When it comes to protecting real estate, LLCs and trusts are two popular options, each with distinct benefits:

- LLCs: Best for limiting personal liability. They shield your personal assets from lawsuits tied to your property.

- Trusts: Focus on estate planning and privacy. They help avoid probate, keep financial details private, and offer control over inheritance.

If you’re managing rental properties, an LLC can protect you from tenant-related risks. If your goal is long-term wealth transfer, a trust ensures smooth asset distribution. Combining both – a trust-owned LLC – offers liability protection and estate planning benefits.

Quick Comparison

| Criteria | LLC | Trust |

|---|---|---|

| Liability Protection | Limits personal liability to LLC-owned assets | Stronger with irrevocable trusts; revocable trusts offer limited protection |

| Privacy | Public registration required | Typically private, no public registration |

| Tax Treatment | Pass-through taxation | Focuses on estate tax planning |

| Estate Planning | Does not bypass probate | Avoids probate, allows controlled inheritance |

| Costs | Lower setup costs, but ongoing state fees | Higher initial costs, minimal ongoing fees |

For maximum protection, combining both structures may be the best route. Always consult professionals to tailor a strategy to your needs.

How LLCs Protect Real Estate

Liability Protection Through LLCs

An LLC creates a legal barrier between your real estate investments and your personal assets. If legal trouble arises – like a tenant getting injured – creditors can only go after the LLC’s assets, not your personal property. For personal creditors, many states limit their reach to what’s called a "charging order." This means they can claim distributions from the LLC but can’t seize ownership or its assets.

Take this example: If "VacationsRUs LLC" owns a vacation rental and a guest wins a lawsuit after being injured, the creditors can only target the LLC’s holdings. Your personal savings, home, or car stay off-limits. However, this protection isn’t foolproof. If you mix personal and business funds, courts could "pierce the corporate veil", making you personally liable.

"LLCs and insurance. Those types of asset protection are there for you when something goes wrong" – Bonnie Galam

To maintain this protection, keep meticulous records and separate your personal and business finances. Now, let’s dive into how LLCs are taxed and why that matters for real estate investors.

How LLCs Are Taxed

LLCs are designed with tax simplicity in mind. They use pass-through taxation, which means the LLC’s profits and losses appear on your personal tax return, helping you avoid double taxation. If you have a single-member LLC, the IRS treats it as a "disregarded entity" for federal tax purposes. While LLCs are primarily about liability protection, they do offer some tax perks.

For instance, you can deduct expenses like maintenance, property management fees, and depreciation. If your LLC operates at a loss, those losses can offset your personal income, potentially lowering your tax bill. Plus, you can factor in the mortgage amount when calculating losses. Both LLCs and trusts allow for 1031 exchanges, which let you defer capital gains taxes when selling one rental property and buying another within the IRS’s specified timeframe.

However, transferring property into an LLC isn’t always straightforward. Such a move could trigger state transfer taxes, capital gains taxes if the property has appreciated, or even a property tax reassessment. Additionally, transferring property before inheritance might result in the loss of a stepped-up basis for heirs, leading to higher capital gains taxes down the line. Always consult a tax expert before making these kinds of transfers.

With the tax side of LLCs covered, let’s take a closer look at the costs and requirements of forming and maintaining one.

LLC Costs and Requirements

Setting up an LLC involves several steps, including filing Articles of Organization with your state, choosing a unique business name, appointing a Registered Agent, and getting an Employer Identification Number (EIN) from the IRS. The initial costs depend on your state but usually fall in the range of a few hundred dollars. Some online services offer packages starting at around $49, plus state fees. It’s also a good idea to create an Operating Agreement to outline how the LLC will be managed.

Once your LLC is up and running, there are ongoing expenses. You’ll need to pay annual state fees and taxes, which can go as high as $800 or more for profitable LLCs. Even if your LLC doesn’t owe taxes, you’re required to file annual tax returns and provide Schedule K-1 forms to members.

To keep your LLC in good standing, maintain financial separation by using a dedicated business bank account. If you’re planning to transfer a mortgaged property into the LLC, check with your lender first. Some mortgages include "due on sale" clauses, which could be triggered by the transfer.

"It generally costs more to form and operate an LLC than a sole proprietorship or partnership. You must pay filing fees to form an LLC. Although usually not legally required, it’s highly recommended for LLCs to adopt a written LLC operating agreement laying out how the LLC will be governed. Once the LLC is formed, you’ll have to pay annual fees and taxes to the state. These vary from state to state but can be as high as $800 per year or more for highly profitable LLCs" – Nolo

How Trusts Protect Real Estate

Types of Trusts for Real Estate

If you’re looking for an alternative to LLCs for protecting your real estate, trusts might be the solution.

A trust allows you to transfer property management to a trustee, following the terms you establish as the grantor. By placing real estate into a trust, the property is no longer part of your personal estate. This shift can bring benefits like smoother management, potential tax perks, and greater privacy.

There are two primary types of trusts for real estate: revocable living trusts and irrevocable trusts. A revocable living trust gives you flexibility since you can modify or cancel it during your lifetime. You maintain full control of the property, and after your death, the assets pass directly to your beneficiaries without the need for probate. However, because you retain control, creditors may still be able to access the assets.

On the other hand, an irrevocable trust offers a different approach. Once created, it typically cannot be changed or canceled. This lack of flexibility comes with a major advantage: strong protection against creditors. By transferring ownership of the property to the trust, it’s no longer part of your estate, making it much harder for creditors to claim. If shielding assets from potential creditors is a top priority, an irrevocable trust is often the better choice.

One key point to remember: a trust only provides these advantages if you transfer your assets into it while you’re alive. Any property left out of the trust will still go through probate after your death.

Creditor Protection in Trusts

Irrevocable trusts are particularly effective at protecting assets from creditors and lawsuits. By transferring ownership to the trust, the property is no longer legally tied to you, making it difficult for creditors to access. In contrast, revocable trusts offer limited protection since you retain control over the assets.

Timing is everything. If you move property into a trust with the intention of dodging existing or imminent debts, courts might see this as a fraudulent transfer, which creditors can challenge. To ensure protection, it’s best to establish and fund the trust well before any financial trouble arises. Working with an experienced asset protection attorney can help you structure the trust correctly and avoid legal pitfalls.

Beyond shielding assets from creditors, trusts also serve as valuable tools for estate planning and maintaining privacy.

Estate Planning and Privacy Benefits

Trusts are excellent for preserving wealth and ensuring your assets are distributed according to your wishes after your death. You can set specific conditions for inheritance, like requiring beneficiaries to meet certain criteria, which ensures your intentions are honored.

Another advantage is that trusts bypass the public and often lengthy probate process, allowing heirs to receive their inheritance quickly and privately. As attorney Michael K. Elson explains:

"Probate entails public court proceedings which can last two years or more; whereas trusts are private and can be administered very quickly which your heirs will greatly appreciate".

Trusts can also provide tax benefits by reducing estate taxes and maximizing exemptions, potentially saving married couples close to $1 million. In cases where you become incapacitated, a trust can prevent the courts from taking control of your assets. Additionally, trusts offer a level of privacy that LLCs typically cannot match, as trusts do not require public registration, while LLC membership information is often part of public records.

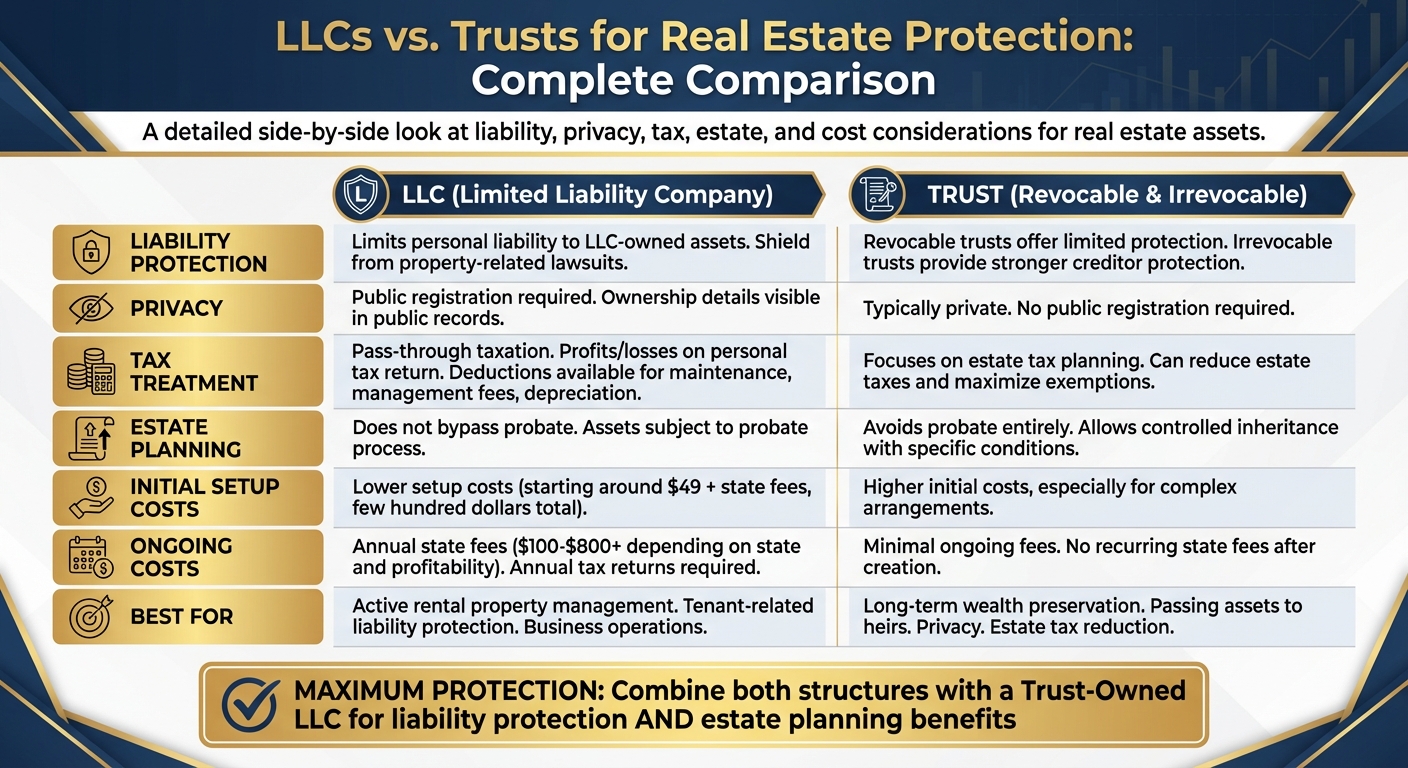

LLCs vs. Trusts: Side-by-Side Comparison

Comparison Criteria

To make an informed choice between an LLC and a trust for real estate protection, it’s essential to weigh several key factors. These include:

- Liability protection: How well does each option shield personal assets from lawsuits or creditor claims?

- Privacy: Does the structure keep ownership details private, or are they part of public records?

- Tax treatment: How is income reported, and what tax advantages or deductions are available?

- Estate planning benefits: Can assets transfer to heirs without probate, and how flexible is the process?

- Cost-effectiveness: What are the initial setup costs and ongoing maintenance fees?

These factors directly influence which structure aligns best with your goals. The table below highlights the main differences between LLCs and trusts.

Comparison Table: LLCs vs. Trusts

| Criteria | LLC | Trust |

|---|---|---|

| Liability Protection | Limits liability to LLC-owned assets. | Offers limited protection unless structured as a complex irrevocable trust. |

| Privacy | Requires public registration, making ownership details visible. | Typically maintains privacy, with no public registration required. |

| Tax Treatment | Generally enjoys pass-through taxation with flexible options. | Focuses on estate planning rather than immediate tax benefits. |

| Estate Planning | Assets may be subject to probate unless transferred into a trust. | Avoids probate entirely and allows controlled distribution of assets. |

| Initial Setup Cost | Generally features lower setup costs. | Can be higher, especially for complex trust arrangements. |

| Ongoing Costs | Involves annual state filing fees (around $100–$500, depending on the state). | Typically does not require recurring state fees after creation. |

This side-by-side view simplifies the decision-making process based on your real estate protection needs.

When to Use an LLC vs. a Trust

Choose an LLC if you’re actively managing rental properties or dealing with tenants. LLCs are ideal for protecting personal assets in scenarios where liability risks, like tenant disputes or property-related lawsuits, are more common.

Choose a trust if your focus is on long-term wealth preservation and passing assets to heirs efficiently. Trusts are excellent for avoiding probate, keeping your financial affairs private, and setting specific inheritance conditions. They can also help reduce estate taxes.

For maximum protection, many people combine the two – using an LLC for liability protection and a trust for estate planning. This strategy ensures both immediate asset security and long-term financial planning.

sbb-itb-39d39a6

Using LLCs and Trusts Together

Trust-Owned LLC Structures

Combining LLCs and trusts can create a powerful framework for asset protection, estate planning, and privacy.

A trust-owned LLC merges the liability protection of an LLC with the estate planning benefits of a trust. In this setup, the trust owns the LLC that holds the real estate, while a designated manager oversees day-to-day operations like acquisitions and property management – minimizing the need for the trustee to get involved in routine matters.

This structure not only avoids probate but also ensures the smooth continuation of business operations in cases of incapacity or death. However, the type of trust you choose is crucial. A revocable trust offers more control but less protection from creditors, while an irrevocable trust provides stronger asset protection but requires transferring control to a third-party trustee.

"By placing LLC membership interests in a trust, business owners can combine the two types of legal entities and enjoy the best of both worlds." – DeWitt Law

To implement this effectively, ensure your LLC’s operating agreement allows for a trust as a member and update legal documents with the necessary consents from all members.

Adding Domestic and Offshore Layers

For those seeking even more robust protection, combining domestic LLCs with offshore trusts offers an additional layer of defense. This strategy is particularly appealing to high-net-worth individuals who face significant creditor risks or manage international real estate portfolios.

In this arrangement, an offshore trust – often established in jurisdictions like Anguilla – owns a U.S. LLC that holds the real estate assets. This setup provides stronger creditor protection, greater cross-border diversification, and enhanced privacy since offshore trusts are generally not listed in U.S. public records.

While this approach offers substantial benefits, it also comes with increased complexity and higher costs, making it better suited for those with larger portfolios.

Matching Structures to Your Needs

The right combination of structures depends on your specific situation. For example, a single rental property might only require an LLC, while a larger real estate portfolio could benefit from a trust-owned LLC. If you’re a high-income professional or someone with significant creditor exposure, adding more protective layers could be a wise choice.

Privacy is another key factor. A trust-owned LLC can provide greater anonymity than an LLC alone. For international investors or digital entrepreneurs, incorporating offshore trust layers might offer even more advantages. Ultimately, working with legal and financial experts is critical to finding the right balance between protection, control, and cost. This tailored approach ensures your asset protection strategy aligns with your unique needs and goals.

Conclusion

Key Takeaways

Deciding between an LLC and a trust for real estate protection isn’t about picking one over the other – they serve different purposes and can work together effectively.

LLCs are designed to shield personal assets from business-related liabilities. They protect your personal wealth from claims tied to your real estate investments. However, they don’t address estate planning needs – LLCs won’t bypass probate or simplify asset transfers after death.

Trusts, on the other hand, focus on estate planning. A revocable living trust allows you to avoid probate, keep your affairs private, and ensure your assets are distributed smoothly to your heirs. While revocable trusts offer flexibility, they provide limited protection against creditors. An irrevocable trust, though more rigid, offers stronger creditor protection by removing assets from your personal estate – at the cost of handing control to a third-party trustee.

For a well-rounded strategy, combining both tools is often the best approach. A trust-owned LLC merges the liability protection of an LLC with the estate planning benefits of a trust. This setup avoids probate and ensures your real estate investments are protected and efficiently managed.

Working with Professionals

Once you understand these key points, the next step is to consult professionals who can tailor these strategies to your specific needs.

Navigating the legal and tax complexities of real estate protection requires expertise, as rules vary depending on your location and circumstances. Maya Powers, Estate Planning Content Expert at Trust & Will, emphasizes the importance of professional guidance:

"Ultimately, choosing between an LLC and a living trust depends on your specific goals. Seeking professional assistance can help your decision-making much easier, as it can help you sort through a variety of options and match up the tools that will best help you meet your objectives."

Global Wealth Protection specializes in crafting personalized asset protection plans for entrepreneurs and investors. Whether you’re setting up a simple LLC for a rental property or building a multi-layered structure, working with experienced professionals ensures your strategy is compliant, tax-efficient, and aligned with your goals. Without expert guidance, you risk leaving your assets exposed. With it, you can safeguard your investments and enjoy greater peace of mind.

FAQs

What are the advantages of using both an LLC and a trust to protect real estate?

Combining an LLC with a trust creates a smart approach to safeguarding and managing real estate. An LLC offers liability protection, keeping personal assets – like your home or savings – safe if legal action is taken against the property. On the other hand, a trust simplifies estate planning by bypassing probate, ensuring the property is passed directly to your chosen beneficiaries.

When the LLC is owned by a trust, it brings an extra layer of privacy and control. The trust can outline how the LLC should be managed in the event of death or incapacity, keeping assets out of court proceedings and shielding them from creditors. Plus, this arrangement preserves the LLC’s tax advantages, such as pass-through taxation, and allows ownership to transfer smoothly without disrupting day-to-day operations.

Essentially, the LLC protects you from liability, while the trust ensures long-term security, privacy, and an efficient succession plan for your real estate investments.

What are the privacy differences between LLCs and trusts for real estate ownership?

LLCs provide limited privacy because the required formation documents – like articles of organization and annual reports – are usually filed with the Secretary of State. This means basic ownership details are often accessible to the public. While you can take steps to increase privacy, such as using a registered agent or forming the LLC in a state with more privacy protections, ownership information is still searchable in public records.

In contrast, trusts are naturally private. They don’t require public filings, so the details – such as the names of the settlor, trustee, and beneficiaries – stay confidential. Trust documents are only revealed in specific situations, like a court order or a request from a beneficiary. This makes trusts a more discreet choice for holding real estate or other assets.

What are the tax implications of transferring real estate to an LLC or a trust?

Transferring real estate into a Limited Liability Company (LLC) can lead to several tax-related outcomes. Many states require you to pay a transfer tax or recording fee when the title is moved to an LLC, even if you’re the sole owner. If the property has gained value, the transfer could also create a capital gains tax event when the LLC eventually sells the property, as the original cost basis is carried over. Additionally, moving the property into an LLC might trigger a property tax reassessment, which could result in higher annual taxes. Another consideration is the potential loss of the stepped-up basis that heirs would otherwise receive, potentially increasing their tax burden.

When it comes to a trust, particularly a revocable living trust, the tax implications are different. Since the grantor retains ownership for tax purposes, there’s usually no immediate taxable event. Income, deductions, and gains are simply reported on the grantor’s personal tax return. Trusts can also help bypass probate costs and may lower inheritance tax exposure for your heirs. However, transferring property into an irrevocable trust might be seen as a gift for federal tax purposes, which could count against your annual gift exclusion or lifetime exemption. To ensure your approach aligns with your goals, it’s always wise to consult a tax professional or attorney.