August 22, 2014

By: Gordon Haave, Managing Director of Agora Trust LLC

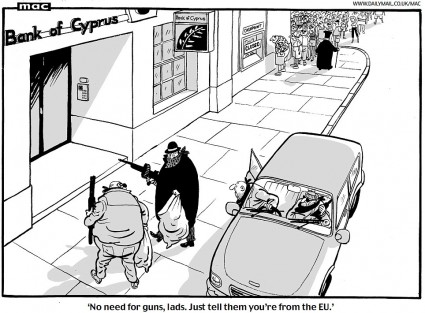

Cyprus recently completed a bank bail-in for its troubled financial system. The terms are as follows: The German government is contributing 13 billion euros to help bail out Cyprus bankers and their Russian clients. What did Cyprus kick in? As part of the program, Cyprus kicked in 7.5 billion Euros by levying a one-time tax of 6.75% from INSURED Cyprus bank deposits of E100,000 or less and a 9.9% tax on amounts above that.

Cyprus recently completed a bank bail-in for its troubled financial system. The terms are as follows: The German government is contributing 13 billion euros to help bail out Cyprus bankers and their Russian clients. What did Cyprus kick in? As part of the program, Cyprus kicked in 7.5 billion Euros by levying a one-time tax of 6.75% from INSURED Cyprus bank deposits of E100,000 or less and a 9.9% tax on amounts above that.

What does this mean for you? The concept of the bank “bail-in” is picking up traction around the globe.

A bank “bail-in” means that depositors pick up the costs for propping up a failing bank, as opposed to tax payers.

By and large this is a good thing: The government should stop bailing out banks altogether, and to the extent that the government offers deposit insurance (which it shouldn’t) it should only insure the amounts that it has agreed to insure and not increase them every time the banking industry is about to collapse from its usual dosage of greed, fraud, and poor decision making.

Both the US, UK, and EU have adopted a framework for the next melt-down that is vastly preferable to the last bailout. The appropriate section of the Dodd Frank legislation, Title II, reads as follows:

“Title II of the Dodd-Frank Act provides the FDIC with new powers to resolve SIFIs by establishing the orderly liquidation authority (OLA). Under the OLA, the FDIC may be appointed receiver for any U.S. financial company that meets specified criteria, including being in default or in danger of default, and whose resolution under the U.S. Bankruptcy Code (or other relevant insolvency process) would likely create systemic instability. Title II requires that the losses of any financial company placed into receivership will not be borne by taxpayers, but by common and preferred stockholders, debt holders, and other unsecured creditors, and that management responsible for the condition of the financial company will be replaced. Once appointed receiver for a failed financial company, the FDIC would be required to carry out a resolution of the company in a manner that mitigates risk to financial stability and minimizes moral hazard. Any costs borne by the U.S. authorities in resolving the institution not paid from proceeds of the resolution will be recovered from the industry. “

What this means is that next time around, the US is prepared to do the right thing:

If a bank is “in danger of default” the FDIC can take over the bank and begin an orderly liquidation of it. The losses will be borne by stockholders, debt holders, management, and “other unsecured creditors”. That other unsecured creditors is your deposits that exceed the FDIC deposit threshold of $250,000.

A common strategy to minimizing this risk is to simply have more than one account at more than one bank, but it is not clear that is going to work. Senior policy makers in the EU and the US are questioning that route, and it appears that it will be up to the interpretation of the relevant deposit insurer when the time comes. Seeing as the FDIC is under-capitalized even now and that the next time there is a melt-down it is likely to be worse than the previous one, I don’t consider relying on such a strategy to be prudent.

A better solution is jurisdictional and currency diversification. By spreading your money out in banks across the world in different currencies, your risk of losing your hard earned cash is greatly diminished. If you like to keep a million dollars liquid, an easy solution would be a dollar account in the US for your daily needs, another dollar account in Nevis, a Euro account in Andorra, and a Hong Kong dollar account in St. Lucia. There are endless variations of this.

You might lose some of your money, but you are not going to lose it all, of which you are at risk now if it is all in one place.

You can further increase the protection of your cash by having it held by an offshore LLC, or ideally a Trust, so that it is protected from creditors as well.