Americans are leaving their home states for other states and even other countries as their discontent drives them to vote with their feet.

August 16, 2021

By: Bobby Casey, Managing Director GWP

A brief timeline of how things played out:

-

Around March people were told to stay home and wear masks to “flatten the curve”. I think it’s safe to say at this point, most people and businesses were amenable to the initiative, and earnestly made an effort to just suck it up. They generally stayed home, businesses that could, allowed people to work from home. People wore masks.

-

As we got further and further past the “15 days to flatten the curve”, more people began to get skeptical, in some places more than others. South Dakota didn’t do very much policy wise about the pandemic. Sweden never really instituted a mask mandate or a stay home mandate. But places like Australia and New York or California really dug their heels in.

-

In the midst of all that was a presidential race in the US, which obviously politicized the virus, and ultimately resulted in an administrative turn over.

The skepticism hit hard in the summer when people grew weary. Stimulus checks and moratoriums on evictions rolled out, businesses were shutting down permanently, and unemployment soared.

Within the past year many businesses yielded to permanent remote work and people have been gradually relocating. Relocation, just within the same country, takes time: maybe anywhere from 3 to 6 months. For those who made an international move, that takes even longer.

That’s under normal circumstances. With all the restrictions to do with COVID, many things have become protracted. Processing records and paperwork, with some government offices especially, is really backlogged.

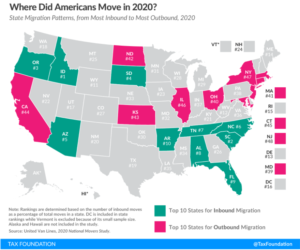

Within the US, just in 2020, here’s a map of where Americans moved just within the US:

Four of the 10 worst-performing states on this year’s [State Business Tax Climate] Index are also among the 10 states with the most outbound migration in this year’s National Movers Study (New Jersey, New York, Connecticut, and California). Seven of the top 10 ranked inbound migration states also rank in the top half of states on the Index, which measures tax structure. And the three which do not (Alabama, Arkansas, and South Carolina), while having significant room for improvement in the structure of their tax codes, generally feature low tax burdens. Conversely, all but one of the top outbound states rank in the bottom third of the Index, the only exception being North Dakota (17th), where outbound migration has been driven by a decline in energy markets.

While there are myriad reasons why people would move, many low tax states also happened to be less onerous with their COVID response. Lower tax burdens aren’t just a good incentive to move, they are also great to break ties when considering where to go for those who are moving to find a cheaper cost of living, retiring to nicer weather, or moving for a job.

Now let’s take a look at the international scene…

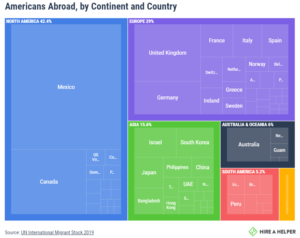

The high end estimate of US Citizens living abroad is around 10 million. The UN will say it’s closer to 4 million, and other sources say 9 million. Whatever the exact number is, these are the ones who still have citizenship (non-military) living abroad. Whether they are digital nomads who retain their citizenship or relocated for a job, they are already one foot out the door.

Here’s where they went:

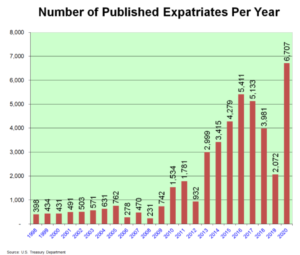

The last highest renunciation year before 2020 was 2016, which was 24% lower at 5,411. Below is a chart showing renunciations by year:

In 2010, Foreign Account Tax Compliant Act (aka FATCA) passed into law. In 2014 was when enforcement would begin.

The discussions hit the news long before the law, and sure enough you saw a spike in 2010 of 1,534 and 1,731 in 2011. The US saw annual renunciations break a thousand for the first time in those years.

In 2013, the US would see renunciations break two thousand for the first time, and not drop below that since. In 2013, 2,999 renunciations were recorded. In 2014, 3,415; in 2015, 4,279; in 2016 a record 5,411.

It dropped off a bit year over year in 2017, 5,133 renunciations recorded; in 2018, 3,981; in 2019, 2,072; and then the new record of 6,707 in 2020.

There are other explanations for the spikes. One viable explanation, which makes a lot of sense, is records catching up to reality. Many people were presumed to still be American citizens when in fact their renunciations had long since been processed. They were still recorded in 2020, despite having the official documents finalized years prior.

Okay, but FATCA was the catalyst behind people seeking new tax homes, without a doubt.

Here’s the even bigger kicker. According to David Lesperance, an international tax lawyer based in Poland who specializes in helping people renounce U.S. citizenship:

“There are probably 20,000 or 30,000 people who want to do this, but they can’t get the appointment. There’s not a peak demand — the system’s capacity has peaked.”

“It’s a year-and-a-half to get an appointment at a Canadian embassy. Bern [Switzerland] alone has a backlog of over 300 cases.”

People are trying to get out in the tens of thousands, but have been wait-listed for years.

A new catalyst is here. The obscene inflation rates and President Joe Biden’s announcement of his intention to hike taxes:

-

Corporate taxes to hike from 21% to 28%

-

Individual taxes to hike from 37% to 39.6%

-

Capital Gains taxes to hike from 20% to 39.6%

If someone decided today to begin the process of renouncing citizenship in the US, they would likely have several years to wait before it would be finalized. That said, having a second passport and second citizenship in the meantime is nothing to scoff at.

There are quite a few tax benefits you can claim in the interim while you wait for the US to process your renunciation request. Even just living as an American citizen abroad has plenty of worthwhile tax benefits.

At the end of the day, five years from now is coming no matter what. If becoming an expat, either as an American living abroad as a citizen of a new country, is something you are seriously considering, let’s talk. Five years from now, you could be saving money in taxes on a beach somewhere!

Click here to schedule a consultation on how you can protect your assets from overreaching governments, or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.