This Chart is Screaming “Market Crash Incoming!”…

Every major recession for the last 41 years has followed the inversion of 2-year and 10-year treasury rates. The reason is simple…

If longer term investments aren’t favorable over shorter term investments in U.S. treasuries, that generally indicates economic problems right around the corner.

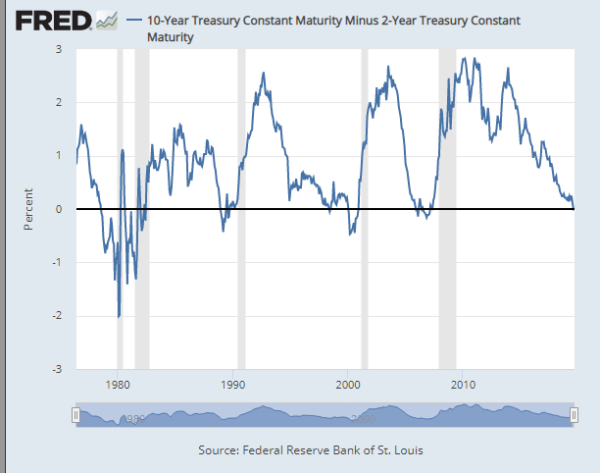

The yield curve inversion doesn’t necessarily “cause” a recession, but it serves as a reliable market signal that a crash is imminent. You can see the relationship between yield curve inversion and recessions in the official U.S. chart below:

The grey areas indicate major U.S. recessions. Each one follows closely after the yield curve “dips” below the baseline (inverts).

In a special alert at Lardan Financial, Leon Wilfan is calling the economic period that began in 2018 a “transition” from the bull market to a bear market:

It is in these transition periods that the market ranges sideways, as fear and greed battle for supremacy. Such were the periods from 1999 to 2000 and from 2006 to 2007. And such is the period we are in right now… a period that began in 2018. And what inevitably follows such a period is a market crash.

Will the market decline by 30%… 50%… more?

Of course we can’t know exactly how far the market will decline. But the last recession ended a decade ago, so the U.S. is overdue for a “big one.”

And keep in mind that while the 2-year / 10-year inverted curve is the most important signal, the 3-month treasuries have been inverted for even longer.

In fact, most short-term U.S. treasuries have been “flat” (close to inverting) or inverted to the 10-year treasuries for most of 2019.

One thing is certain, you should start preparing for the worst now.

Even if the crash doesn’t happen tomorrow, or next week, every major U.S. recession of the last five decades has happened within 24 months of a yield curve inversion.

Who knows exactly when it will happen, or how severe it will actually be, but time is running out. According to another signal, the U.S. may be closer to a recession than you think…

The “Expanding Wedge” Reveals the End of the Bull Market

Generally, when a market gets really volatile, that is a beacon that shows panic is increasing. One of the signals that points to a volatile market is known as the “expanding wedge.” Price trades at higher highs and lower lows, forming a wedge.

You can see this wedge forming in the S&P 500 chart below:

Look at the lower red line. If the S&P crashes below 2,250, U.S. stock markets would panic. Leon Wilfan explains:

High-volatility is a direct indicator of growing anxiety in the market. When investors feel uneasy about their positions, they panic, resulting in a price crash.

To sum up: Reliable signals like the inverted yield curve and an “expanding wedge” both point to an imminent stock market crash in the U.S.

This is why it’s critical you start to explore your options for hedging your bets and protecting your wealth. There is still time to prepare, but not much.

How to Keep Your Options (And Exits) Open

Today, it’s more important than ever to shield your money from stock markets, governments, and central banks. It’s also critical that you safely grow your wealth.

So I’d like to show you how to do both.

As you probably know, I’ve been living the life of a “digital nomad” since 2001. And during that time, I’ve learned dozens of extremely valuable lessons about how to keep your options open and maximize your freedom.

I created GWP Insiders to share those lessons.

In fact, I recently updated the entire membership area and I’m relaunching it as GWP Insiders 3.0. And, for a limited time, you can save 70% on membership.

Why should you seriously consider this?

GWP Insiders is a complete roadmap of internationalization strategies for location independent entrepreneurs and investors looking for answers to tax, residency, wealth, and lifestyle questions.

Bottom line, we believe in REAL freedom. Freedom to keep the money you earned. Freedom to travel where you want, when you want…

Freedom to be private and secure in your business affairs and day to day life.

When you become a member of GWP Insiders, you’ll have access to some of the most valuable and closely guarded secrets the wealthy use to protect and grow their wealth.

For example, you’ll discover:

- How to obtain citizenship and a second passport in less than one year.

- The biggest tax haven in the world (most NEVER get this right).

- How create offshore bank and brokerage accounts to store, protect, and grow your wealth.

- How to structure your business to minimize or eliminate taxes.

- The best opportunities for investing in foreign real estate.

- The best places around the world for living as an expat or nomad.

- And much, much more.

Right now, you can save 70% on your GWP Insiders 3.0 membership. But please hurry because this offer won’t last much longer.

To living privately,

Bobby Casey

Location Independent Entrepreneur

P.S. U.S. stock markets are on borrowed time. The next recession could start any day now. Become a GWP Insiders member today and learn the secrets for protecting and growing your wealth so you can keep your options (and exits) open…