by Scott Causey, GWP Resource Correspondent

I really believe it is incredibly important that people know nothing of history, just like the vast majority of “educated” people in America. I am referring to financial history in particular. You see, if those subjects and topics were actually taught in public schools and universities, the FDIC would have a very big problem on their hands. It would then be possible for the “average man” to see through the drivel on mainstream economic channels. When a news anchor asks a guest “When will the Fed raise interest rates?”, you could simply laugh at the ignorance of the question in historical as well as factual context. The last time the Fed lowered interested rates to zero was during the Great Depression. They then quickly raised them again….24 years later. Let that sink in fully for a moment. I’ll wait.

For the sake of brevity, lets skip over the world wars and get right down to it. The roaring 1920’s saw a huge boom in credit expansion and the stock market. Once incomes could no longer support the debt loads the inevitable happened. Yes, you can examine this period of history for yourself, and I encourage you to do so. Yes you can make the argument that the Fed stood by and let the collapse happen. In my mind, that is absolutely historically correct. More importantly, however, is that this is what Ben Bernanke refers to over and over when grilled on his open ended QE to infinity policy. Tens of trillions of dollars printed out of thin air and given to banks at 0% don’t lie.

It is astounding to me that well known economists are still allowed to argue imminent deflation. Maybe they didn’t notice gold just put in a new all time nominal high in euros this week. That’s soon to be followed in U.S. dollars and every other currency. In other words, the path has been chosen and we are racing full speed ahead. Debtors are wiped out in a huge deflation. That is what happened in the 1930’s. Because of who the debtors are now, clearly that is not going to be allowed to happen. This process has been ongoing since March of 2009.

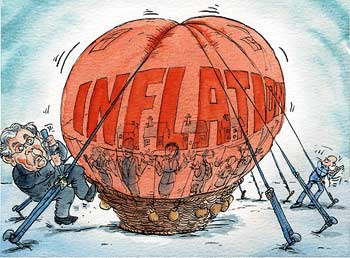

Collectively, what the world’s central banks are betting is that they will be able to print unrestrained against each other to give some illusory appearance in exchange rates. The same is true with their nefarious manipulations in the bond and stock markets. The most powerful men in the world are pulling the levers they need for inflation to sustain the system at any cost. They also know that they can’t give the markets clear signs that they have lost control. So while it’s ok for stocks, bonds, and real estate to go to as high a level as they want to, some other things rising in value are frowned upon.

These egotistical maniacs actually think they can blow the largest inflationary bubble the world has ever seen without moving the “Enemies of the State” to prices high enough to disrupt “growth”. Enemies of the status quo are oil, gold, and silver. Oil prices are up roughly 1000% since 1999. That doesn’t stop talking heads on cable from telling you all about the “evil speculators” driving your gasoline prices higher and why you should write your local congressman to get this under control immediately!

Unless you follow futures markets and announcements from the CME group, you might label me a “conspiracy theorist”. In the months leading up to America losing its “AAA” credit rating last year, margins on futures contracts on gold and silver were raised multiple times. The justification from CME was to ensure “orderly” markets. It may be important to note here that CME only deems necessary to adjust margins when real money, IE gold and silver are going higher in price. When silver crashed in price from almost 51 dollars in April of 2011 to under 30, no margins to initiate futures contracts were adjusted lower. As the prices of gold and silver rose, however, that’s an entirely different story. Gold has seen 2 margin increases in a single day before!

So what all that means in layman’s terms, is that to initiate a “speculative” trade in the futures market, it gets progressively more and more expensive as the price of the underlying asset gets more expensive. You would also have to post more collateral IE cash if you already had a position in gold or silver futures. In other words, paper contracts promising to deliver and not the real thing. Futures are a literal casino masquerading as “hedging” for producers of commodities necessary for the economy. This was not always the case, but MF Global’s failure was a sign of things to come.

Unless you’ve been under a rock lately, you may have noticed that for all intents and purposes, the S&P 500 is back to all time highs. Wednesday of this week, CME group saw fit to ensure orderly markets again and did quite an extraordinary thing; they LOWERED margins on S&P, Nasdaq, and Dow Jones futures contracts by 12%! In other words, folks if QE3 to infinity and beyond isn’t enough to get the market moving higher it will be ENCOURAGED TO DO SO!

Personally, it makes me more than a little uneasy to run with the crowd and expect to make any significant capital gains. Especially with the risk that you are taking to continue to expand multiples on stocks that have yield in particular with the backdrop of economic indicators indicating most of the world has already entered recession again. Some of you, I’m sure, must be having the thought “Why fight the system?” or “If you can’t beat them join them”.

Well, for starters, what happens when you hold a beach ball 10 feet below the water and then suddenly let it go? History tells us Weimar, Zimbabwe, and the United States in the late 1970’s happens. Also for your consideration, almost never does gold have a day where the price advances more than 2%. That has only happened 3 times in the last 10 years; a decade that has seen gold explode in value! The retreat is being managed, but the direction is far from over.

Bloomberg ran a news headline Friday afternoon that announced “South African gold producers considering bringing forward wage talks”, implying to the “markets” that violence in South Africa for platinum and gold miners was about to end. What people don’t seem to understand is that “markets” are run by computers these days. This includes computers that immediately trade off news headlines before you even have a chance to read them. This headline immediately caused gold, platinum, and silver to sell off hard intraday. Want to know a funny little secret? South Africa is not even in the top 50 producers of silver in the world, but it sold off anyway. What the “hit” was really about was trying to put a lid on a market that’s “encouraged” to behave.

After all, we have an election in a few weeks. Pschycologically important numbers for traders are for gold to close above 1780 and silver above 35. Thanks to Bloomberg, we closed just below that today. Also thanks to Bloomberg, your fiat dollars will go further Monday when the market opens. All in due time. That inflation train is never late.