August 22, 2014

By: Gordon Haave, Managing Director of Agora Trust LLC

What does this mean for you? The concept of the bank “bail-in” is picking up traction around the globe.

A bank “bail-in” means that depositors pick up the costs for propping up a failing bank, as opposed to tax payers.

By and large this is a good thing: The government should stop bailing out banks altogether, and to the extent that the government offers deposit insurance (which it shouldn’t) it should only insure the amounts that it has agreed to insure and not increase them every time the banking industry is about to collapse from its usual dosage of greed, fraud, and poor decision making.

Both the US, UK, and EU have adopted a framework for the next melt-down that is vastly preferable to the last bailout. The appropriate section of the Dodd Frank legislation, Title II, reads as follows:

“Title II of the Dodd-Frank Act provides the FDIC with new powers to resolve SIFIs by establishing the orderly liquidation authority (OLA). Under the OLA, the FDIC may be appointed receiver for any U.S. financial company that meets specified criteria, including being in default or in danger of default, and whose resolution under the U.S. Bankruptcy Code (or other relevant insolvency process) would likely create systemic instability. Title II requires that the losses of any financial company placed into receivership will not be borne by taxpayers, but by common and preferred stockholders, debt holders, and other unsecured creditors, and that management responsible for the condition of the financial company will be replaced. Once appointed receiver for a failed financial company, the FDIC would be required to carry out a resolution of the company in a manner that mitigates risk to financial stability and minimizes moral hazard. Any costs borne by the U.S. authorities in resolving the institution not paid from proceeds of the resolution will be recovered from the industry. “

What this means is that next time around, the US is prepared to do the right thing:

If a bank is “in danger of default” the FDIC can take over the bank and begin an orderly liquidation of it. The losses will be borne by stockholders, debt holders, management, and “other unsecured creditors”. That other unsecured creditors is your deposits that exceed the FDIC deposit threshold of $250,000.

A common strategy to minimizing this risk is to simply have more than one account at more than one bank, but it is not clear that is going to work. Senior policy makers in the EU and the US are questioning that route, and it appears that it will be up to the interpretation of the relevant deposit insurer when the time comes. Seeing as the FDIC is under-capitalized even now and that the next time there is a melt-down it is likely to be worse than the previous one, I don’t consider relying on such a strategy to be prudent.

A better solution is jurisdictional and currency diversification. By spreading your money out in banks across the world in different currencies, your risk of losing your hard earned cash is greatly diminished. If you like to keep a million dollars liquid, an easy solution would be a dollar account in the US for your daily needs, another dollar account in Nevis, a Euro account in Andorra, and a Hong Kong dollar account in St. Lucia. There are endless variations of this.

You might lose some of your money, but you are not going to lose it all, of which you are at risk now if it is all in one place.

You can further increase the protection of your cash by having it held by an offshore LLC, or ideally a Trust, so that it is protected from creditors as well.

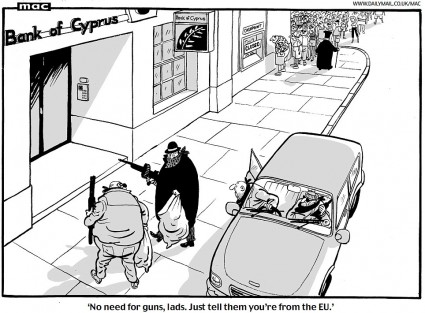

What happened

The economy basically collapsed in Cyprus and the EU ordered that they take money from private accounts to keep one of the two banks solvent-ish.

Bail-ins are NOT the right thing. The right thing is to let the bond holders take their losses, which Hussman has reported would have been enough for US banks in 2008 to remain solvent.

Hi Mary,

I agree that bondholders should take their lumps first. However depositors should take their lumps BEFORE taxpayers. That keeps depositors interested in monitoring the financial condition of the banks they deposit in.

Digital currencies are growing as a viable option for this need. Of course they have their own risks as well, but they do solve the problem of helping one keep liquid assets in a form that cannot be easily confiscated by anyone.

One particular digital currency, NXT can give you access to your money from anywhere in the world, and all you need to get to it is an internet connection and a really long password (which you must remember). If you forget the password, there is no one to ask for help, but the password is all you need to get to your money from anywhere.

Additionally, new services within the digital currency system for NXT now allow for features that will allow you to give you heirs access to your funds without having to give them the password to your account.

The reason your money is so safe is because you’re not trusting any other humans to take care of it for you. However, that also means that no other humans can help you if you have a problem. So, self education is most important before you should even consider moving any significant portion of funds into digital assets. Learn and practice with small amounts, and in a couple of years it will be natural and safe for you to keep whatever you need stored in a password in your head.

http://crypto-daytrader.blogspot.com/2014/08/nxt-wallet-setup-be-careful-nxt-is.html