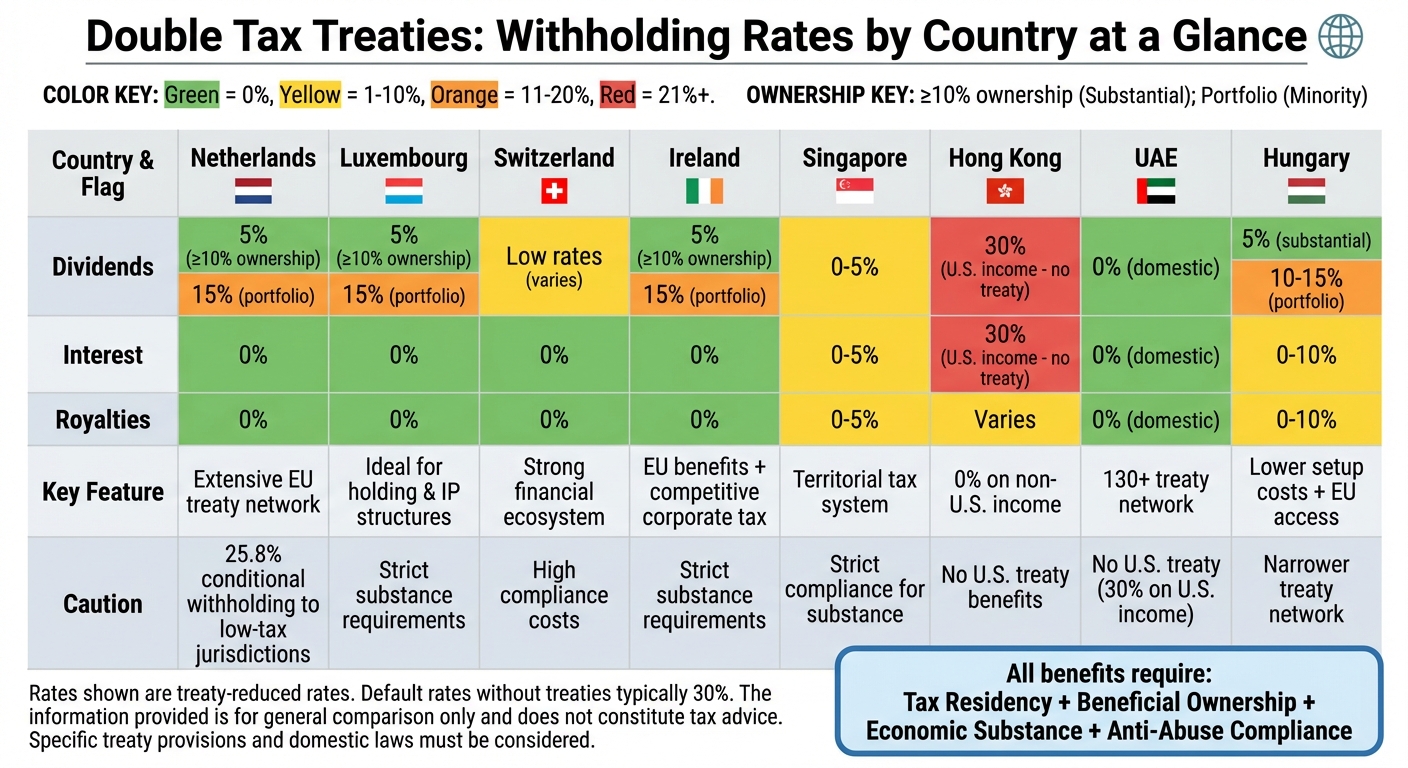

When earning foreign income like dividends, interest, or royalties, withholding taxes can significantly reduce returns. Double Tax Treaties (DTTs) help investors by lowering these rates, sometimes to as low as 0%. However, accessing these benefits requires meeting strict conditions like economic substance, beneficial ownership, and anti-abuse provisions. Here’s a quick summary of key jurisdictions and their treaty benefits:

- Netherlands: 0% on interest/royalties, 5%-15% on dividends; strict substance requirements.

- Luxembourg: 0% on interest/royalties, 5%-15% on dividends; ideal for holding and IP structures.

- Switzerland: Low rates for dividends; 0% on interest/royalties; high compliance costs.

- Ireland: 0% on interest/royalties, 5%-15% on dividends; strong EU tax benefits.

- Singapore: 0%-5% on most payments; strict compliance for substance.

- Hong Kong: No U.S. treaty; full 30% U.S. withholding applies.

- UAE: 0% domestic withholding; no U.S. treaty benefits.

- Hungary: 0%-10% on interest/royalties; 5%-15% on dividends; affordable setup.

To qualify, you must meet residency, substance, and anti-abuse rules. Choose a jurisdiction based on your investment goals, compliance ability, and treaty network.

1. Netherlands

Treaty Withholding Rates (Dividends, Interest, Royalties)

The U.S.–Netherlands tax treaty offers some of the most attractive withholding rates for U.S. investors. For dividends, the rate is reduced to 5% if you directly own at least 10% of the voting stock. For portfolio investors, the rate is 15%. Even better, there’s a 0% withholding rate on both interest and royalty payments, making the Netherlands a popular choice for financing structures and intellectual property (IP) holdings.

However, starting January 1, 2021, the Netherlands introduced a conditional withholding tax of 25%, which increased to 25.8% in 2022, on interest and royalty payments to low-tax jurisdictions or in cases of abuse. This change has added complexity for certain arrangements.

Conditions for Reduced Rates

To qualify for these reduced rates, you must meet several requirements:

- Be a tax resident of either the U.S. or the Netherlands under domestic law and treaty provisions.

- Be the beneficial owner of the income.

- Comply with the Limitation on Benefits (LOB) provisions, which ensure the treaty’s benefits aren’t misused.

Additionally, the treaty includes a Principal Purpose Test to prevent treaty shopping. Essentially, you can’t set up a Dutch entity just to access treaty benefits unless there’s genuine economic activity behind it.

Investor Suitability

The Netherlands is particularly appealing for holding companies, IP licensing structures, and financing arrangements within multinational groups. U.S. investors with large European operations often use Dutch entities to handle cross-border dividend flows and royalty payments efficiently. The participation exemption – which eliminates tax on dividends and capital gains – combined with the treaty’s 0% withholding rates on interest and royalties, offers significant tax advantages.

That said, these benefits come with strict requirements. Dutch structures must demonstrate real economic substance, which means having actual operations in the Netherlands. This includes maintaining office space, employing local staff, holding board meetings in the country, and conducting genuine business activities. If your structure is purely on paper and lacks substance, it’s likely to fail anti-abuse tests.

Anti-Abuse Provisions

The treaty includes robust anti-abuse measures to prevent exploitation. The conditional withholding tax introduced in 2021 targets payments routed through the Netherlands to low-tax or blacklisted jurisdictions. If a Dutch entity pays interest or royalties to such jurisdictions, a 25%+ withholding tax applies, effectively removing any tax advantage. The Netherlands maintains a list of these low-tax jurisdictions to enforce compliance.

In addition, the Principal Purpose Test ensures that treaty benefits are denied for structures without a valid commercial purpose. Simply put, your Dutch presence must serve a legitimate business need beyond just cutting taxes. Without this, you risk losing access to the treaty’s benefits.

2. Luxembourg

Treaty Withholding Rates (Dividends, Interest, Royalties)

Luxembourg has built a reputation as a key European hub for holding and financing, thanks to its extensive treaty network. Under the U.S.–Luxembourg treaty, dividends are taxed at 5% for shareholders owning at least 10% of a company and 15% for portfolio investors. Meanwhile, interest and royalty payments can qualify for a 0% rate, provided specific conditions are met. These treaty benefits significantly reduce inbound withholding taxes for Luxembourg-based entities. Domestically, Luxembourg applies a 15% tax rate on dividends, but treaties often lower this rate, making the country attractive for multinational financing and intellectual property (IP) licensing. However, access to these favorable rates depends on meeting strict residency and substance requirements.

Conditions for Reduced Rates

To benefit from Luxembourg’s reduced rates, entities must establish genuine Luxembourg tax residency, prove beneficial ownership, and satisfy Limitation on Benefits (LOB) tests, such as ownership or base-erosion thresholds. Additionally, the Principal Purpose Test (PPT) can block treaty benefits if tax advantages were a primary motivation for the structure. Simply routing payments through Luxembourg without conducting real business activities won’t pass muster. Demonstrating local management and genuine operations is essential.

Investor Suitability

Luxembourg is particularly well-suited for multinational corporations, private equity funds, and institutional investors seeking a European platform for holding or financing structures. It’s an ideal choice for managing European operations with significant cross-border dividend flows or consolidating intellectual property licensing. The country’s robust treaty network, combined with its advanced financial services infrastructure, supports complex international operations.

However, Luxembourg is not the right fit for "brass-plate" setups with minimal substance. According to OECD data, jurisdictions like Luxembourg with strong treaty networks often achieve withholding rates in the 0–5% range, but only for entities with genuine operational presence. If your primary goal is tax reduction without real business activity, expect to fail anti-abuse tests.

Anti-Abuse Provisions

Modern treaties have introduced stringent anti-abuse measures, including LOB and PPT provisions, to deny benefits to entities lacking genuine commercial substance. To qualify, your Luxembourg entity must demonstrate real business activities, take on actual risks, and serve legitimate business purposes beyond tax savings.

In practice, this requires maintaining clear documentation of local management and decision-making. Your Luxembourg entity should have proper capitalization, hold board meetings locally, and provide evidence that it actively controls the assets and income tied to treaty benefits. Without these elements, foreign tax authorities may challenge your reduced withholding rates, potentially leading to back taxes and penalties.

3. Switzerland

Treaty Withholding Rates (Dividends, Interest, Royalties)

Switzerland’s tax treaty with the U.S. offers reduced withholding rates on dividends, interest, and royalties. For qualifying corporate shareholders, dividend rates are lowered, though portfolio dividends are subject to slightly higher rates. Interest and royalty payments often benefit from zero withholding, making Switzerland an attractive option for international financing and intellectual property arrangements.

In 2025, the National Foreign Trade Council (NFTC) highlighted Switzerland as the top priority for U.S. tax treaty negotiations. Among member companies, reducing dividend withholding rates ranked as the most important goal.

To take advantage of these benefits, meeting strict compliance standards is a must.

Conditions for Reduced Rates

To claim the treaty’s reduced rates, entities must comply with specific tax residency and beneficial ownership requirements. Swiss entities need to obtain valid residency certificates from cantonal or federal tax authorities, while U.S. entities must secure the appropriate IRS documentation. Additionally, demonstrating economic substance is critical. This includes having decision-making authority within Switzerland, appointing local directors, maintaining a physical office, and employing local staff.

Investor Suitability

Switzerland’s treaty benefits are particularly appealing to multinational corporations, institutional investors, and high-net-worth individuals managing large cross-border investments or intellectual property portfolios. The zero withholding on interest and royalty payments adds to its attractiveness for structuring international financing and IP licensing. However, smaller investors may find the compliance costs and substance requirements too burdensome.

Given these conditions, adhering to anti-abuse regulations is crucial.

Anti-Abuse Provisions

Swiss tax treaties include strong anti-abuse measures, such as the Limitation on Benefits (LOB) clause, Principal Purpose Test (PPT), and strict beneficial ownership rules. These provisions are designed to prevent treaty shopping. Benefits may be denied if an arrangement’s main purpose is to secure tax reductions without genuine business activity. Failing to meet LOB criteria or funneling income to non-treaty residents can also result in denial. To comply, entities must document legitimate operations and ensure they meet the treaty’s strict anti-abuse standards.

4. Ireland

Treaty Withholding Rates (Dividends, Interest, Royalties)

Ireland’s tax treaty with the U.S. offers attractive withholding tax rates. For dividends, the treaty sets a 5% rate for corporate shareholders holding at least 10% of voting stock and 15% for portfolio investors. Even more appealing, interest and royalty payments are subject to a 0% withholding rate. These rates align with Ireland’s domestic policies, which often exempt interest and royalties paid to EU or treaty-resident associated companies from withholding taxes. Compared to many other countries – where OECD data shows default rates of 10–20% or higher – Ireland stands out. However, benefiting from these rates requires strict adherence to residency and substance requirements.

Conditions for Reduced Rates

To qualify for these reduced treaty rates, entities must meet stringent residency and beneficial ownership requirements. Irish entities must demonstrate local substance, which includes holding regular board meetings in Ireland, maintaining physical offices, and employing local staff with real decision-making authority. U.S. entities need to provide proper IRS documentation verifying their tax residency. Additionally, payments routed through permanent establishments in third countries are ineligible, as this would trigger anti-conduit rules.

Investor Suitability

Ireland’s tax treaty benefits are particularly suited for multinationals, global funds, and businesses managing large intellectual property portfolios. The 0% rates on interest and royalties, combined with Ireland’s strong market connectivity, make it an appealing choice for these groups. However, smaller investors might find the compliance and substance requirements challenging. For those managing significant cross-border investments or IP licensing, the potential tax savings can outweigh these hurdles.

Anti-Abuse Provisions

Ireland applies rigorous anti-abuse measures in its treaties, including the OECD’s Principal Purpose Test and Limitation on Benefits clauses. These provisions block treaty benefits if the main goal is tax avoidance. Additional safeguards target "letterbox" entities that lack genuine economic activity. To retain access to treaty benefits, entities must show legitimate business operations, supported by documented substance such as local staffing and real decision-making processes.

5. Singapore

Treaty Withholding Rates (Dividends, Interest, Royalties)

Singapore stands out as a key player in the Asia-Pacific region when it comes to reducing withholding tax burdens, following the example set by many European nations. Its extensive network of tax treaties places it among the top jurisdictions offering low withholding rates. For example, under the U.S.-Singapore tax treaty, rates on dividends, interest, and certain royalties can dip below 5%, depending on the payment type and the investor’s specific circumstances. These treaty rates, combined with Singapore’s domestic tax policies – such as its relatively low corporate tax rates and exemptions for certain types of foreign-sourced income – make it an appealing location for treaty-based holding and financing structures.

Conditions for Reduced Rates

To qualify for these favorable rates, investors need to meet specific requirements. This includes obtaining a tax residency certificate from the relevant authority to prove tax residence, demonstrating beneficial ownership, and showcasing genuine economic substance. Economic substance can be established by maintaining local directors, office space, decision-making authority, bank accounts, and proper records in Singapore. Modern treaties emphasize these substance requirements, and failing to meet them could result in the denial of treaty benefits or the application of anti-avoidance measures.

Investor Suitability

Singapore’s tax treaty network and low withholding tax exposure make it a preferred choice for multinationals managing Asia-Pacific operations, intellectual property portfolios, or significant cross-border investments. Many companies centralize their holding and IP structures in Singapore to take advantage of these benefits. However, U.S. investors need to carefully consider how Singapore’s treaty benefits interact with U.S. tax laws, including Controlled Foreign Corporation (CFC) rules, Global Intangible Low-Taxed Income (GILTI) provisions, and Passive Foreign Investment Company (PFIC) rules. For smaller investors, the compliance costs and substance requirements might outweigh the potential tax savings, making it a less practical option. These factors highlight the importance of understanding Singapore’s strict anti-abuse measures.

Anti-Abuse Provisions

While Singapore offers attractive treaty benefits, it enforces strict anti-abuse measures to ensure these advantages are only available to entities with genuine operational substance. The country’s treaties incorporate OECD BEPS-aligned provisions, targeting arrangements that lack real economic activity. For instance, Limitation on Benefits (LOB) clauses restrict treaty benefits to "qualified persons", such as publicly traded companies or entities meeting specific ownership and base-erosion tests. The Principal Purpose Test (PPT) allows authorities to deny benefits if one of the main purposes of an arrangement was to gain treaty advantages, especially if granting them would go against the treaty’s intent. Additionally, anti-conduit or look-through rules may reassign income to the ultimate investor if Singapore is merely used as an intermediary without substantial activities. Simply setting up a Singapore entity between an operating subsidiary and the ultimate investor is no longer enough to secure low withholding rates.

sbb-itb-39d39a6

6. Hong Kong

Treaty Withholding Rates (Dividends, Interest, Royalties)

For U.S. investors, Hong Kong presents a unique scenario since it doesn’t have a double tax treaty with the United States. As a result, U.S.-sourced dividends and interest face the full statutory 30% withholding tax, unlike jurisdictions where treaties lower these rates. While Hong Kong imposes no withholding tax (0%) on dividends and interest for non-U.S. income, this advantage doesn’t apply to income sourced from the U.S. Royalty withholding rates, on the other hand, depend on specific circumstances.

This lack of a U.S.–Hong Kong treaty puts the jurisdiction at a disadvantage when compared to countries offering treaty benefits. Without treaty relief, U.S.-sourced income remains subject to the full statutory tax rates, which can significantly cut into returns for U.S. investors. This highlights the importance of choosing jurisdictions with tax treaties to maximize returns on U.S.-sourced income.

Investor Suitability

Hong Kong is particularly appealing for investors whose income is primarily non-U.S. Its territorial tax system, combined with a 0% corporate tax on foreign-sourced income, creates a favorable environment. Companies earning income outside Hong Kong enjoy local profit tax rates ranging from 8.25% to 16.5%. This makes Hong Kong an attractive hub for Asia-Pacific holding structures, where multinational companies often centralize regional operations, manage intellectual property licensing, or oversee other investments to benefit from these tax advantages.

However, for U.S. investors with portfolios heavily reliant on U.S.-sourced income, Hong Kong’s lack of treaty relief and the resulting full statutory withholding rates can significantly reduce returns. While Hong Kong offers strong domestic tax benefits for non-U.S. income, its treaty limitations make it less competitive for strategies aimed at reducing U.S. withholding taxes. This contrasts sharply with the investor-friendly tax frameworks available in other jurisdictions discussed earlier.

7. United Arab Emirates

Treaty Withholding Rates (Dividends, Interest, Royalties)

The United Arab Emirates (UAE) takes a distinctive approach to withholding taxes, offering a 0% domestic withholding tax on dividends, interest, and royalties paid to non-residents. This means that when a UAE company distributes profits or makes payments abroad, no tax is deducted at the source. Unlike many other countries that reduce their high statutory rates through treaties, the UAE’s agreements focus on protecting investors by limiting the taxes imposed in their home countries.

The UAE boasts a network of over 130 double tax treaties, covering numerous regions around the globe. These treaties often cap withholding tax rates in the source country at 5–15% for dividends and 0–10% for interest and royalties. Since the UAE already applies a 0% domestic rate, these treaty provisions serve more to shield investors from excessive taxation in their home countries than to reduce UAE withholding taxes. However, these benefits come with strict anti-abuse measures.

Conditions for Reduced Rates

Modern UAE tax treaties include robust anti-abuse provisions, such as Limitation on Benefits (LOB) clauses, Principal Purpose Test (PPT) rules, and restrictions on conduit arrangements. These measures are designed to prevent treaty benefits when the primary purpose of a structure is to secure reduced withholding rates. Tax authorities may deny treaty benefits if the UAE entity lacks sufficient economic substance, such as a physical office, local employees, board meetings, or actual business operations.

Additionally, beneficial ownership requirements add another layer of scrutiny. The UAE entity must demonstrate that it is the true economic owner of the income. Authorities assess whether key decisions are made within the UAE, whether local directors exercise real control, and whether the entity assumes economic risks consistent with its earnings. Without genuine substance – like holding board meetings, employing local staff, and conducting strategic decision-making within the UAE – investors risk losing treaty benefits under PPT or LOB challenges.

Investor Suitability

Given these conditions, the UAE is particularly appealing to investors whose home countries have favorable tax treaties with the UAE. The 0% withholding tax on outbound profit distributions allows investors to receive income without source-country tax deductions, and treaty benefits in their home country can further enhance this advantage. This makes the UAE an attractive base for holding companies, financing arrangements, or intellectual property structures, especially for operations targeting the Middle East and Asia-Pacific regions.

However, U.S. investors face notable challenges. The United States does not have an income tax treaty with the UAE, preventing U.S. persons from accessing reduced U.S. withholding rates through UAE-based structures. As a result, U.S.-sourced dividends and interest paid to UAE entities are subject to the full 30% statutory withholding rate. While the UAE’s 0% outbound withholding remains beneficial, U.S. investors must rely on strategies like entity classification, GILTI/Subpart F planning, and solid documentation to optimize their tax positions. Compared to jurisdictions like the Netherlands or Luxembourg, which maintain tax treaties with the U.S., the UAE is less competitive for U.S.-focused investments.

8. Hungary

Treaty Withholding Rates (Dividends, Interest, Royalties)

Hungary stands out as an appealing choice for cross-border tax planning, thanks to its favorable treaty withholding rates. Many of Hungary’s tax treaties reduce dividend withholding taxes to around 5% for substantial corporate shareholdings and 10–15% for portfolio investors. These rates are a clear improvement over non-treaty scenarios.

Interest and royalty payments enjoy even more attractive terms. Hungary’s treaties with OECD countries and other key jurisdictions often provide 0–10% withholding on cross-border interest and royalty payments. In some cases, interest payments that meet specific treaty conditions are entirely exempt from withholding taxes. This makes Hungary particularly attractive for financing and treasury operations, where non-treaty withholding rates could otherwise be significantly higher.

Conditions for Reduced Rates

While Hungary offers competitive rates, accessing these benefits requires meeting specific conditions. The recipient must be a resident of a treaty partner country, the beneficial owner of the income, and hold at least 10% of the shares in the Hungarian payer. Additionally, the recipient must maintain up-to-date tax residency and corporate documentation. In some cases, treaties also require a minimum holding period of 12 months.

Investor Suitability

Hungary’s treaty framework is especially advantageous for investors who can meet these conditions. It is well-suited for regional holding companies receiving dividends from Central and Eastern European countries, where treaties often reduce dividend withholding to 5% or less for substantial corporate shareholders.

The country also serves as an excellent base for financing and treasury centers, which can take advantage of reduced or zero withholding taxes on interest payments when lending to group companies. Similarly, IP-focused entities benefit from low or zero royalty withholding under certain treaties, provided they comply with transfer pricing and substance requirements. Private equity and investment funds can also benefit by structuring their holdings to meet ownership thresholds while avoiding treaty anti-abuse provisions.

Anti-Abuse Provisions

Hungary enforces strict measures to ensure that treaty benefits are tied to genuine economic activity. Its treaties incorporate BEPS and MLI standards, including enhanced Principal Purpose Tests (PPT) and anti-conduit rules. Many treaties require that the recipient is the beneficial owner of the income and that obtaining the reduced rate was not one of the arrangement’s primary purposes.

For treaties with Limitation on Benefits provisions, claimants may need to meet specific ownership, base-erosion, and activity tests, which can exclude passive or shell entities from accessing treaty benefits. This encourages the use of substantive Hungarian entities – those with real decision-making authority, local staff, and genuine business operations. Structures that lack local substance, such as those without local directors or decision-making capabilities, risk having their treaty benefits denied under PPT or beneficial ownership rules. Hungary’s framework ensures that tax benefits are reserved for arrangements with legitimate commercial substance rather than purely tax-driven setups.

Comparison of Benefits and Drawbacks

This section takes a closer look at the advantages and challenges associated with eight jurisdictions that are well-known for their favorable double tax treaty regimes. The table below highlights key points, focusing on treaty coverage, qualification criteria, and practical considerations.

| Country | Key Benefits | Main Drawbacks |

|---|---|---|

| Netherlands | Extensive treaty network with favorable rates, plus the added benefits of EU membership. | Tightening anti-abuse rules and stricter substance requirements can be difficult for entities without a strong local presence. |

| Luxembourg | Broad treaty network with reduced withholding tax rates under qualifying conditions, supported by EU directives. | Higher setup and compliance costs, along with stringent beneficial ownership tests, may deter some investors. |

| Switzerland | Wide treaty coverage, a strong financial ecosystem, and favorable cantonal tax regimes for holding companies. | Higher operational costs and a complex, variable tax framework demand careful navigation. |

| Ireland | Competitive corporate tax rates, effective treaty benefits, and EU membership perks. | Strict substance requirements and detailed compliance measures, including transfer pricing documentation. |

| Singapore | Territorial tax system with no domestic withholding on many cross-border payments, backed by a strong regional treaty network and political stability. | Higher setup and operational expenses, coupled with stringent substance and transparency requirements. |

| Hong Kong | Low-tax environment with no domestic withholding on dividends and interest, supported by a territorial tax system. | Limited treaty network and evolving regulations may increase compliance demands. |

| United Arab Emirates | Emerging treaty hub with favorable domestic tax conditions and strategic access to the Middle East. | Regulatory uncertainty due to an evolving tax framework and stricter transparency standards. |

| Hungary | Competitive treaty benefits and lower setup costs, along with EU directive access as an EU member. | A narrower treaty network and strict compliance rules, including specific holding conditions, may limit its appeal. |

According to the OECD’s Corporate Tax Statistics 2025, many jurisdictions offer treaty-based withholding tax (WHT) rates below 5%, particularly for interest and royalties, showcasing the competitive edge these treaties provide. An IMF working paper further emphasizes that the lowest withholding rate within a country’s treaty network can significantly influence cross-border investments and profit-shifting strategies. For advanced economies, tax treaties often reduce withholding rates on royalties and technical fees by around 15 percentage points, illustrating the importance of examining treaty details beyond surface-level rates.

Costs for setup and operations differ widely. Jurisdictions like Luxembourg and Switzerland may come with higher expenses, while others, such as Hungary, present more affordable entry points. However, the decision shouldn’t rely solely on tax savings. Factors like substance requirements, compliance obligations, and local regulatory environments play a critical role in determining the best jurisdiction for an investment structure.

Ultimately, the right choice depends on an investor’s cash flow needs, ownership structure, and ability to meet compliance demands.

Conclusion

Selecting the right jurisdiction to optimize withholding tax rates hinges on your specific investment goals and structure. For individual investors focused on generating passive income, jurisdictions like Singapore or Hong Kong often stand out. Their territorial tax systems and low domestic withholding rates create efficient setups for income streams. On the other hand, corporate entities, particularly holding companies, may find jurisdictions like the Netherlands, Luxembourg, or Switzerland more appealing. These countries offer extensive treaty networks, albeit with higher operational costs. The key takeaway? Align your jurisdiction choice with your business model and priorities.

Your business structure plays a crucial role in this decision. Holding companies typically benefit from jurisdictions with broad treaty coverage, whereas operating companies must consider whether they can realistically meet substance requirements. Surveys show that Switzerland and Singapore are often top choices for treaty planning, underscoring their appeal in international tax strategies. Beyond withholding rates, these jurisdictional differences can significantly impact asset protection on a global scale.

Navigating these complexities requires professional expertise. Anti-abuse regulations are stringent, and failing to meet compliance standards can lead to unexpected tax liabilities. Recent policy changes in the Netherlands, for instance, highlight how quickly compliance requirements can evolve.

If you’re looking for expert guidance, Global Wealth Protection can help. They specialize in assisting location-independent entrepreneurs and investors in structuring businesses to minimize taxes and safeguard assets. Through their GWP Insiders membership program, you can access tailored advice on jurisdiction selection for company formation and personal residency, along with personalized consultations to address your unique needs.

FAQs

What do you need to qualify for lower withholding tax rates under Double Tax Treaties?

To take advantage of reduced withholding tax rates under Double Tax Treaties, there are a few essential steps to follow. First, you need to be a resident of one of the countries participating in the treaty. To prove this, you’ll typically need to provide a valid tax residency certificate issued by the tax authorities in your country.

Next, you must meet the treaty’s specific conditions. These often include being the beneficial owner of the income and ensuring that the income aligns with the treaty’s intended purpose.

Since the requirements can differ depending on the countries involved, it’s crucial to carefully review the details of the applicable treaty. Working with a tax professional can help you navigate the process, stay compliant, and make the most of the treaty’s benefits.

How do anti-abuse rules impact the use of Double Tax Treaties?

Anti-abuse rules exist to stop individuals and businesses from taking advantage of Double Tax Treaties in ways they shouldn’t. These rules ensure that treaties serve their actual purpose: preventing double taxation. At the same time, they work to discourage practices like tax evasion or overly aggressive tax strategies.

By focusing on artificial setups or schemes designed purely to exploit tax treaties, these measures help uphold fairness in global taxation and safeguard the reliability of tax systems.

Which countries have the lowest withholding tax rates for U.S. investors under double tax treaties?

Countries like Anguilla, Seychelles, Nevis, Panama, the United Kingdom, and Estonia stand out for offering appealing withholding tax rates to U.S. investors. These locations often benefit from favorable double tax treaties or naturally low withholding rates, making them popular choices for international investments.

However, it’s crucial to carefully review the terms of each treaty and assess how they fit with your specific investment plans. Working with a tax professional can help you navigate these options effectively, ensuring your strategy aligns with your goals while staying fully compliant with the law.