Being a nomad doesn’t mean you have to leave the country. It has more to do with location independence. If you do it right, it can be a wonderful experience!

November 11, 2019

By: Bobby Casey, Managing Director GWP

Location independence offers a lot of benefits.

Shikha Dalmia writes a lot about immigration and US policy surrounding that issue. One of the things she says is unique to immigrants is that they have no real roots, so they can take jobs wherever they crop up.

If there’s a construction job in Texas, they just go. If there’s a harvesting job in California, they just go. That kind of location independence is something immigrants have and American’s often do not.

This was true during the financial crisis ten years ago, when Obama offered 99 weeks of unemployment payouts to people who wouldn’t or couldn’t to leave their city or state to take work elsewhere.

Whether you need to be near friends and family or need to be near work and opportunities, location independence offers the flexibility to be wherever you need to be.

There is a significant contingent of people who are permanent travelers. Some have jobs that take them all over the place. Others are retirees living out of their RVs, visiting their grand kids all over the country, and taking in the sights. Others still are modern-day vagabonds who have converted an old school bus into a tiny-house on wheels and set out for a US adventure.

Most have a state they consider “home base”. Truckers and airline crews might have that. Others probably wish they didn’t have to have a permanent residence, but reluctantly do for practical purposes like renewing their driver license or getting their mail.

If you are either a domestic nomad or want to become one, here are a few tips that can help you.

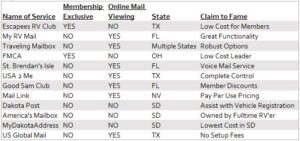

Almost everything can be done digitally and paperlessly. Almost, which means there are things that still cannot. If you want or need to receive physical mail, you can sign up for a mail forwarding service right for your needs and budget.

They will scan the outside of the piece of mail and email that to you. You decide what they do with it: send it, open it and scan its contents to you, shred it, or hold it.

They give you a mailing address to which mail gets sent. For people who don’t know where they are going to be at any given time, it’s much better than asking friends and family to collect it for you.

See grid below for some popular options:

Where to Stay

If you’re a full-time RVer, you have some pretty cool options out there! There are state parks and private parks, as well as memberships that come with some discounts and amenities. The memberships have write-ups on the internet, but they vary based on use, and use depends on what you’re doing and where you’re going.

The discounts that seem to matter most are insurance, gear, and campsite stays. Many nomads get a combination of memberships that come to about $15-$20/month.

Two possible options not mentioned in the blogger sites is BoondockersWelcome.com and HipCamp.com. These are networking sites that RVers can use to find places to set up camp.

This requires some planning as well as some flexibility, but if you do it right, it can be done on a shoe-string budget!

Residency

I talk a LOT about getting residency in other countries… I even talk about setting up corporate structures in other states and jurisdictions… but what about the domestic US nomad? What should they consider when determining a “home state”?

Friends and family are nice. You might get one of them to let you use their address as a home-base for purposes of mail and licensing.

But the same things I tell you to consider when looking for a tax home outside the US, are the same things you need to consider when you look for a “residence” within the US: what are the tax liabilities and costs.

There are countries that are tax friendly, which I discuss in great detail in GWP Insiders. Likewise, there are states that are tax and nomad friendly. I expected New Hampshire and Arizona to top the list, but they didn’t. Even Texas and Florida, while better than most, didn’t take the top slot.

South Dakota is the title holder for best state of residency for the domestic US nomad. Go figure!

-

You can use a personal mail box address to meet your residency requirement.

-

No state income tax

-

No state income tax on Social Security income

-

No personal property tax

-

No pension tax

-

4% excise tax on net purchase of vehicles and RVs

-

Low vehicle insurance rates

-

No state inheritance tax

-

No intangible tax on investments

-

Low vehicle license fees

-

No annual vehicle inspection requirements

-

You can also replace or renew your license online or by mail. You would have to return every 5 years to prove you were in the state for one night somewhere in South Dakota.

Staying Connected

Some people want off the grid entirely, and I don’t blame them. They might check in on their phones from time to time, but otherwise want to disconnect from it all.

But, if you are one of the nomads that require the internet either because of preference or necessity, there are options.

If you look around on the internet, some rely on the benevolence of public services offered through the campsite, a library, or cafe. That certainly is one way to go. It’s tough to be location independent if you still rely on a location to provide you with internet services.

If you like a little more security, bandwidth, and most of all portability, then a mobile hot-spot is much better.

Large carriers like AT&T, Verizon, and T-Mobile offer hot-spot packages. There are also some independent carriers, like Skyroam, which offer hot-spot packages for individuals and businesses.

Even if you only do it for a short while, enjoy the freedom that location independence offers.

Click here to schedule a consultation or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.