Want to protect your identity while running a business? An Anonymous LLC might be the solution.

This type of LLC keeps your ownership details off public records by listing a registered agent instead of your name. It provides the same benefits as a standard LLC – like limited liability and pass-through taxation – but prioritizes privacy.

Key points to know:

- Privacy Advantages: Shields your identity from public databases, reducing risks like lawsuits or unwanted attention.

- Top States: Wyoming, New Mexico, and Delaware offer strong privacy protections, with New Mexico being the most cost-effective.

- Recent Changes: A 2025 federal rule now exempts domestic U.S. LLCs from some ownership reporting, making privacy easier to maintain.

- Offshore Option: Anguilla offers higher privacy, zero taxes, and streamlined setup for those seeking international solutions.

Whether you’re a real estate investor, entrepreneur, or public figure, an Anonymous LLC can help protect your personal information and assets. But privacy isn’t absolute – banks and government agencies still require disclosures. Choose the right jurisdiction based on your needs, and stay compliant to maintain protection.

Top US States for Anonymous LLCs

While several U.S. states offer privacy advantages for LLCs, offshore jurisdictions like Anguilla take asset protection to a whole new level.

What Makes a State Privacy-Friendly

A privacy-friendly state ensures your personal details remain out of public view. In many cases, these states don’t require member or manager names on LLC formation documents – only the registered agent’s information is publicly disclosed. This means the registered agent essentially acts as a shield, keeping your identity private. States with minimal reporting requirements and no state income tax add an extra layer of financial privacy, making them particularly appealing.

Comparing Wyoming, New Mexico, South Dakota, and Delaware

Each of these states brings unique benefits for those prioritizing privacy. New Mexico stands out for its strict anonymity, as it doesn’t collect or store ownership details during formation or through ongoing reports. Wyoming’s Articles of Organization omit member or manager names, leaving only the LLC name, registered agent, and principal business address on public records. Delaware follows a similar approach, requiring no owner or manager details on its Certificate of Formation and eliminating the need for annual reports. South Dakota, while lesser-known, offers strong privacy protections alongside features that cater to trust-friendly structures.

| State | Formation Fee | Annual State Fee | Annual Reporting | Privacy Level | Key Advantage |

|---|---|---|---|---|---|

| New Mexico | $50 | $0 | None | Maximum | Cost-effective with no ongoing reports |

| Wyoming | $100–$102 | $60 | Required | High | Strong asset protection and low fees |

| Delaware | $90–$110 | $300 | None | High | Investor-friendly and streamlined compliance |

| South Dakota | Moderate | Moderate | None | High | Trust-friendly structures |

While these states provide solid privacy protections, it’s important to note that true anonymity can still be limited by federal and cross-state requirements.

Wyoming, the pioneer of LLC laws in 1977, now hosts about 65% of all U.S. LLCs. Delaware’s privacy perks are tied to its pro-business legal framework, which emphasizes flexibility and operational ease. All four states mandate the use of a professional registered agent, with annual fees ranging from $25 to $300 depending on the level of service.

Limitations of US Anonymous LLCs

Even with strong privacy protections, U.S. anonymous LLCs are not entirely shielded from scrutiny. For instance, government agencies and financial institutions still require certain disclosures. When applying for an EIN, the IRS mandates a "responsible party" with a Social Security Number. Similarly, banks enforce Know Your Customer (KYC) regulations, requiring proof of ownership through documents like your Operating Agreement and EIN confirmation.

Operating across state lines can also compromise anonymity. For example, if an anonymous LLC formed in Wyoming conducts business in states like California or New York, you’ll need to register as a foreign LLC – often requiring disclosure of member or manager names. Additionally, if your LLC faces litigation, courts can issue subpoenas to uncover the identities of its members.

To better protect your privacy, consider using a professional service to file your Articles of Organization, ensuring your name doesn’t appear as the organizer. Keeping business and personal finances separate is equally critical – mixing funds can lead to courts "piercing the corporate veil", potentially holding you personally liable. Using a virtual office or a professional registered agent address can also help keep your home address off public records.

These challenges highlight why offshore options may offer a higher level of privacy for those seeking stronger asset protection.

sbb-itb-39d39a6

Anguilla: The Top Offshore LLC Jurisdiction

When privacy in the U.S. doesn’t meet your needs, Anguilla stands out as a prime offshore destination for LLCs. This British Overseas Territory offers a unique mix of zero taxation and strict confidentiality – details about members, managers, and owners remain private. Unlike many domestic jurisdictions, Anguilla’s legal framework ensures a higher level of identity protection. This shift toward offshore options highlights the changing priorities in offshore asset protection strategies.

Why Choose an Anguilla LLC

An Anguilla LLC is designed with asset protection and simplicity in mind. The jurisdiction is tax-neutral, meaning there’s 0% tax on corporate income, capital gains, gifts, inheritances, and withholding for non-residents. Modeled after the Wyoming LLC but with added protections, Anguilla LLCs offer features like perpetual existence and streamlined governance. There are no legal requirements for directors, company secretaries, or annual general meetings. Owners retain full control through their Operating Agreement and benefit from flow-through taxation, which avoids double taxation at the corporate level.

How to Form an LLC in Anguilla

Anguilla makes forming an LLC straightforward with its ACORN system – a 24/7 online platform. A licensed local registered agent can set up your LLC in just one business day. The government incorporation fee for electronic submissions is $250, while full-service formation packages average around $2,800. LLCs can be owned by a single individual of any nationality, and there’s no minimum capital requirement. For those seeking maximum privacy, nominee director services are available to keep your identity off internal records.

Legal Framework and Compliance Requirements

Anguilla’s Limited Liability Company Act 2014 provides strong legal protections, drawing from English Common Law. LLCs must maintain accounting records at their registered office, but ongoing reporting is minimal. The annual renewal fee starts at $200. However, companies involved in "relevant activities" like banking, insurance, or intellectual property must comply with Economic Substance regulations – or prove tax residency and substantive activity in another jurisdiction.

It’s important to note that Anguilla’s tax neutrality doesn’t exempt you from tax obligations in your home country. For instance, U.S. citizens must still adhere to IRS reporting requirements, including FATCA and FBAR compliance.

How to Set Up an Anonymous LLC

After considering the privacy benefits and costs associated with forming an LLC, the choice of jurisdiction becomes a critical step in securing effective asset protection.

Choosing Your Jurisdiction

The jurisdiction you select directly impacts your LLC’s privacy, costs, and compliance requirements. Within the U.S., Wyoming, New Mexico, and Delaware are popular choices for privacy-conscious LLCs. Here’s why:

- Wyoming: Offers strong asset protection for single-member LLCs and doesn’t require public disclosure of member or manager names.

- New Mexico: Provides the highest level of anonymity by not requiring annual reports or owner disclosures.

- Delaware: Known for its specialized Court of Chancery, which handles business disputes efficiently, though it does require a flat $300 annual tax.

If you’re looking for privacy outside the U.S., Anguilla is a compelling option. It imposes no taxes on corporate income, capital gains, or inheritances, and ownership details remain private. Anguilla’s ACORN system allows for real-time incorporation, processing filings within one business day for a $250 government fee. However, if your LLC operates in a state different from its formation, you’ll need to "foreign qualify", which may require disclosing member details, potentially compromising anonymity.

Once you’ve selected your jurisdiction, you’re ready to move on to the filing process.

Filing and Registration Process

The filing process is fairly similar across jurisdictions. In the U.S., you’ll need to:

- Choose a compliant LLC name (e.g., including "LLC", "Limited Liability Company", or "Ltd.").

- Appoint a professional registered agent. Avoid serving as your own agent, as it would expose your personal address in public records.

- File Articles of Organization with the Secretary of State. In privacy-focused states like New Mexico and Wyoming, these documents don’t require owner names. Hiring a service to act as the organizer can further safeguard your identity.

In Anguilla, the incorporation process is managed through the Commercial Online Registration Network (CRES), which operates 24/7. To register, you’ll need to:

- Work with a licensed local registered agent.

- Draft an LLC Agreement defining member roles and voting rights.

- Set up a business bank account to meet anti-money laundering (AML) and know-your-customer (KYC) requirements. Local banks like Republic Bank (Anguilla) Limited and National Commercial Bank of Anguilla offer options for this step.

Ongoing Compliance and Privacy Maintenance

After filing, staying compliant is essential to maintaining your LLC’s status and privacy. Here’s what you should know:

- State-Level Compliance (U.S.):

- New Mexico: No annual reporting or fees.

- Wyoming: Requires an annual report and a $60 fee, which includes owner details.

- Delaware: Charges a flat $300 annual tax but doesn’t require an annual report.

- Nevada: Requires an Annual List fee of $150, plus a $200 state business license fee.

- Federal Compliance: All LLCs must adhere to the Corporate Transparency Act, which mandates filing Beneficial Ownership Information (BOI) reports with FinCEN. These reports include real names, addresses, and ID numbers of owners with a 25% or greater interest. LLCs formed after March 26, 2025, must file BOI reports within 30 days. Non-compliance can result in civil penalties of up to $500 per day. While BOI filings aren’t public, they are accessible to law enforcement and federal agencies.

Additionally, the IRS requires naming a "responsible party" when applying for an EIN, linking an individual’s identity to the LLC for tax purposes. To uphold liability protection, keep personal and business finances separate, and report any changes in beneficial ownership to FinCEN within 30 days.

- Anguilla Compliance: Anguilla LLCs must pay an annual renewal fee of about $250. Companies operating in regulated sectors, like banking or insurance, must also comply with Economic Substance regulations.

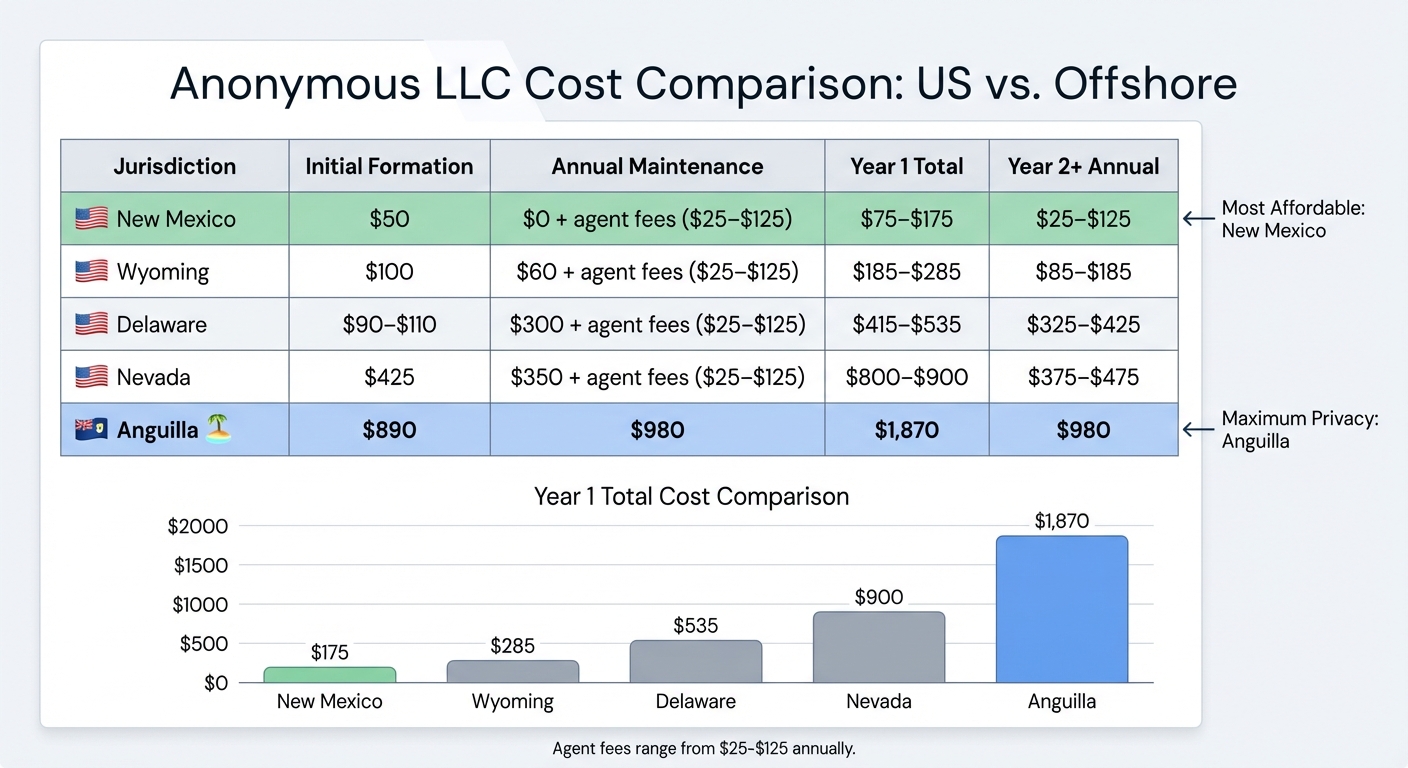

Cost Comparison: US vs. Offshore Anonymous LLCs

Anonymous LLC Cost Comparison: US States vs Offshore Jurisdictions

When choosing where to establish your anonymous LLC, understanding the costs involved can help you make a well-informed decision. Here’s a detailed breakdown of formation and maintenance expenses across different jurisdictions.

Formation Costs

In the United States, New Mexico stands out as the most affordable option, with an initial filing fee of just $50 and no extra charges. Wyoming follows at $100, while Delaware costs between $90 and $110. On the higher end, Nevada charges $425, which includes $75 for Articles of Organization, $200 for a State Business License, and $150 for the Initial List of Managers.

For offshore options, Anguilla has a formation cost of $890. This fee includes mandatory services like a registered agent and local office, offering enhanced privacy and tax neutrality in exchange for the higher upfront cost.

Annual Fees and Maintenance Costs

Annual costs vary significantly between jurisdictions. New Mexico has no state-imposed annual fees or reporting requirements, making it a low-maintenance choice. Wyoming charges a $60 annual report fee for entities with in-state assets under $300,000. Delaware imposes a flat $300 franchise tax annually, while Nevada requires $350 annually, which combines the Annual List fee and business license renewal.

For offshore entities, Anguilla has annual fees of approximately $980. This includes government renewal charges and registered agent services. Unlike US-based LLCs, Anguilla LLCs are exempt from corporate income, capital gains, and withholding taxes. However, if your LLC operates in regulated industries like banking or fund management, you may incur additional compliance costs due to Economic Substance requirements.

Total Cost Breakdown

To get a complete picture, factor in registered agent fees (ranging from $25 to $125 annually) and potential FinCEN compliance costs. Below is a summary table for easy comparison:

| Jurisdiction | Initial Formation | Annual Maintenance | Year 1 Total | Year 2+ Annual |

|---|---|---|---|---|

| New Mexico | $50 | $0 + agent fees ($25–$125) | $75–$175 | $25–$125 |

| Wyoming | $100 | $60 + agent fees ($25–$125) | $185–$285 | $85–$185 |

| Delaware | $90–$110 | $300 + agent fees ($25–$125) | $415–$535 | $325–$425 |

| Nevada | $425 | $350 + agent fees ($25–$125) | $800–$900 | $375–$475 |

| Anguilla | $890 | $980 | $1,870 | $980 |

For those seeking a cost-effective solution, New Mexico is the clear winner, particularly for long-term maintenance. On the other hand, Anguilla offers unparalleled privacy and tax neutrality, making it an attractive choice for those prioritizing offshore benefits. Your decision ultimately depends on whether your focus is on minimizing expenses or maximizing privacy and tax advantages.

Conclusion

When deciding on the right jurisdiction for your anonymous LLC, it’s crucial to weigh your privacy priorities, budget, and compliance needs. For those seeking the most affordable option with strong privacy protections, New Mexico stands out. It offers anonymity from public records without breaking the bank. If legal protections like charging order protection are a priority, Wyoming provides a compelling choice with its $100 initial fee and $60 annual renewal cost. For businesses with more intricate operations, Delaware offers a sophisticated legal framework, while Nevada is a solid pick for its strong asset protection – though it comes at a higher price.

For those looking beyond U.S. borders, Anguilla delivers unparalleled privacy and tax neutrality. Its refusal to recognize foreign judgments and exemption from corporate income taxes make it an attractive option for serious asset protection strategies. However, it’s important to note that foreign entities operating in the U.S. must still comply with beneficial ownership reporting requirements.

"New Mexico emerges as the most privacy-protective and cost-effective anonymous LLC jurisdiction." – Alex Recouso, CEO, CitizenX

Ultimately, your choice should align with your budget, the level of privacy you require, and the complexity of your business activities. For passive holding structures, New Mexico is a top contender. Wyoming’s legal protections are well-suited for active investments, while Delaware’s franchise tax may be justified for complex operations. If maximum asset protection is the goal, Anguilla’s offshore benefits could be worth the added expense.

The regulatory environment has shifted in favor of anonymous LLCs, particularly with domestic U.S. entities now exempt from FinCEN beneficial ownership reporting. Whether you opt for a cost-effective domestic solution or an offshore jurisdiction like Anguilla, your decision should balance immediate financial considerations with long-term asset protection strategies. To maintain privacy and protection, ensure compliance, work with professional registered agents, and keep personal and business finances strictly separate.

FAQs

What privacy advantages does an Anonymous LLC provide?

An Anonymous LLC is a powerful tool for maintaining privacy, as it keeps the identities of its owners – whether members or managers – out of public records. Unlike standard LLCs, these entities don’t require owner names to be disclosed in public state filings. This layer of confidentiality helps shield personal information, reducing exposure to risks like harassment, lawsuits, or unwelcome attention.

Beyond privacy, anonymous LLCs also provide asset protection and enable discreet financial dealings. In the U.S., states like Wyoming, New Mexico, South Dakota, and Delaware are popular choices for forming anonymous LLCs due to their strong privacy laws. For those looking internationally, Anguilla stands out as a trusted jurisdiction with strict confidentiality measures. Establishing an anonymous LLC is a smart way to protect your identity and operate securely within the bounds of the law.

How does Anguilla’s privacy for LLCs compare to states like Wyoming and New Mexico?

Anguilla provides stronger privacy protections for LLC owners compared to U.S. states like Wyoming and New Mexico. While states such as Wyoming and New Mexico offer significant privacy – like not requiring public disclosure of member or manager names – they still fall under federal laws like the Corporate Transparency Act. This law mandates reporting beneficial ownership details to the U.S. government, limiting the overall privacy they can offer.

Anguilla, on the other hand, has a legal framework crafted to prioritize confidentiality. It keeps the identities of LLC owners shielded from both public and governmental access. This makes it an appealing option for those seeking enhanced privacy and asset protection outside the scope of U.S. regulations. For individuals who value international confidentiality, Anguilla emerges as a leading choice for setting up offshore LLCs.

What are the challenges and compliance requirements of maintaining an Anonymous LLC?

Maintaining an Anonymous LLC can provide valuable privacy by keeping owner identities out of public records. However, it’s essential to navigate compliance requirements and understand the limitations involved. For instance, federal laws like the Corporate Transparency Act require reporting the identities of beneficial owners to the government. This reduces anonymity at the federal level, even if state records remain private.

States like Wyoming, New Mexico, Delaware, and Nevada are known for their strong privacy protections. Yet, even in these states, owners must meet obligations such as filing annual reports and paying required fees, which vary depending on the jurisdiction. Additionally, services like registered agents or nominee managers can add another layer of privacy, but these must be used carefully to avoid potential legal complications.

It’s also worth noting that while Anonymous LLCs offer substantial privacy, certain situations – like banking, taxation, or legal disputes – may still require owners to disclose their identities. Staying up-to-date with legal requirements and ensuring full compliance is key to preserving the privacy benefits of this business structure.