Owning assets in multiple countries is complicated. Without proper planning, your heirs could face double taxation, legal conflicts, and reduced inheritances. Here’s what you need to know:

- Key Challenges:

- Different countries have unique tax and inheritance laws.

- U.S. estate documents often don’t apply abroad.

- Forced heirship rules in civil law countries may override your wishes.

- Who Needs This:

- U.S. citizens or residents with foreign assets.

- Expats, international investors, or families across borders.

- Risks of No Plan:

- Double taxation (e.g., U.S. + foreign taxes).

- Lengthy legal battles and high fees.

- Penalties for failing to report foreign accounts (up to 50% of account value annually).

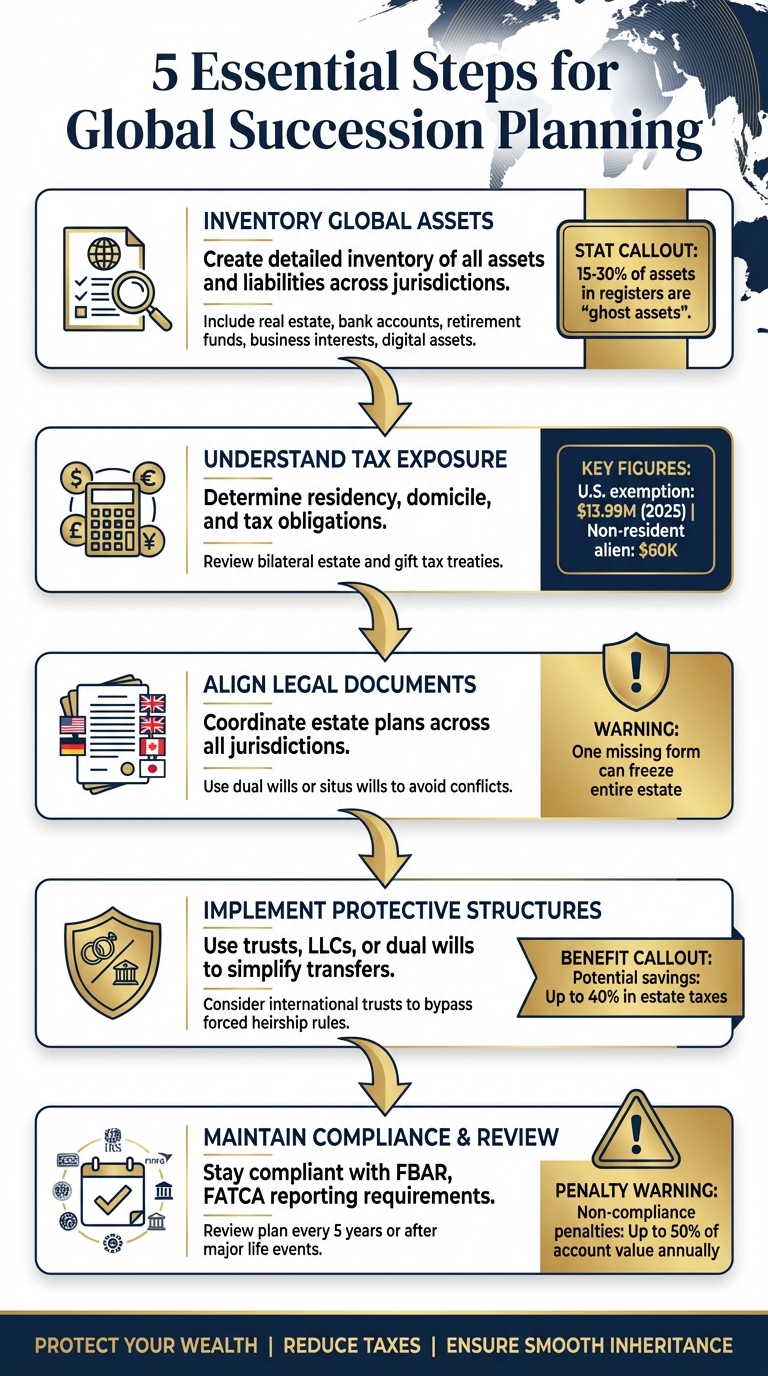

- Steps to Take:

Bottom Line: A coordinated global succession plan protects your wealth, reduces taxes, and ensures your heirs avoid unnecessary complications.

Mapping Your Global Estate

Before diving into succession planning, it’s crucial to get a clear and organized view of your global estate – what you own and where it’s located. This step directly addresses the tax and legal challenges that can arise without proper planning. Having an accurate inventory helps you identify tax exposure, align legal documents, and ensure your heirs can smoothly access their inheritance.

Creating an Asset and Liability Inventory

Once you understand the risks of uncoordinated succession planning, the next step is to map out your global estate. Start by creating a detailed inventory of all your assets and liabilities across various jurisdictions. Group these into categories like real estate, bank accounts, retirement funds, business interests, insurance policies, and digital assets.

For each item, note key details such as ownership, location, estimated value, and who is responsible for managing it. To avoid confusion, especially with similar assets, use unique identifiers. For instance, if you own rental properties in Miami and Madrid, labeling them distinctly will simplify matters during probate.

Double-check your list against bank statements, property deeds, and official records to identify any "ghost assets" – assets that might still appear in records but are no longer owned. Research shows that 15% to 30% of assets in many registers fall into this category. To keep your inventory accurate, conduct a full review annually and smaller updates throughout the year.

Understanding Residency, Domicile, and Tax Exposure

Residency and domicile are key factors in how your global estate will be taxed. Residency is typically based on physical presence – like the number of days spent in a country – while domicile refers to the place you consider your permanent home with no plans to leave.

These factors determine whether a jurisdiction taxes your worldwide assets or only those located within its borders. For example, the United States taxes worldwide assets for individuals domiciled there, but non-resident aliens are taxed only on U.S.-based assets.

"The U.S. estate tax is imposed on immigrants to the United States based on their domicile. For estate and gift tax purposes, a person is domiciled in the United States if they dwell in the country and have no plans to leave." – Abacus Wealth International

If you hold a U.S. green card, you’re generally considered domiciled in the United States for estate and gift tax purposes, making your worldwide assets subject to federal estate tax. Non-resident aliens, on the other hand, are limited to a $60,000 estate tax exemption. Reviewing bilateral estate and gift tax treaties is essential, as these agreements can help avoid double taxation.

Organizing and Managing Documentation

Once you’ve cataloged your assets and assessed your tax exposure, the next step is organizing your documentation. Consolidate and standardize your records, and keep duplicate sets of critical documents in a secure location outside your primary residence country. In civil law jurisdictions, official translations and affidavits from local solicitors may be required to explain succession rules.

Organize documents based on the legal location (situs) of each asset, as every jurisdiction has unique rules for asset transfer, probate, and tax reporting. For digital assets like cryptocurrency, use secure digital storage to manage cloud credentials and private keys, ensuring they remain accessible. Consider automated triggers that transfer digital assets after a set period of inactivity.

"One missing form in a jurisdiction home to important property or holdings can freeze the entire estate and distribution process." – Harvey Law Group

For business interests or share portfolios, holding them through a nominee company can simplify transfers, avoiding the need for separate probate grants in multiple jurisdictions. Collaborate with professionals like international estate planning attorneys, cross-border financial planners, and tax specialists to ensure your documentation aligns with treaties and local laws.

Cross-Border Legal and Tax Considerations

When planning your estate across borders, it’s crucial to understand the legal and tax systems that govern asset transfers in different jurisdictions. Let’s break this down.

Inheritance Laws and Forced Heirship Rules

Inheritance laws vary widely between countries, often depending on whether they follow common law or civil law principles. In common law countries like the United States, United Kingdom, and Ireland, you generally have the freedom to decide who inherits your assets. On the other hand, civil law countries such as France, Spain, and Germany enforce forced heirship rules, which require specific portions of your estate to go to particular heirs, like children or spouses.

For instance, if you own a vacation home in France, French law may require that part of it be allocated to your children, regardless of your wishes. To complicate matters, some civil law countries also include clawback provisions. These provisions can pull lifetime gifts back into the estate calculation to ensure statutory heirs receive their mandated share.

Determining which country’s laws apply to your estate can get tricky. Common law countries often look at the deceased’s domicile, while civil law countries might consider habitual residence or nationality. Generally, real estate is governed by the law of the country where it’s located (lex situs), while movable assets like bank accounts follow the law of your domicile (lex domicilii).

"A revocable trust that works perfectly for your US assets could be disregarded by countries like France or Spain who practice civil law." – Harvey Law Group

One notable effort to harmonize inheritance rules is Brussels IV (EU Regulation 650/2012). This regulation allows individuals to choose the law of their nationality to govern their entire estate, potentially sidestepping local forced heirship rules. However, it’s important to note that this election only covers succession laws and does not address tax issues.

Naturally, understanding the legal framework leads to the next big question: how do taxes factor into all of this?

Tax Exposure and Treaty Planning

Tax systems differ greatly across borders, and without careful planning, your estate could be taxed multiple times in different jurisdictions. For instance, U.S. citizens are subject to worldwide taxation, with a federal estate tax exemption set at $13,990,000 for 2025.

Some countries impose even higher taxes. In France, inheritance taxes on amounts exceeding €100,000 can reach up to 60%, while Japan’s inheritance tax climbs to 55% for estates valued over ¥600 million. Taxation methods also vary: the U.S. and UK tax the estate itself before distribution, while countries like Ireland and Germany tax the beneficiaries on what they receive.

Double taxation treaties can help reduce overlapping tax liabilities. These agreements typically assign primary taxing rights to specific jurisdictions and offer credits for taxes paid elsewhere. In situations where no treaty exists, unilateral relief or tax credits may still be available.

For U.S. citizens, compliance with FBAR (Foreign Bank and Financial Accounts) reporting is mandatory. Failing to report foreign accounts can result in severe penalties, potentially up to 50% of the account’s value per year.

With these legal and tax complexities in mind, structuring your assets using trusts and other entities can provide a practical way forward.

Using Trusts and Entities for Cross-Border Planning

Trusts and legal entities can simplify asset management, protect privacy, and reduce legal conflicts – when structured correctly. International and offshore trusts are particularly effective for sidestepping forced heirship rules. By transferring assets to a trustee during your lifetime, these assets are no longer part of your legal estate upon death, avoiding probate and forced heirship requirements.

However, civil law jurisdictions often treat trusts differently. In some cases, they may classify trusts as corporate entities, leading to higher taxes or even disregarding the structure entirely. For example, a U.S. revocable living trust might not be recognized in France or Spain, exposing the assets to local forced heirship rules.

"Assets settled into a trust during the lifetime of a settlor will not form part of his or her estate on death and will therefore not be subject to probate or similar administrative processes." – Alpadis

Private foundations can also be a useful alternative in countries where trusts are not recognized, helping to preserve family legacies and protect assets. Additionally, holding companies and LLCs can consolidate control over global assets, simplify ownership transitions, and bypass local probate requirements.

For those managing assets in multiple countries, nominee companies can hold international share portfolios within a single jurisdiction. This approach eliminates the need for separate probate processes in each country where assets are registered.

Collaborating with local experts is key to ensuring your structures work effectively across borders. For example, a well-structured Cook Islands trust could save heirs up to 40% in estate taxes while offering robust asset protection. However, the same trust might face immediate taxation or be disregarded entirely in countries like the UK or France if it doesn’t align with local tax residency rules.

Designing a Coordinated Succession Structure

Once you’ve tackled the complexities of cross-border legal and tax considerations, the next step is to craft a plan that aligns your personal goals with the legal and tax requirements of each jurisdiction.

Setting Objectives and Priorities

Start by clarifying your main goals before deciding on legal structures. Trying to optimize for everything can dilute the focus on your most important priorities.

For many high-net-worth individuals, tax planning is often a top concern. For example, the U.S. federal estate and gift tax lifetime exclusion will be $13.99 million per person (or $27.98 million for married couples) in 2025. If you’re married to a non-U.S. citizen, however, the annual marital gift tax exclusion is capped at $190,000 in 2025.

Privacy is another key consideration. Many families aim to keep asset ownership out of public records to reduce risks like litigation or unwanted attention. For instance, land trusts can help shield real estate ownership from public exposure.

Control is also important, both during your lifetime and after. Revocable trusts allow you to maintain control while you’re alive, whereas irrevocable structures – like some offshore trusts – offer stronger protection from creditors and lawsuits but require relinquishing direct control.

Finally, family dynamics come into play, especially when dealing with forced heirship rules in certain jurisdictions. Balancing legal requirements with personal wishes is critical to maintaining harmony.

Structuring Ownership Across Asset Classes

Different types of assets require different ownership strategies. What works for a vacation home in Spain might not be ideal for a Wyoming LLC or your cryptocurrency holdings.

- Real Estate: Real estate is governed by the laws of its location (lex situs). For example, a property in Mexico might be held in a fideicomiso (a Mexican trust structure) with a U.S. LLC as the beneficiary for added protection. In the U.S., holding each property in a separate LLC can help protect your portfolio.

- Business Interests: Using holding company structures can simplify ownership transitions and reduce the need for probate across multiple jurisdictions. Wyoming LLCs are a popular choice for their asset protection features.

- Investment Portfolios: Managing international investments requires expert advice to avoid unexpected tax consequences.

- Digital Assets: Without proper documentation, digital assets like cryptocurrency or online accounts could become permanently inaccessible.

Here’s a quick comparison of ownership strategies across asset types:

| Asset Class | Direct Ownership | Trust Structure | LLC/Corporate Entity |

|---|---|---|---|

| U.S. Real Estate | Simple but subject to probate | Avoids probate and offers privacy | Provides liability protection and flexibility |

| Foreign Real Estate | Subject to local forced heirship rules | May not be recognized in civil law countries | Can bypass probate but requires local compliance |

| Business Interests | Full control but higher exposure | Helps with tax deferral and succession planning | Limited liability and easier transfer |

| Investment Accounts | May face estate-level taxation | Grantor trusts can provide tax advantages | Acts as a corporate wrapper for global holdings |

Once you’ve mapped out ownership strategies, ensure your U.S. and foreign estate plans work together seamlessly.

Coordinating U.S. and Foreign Estate Plans

A well-coordinated estate plan avoids conflicts between jurisdictions. For example, a general revocation clause in a new will could unintentionally cancel an existing will in another country.

"The safest strategy is often creating Dual Wills: one specifically governing your US-situs assets and a separate one addressing your foreign-situs assets." – Kishore Chennu, Principal Consultant, TheTaxBooks

Using situs wills – separate wills tailored to the laws of each jurisdiction – can help avoid probate delays and ensure enforceability.

In European Union countries, the EU Succession Regulation (EU 650/2012) allows you to choose your home country’s laws (based on nationality) to govern estate distribution. This can help bypass forced heirship rules in countries like France or Spain. However, this election applies only to succession laws, not tax matters.

Trust coordination across borders can get tricky. While a U.S. revocable living trust is effective for avoiding probate domestically, countries like France or Germany may not recognize it and could impose punitive taxes. For instance, if you’ve lived in Germany for over ten years, distributions from a U.S. trust might be taxed at rates up to 50%.

To avoid double taxation, review applicable tax treaties. Collaborating with advisors who understand both U.S. and foreign tax laws is essential to navigate these complexities effectively.

sbb-itb-39d39a6

Implementing and Maintaining Your Global Succession Plan

Building an International Advisory Team

When dealing with the intricacies of global succession planning, having a team of specialized advisors is non-negotiable. Start by assembling a group of professionals who can address the unique challenges tied to each jurisdiction where your assets or family members are located.

Your team should include a U.S. estate planning attorney, foreign legal counsel, tax experts, and a financial advisor. The U.S. attorney will oversee the overall strategy, while foreign counsel ensures compliance with local succession laws in each jurisdiction. Tax specialists will focus on navigating international treaties to avoid double taxation. A financial advisor often acts as the central coordinator, which is especially helpful for families spread across multiple continents. Interestingly, nearly 40% of ultra-high-net-worth individuals have family members living in different countries. If your plan involves offshore structures, you may also need a professional trustee to manage entities in jurisdictions like the Cayman Islands or Cook Islands.

"A U.S. tax or estate planner operating in the international sphere needs not only a profound understanding of U.S. rules and practice but also an excellent network of similarly qualified colleagues in other countries." – Michael J. A. Karlin, Jane Peebles, and Joohee Jung

Coordination is the glue that holds everything together. Your U.S. attorney and foreign legal counsel must stay in close communication to prevent conflicts between documents. For example, a revocation clause in one will could inadvertently cancel another. Tax specialists also need to collaborate to identify treaty benefits and ensure compliance with reporting obligations like FATCA and FBAR.

Step-by-Step Implementation

Once your advisory team is in place, you’re ready to implement your global succession plan. Here’s how to move forward:

Start by reviewing your global asset inventory. Make sure every asset is properly classified by jurisdiction and complies with local rules. Pay special attention to real estate, as it’s governed by the laws of the country where it’s located, regardless of your residence.

Next, map out the jurisdictions involved. Identify your residency, domicile, and where each asset is located (its situs). This helps determine which countries have taxing authority over your estate and which succession laws apply.

Prepare legal documents with precision. If you’re using separate wills for different countries, draft them carefully to avoid conflicts – one will shouldn’t accidentally revoke another. For assets in countries that recognize the Washington Convention, consider an "International Will" to simplify cross-border recognition. In the U.S., pairing a "pour-over" will with a revocable trust ensures that any remaining probate assets seamlessly transfer into your trust structure.

Establish protective structures based on your goals. Irrevocable trusts or family foundations in favorable jurisdictions can shield assets from creditors and forced heirship laws. For digital assets, set up secure digital vaults so trustees and beneficiaries can access critical credentials and authentication keys immediately.

Stay compliant with FATCA and FBAR reporting to avoid penalties. And always keep at least two sets of your legal and financial documents accessible outside your primary country of residence.

Regular Review and Updates

Implementing the plan is just the beginning. Regular reviews are essential to ensure your succession plan stays aligned with changing circumstances and legal landscapes. Experts recommend revisiting your plan every five years to keep it current with evolving laws and personal objectives.

Life events like marriage, divorce, the birth of children, or the death of a spouse or beneficiary should trigger updates to your plan. Relocating to a new country or acquiring assets in new jurisdictions also calls for a review. For example, if you or your trustee moves to a country that doesn’t recognize trusts – common in parts of Europe – you may need to adjust your plan to avoid potential legal or tax complications.

"What worked five years ago might not be optimal today. A certified financial planner and estate planning attorney can help ensure your structure remains tax-efficient across all jurisdictions." – Harvey Law Group

Significant financial changes, like receiving a large inheritance or taking on major debt, are additional reasons to revisit your plan. The ultimate goal is to keep your plan flexible and effective, ensuring it protects your assets and fulfills your wishes, no matter what changes life brings.

Conclusion

Creating a succession plan for global assets is crucial for protecting your wealth and ensuring your family has quick, conflict-free access to it. By carefully mapping your assets across different jurisdictions, coordinating legal structures, and assembling the right advisory team, you establish a solid framework. This approach not only shields your wealth from creditors but also reduces exposure to hefty tax liabilities and ensures your wishes are respected – avoiding complications like forced heirship laws.

The stakes of neglecting proper planning are high. Without a clear, coordinated strategy, your heirs could face substantial tax penalties and prolonged legal battles. Navigating multiple jurisdictions requires careful alignment to safeguard your family’s interests and the legacy you’ve worked hard to build.

"The core objective should be to ensure that the family’s wealth is passed in line with the wishes of the wealth creators." – Gabriele Di Girolamo, Head of Wealth Planning Europe, Julius Baer

A well-thought-out plan does more than protect finances – it fosters family harmony. Beyond financial security, it removes uncertainty about asset distribution, ensuring clarity on who gets what and when. This clarity not only preserves wealth but also strengthens the bonds and values that define your family’s future. Transparent structures and open communication can prevent the lengthy disputes that often arise when assets are spread across multiple legal systems.

But planning doesn’t stop at implementation. Regularly reviewing your plan ensures it stays aligned with evolving laws, changes in your assets, and shifts in family dynamics. Consistent updates keep your legacy secure and maintain protection across all jurisdictions.

FAQs

How can I prevent my global assets from being taxed twice?

To sidestep double taxation on your global assets, you can take advantage of tax treaties between nations and claim foreign tax credits on your U.S. tax return. Another option is organizing your holdings through cross-border entities like international trusts or wills, which can help align with treaty rules and reduce tax burdens.

Partnering with seasoned professionals who understand the legal and tax landscapes of multiple jurisdictions can safeguard your wealth and simplify the entire process.

What are forced heirship rules, and how can they impact international estate planning?

Forced heirship rules are legal mandates in certain countries that dictate how a portion of a deceased person’s estate must be distributed, often prioritizing specific heirs like children or a surviving spouse. These laws can restrict how freely someone can allocate their assets, even if their personal wishes differ.

Take this as an example: in some countries, children are entitled to a guaranteed share of the estate, no matter what the deceased might have outlined in their will. This can complicate international estate planning, especially if you hold assets in regions governed by forced heirship laws. Without a well-thought-out plan, these rules could override your will, potentially causing disputes or triggering unexpected tax issues.

To handle these challenges, collaborating with cross-border legal and tax experts is crucial. In some situations, you might have the option to apply the laws of your nationality to your estate, providing greater control. However, this approach demands precise planning to ensure you comply with local regulations while safeguarding your global assets.

Why is it important to align U.S. and foreign estate plans?

Aligning estate plans between the U.S. and other countries is essential to steer clear of hefty tax bills and potential legal headaches. If these plans aren’t properly coordinated, you could end up paying taxes twice – U.S. estate taxes on your global assets and additional inheritance or estate taxes in the country where your property is located. On top of that, some countries might not honor a U.S. will or could impose local laws that clash with your wishes.

A well-thought-out estate plan brings clarity and efficiency. It helps ensure your assets are passed on to the intended beneficiaries without unnecessary delays or complications. By factoring in tax treaties, local probate processes, and inheritance laws, you can reduce costs, ease administrative challenges, and protect your wealth across borders.