The economies around the world are in an economic conundrum seeing varying levels of inflation and unemployment giving rise to the theory that stagflation is imminent.

October 11,2021

By: Bobby Casey, Managing Director GWP

Ever hear someone say: “We’re all in the same boat”? While that sounds unifying, it’s wrong. We aren’t in the same boat. We’re in the same waters, all in different boats, getting affected by the tides differently.

The economic affects of the emergency policies in the US are not nearly as bad as those in places like Brazil or India. And even within developed countries like the US or the UK, the effects felt by the middle class are different from what is felt by the poor.

Government interventions couched in “helping the poor” usually wind up hurting them even more. They are cans kicked down the road that revisit with interest. Trillions in stimulus, extended unemployment, restrictions on activities, and vaccination mandates took a toll. Lock-downs drove people to take their commerce online, and COVID related “precautions” congested the ports.

Much to the chagrin of global leaders, the inevitable topic of inflation keeps surfacing. Pesky economics is really robbing the spotlight from these puffed chested politicians who are tripping on the power they have spending on various “stimulus” programs to look benevolent.

To be fair, some of the price hikes are to do with the backlogged supply chain at the ports and shipping in general. Supposedly this has to do with shortages of staff and extra precautions around the pandemic, but that means refined oil takes longer to get to the gas stations, food takes longer to get to the grocers, and hardware takes longer to get to constructions sites.

So the supply chain stoppage is certainly relevant with regard to price hikes.

But let’s not pretend that the trillions in “emergency” printing and spending shares no culpability here. Logistics can be sorted, and once they are, their effects will be felt relatively quickly. But money printing and super low interest rates? Not so much.

The Organization for Economic Cooperation and Development (OECD) believes the supply chain issues and vaccination rates are to blame for the uncertainty of inflation. I’m reticent to accept that the lion’s share belongs to that alone.

People are feeling the crunch of empty shelves and higher prices in general. But if this was just temporary, why are some signals suggesting otherwise?

Here’s an excerpt of a post from a Facebook friend who works in the mortgage industry:

It is confirmed that the conforming loan limit will rise to $625,000 next year for a single family residence on a conventional mortgage.

This is the highest amount of money someone can borrow for the “conventional loan” loan product. This is the most common residential mortgage product.

It is rising from $548,200. That’s a 13% jump year-over-year and the largest ever jump in a single year.

For comparison, from 2006-2016, it remained stagnant at $417,000. 2017-2022 it will have risen 32%, with 13% of that rise coming from 2021-2022 bump.

One might see this as a lagging indicator of real inflation.

13%.

So if you’re waiting to buy a house until next year because you think prices “might settle down,” there is no reason to think that will happen. Borrowers in 2022 will be able to get a conventional mortgage for $75,000 more than what they could in 2021.

Home prices will not get cheaper in 2022.

This is a rather distressing signal. Anyone who’s watched a similar pattern happen with higher education knows this is bad news for “affordable housing”. Low interest rates, and pumping more money into the markets are a recipe for disaster.

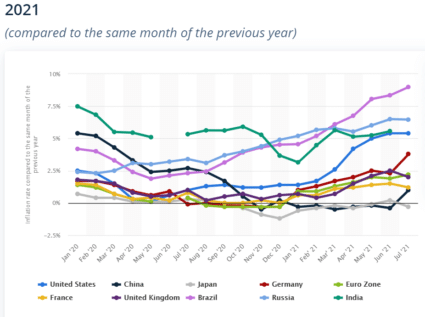

Most countries around the world are seeing some sort of inflation to varying degrees. But looking at this chart, the US is dabbling in the same space as developing countries such as Brazil, Russia, and India! It’s not exactly in good company economically.

Brazil has been particularly hard. In addition to supply chain disruptions, they are suffering one of the worst droughts in nine years. So it’s expected that 2021 will “finish at 8.51%, then slow to 4.14% by end-2022” according to the Associated Press. However, in that same article, there are some items that have surged in price:

While headline inflation just entered double-digit territory, many specific items were already there. In the 12 months through September, electricity prices jumped 28.8% and cooking gas 34.7%, according to data released Friday. Chicken surged 28.8% and red meat 24.8%.

Of course, the hardest hit are the nation’s poor. This is always the case. Low wage earners will struggle even more to make ends meet as things become more expensive. Naturally, we can expect political partisans to insist upon raising the minimum wage.

This isn’t a foreign cycle: the central banks trigger inflation, poor people can’t live off their wages, politicians demand higher wage mandates to keep up, which inflates costs even more.

The US is seeing hikes in food and fuel prices as well. Certainly not to the extend that Brazil is, but noticeable enough. Look at what the USDA Economic Research Service Survey reported:

The food-away-from-home (restaurant purchases) CPI increased 0.4 percent in August 2021 and was 4.7 percent higher than August 2020; and

The food-at-home (grocery store or supermarket food purchases) CPI increased 0.3 percent from July 2021 to August 2021 and was 3.0 percent higher than August 2020.

In 2021, food-at-home prices are expected to increase between 2.5 and 3.5 percent, and food-away-from-home prices are expected to increase between 3.5 and 4.5 percent. In 2022, food-at-home prices are expected to increase between 1.5 and 2.5 percent, and food-away-from-home prices are expected to increase between 3.0 and 4.0 percent.

This is a 3% tax on groceries across the board, but you don’t get anything for it.

A term coined during the Carter Administration in the US was: Stagflation. According to Investopedia:

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation). Stagflation can be alternatively defined as a period of inflation combined with a decline in the gross domestic product (GDP).

Murmurs are stirring in the UK if this is where they are headed. And it looks to be the case in many of the G-20 nations. No amount of further government meddling or central planning is going to fix this, yet I fear that’s exactly what the world is in for.

Click here to schedule a consultation on how you can protect your assets from overreaching governments, or here to become a member of our Insider program where you are eligible for free consultations, deep discounts on corporate and trust services, plus a wealth of information on internationalizing your business, wealth and life.