The Foreign Account Tax Compliance Act (FATCA) is a U.S. law designed to combat tax evasion by requiring U.S. taxpayers and foreign financial institutions (FFIs) to report foreign financial assets. Here’s what you need to know:

- Who Needs to Report: U.S. taxpayers with foreign financial assets exceeding specific thresholds must file Form 8938. FFIs must identify and disclose accounts held by U.S. persons, often detailed in an offshore banking report.

- Penalties for Non-Compliance: Individuals face penalties starting at $10,000, while FFIs risk a 30% withholding tax on U.S.-source payments.

- Filing Deadlines: For 2025 tax returns, Form 8938 is due April 15, 2026, with extensions available.

- Key Updates for 2026: New digital asset reporting rules take effect, and relief for FFIs has been extended for compliance challenges.

Failing to comply can lead to severe penalties, so understanding these rules is critical for both individuals and institutions. FATCA ensures transparency in offshore financial reporting, and staying compliant is essential to avoid fines and audits.

Who Must File Under FATCA?

FATCA imposes reporting requirements on two main groups: U.S. persons holding foreign assets and Foreign Financial Institutions (FFIs) serving U.S. account holders. Knowing which group you fall into is key to understanding your specific obligations.

Definition of U.S. Persons

Under FATCA, a U.S. person includes all U.S. citizens and resident aliens, no matter where they live. This means that U.S. citizens and green card holders are subject to FATCA even if they reside outside the United States.

Certain U.S.-based entities – like corporations, partnerships, and trusts – also qualify as U.S. persons if they hold specified foreign financial assets. However, there’s an important condition: you only need to file Form 8938 if you’re already required to file a U.S. income tax return for that year. If your income is below the standard filing threshold, you’re exempt from FATCA reporting, regardless of the value of your foreign assets.

For U.S. residents, FATCA thresholds are $50,000 at the end of the year or $75,000 at any point during the year. If you live abroad, these thresholds increase to $200,000 and $300,000, respectively. Married couples filing jointly can double these limits. To qualify for the higher thresholds for those living abroad, you must establish a foreign tax home and spend at least 330 days outside the United States during the year.

Now let’s look at the obligations placed on Foreign Financial Institutions.

Foreign Financial Institution (FFI) Obligations

Foreign Financial Institutions (FFIs) face their own set of requirements under FATCA. FFIs include a range of entities, such as:

- Depository institutions (e.g., banks and savings associations)

- Custodial institutions (e.g., mutual funds and brokerages)

- Investment entities (e.g., hedge funds and private equity funds)

- Insurance companies offering cash value products or annuities

To avoid a 30% withholding tax on certain U.S.-source payments, FFIs must register with the IRS through the FATCA Registration Website. Once registered, they receive a Global Intermediary Identification Number (GIIN), which identifies them to both withholding agents and the IRS. The IRS publishes a monthly list of registered FFIs and their GIINs for verification purposes.

Registered FFIs must fulfill three main responsibilities:

- Identify U.S. account holders through due diligence.

- Report annually on these accounts, providing details to the IRS.

- Withhold 30% on certain payments to non-compliant foreign payees or account holders who refuse to provide required information.

In addition, FFIs must report foreign entities with substantial U.S. taxpayer ownership.

The reporting process depends on the jurisdiction. As of late 2025, more than 115 jurisdictions have signed FATCA Intergovernmental Agreements (IGAs). Under Model 1 IGAs, FFIs report to their local tax authorities, which then share the data with the IRS. Under Model 2 IGAs, FFIs report directly to the IRS using the International Data Exchange Service (IDES).

Some FFIs are exempt from registration and reporting. These include most government entities, non-profit organizations, small local financial institutions that primarily serve residents of their own country, and certain retirement entities. To qualify for reduced reporting requirements, these "local" FFIs must avoid soliciting business abroad and must not discriminate against U.S. citizens living in their country.

Filing Thresholds and Reportable Assets

When it comes to FATCA filing requirements, the first step is figuring out the value of your foreign assets. Whether or not you need to file Form 8938 boils down to two key factors: the total worth of your foreign assets and the types of assets you own. These thresholds and definitions are what determine your reporting responsibilities.

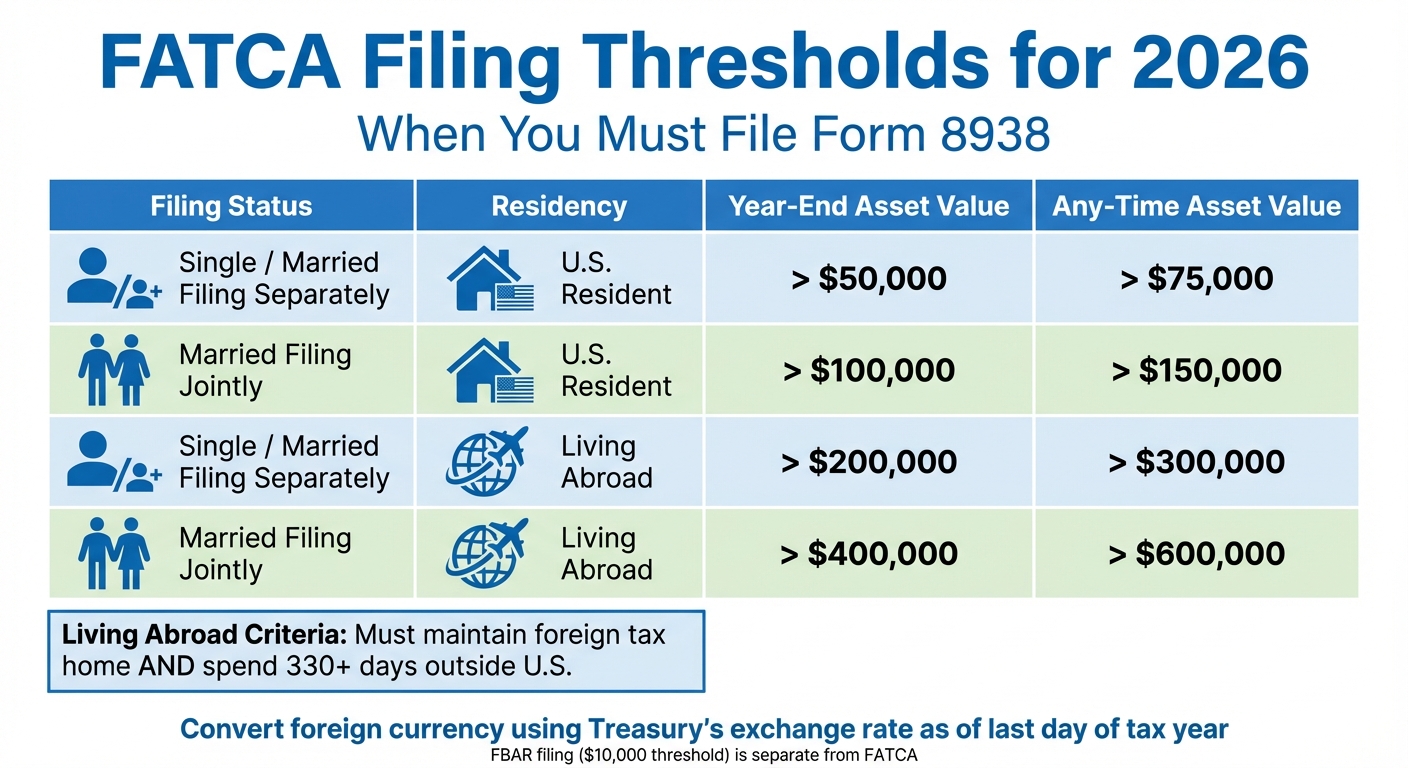

FATCA Filing Thresholds for 2026

The FATCA thresholds for the 2025 tax year (to be filed in 2026) remain unchanged from previous years. Whether you need to file depends on your residency and tax filing status.

You’re required to file Form 8938 if the total value of your specified foreign financial assets exceeds either the year-end limit or the highest value during the year. For U.S. residents filing as single or married filing separately, the thresholds are $50,000 at year-end or $75,000 at any point during the year. Married couples filing jointly have higher thresholds: $100,000 at year-end or $150,000 at any time during the year.

For those living abroad, you must meet two criteria: maintain a foreign tax home and spend at least 330 days outside the U.S. during the year. In such cases, the thresholds increase significantly. Single filers or those married filing separately must report if their assets exceed $200,000 at year-end or $300,000 at any point during the year. Married couples filing jointly face thresholds of $400,000 at year-end or $600,000 at any time during the year.

| Filing Status | Residency | Year-End Asset Value | Any-Time Asset Value |

|---|---|---|---|

| Single / Married Filing Separately | U.S. Resident | > $50,000 | > $75,000 |

| Married Filing Jointly | U.S. Resident | > $100,000 | > $150,000 |

| Single / Married Filing Separately | Living Abroad | > $200,000 | > $300,000 |

| Married Filing Jointly | Living Abroad | > $400,000 | > $600,000 |

To convert foreign currency values, use the Treasury’s exchange rate as of the last day of the tax year.

It’s worth noting that FATCA and FBAR (FinCEN Form 114) are separate filings. Even if you’ve already filed an FBAR, which has a much lower $10,000 threshold, you still need to file Form 8938 if your foreign assets meet the FATCA thresholds.

Now that the thresholds are clear, the next step is identifying which foreign assets need to be reported.

Types of Reportable Foreign Assets

Meeting the thresholds means you’ll need to report certain types of foreign assets, which fall into two main categories: foreign financial accounts and foreign non-account assets held for investment.

Foreign financial accounts include items like checking or savings accounts, brokerage accounts, and foreign retirement plans. If you share an account with a non-U.S. spouse, you generally must report the full balance on Form 8938, not just your portion.

Non-account assets cover a broad range of holdings, such as foreign stocks or securities held directly, interests in foreign partnerships or corporations, foreign hedge funds, and life insurance policies with cash value. For instance, foreign stocks in a U.S. brokerage account don’t need to be reported, but if held directly or through a foreign brokerage, they do.

Some assets are excluded from reporting. For example, foreign real estate owned directly isn’t considered a specified foreign financial asset, though shares in a foreign real estate investment trust (REIT) are reportable. Similarly, social security payments from foreign governments are exempt. Assets used in a trade or business, rather than for investment, are also not subject to FATCA reporting.

"Specified foreign financial assets include foreign financial accounts and foreign non-account assets held for investment… such as foreign stock and securities, foreign financial instruments, contracts with non-U.S. persons, and interests in foreign entities."

– IRS

If you’ve already reported certain assets on other IRS forms – like Form 3520 for trusts, Form 5471 for foreign corporations, or Form 8621 for passive foreign investment companies – you don’t need to duplicate those details on Form 8938. Instead, simply note the forms you filed and include the asset values when calculating your thresholds.

The IRS is also monitoring digital assets held in foreign exchanges. While reporting for all crypto holdings isn’t yet mandatory, this area is evolving, and investors should stay informed to avoid compliance issues in 2026. As CPA Vincenzo Villamena advises:

"When in doubt, report. It’s better to include a borderline asset than risk a penalty for omission. Over-reporting does not trigger penalties, under-reporting does".

How to File Form 8938

If you’ve determined that you meet the reporting thresholds for foreign financial assets, the next step is completing and submitting Form 8938. This form must be attached to your annual federal tax return. Knowing the layout of the form and what details go where can make the process much smoother.

Understanding Form 8938 Sections

Form 8938 consists of six parts, each focusing on specific details about your foreign financial assets:

- Part I: This section is for reporting foreign financial accounts, such as checking, savings, or brokerage accounts held with foreign institutions. You’ll need to include the account holder’s name, the institution’s address, and the maximum balance during the year.

- Part II: Here, you’ll report foreign financial assets not held in an account. This could include foreign stocks, bonds, or ownership interests in foreign entities like partnerships or corporations.

- Part III: Use this section to report income generated from the assets listed in Parts I and II. This includes earnings like interest, dividends, royalties, or capital gains.

- Part IV: If any of your foreign assets are already reported on other IRS forms (e.g., Form 3520, 5471, or 8621), list them here. While you don’t need to duplicate details, you must note which forms were filed and include those asset values when determining whether you meet the filing thresholds.

- Parts V and VI: These sections gather additional account details, such as account numbers or other required information.

When completing the form, convert all foreign financial amounts into U.S. dollars using the Treasury Department’s exchange rate as of the last day of the tax year. For valuation, you can use a reasonable estimate of the highest fair market value during the year. If you’re reporting bank account balances, annual financial statements are generally sufficient. Keep supporting documents like foreign bank statements and account summaries in case the IRS requests verification.

Once you understand the structure of the form, you’re ready to move on to the filing process and deadlines.

Filing Process and Deadlines

After completing Form 8938, attach it to your federal tax return and file it by the standard tax deadline: April 15, 2026. If you’re living abroad, the deadline extends to June 16, 2026, and you can file for an additional extension until October 15, 2026 by submitting Form 4868.

If you’re not required to file a federal income tax return for the year, you generally won’t need to file Form 8938, even if you hold foreign assets. However, if your foreign assets meet the specified thresholds, filing Form 8938 is mandatory regardless of your income.

It’s important to note that filing Form 8938 does not eliminate the need to file an FBAR (FinCEN Form 114) if your foreign account balances exceed $10,000 at any point during the year. The FBAR must be submitted separately through FinCEN’s BSA E-Filing System and follows its own deadline. Ensure the information on both forms matches to avoid raising red flags with the IRS.

sbb-itb-39d39a6

Penalties for FATCA Non-Compliance

The IRS takes FATCA compliance seriously, backing it up with stiff penalties and advanced data analysis to ensure both individuals and institutions meet their obligations.

Monetary Penalties

Failing to file Form 8938 can cost you. The initial penalty is $10,000, but if non-compliance continues for more than 90 days after receiving an IRS notice, an additional $10,000 is added every 30 days, up to a maximum of $50,000. In total, penalties for not filing can reach $60,000.

Beyond filing penalties, if you fail to disclose foreign financial assets and this omission causes you to underreport your tax liability, the IRS can impose a penalty of 40% on the underreported tax tied to those assets.

For Foreign Financial Institutions (FFIs), the stakes are even higher. Non-compliance or refusal to enter into an FFI agreement results in a 30% withholding tax on certain U.S.-source payments, including interest, dividends, and proceeds from securities sales. Additionally, failing to report over $5,000 in gross income from foreign assets can extend the statute of limitations on your tax return to six years – or keep it open for three years after the required information is finally provided.

These penalties are part of the IRS’s broader strategy, which relies on cutting-edge technology to enforce compliance.

IRS Enforcement Trends

The IRS has stepped up its game with advanced enforcement tools. Using AI and data analytics, the agency now risk-scores every tax return. As Mike Wallace, CEO of Greenback Expat Tax Services, explains:

"The IRS is no longer relying on manual or random audits. Its computer systems automatically risk-score every return, prioritizing those that stand out".

This means discrepancies between your Form 8938 and data reported by foreign banks are flagged quickly.

The IRS also receives direct reports from Foreign Financial Institutions through the International Data Exchange Service (IDES). This automated system cross-references information from foreign banks and governments with your Form 8938. Wallace emphasizes:

"Compliance (filing correctly, completely, and on time) is now mandatory, even when no tax is owed".

Enforcement efforts are increasingly focused on high-net-worth individuals and those with substantial ownership in foreign entities. The IRS is also zeroing in on gatekeepers, such as investment advisors, accountants, and attorneys, who help structure offshore arrangements. As noted by Holland & Knight:

"In 2026, OFAC will intensify its enforcement crackdown on gatekeepers – professional service providers such as investment advisors, accountants, attorneys and providers of trust and corporate services – who fail to properly understand and mitigate sanctions risks".

2026 Updates to FATCA Regulations

The 2026 updates to FATCA regulations introduce new rules aimed at addressing digital asset reporting and easing compliance challenges for Foreign Financial Institutions (FFIs). These changes reflect the IRS’s ongoing efforts to adapt to evolving financial landscapes while providing transitional support for institutions navigating complex requirements.

Digital Asset Reporting Guidance

Starting January 1, 2026, brokers will need to report the cost basis for digital asset transactions, replacing the previous gross proceeds reporting system used in 2025. For instance, if you sell cryptocurrencies like Bitcoin or Ethereum through a custodial exchange, the IRS will now receive both the purchase and sale prices, ensuring accurate capital gains calculations. This change builds on the IRS’s increased focus on digital asset compliance.

The newly introduced Form 1099-DA, titled "Digital Asset Proceeds from Broker Transactions", will serve as the primary reporting tool. This form applies to a broad range of digital assets, including cryptocurrencies, stablecoins, and non-fungible tokens (NFTs), defined as any digital representation of value recorded on a cryptographically secured distributed ledger.

Additionally, real estate professionals must comply with new rules. For property transactions closing on or after January 1, 2026, where digital assets are used as payment, the fair market value of those assets must be reported to the IRS.

To ease the transition, the IRS is offering a "good faith" compliance period for 2025 transactions (reported in 2026). Brokers making genuine efforts to meet the new requirements may qualify for penalty waivers, even for late or incorrect filings of Form 1099-DA. To further reduce risks, brokers are encouraged to use the IRS TIN-matching program in 2026, which helps prevent backup withholding and related penalties.

Beyond digital asset reporting, the IRS has also extended relief measures for FFIs to help them stay compliant during this transition period.

FFI Relief Extensions

Under IRS Notice 2024-78, temporary relief for Reporting Model 1 FFIs has been extended through 2025, 2026, and 2027. This extension provides flexibility in obtaining Taxpayer Identification Numbers (TINs) for preexisting accounts. During this period, the IRS will not consider a Model 1 FFI to be in "significant non-compliance" solely for failing to report U.S. TINs.

However, the relief comes with new conditions. FFIs must report a Foreign TIN (FTIN) if available in their records and use the "AddressFix" element to document the city and country of residence for account holders missing a U.S. TIN. These requirements differ from the earlier relief notices issued for 2022–2024.

"Notice 2024-78 extends through 2027 the relief program that the IRS previously set out for 2022–2024 in Notice 2023-11"

The extended relief applies only to preexisting accounts, defined as those maintained as of the determination date outlined in the relevant Intergovernmental Agreement (IGA). For accounts opened after that date, FFIs must either provide a U.S. TIN or use TIN Code 999999999. FFIs are also required to conduct an annual electronic search for missing TINs and send annual requests to account holders using the most effective communication method.

To ensure compliance, FFIs must retain records of their TIN solicitation policies through 2031, extending the previous deadline by three years.

"Significant noncompliance with the documentation and data collection obligations under an IGA could result in the FFI being subject to Foreign Account Tax Compliance Act (FATCA) withholding on US-source payments received"

This extended relief period offers FFIs an opportunity to refine their Know Your Customer (KYC) processes and upgrade automated reporting systems to handle these new requirements effectively. However, the IRS has indicated that any future permanent relief will likely be more limited in scope than the current temporary measures.

Conclusion

FATCA compliance isn’t just a legal obligation – it’s a necessity for U.S. taxpayers and Foreign Financial Institutions (FFIs) navigating today’s interconnected financial landscape. Non-compliance can lead to steep penalties, prolonged audits, and for FFIs, even exclusion from the U.S. financial market.

With 113 countries participating through intergovernmental agreements and approximately 250,000 FFIs impacted globally, FATCA has fundamentally changed the way offshore assets are handled. The IRS’s advanced data analytics now cross-check reports from FFIs with individual filings, making discrepancies harder to conceal and quicker to flag.

For taxpayers who’ve missed the mark, the Streamlined Filing Compliance Procedures offer a lifeline. This program allows individuals to correct past omissions without facing standard penalties, but only if they act before the IRS identifies the issue. Not filing Form 8938 leaves the statute of limitations open for three years after the required information is provided – or six years if over $5,000 of income was omitted.

Looking ahead, the 2026 updates introduce new digital asset reporting requirements and extend relief for FFIs through 2027. These changes demand immediate attention. FFIs and taxpayers must ensure their systems and records are up to date, verify Global Intermediary Identification Numbers (GIIN), and maintain detailed records of all foreign holdings, including cryptocurrencies on non-U.S. exchanges. When converting foreign balances, it’s crucial to use the IRS-approved year-end Treasury exchange rate.

As regulations evolve and enforcement intensifies, the cost of non-compliance grows. FATCA isn’t just about following rules – it’s about ensuring transparency in global financial reporting. Ignoring these requirements can lead to severe financial and operational consequences. Whether you’re an individual with foreign accounts surpassing reporting thresholds or an FFI managing U.S. account holders, staying ahead of compliance requirements is key to avoiding penalties and maintaining access to the U.S. financial system.

For tailored advice on navigating FATCA compliance and protecting offshore assets, visit Global Wealth Protection.

FAQs

What updates are expected for FATCA reporting requirements on digital assets in 2026?

While there’s no detailed information yet about changes to FATCA reporting requirements for digital assets in 2026, the IRS has been actively developing regulations for reporting the sale and exchange of these assets. This suggests that updates could be on the horizon.

If you’re an entrepreneur or investor managing digital assets, staying informed about new IRS guidance is crucial to remain compliant. Working with a tax professional or a specialized service provider can help you handle these evolving regulations with confidence.

How can U.S. taxpayers find out if they need to file under FATCA?

To figure out if you need to file under FATCA, start by adding up the total value of all your foreign financial assets. Then, compare that amount to the IRS filing thresholds. These thresholds depend on your tax filing status – like whether you’re single or married filing jointly – and whether you live in the U.S. or abroad. If your foreign assets exceed the threshold that applies to you, you’ll need to report them. For the most accurate and current numbers, check the IRS guidelines on FATCA compliance.

Keep in mind that these thresholds can change over time, so it’s crucial to stay updated to ensure you’re meeting the requirements.

What happens to Foreign Financial Institutions (FFIs) if they don’t comply with FATCA?

Foreign Financial Institutions (FFIs) that don’t adhere to the requirements of the Foreign Account Tax Compliance Act (FATCA) face steep penalties. One of the most severe is a 30% withholding tax on specific U.S.-source payments, including interest, dividends, and other forms of income.

Beyond this withholding tax, the IRS may impose additional penalties for non-compliance. These penalties can disrupt an institution’s operations and tarnish its reputation. Staying compliant with FATCA is essential to sidestep these financial and reputational risks.