residency now plays a central role in determining inheritance tax liability. If you’ve been a UK tax resident for 10 out of the previous 20 tax years, you’ll be classified as a Long-Term Resident (LTR). Once you reach this status, your worldwide assets become subject to UK inheritance tax at 40% on amounts exceeding the nil-rate band of £325,000 (around $408,000). This represents a notable change from the previous rule, which required 15 out of 20 years of residency for deemed domicile status.

Mark Spalding, Director at Crowe UK, explains the mechanics:

"The new regime looks at the 20 tax years immediately prior to the year of the chargeable event, and if individuals have been UK resident for at least 10 of those 20 years they will be treated as long term resident."

The reforms also introduce a new "IHT tail", which determines how long your worldwide assets remain subject to UK inheritance tax after you leave the country. Unlike the fixed 3-year period under the old system, the new tail varies between 3 and 10 years, depending on how long you resided in the UK:

| Years of UK Residence (in the 20 years prior to departure) | Length of IHT Tail |

|---|---|

| 10 to 13 years | 3 tax years |

| 14 years | 4 tax years |

| 15 years | 5 tax years |

| 16 years | 6 tax years |

| 17 years | 7 tax years |

| 18 years | 8 tax years |

| 19 years | 9 tax years |

| 20 years | 10 tax years |

For example, if you lived in the UK for 20 years, you could still face inheritance tax on your global assets for up to 10 years after leaving.

There’s a transitional relief available: individuals who were non-UK domiciled on October 30, 2024, and who leave the UK by the 2025/26 tax year may qualify for a shortened 3-year tail, regardless of their prior length of residence.

What Happens to Excluded Property Settlements

Under the previous rules, non-UK assets placed in a trust while the settlor was non-domiciled were granted "excluded property" status, keeping them outside the UK inheritance tax scope indefinitely – even if the settlor later became deemed domiciled. The new rules change this, as excluded property status now hinges on the settlor’s current residency rather than their status when the trust was created.

Gavin Shaw, Partner at KPMG UK, explains the implications:

"Non-UK and UK trusts can therefore fall in and out of the relevant property regime based on the settlor’s residence and will be subject to exit charges as a result when relevant property becomes excluded property."

Fortunately, some protections remain for existing trusts. Trusts established before October 30, 2024, will retain certain benefits: non-UK assets in these trusts won’t fall under the Gift with Reservation of Benefit (GWROB) rules. This means they won’t be included in the settlor’s estate for inheritance tax purposes. However, such trusts will still be subject to the relevant property regime, including 10-year anniversary charges (up to 6%) and exit charges on distributions, if the settlor becomes a Long-Term Resident.

For trusts created or funded after October 30, 2024, the situation becomes more complex. If the settlor can benefit from the trust and later qualifies as an LTR, the trust’s value could be included in their personal estate, potentially leading to double taxation. To avoid this, trust terms must exclude any settlor benefits.

These changes underscore the importance of proactive estate planning. If you’re nearing your 10th year of UK residence and haven’t yet set up an offshore trust, it may be worth considering lifetime gifts of non-UK assets before they fall within the inheritance tax net.

Temporary Repatriation Facility and Rebasing Relief

The UK government has introduced two transitional measures to help individuals who previously used the remittance basis adjust to the updated tax system: the Temporary Repatriation Facility (TRF) and Rebasing Relief. These measures offer a chance to address past tax positions and potentially reduce future tax burdens.

Lower Tax Rates for Repatriated Foreign Income

The TRF will be available from April 6, 2025, to April 5, 2028. It allows former remittance basis users to bring untaxed foreign income and gains – earned before April 6, 2025 – into the UK at reduced tax rates. For the 2025/26 and 2026/27 tax years, the rate is 12%, increasing to 15% in the final year (2027/28). Comparatively, standard tax rates can climb as high as 45% for income and 24% for gains.

This facility operates through a designation process. Individuals must actively select which foreign income and gains to include under TRF when filing their Self Assessment tax return. Once the TRF tax is paid on these designated amounts, the funds can be brought into the UK at any point in the future – without incurring additional UK tax. This applies to both liquid assets like cash and illiquid assets such as overseas property or artwork purchased with pre-2025 foreign income.

Mark Spalding, Director at Crowe UK, highlights the practical benefits:

The TRF represents a welcome transitional relief for those non-doms who have previously claimed the remittance basis and do not qualify for the FIG regime – particularly those who may be running low on clean capital.

One of the key advantages of the TRF is its ability to simplify the complex "mixed fund" rules. It allows individuals to designate a portion of a mixed account, even if the exact source of the funds is unclear.

However, there are limitations. Double tax relief cannot be claimed on amounts designated under TRF. If substantial foreign taxes have already been paid on the income, using the standard remittance basis may be more advantageous. Setting up a separate offshore "TRF capital" account to hold designated, tax-paid funds could help streamline future remittances. These TRF rules naturally lead to another transitional benefit: Rebasing Relief for long-held foreign assets.

Rebasing Relief for Assets Owned Before 2017

Rebasing Relief offers a valuable opportunity for individuals with long-held foreign assets. This relief allows you to reset the base cost of assets to their market value as of April 5, 2017. When you sell these assets, only the gains made after this date will be subject to UK Capital Gains Tax, effectively exempting earlier gains.

To qualify, you must meet specific conditions: you must have claimed the remittance basis in at least one tax year between 2017/18 and 2024/25, continuously owned the asset from April 5, 2017, to April 5, 2025, and kept the asset outside the UK from March 6, 2024, to April 5, 2025. This relief applies only to personally owned assets and does not extend to assets held in trust structures.

A crucial step for Rebasing Relief is documentation. Obtain formal valuations of your foreign assets as of April 5, 2017, to ensure accurate future Capital Gains Tax calculations. Whether it’s overseas real estate, share portfolios, or other investments, having proper valuation records will be essential when the time comes to sell.

For the TRF, aim to make designations in the first two years to benefit from the lower 12% tax rate before it rises to 15%. For Rebasing Relief, ensure your assets remain outside the UK during the critical period from March 2024 to April 2025 to maintain eligibility.

Retained Reliefs and Updated Anti-Avoidance Measures

With the recent updates to the FIG and inheritance tax systems, the UK government has reshaped the tax landscape for non-dom taxpayers. While many aspects have changed, certain reliefs remain intact – albeit with adjustments. At the same time, the government has announced plans to review and potentially tighten anti-avoidance measures starting in 2026. Anyone considering working or investing in the UK should take note of these retained reliefs and the changes on the horizon. Below, we break down the key updates to reliefs and the anticipated anti-avoidance measures.

Overseas Workday Relief Cap

The Overseas Workday Relief (OWR) remains available, but with significant changes. First, the relief now applies for up to four years of UK residence, an increase from the previous three years, provided the individual has not been a UK resident in the 10 consecutive tax years prior to their arrival.

A new cap has been introduced, limiting the relief to the lower of approximately $370,000 (or £300,000) or 30% of qualifying employment income per tax year. This cap significantly reduces the benefit for high-earning individuals compared to the previous uncapped system.

Another notable change is the removal of the remittance requirement. Now, overseas earnings can be paid directly into UK bank accounts without jeopardizing the tax exemption. However, claiming OWR comes with trade-offs: individuals lose their UK income tax personal allowance and the Capital Gains Tax annual exempt amount for that tax year.

Jennifer McNally, Partner at Crowe UK, shared her perspective:

The alignment of OWR with the FIG regime is sensible and extends eligibility for the relief for a further year. The simplification of the operation of the relief is also welcome… However, we can see no good reason why the relief should be capped annually.

Meanwhile, Business Investment Relief (BIR) remains available for foreign income and gains earned before April 6, 2025. This allows qualifying funds to be invested in UK businesses without triggering a tax charge.

While these updates streamline income reporting, the forthcoming anti-avoidance measures will add another layer of complexity to offshore tax planning.

Future Anti-Avoidance Simplifications

Starting in 2026, offshore tax planning will face heightened scrutiny. For now, "motive defenses" – which protect offshore trusts not created for tax avoidance purposes – remain in place. However, these defenses are under formal review. Mark Spalding, Director at Crowe UK, cautioned:

The previous income tax and CGT ‘motive defenses’… will continue to apply, but are subject to review and may possibly be restricted or removed with effect from April 6, 2026.

The government is also increasing HMRC’s resources to address offshore non-compliance and reduce the tax gap. Two areas under review include the taxation of carried interest, which will see its tax rate rise to 32% starting April 6, 2025, and offshore interest reporting rules. A consultation is planned to resolve discrepancies between offshore interest reported on a calendar year basis and the UK tax year.

Additionally, individuals using the FIG regime or OWR will now need to identify and report specific foreign income and gains on their Self Assessment tax return, even if these amounts are not subject to UK tax. This change gives HMRC much more visibility into offshore assets than was required under the previous remittance basis. For those planning a long-term stay in the UK, keeping a close eye on the 2026 reviews will be critical, as they could bring significant changes to the taxation of offshore structures and international income.

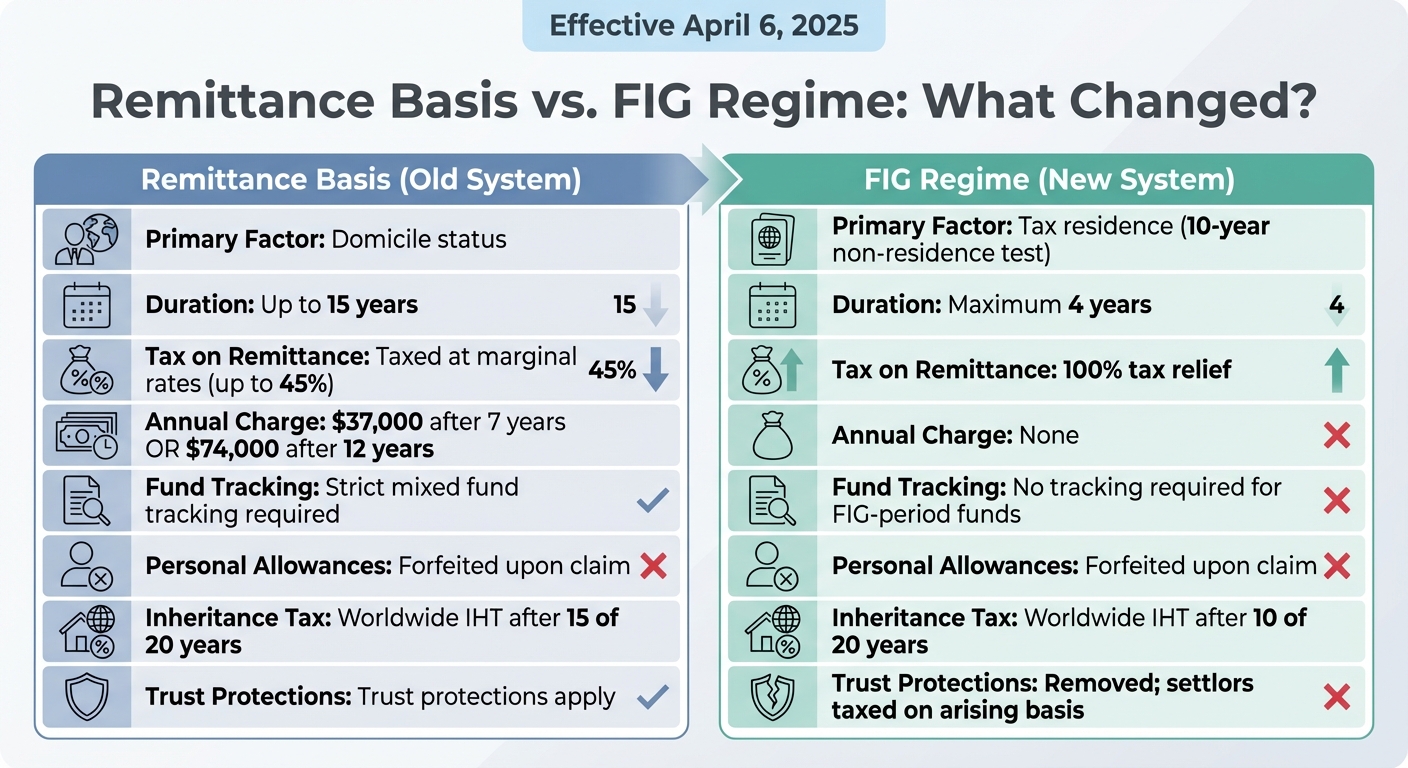

Remittance Basis vs. FIG Regime: A Side-by-Side Comparison

The transition from the remittance basis – a system relying on domicile status and intricate tracking of funds – to the FIG regime, which focuses solely on tax residence and includes a four-year tax relief period, has reshaped how foreign income is taxed in the UK.

This shift impacts both the length of tax relief and the flexibility in managing offshore funds. Under the remittance basis, individuals could defer UK taxes on foreign income for as long as 15 years, provided the funds stayed offshore. The FIG regime, however, limits tax relief to four years but allows unrestricted remittance of foreign funds into the UK without penalties.

The cost structure has also seen a major overhaul. The remittance basis required annual charges of $37,000 (£30,000) after seven years of residence or $74,000 (£60,000) after 12 years. In contrast, the FIG regime eliminates these fees entirely. Additionally, while the FIG regime removes the need for mixed fund tracking during the four-year window, it requires taxpayers to report all foreign income and gains on UK tax returns, giving HMRC greater visibility into offshore assets. These changes highlight the evolving considerations for global investors operating within a residence-based tax framework.

Below is a table summarizing the main differences between the two systems:

Comparison Table: Remittance Basis vs. FIG Regime

| Feature | Remittance Basis (Old) | FIG Regime (New) |

|---|---|---|

| Primary Factor | Domicile status | Tax residence (10-year non-residence test) |

| Duration | Up to 15 years | Maximum 4 years |

| Tax on Remittance | Taxed at marginal rates (up to 45%) | 100% tax relief |

| Annual Charge | $37,000 (after 7 yrs) or $74,000 (after 12 yrs) | None |

| Tracking | Strict mixed fund tracking required | No tracking required for FIG-period funds |

| Personal Allowances | Forfeited upon claim | Forfeited upon claim |

| Inheritance Tax | Worldwide IHT after 15 of 20 years | Worldwide IHT after 10 of 20 years |

| Trust Protections | Trust protections apply | Removed; settlors taxed on an arising basis |

Conclusion

The UK’s move from domicile-based to residence-based taxation represents a major overhaul in how non-dom taxation is handled. Starting April 6, 2025, the remittance basis will be completely eliminated. In its place, a four-year Foreign Income Gains (FIG) regime will offer 100% tax relief on foreign income, but this benefit comes with a trade-off – individuals must give up their personal allowances. Additionally, inheritance tax (IHT) rules are tightening, with a 10-year residence test pulling worldwide assets into the UK tax net sooner, and the IHT "tail" extending for up to 10 years after leaving the UK.

Transitional measures, such as the Transitional Relief Fund (TRF) and rebasing relief, offer some opportunities to adjust to the upcoming changes. However, the removal of trust protections and stricter disclosure requirements mean HMRC will have much greater insight into offshore assets.

"The concept of domicile is outdated and incentivises individuals to keep income and gains offshore." – HM Treasury

For expats and global investors, the new rules demand careful planning. The timeframe to take advantage of transitional reliefs is limited – the TRF ends in 2028, and the four-year FIG regime won’t work for everyone. Those with lower foreign income might find that losing personal allowances outweighs any potential tax savings. This highlights the importance of detailed tax planning as international tax policies continue to change.

With the complexities of these reforms – ranging from managing onward gifting rules to understanding how IHT interacts with Gift with Reservation of Benefit provisions – seeking expert advice is crucial. Global Wealth Protection specializes in crafting strategies for tax efficiency, asset protection, and international planning, helping individuals navigate these intricate changes effectively.

FAQs

What are the key advantages and challenges of the UK’s Foreign Income and Gains (FIG) regime for non-residents?

The UK’s Foreign Income and Gains (FIG) regime offers a valuable tax break for individuals who become UK tax residents after spending at least 10 consecutive tax years outside the country. Here’s the key benefit: foreign income and capital gains earned after April 6, 2025, are exempt from UK taxes for the first four years of residency. This means no need to worry about tracking when foreign funds are brought into the UK, and it eliminates the hassle of paying the annual remittance-basis charge that used to apply. On top of that, qualifying British expats may enjoy inheritance tax relief on non-UK assets, keeping them out of the UK inheritance tax net.

That said, the FIG regime comes with some important limitations. First, eligibility hinges on meeting the strict 10-year non-residency requirement, which leaves out many newer arrivals. The tax exemption is also temporary – after the four-year window closes, foreign income and gains become fully taxable in the UK. This shift can create a hefty tax bill, especially for those with significant offshore assets. It’s also worth noting that UK-sourced income is taxable from the start, and navigating the transition rules can be tricky. While the FIG regime offers a short-term tax break, careful planning is essential to handle potential long-term tax challenges effectively.

How do the new UK inheritance tax rules impact long-term residents?

Starting April 6, 2025, new regulations will impact long-term UK residents. If you’ve been a UK tax resident for 10 straight years or 10 out of the last 20 years, your overseas assets will fall under the scope of UK inheritance tax. This applies to both transfers made during your lifetime and assets passed on after death.

For expats and international investors, this is a crucial time to reassess estate planning strategies. Taking proactive steps can help ensure compliance with the new rules while reducing potential tax burdens.

What transitional relief options are available for non-doms impacted by the recent UK tax changes?

Transitional relief brings several advantages for non-doms navigating the recent tax changes, including:

- Reduced tax on foreign income: For the 2025/26 tax year, only 50% of foreign income will be subject to UK tax.

- Lower tax rate for remittances: A temporary 12% tax rate applies to foreign income and gains earned before April 6, 2025, if remitted during the 2025/26 or 2026/27 tax years.

- Asset re-basing: Foreign assets will be re-based to their values as of April 5, 2019, for disposals made after April 6, 2025.

- Trust income exemptions: Income from non-resident settlor trusts remains exempt unless distributed to UK residents.

These provisions are designed to make the transition smoother for global investors and expatriates adjusting to the updated tax framework.