August 25, 2014

By: Kelly Diamond, Publisher

It’s getting harder and harder for individuals to live peaceful lives with all of this government incited divisiveness. It’s getting damn near impossible to color within the legal lines when on any given day, we could be guilty of three felonies and not even know it!

This requires that much more vigilance on the part of each individual… in the context of an otherwise very collectivist society… to maintain an open mind toward others, educate and inform who we can, and align ourselves with like-minded folks who can still help us protect our privacy and other precious assets.

Admittedly, protecting yourself and your assets should not be so much work, but such are the times. Moreover, the citizens of a country with bad policies shouldn’t bear the brunt of or be punished for what their government does in their name.

Recently, a few countries agreed to sell out their American clients: two major banks in Switzerland, Singapore, and the Cayman Islands. Whether it’s a reciprocity deal or the threat of something else, there is a compelling enough reason for these banks to comply.

As we’ve mentioned before, the US is among two countries that will tax your income regardless of where you earn. It is by far the most self-entitled country in the world, despite the myriad socialist policies held by other countries. It has the highest corporate tax rate, so it feels especially entitled to the productivity of earners and economic stimulators. It has the highest prison rate, which by extension makes it one of the largest welfare states in existence… more so than China! I mean, if you take the prison population (60% of which are non-violent offenders) and the headcount of total government employees alone, you have a rather huge population of welfare recipients… now add on those who willfully sign up for the dole. That’s just sprinkles on the sundae.

FATCA isn’t just about getting those rich folks who are trying to dodge taxes, although that’s how it was sold. FATCA is about casting a net of control so wide across the globe that it ensnares individuals just trying to make a living and pursue their own happiness.

FATCA is horrible and will cost more than it will reign in and cause more harm than it will help. But this policy combined with any efforts to prevent corporations from inverting will not just keep money in the United States or prevent it from fleeing. It is going to scare people out of the United State altogether because it’s not worth it to be an American or tied to America in any way.

Remember, FATCA isn’t just for American citizens. It’s for American PERSONS. Not the same… not even a little bit. An American “person” could be a legal resident, someone who was born here but was taken back to the native countries of their respective parents. Who knows!? I’ll tell you who doesn’t know: the IRS. They purposefully keep the verbiage nebulous so that they can swoop in and persecute. Look at how the IRS and the Department of Treasury have handled Bitcoin thus far: no laws, no fast and hard regulations, just “guidance” that is reluctant to define any terms.

What does this mean for you? It depends. If you are an American this is what you have to look forward to: “Americans living abroad have lost access to financial products and services because banks are hesitant about facing thorny compliance probes,” says Mary Louise Serrato, Executive Director of American Citizens Abroad.

It would seem that it’s not only NOT worth it to be an American but it’s not worth it to DEAL with Americans because of all the legal baggage they tote around with them! I can’t blame anyone for wanting to distance themselves from the United States. While legislators refuse to do a cost benefit analysis of their legislation, businesses always do one. So far, there is a greater cost than benefit to dealing with the US. That is the stigma attached to every American.

Much like universal healthcare, the costs in processing the paperwork alone is senseless. But again, we have the US pouring more money into forcing compliance than allowing individuals to live freely and associate with whomever they feel are in their best interests.

The US pours close to $9 billion per year fighting illegal immigration. There is no scenario where that amount of cash being spent keeping people out is saving us MORE than that in the long run year over year.

The US as poured to date this year nearly $26.5 Billion on keeping people from using, possessing, or selling illicit drugs. What’s the cost benefit analysis on that? More like a LOST benefit analysis considering how many people are dying not from the dangers of the drugs themselves, but from the law enforcement tactics used against them.

And now this. The US is going to pour some yet-to-be-seen-but-guaranteed-to-be-a-lot amount of money into forcing international banks to comply with their reporting procedures. These banks are going to either refuse to do business with Americans or spend an unnecessarily obscene amount of money trying to keep up with America’s paperwork and for what?

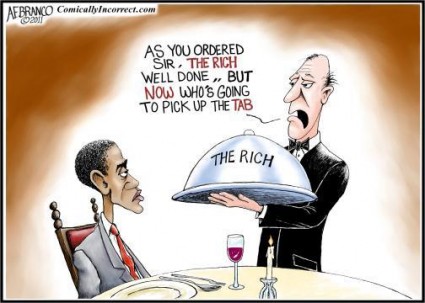

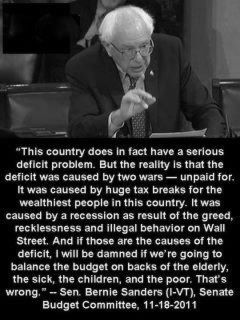

It’s this sort of scapegoating that has led to policies like FATCA and the Anti-Inversion Act. They feign disgust for affluence or opulent living, demand people who have more pay more to make a populist appeal, then shame them no matter what they do.

It is troubling that these politicians want to blame productive, wealthy individuals for the failure of government and still hold them responsible for shouldering the cost of their failed policies. The productive are both the villain and the savior depending on the election cycle. The reality is, productive people from large corporate CEOs down to the small business owner are all the victims of theft. Some have the means to escape the oppression and so the government is upping the effort to lasso them back in.

With all this unfolding in rapid succession, getting out and as far away from the US is more critical than ever! Learn how by clicking here and scheduling a consultation now!

Spot on with this write-up, I really believe that this amazing site needs a lot more attention. I’ll probably be back again to

read more, thanks for the info!