by Scott Causey, GWP Resource Correspondent

Can You Afford to Stay out of the Silver Market?

“Now, all of you know these changes are necessary for a very simple reason–silver is a scarce material. Our uses of silver are growing as our population and our economy grows. The hard fact is that silver consumption is now more than double new silver production each year. So, in the face of this worldwide shortage of silver, and our rapidly growing need for coins, the only really prudent course was to reduce our dependence upon silver for making our coins.

If we had not done so, we would have risked chronic coin shortages in the very near future.

There is no change in the penny and the nickel. There is no change in the silver dollar, although we have no present plans for silver dollar production.

Some have asked whether our silver coins will disappear. The answer is very definitely-no.

Our present silver coins won’t disappear and they won’t even become rarities. We estimate that there are now 12 billion–I repeat, more than 12 billion silver dimes and quarters and half dollars that are now outstanding. We will make another billion before we halt production. And they will be used side-by-side with our new coins.

Since the life of a silver coin is about 25 years, we expect our traditional silver coins to be with us in large numbers for a long, long time.

If anybody has any idea of hoarding our silver coins, let me say this. Treasury has a lot of silver on hand, and it can be, and it will be used to keep the price of silver in line with its value in our present silver coin. There will be no profit in holding them out of circulation.“

President Johnson was absolutely correct about a couple of things. At the time, the United States’ government did have tremendous stockpiles of silver, around 10 billion ounces of inventory. He was also correct in saying that they could, and they would, use that inventory to keep prices low. It actually has worked for decades in that way. Governments around the world have been able to sell silver into the market for decades without any worries about having enough supply for tomorrow or any fear of escalating prices because of the vast quantities that were available then.

Is there manipulation in the Silver market?

Oh how the landscape has changed in the intervening 47 years! Those same coins described as “no profit in holding them out of circulation” are now showing a slight increase in value. How slight? You can buy $1000 dollars “face value” of these coins (dimes, quarters, half dollars) for the low price of $21,500 dollars today! The coins contain 90% silver content and that is why they are so valuable today. As the price of silver has gone up through the years so has the value of the coins. To be a successful investor in today’s world, it is much more important to monitor actions and not words!

In spite of that incredible increase in value, almost no one understands any of the underlying reasons in the silver market for the increase in the value of silver, or the reasons why it is still the most undervalued asset in the world. The spot price of silver this morning is still 40% below the record price of silver of around 50 dollars an ounce. This 50 dollar price occurred both in April of 2011 and all the way back in 1980! There are not many things in this world that you can buy with federal reserve notes that are cheaper than they were in 1980! Even if you use absurdly low CPI numbers to arrive at annualized inflation rate (does not include food or energy costs) from 1980 till today, it may surprise you that 50 dollar silver in 1980 dollars is now equivalent to 135 dollars! And again, that is using inflation numbers the way the government measures them now, meaning sans food and energy costs.

Silver production is falling, but will demand follow?

Just a few days ago, Hecla Mining and Coeur D’ Alene Mining both posted Q2 “earnings” and the results were disastrous, to say the least. Hecla and Coeur D’ Alene are both primary silver miners, meaning that the majority of their revenues come from silver mining. Hecla stumbled in the quarter to the tune of a 2.5 million dollar loss, thanks in huge part to the EPA shutting down their “Lucky Friday” mine. Even more telling, however, was the remaining ounces of silver the company was able to produce out of the ore they were able to move. To better illustrate this, let’s look at a comparison going back to 1989.

1989 = 5,166,591 oz / 264,600 milled tons = 19.5 oz/t

2000 = 12,424,093 oz / 619,438 milled tons = 20.5 oz/ t

2010 = 7,206,973 oz / 800,397 milled tons = 9.0 oz/t

1H 2012 = 2,693,797 / 362,948 milled tons = 7.42 oz/t

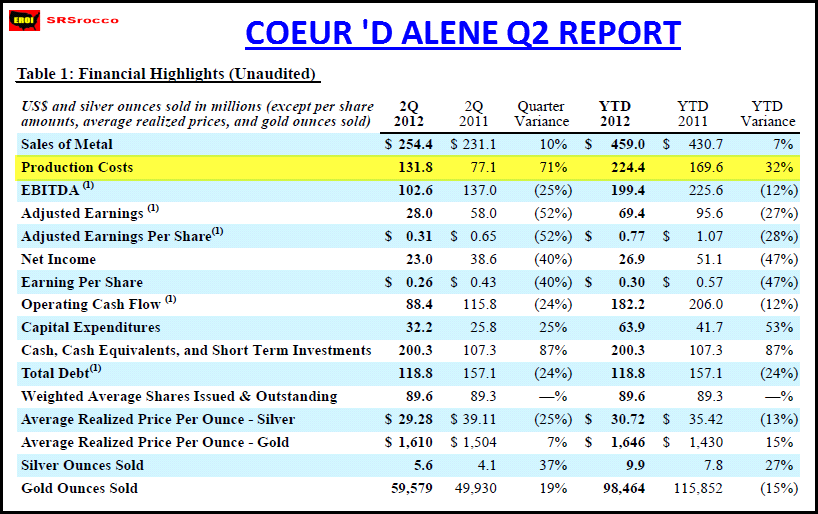

In percentage terms, these numbers are astounding! Hecla is on pace for the year to mill 120,000 more tons of ore than just 10 years ago, and yet, they get much less than half the silver yield for all of their hard work! Now consider how all business costs, especially fuel for heavy mining equipment, has skyrocketed in the intervening 10 years and it’s not too hard to understand silver mining is not a very profitable business these days for Hecla. The stock is reflecting this and has not been this cheap since 2004, when silver was at single digit prices. The moral of the story being that silver prices are not keeping up with the costs of mining the stuff. Not even close. Take a look at Coeure D’ Alene Q2 financial results.

In just one year, their production costs are up 71%! This is off-the-charts stuff, folks. How many of you out there would continue to operate your businesses with ever smaller profit margins even to the point of taking continual losses just to keep the doors open! I think the answer is obvious, which is why you read Global Wealth Protection in the first place.

Only 29% of global silver production comes from Primary silver mines. To be clear, that is a very important 29% in a world where silver demand has never been so high, approaching 1 billion ounces a year of demand and new industrial applications being found almost every day. Without much higher silver prices, it is very clear that these Primary silver miners will not be going concerns with their costs to operate increasing at this pace. They simply do not have the vast pockets of a mining giant like BHP Billiton, and financing IE taking on more leverage is not what prudent CEO’s are doing these days.

The recent bankruptcy filing of ATP Oil and Gas should illustrate this point perfectly. While the deepwater oil drilling moratorium in the Gulf of Mexico continued longer than most expected, ATP’s CEO continued to use debt markets waiting for brighter skies, which ultimately led to the implosion of the company. Some silver mining companies have even resorted to holding physical silver instead of taking the risk of holding paper money in a banking institution that may or may not be a going concern…….tomorrow.

To reiterate, the United States’ government’s stockpiles of silver are now ZERO ounces as of the end of 2011, according to the USGS. Primary silver miners are treading water with the spot price of silver in the 20’s. China recently purchased Barrick Gold Africa (73 percent stake with deal pending) and has stated openly that by the end of the decade they would like 10,000 metric tonnes of gold bullion from the 1054 metric tonnes they reported a couple of years ago. In other words, to arrive at their goal, China would need to take down in the neighborhood of 40% of global gold mining production every year! A recently retired PBOC central banker also commented to the assembled press that it would be prudent for China to add silver to its stockpile as well.

With 3 trillion United States’ dollars to go shopping with currently, this is forever changing the landscape of the precious metals market. Supply and demand realities are simply going to overwhelm any long term attempts at controlling prices, even if a government official tells you otherwise.