Digital nomads seeking simple tax systems and minimal reporting requirements often turn to countries with zero or territorial tax policies. These destinations offer significant advantages, such as no personal income tax, exemptions for foreign-earned income, and streamlined residency options. For U.S. citizens, worldwide income reporting remains mandatory, but choosing the right country can ease compliance and reduce overall tax burdens.

Key Takeaways:

- Zero-tax countries like the UAE, Bahamas, and Cayman Islands eliminate personal income tax entirely.

- Territorial tax systems in Panama, Costa Rica, and Uruguay only tax local income, leaving foreign earnings untouched.

- Special programs like Georgia’s 1% tax for entrepreneurs and Costa Rica’s digital nomad visa cater to remote workers with specific income thresholds.

- U.S. citizens can use the Foreign Earned Income Exclusion (FEIE) – set at $130,000 in 2025 – to shield foreign income from federal taxes.

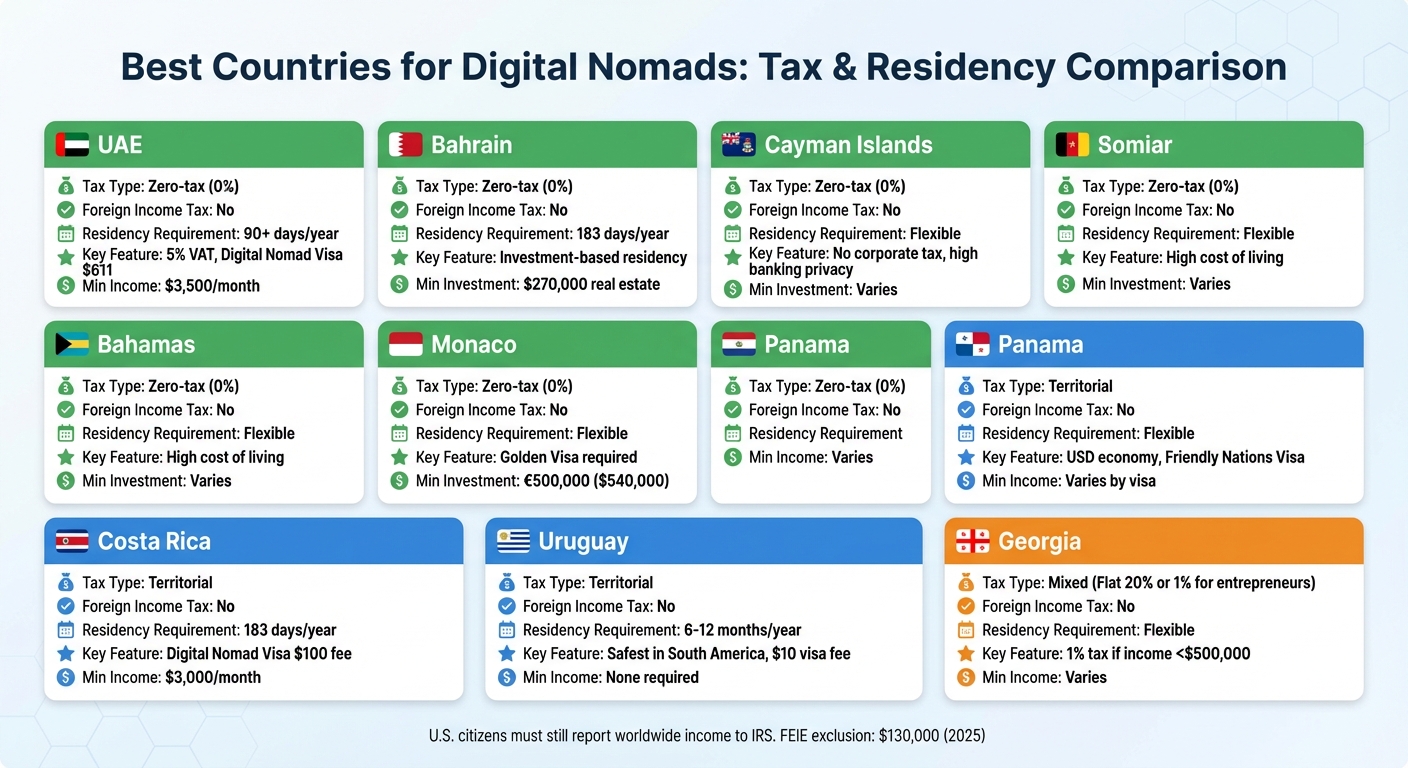

Quick Comparison Table:

| Country | Tax Type | Local Tax on Foreign Income | Residency Requirements | Notable Features |

|---|---|---|---|---|

| UAE | Zero-tax | No | 90+ days/year | 0% income tax, flexible visas, 5% VAT |

| Bahrain | Zero-tax | No | 183 days/year (approx.) | 0% income tax, investment-based residency |

| Cayman Islands | Zero-tax | No | Flexible | No income/corporate tax, high banking privacy |

| Bahamas | Zero-tax | No | Flexible | No income tax, high cost of living |

| Monaco | Zero-tax | No | Flexible | €500,000 investment required for residency |

| Panama | Territorial | No | Flexible | U.S. dollar economy, expat-friendly visas |

| Costa Rica | Territorial | No | 183 days/year | Digital nomad visa, tax-free foreign income |

| Uruguay | Territorial | No | 6-12 months/year | Low-cost visa, $10 application fee |

| Georgia | Mixed (Flat 20%) | No (1% for entrepreneurs) | Flexible | 1% tax for entrepreneurs earning <$500,000 |

Choosing the right destination depends on your income sources, lifestyle preferences, and long-term goals. Zero-tax havens offer simplicity but often come with higher living costs, while territorial systems provide flexibility for remote workers with foreign-sourced income. For U.S. citizens, compliance with IRS rules, including FBAR and FATCA, remains essential regardless of location.

1. United Arab Emirates

Tax System Type

The UAE stands out with its 0% personal income tax, meaning no taxes on salaries, capital gains, investment income, or cryptocurrency profits. Katelynn Minott, CPA & CEO of Bright!Tax, explains:

"The UAE has long been a favorite for expats seeking a zero-income-tax lifestyle – and with good reason."

However, a 5% VAT applies to most goods and services, though education and healthcare are exempt. Additionally, a 9% corporate tax is levied only on profits exceeding AED 375,000 (around $100,000).

Local Reporting Obligations

Since there’s no personal income tax, the UAE doesn’t require annual filings or global income reporting, making financial management much simpler.

Residency Options

The UAE provides multiple residency pathways. One popular choice is Dubai’s Digital Nomad Visa, which now requires a minimum monthly income of $3,500 – reduced from $5,000 in 2022 – and an application fee of $611. Other options include freelance visas, investor visas, or residency through real estate purchases. For larger investments, long-term 10-year visas are also available.

Physical Presence Requirements

To qualify as a tax resident, individuals typically need to spend over 180 days per year in the UAE. However, recent reforms allow remote workers to enjoy the 0% tax benefits with just three months of residency annually. This flexibility makes the UAE especially appealing for digital nomads who want tax advantages without committing to full-time residency.

Up next, let’s explore another destination offering minimal financial reporting.

2. Bahrain

Tax System Type

Bahrain stands out with its 0% personal income tax, meaning residents pay no tax on salaries, dividends, interest, or other earnings. This makes it an attractive option for digital nomads who can retain their entire foreign-sourced income without worrying about local tax liabilities. Instead of taxing individual incomes, the government relies on revenues from oil and gas exports, a 10% VAT, and a 46% corporate tax levied on oil companies. For individuals, this eliminates the hassle of annual income declarations.

Local Reporting Obligations

Since there’s no personal income tax, individuals in Bahrain aren’t required to file annual tax returns. The country’s tax system is designed to be business-friendly with straightforward compliance requirements.

Residency Options

Bahrain offers residency through investment, with multiple pathways available. One option involves purchasing real estate valued at $270,000 or higher. Another route allows for permanent residency by investing approximately $133,000 in property or $266,000 in a local business. Retirees can also qualify if they demonstrate sufficient income.

Physical Presence Requirements

Although Bahrain doesn’t outline specific physical presence rules, the global standard of 183 days is generally applicable for tax residency. Holding a residence permit allows individuals to benefit from the country’s zero income tax policy.

Up next, we’ll look at another destination known for its simple tax and reporting systems.

3. Cayman Islands

Tax System Type

The Cayman Islands operates on a zero-tax system. That means no personal income tax, corporate tax, capital gains tax, VAT, or even property and estate taxes. Instead, the government generates revenue through import duties and business licensing fees. This setup creates a simple and tax-friendly environment, especially for digital nomads earning foreign income, as they won’t face local tax obligations.

Local Reporting Obligations

Since there are no income-based taxes, residents in the Cayman Islands don’t need to file tax returns or keep tax-related records. Reporting requirements here mainly involve declaring import duties and business licensing fees. However, U.S. citizens living in the Cayman Islands must still fulfill their federal tax obligations, including filing federal tax returns and submitting FBAR forms. This straightforward tax system aligns well with the residency options available to international investors.

Residency Options

Gaining residency in the Cayman Islands is relatively simple. Options include making a one-time investment or donation, purchasing real estate, or starting a local business. These accessible pathways align seamlessly with the jurisdiction’s minimal reporting requirements, making it an attractive choice for digital nomads. Known as a leading offshore financial hub, the Cayman Islands also offers a stable economy and strong confidentiality protections for investors.

4. Bahamas

Tax System Type

The Bahamas stands out with its zero-tax system – there’s no personal, corporate, or capital gains tax. This policy has made it a top choice for those seeking tax-friendly destinations.

"The Bahamas exemplifies a classic, zero-tax haven ideal for high-earning expats." – Katelynn Minott, CPA & CEO, Bright!Tax

Local Reporting Obligations

With no income-based taxes, residents in the Bahamas aren’t required to file tax returns or maintain tax records for local purposes. However, U.S. citizens living there still need to comply with federal tax obligations, including filing tax returns and submitting FBAR forms to the IRS.

Residency Options

The Bahamas provides straightforward residency options for investors and high-net-worth individuals. These include investment programs, long-stay permits, or purchasing real estate. Establishing a local company is another viable route. While the country’s lack of reporting requirements simplifies life for residents, it’s worth noting that the cost of living can be steep, especially for imported goods and private healthcare.

5. Monaco

Tax System Type

Monaco stands out with its lack of personal income, capital gains, or wealth taxes, making it an attractive option for digital nomads. This straightforward approach has been in place for decades, solidifying Monaco’s reputation as a tax haven with minimal local tax obligations.

Local Reporting Obligations

Since Monaco doesn’t impose income, capital gains, or wealth taxes, residents are not required to file local tax returns for these categories. This simplicity is a key draw for those looking to avoid complex reporting requirements. Let’s take a closer look at how residency works in Monaco.

Residency Options

Gaining residency in Monaco is typically tied to investment programs, often called the Monaco Golden Visa. This requires a minimum investment of €500,000 (around $540,000). While the investment threshold is clear, the principality’s high living expenses and limited size – just 1.1 square kilometers (less than half a square mile) – might deter some potential long-term residents.

Banking and Compliance Simplicity

Monaco’s tax-free policies also simplify local banking and compliance. However, U.S. citizens are still required to report their foreign accounts to the IRS under FBAR and FATCA regulations. International financial agreements ensure that foreign banks regularly share account details with U.S. authorities, making compliance essential for American residents in Monaco.

6. Panama

Tax System Type

Panama uses a territorial tax system, which means you’re only taxed on income earned within the country’s borders. If your income comes from outside Panama – whether through a U.S. remote job, freelance work for international clients, or overseas investments – you won’t owe any Panamanian income tax.

"Panama’s territorial tax system is a major win for U.S. expats: only income earned within Panama is taxed. If your income is foreign-sourced – like a U.S. remote job, freelance work, or overseas investments – you won’t owe a dime to the Panamanian government." – Katelynn Minott, CPA & CEO, Bright!Tax

For local income, tax rates range from 0% to 25%, while corporate income is taxed at 25%. That said, most digital nomads working for foreign companies remotely won’t encounter these rates.

Local Reporting Obligations

This tax system also simplifies compliance for digital nomads. If all your income is foreign-sourced, your local reporting requirements are minimal. However, you’ll need to provide proof that your income comes from outside Panama, especially if you’re working remotely for an overseas employer.

Residency Options

Panama pairs its tax benefits with two popular residency programs designed for international residents. The Friendly Nations Visa is available to citizens from countries with strong diplomatic ties to Panama, while the Pensionado Program is aimed at retirees. Both programs are known for being straightforward to navigate.

Additionally, Panama’s use of the U.S. dollar eliminates currency exchange hassles for U.S. citizens. Combine that with a large English-speaking expat community, and Panama becomes an appealing choice for relocation.

Banking and Compliance Simplicity

Panama’s banking system is internationally recognized for its stability. Since the U.S. dollar is the official currency, financial transactions are straightforward, and there’s no need to worry about exchange rate fluctuations.

sbb-itb-39d39a6

7. Costa Rica

Tax System Type

Costa Rica’s digital nomad visa offers a major perk: foreign income is completely exempt from local taxes. This means if your earnings come from clients or employers outside Costa Rica, you won’t have to pay income tax on those funds. On top of that, the visa includes exemptions for essential work-related imports, making it easier to bring in the tools you need to do your job.

Local Reporting Obligations

The digital nomad visa doesn’t just save you on taxes – it also simplifies your local reporting responsibilities. Since foreign income isn’t taxed, there’s no need for complex tax filings. To apply for the visa, you’ll need to pay a $100 fee and show proof of a minimum monthly income of $3,000. Once approved, you’ll gain access to local banking services and can even use your current driver’s license without extra paperwork.

Residency Options

For remote workers looking for temporary residency, Costa Rica’s digital nomad visa is the go-to option. It’s designed for individuals who meet the $3,000 monthly income requirement and want a straightforward way to live and work in this tropical paradise.

8. Uruguay

Tax System Type

Uruguay operates on a territorial tax system, meaning it only taxes income earned within its borders. If you’re a remote worker earning from companies based abroad, your foreign-sourced income is completely untaxed. This makes Uruguay a standout option in South America for digital nomads looking to keep their tax obligations simple and manageable.

Local Reporting Obligations

Since foreign income isn’t taxed, there’s no need to file local tax returns for it. This simplicity also extends to Uruguay’s digital nomad visa process. Unlike many other countries, Uruguay doesn’t require a minimum income threshold to qualify – no need to prove earnings of $3,000 or more per month. This straightforward approach makes it easier for remote workers to settle in without unnecessary red tape.

Residency Options

With Uruguay’s digital nomad visa, you can stay in the country for six months to one year, and it’s renewable. The application fee is a mere $10, making it one of the most affordable options out there. Combine this with Uruguay’s reputation as the safest country in South America, and it’s easy to see why it’s such an attractive destination for remote workers seeking peace of mind and simplicity.

Banking and Compliance Simplicity

Uruguay’s territorial tax system doesn’t just simplify taxes – it also makes financial management easier for expats. Since foreign-sourced income and offshore assets aren’t taxed locally, you can maintain your global financial arrangements without worrying about triggering Uruguayan tax obligations. The same no-fuss approach that defines the visa process extends to other aspects of residency, ensuring a smooth and hassle-free experience for digital nomads.

9. Georgia

Tax System Type

Georgia offers a flat 20% personal income tax rate, but there’s a major perk for digital nomads. If you register as an Individual Entrepreneur and your business income stays under $500,000 annually, you can qualify for a dramatically reduced 1% tax rate on that income. Plus, Georgia has a Double Taxation Agreement with the United States, which means U.S. citizens can avoid being taxed twice on the same earnings. This setup makes it easier to comply with tax laws while enjoying favorable residency terms.

For companies based in Georgia, corporate tax is set at 15%, but here’s the catch: it only applies when profits are distributed. Undistributed profits? They’re not taxed. On top of that, there’s no withholding tax on dividends, simplifying financial planning even further.

Local Reporting Obligations

Georgia’s streamlined bureaucracy is a breath of fresh air for those tired of excessive paperwork. Under the 1% Individual Entrepreneur regime, not only do you enjoy lower taxes, but the reporting process is also straightforward. For U.S. citizens, tools like the Foreign Earned Income Exclusion (up to $130,000 in 2025) or the Foreign Tax Credit can help reduce overall tax liabilities even more.

Residency Options

Georgia pairs its tax-friendly policies with accessible residency pathways. Registering as an Individual Entrepreneur not only gives you tax benefits but can also help you secure long-term residency. Additionally, Georgia offers temporary residence permits for various purposes, including work, entrepreneurship, property ownership, or investments.

Banking and Compliance Simplicity

As a rising hub for digital nomads, Georgia combines a welcoming atmosphere with minimal bureaucratic hurdles. Its low cost of living, reliable internet infrastructure, and efficient financial systems make managing your finances here incredibly simple.

Comparison of Benefits and Drawbacks

Choosing the right country involves balancing tax advantages against potential downsides. Some destinations offer complete tax exemption, while others use territorial systems that tax only local income. Let’s break down the benefits and trade-offs to help you decide what works best.

Tax-free havens like the UAE, Bahamas, Monaco, and the Cayman Islands offer zero personal income tax. However, there are nuances to consider. The UAE imposes a 5% VAT and recently introduced a 9% corporate tax on business profits exceeding about $100,000. Monaco, while tax-free, requires a hefty €500,000 minimum investment for its Golden Visa. The Bahamas has no direct taxes but high costs for imported goods and healthcare. The Cayman Islands provide a straightforward tax-free framework with minimal reporting requirements, making compliance simpler.

Territorial tax systems in places like Panama and Costa Rica focus solely on taxing local income, leaving foreign earnings untouched. Panama offers a moderate cost of living and a U.S. dollar-based economy, making it appealing for long-term stays. Costa Rica’s digital nomad visa requires a monthly income of $3,000 and includes perks like tax-free car imports and access to local banking. Uruguay, on the other hand, stands out with its $10 application fee, no minimum income requirement, and reputation as the safest country in South America.

Georgia’s mixed tax system provides a low entry barrier with a 1% tax rate for entrepreneurs earning under $500,000 annually. It also boasts affordable living costs and reliable internet infrastructure. However, any income earned outside its Individual Entrepreneur regime is taxed at a flat 20%, which could offset some of the savings.

For U.S. citizens, federal tax obligations persist regardless of where they live. The Foreign Earned Income Exclusion will allow up to $130,000 in 2025, but self-employment taxes of 15.3% still apply to net income over $400. Non-compliance can be costly, with FBAR penalties for willful violations reaching the greater of $100,000 or 50% of the account balance per year. Additionally, global enforcement through FATCA agreements has tightened, making professional tax advice essential even in countries with simplified reporting requirements.

Conclusion

Your choice of tax residency should align with your income, lifestyle, and financial goals. For high-income business owners, zero-tax jurisdictions such as the UAE, Monaco, or the Cayman Islands can be appealing, as they minimize personal and capital gains taxes on foreign-sourced income. On the other hand, freelancers or entrepreneurs working with smaller budgets might find territorial tax systems in affordable countries more suitable. For instance, Georgia offers a 1% tax rate for entrepreneurs under specific income thresholds, while Uruguay combines low taxes with a reasonable cost of living.

However, tax rates are just one piece of the puzzle. Personal circumstances play a big role, especially for U.S. citizens who are required to report worldwide income to the IRS. If your net earnings exceed $400, self-employment taxes of 15.3% still apply. Navigating these rules – along with FBAR and FATCA compliance – is complex, and non-compliance can result in hefty penalties. Seeking professional tax advice is crucial to avoid costly mistakes.

When deciding, consider factors like tax residency rules (e.g., required days spent in-country), the nature of your income (earned versus passive), and your long-term plans (temporary or permanent residency). For those earning foreign-sourced income, territorial systems like Panama are often a good fit. Meanwhile, zero-tax jurisdictions are better suited for individuals with significant savings or investment income. Don’t overlook daily living expenses, though – high costs can quickly eat into any tax savings.

FAQs

What are the pros and cons of living in a zero-tax country compared to a territorial tax country?

Living in a zero-tax country has its perks – imagine keeping your entire income without worrying about taxes. It also means less complicated financial reporting and better privacy. But there’s a flip side. These countries often come with steep living expenses, fewer public services, and strict rules for residency or running a business.

Meanwhile, territorial tax countries offer a different kind of appeal. They only tax the income you earn locally, leaving your foreign income untouched. This setup is a favorite among digital nomads and remote-working expats. However, keep in mind that you might still owe taxes on local earnings, and some exemptions could be limited, depending on the country.

Each option comes with its own set of benefits and challenges. The right fit for you will depend on your financial priorities, lifestyle, and how you earn your income.

What are the best ways for U.S. citizens living abroad to reduce their tax obligations?

U.S. citizens living overseas have options to lower their tax burden. One approach is to reside in countries with territorial tax systems or no income tax, like Panama, Costa Rica, or the UAE. In these places, only income earned locally is subject to taxation. Another tool is the Foreign Earned Income Exclusion (FEIE), which lets you exclude up to $130,000 of foreign-earned income from U.S. taxes (as of 2025), provided you satisfy either the residency or physical presence tests.

To remain compliant with U.S. tax laws, you’ll need to file forms such as FBAR (for foreign bank accounts) and FATCA (for specific financial assets). Additionally, selecting a country with favorable tax treaties or no tax on foreign income can help you better manage your tax responsibilities while staying in line with IRS requirements.

What should digital nomads look for when choosing a country for tax residency?

When choosing a country for tax residency, digital nomads need to weigh several crucial factors. Start by looking into the tax residency rules, the type of taxation system (whether it’s territorial or worldwide), and the income tax rates. It’s equally important to understand the country’s compliance requirements and check if it has double taxation treaties, as these can simplify your financial responsibilities.

Beyond taxes, consider practical aspects like the cost of living, available visa options, and how straightforward it is to maintain your residency status. Picking a country that fits both your financial plans and lifestyle can make handling taxes and legal matters much smoother while enjoying life abroad.