July 7, 2014

By: Kelly Diamond, Publisher

Then there was the fantastic roll out of “Healthcare.gov”! People who were once paying for a private policy were being directed to Medicare. People who once had affordable policies that covered their needs were losing them. And there was that middle generation of people who couldn’t afford the policies that were being offered to them through healthcare.gov, nor did they qualify for Medicare, so they were given an exemption and offered the under-thirty plan. There isn’t as much coverage because the risk is lower amongst younger people. The problem is, the older people signing up for the plan are a higher risk but are paying the same price.

I wrote about all this more extensively “Obamacare = HTTP Error 404”, but every glitch has led to one exemption or another.

One of the major exemptions, in case you didn’t know, is that if you are not in the US for more than thirty-five days per year, you do not have to own a policy. Not to say that you wouldn’t be subject to the mandates of other governments, but you would be free from the U.S. A.C.A.

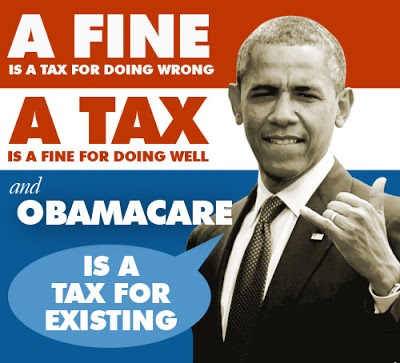

With all the exemptions, it’s a wonder this policy stands a chance of working as it was originally sold to people. Well, come hook or by crook, some people are getting insured, if that means fining the life out of otherwise productive businesses, then so be it!

To show that the government isn’t this ridged, uncaring thing, it is flexible in the administration of how employers provide coverage to its employees. For example, employers can compensate them for a policy they choose privately. But the policy has to fall within the defined parameters of “market reforms”. Here is where I come clean and tell you, flat out, I have NO idea what that means. There’s a 14 page PDF that explains it which left me feeling just slightly dumber than when I went into it.

If the employer fails to meet these requirements, they incur a $100 per day excise tax… including weekends… per employee. That’s $36,500 per year, in case you weren’t counting. That’s someone’s salary… THAT, under free-market circumstances, is another job.

Bobby Casey was tipped off to this by a friend of his who considered Bobby to be “lucky” that he’s not in the US right now to deal with all this. And he would be absolutely RIGHT in his assessment!

Ask yourself, though, what happens every single time the government decides to impose more costly regulations and mandates on the businesses? When minimum wage was imposed and then jacked up regularly to calm the rustled jimmies of all those who had their hands out? When corporate taxes shot back up to 35% (highest in the world)?

Businesses summarily took some advice that I often get: “If you don’t like it, leave.”

They started to outsource manufacturing, data entry, customer service, and billing to other countries. I worked for one such company that did just that. The entire billing department in their New York office was laid off, and it was outsourced to India. Turns out all you need to do is input and match up numbers accurately, and that requires absolutely NO interaction with the English-Speaking part of the world.

When it becomes more cost efficient to send jobs overseas, you have an exodus of employment out of the country. What you essentially have are economic refugees. Sometimes this happens between states like businesses or individuals leaving California or New York for states like Texas and Florida for their lack of income taxes. Sometimes you have full companies leaving in the middle of the night because five consecutive years operating at a loss was all they could take (Read more here.) Fiat even threatened to take their business out if Italy to Poland as well.

When it becomes more cost effective to uproot your life or business and move it to another country, that’s usually a good indication things are amiss. While people will tell me “if you don’t like it, then leave”, they get rather indignant when they realize that involves me taking my wealth and jobs with me.

America is creating an entitlement mentality where citizens have their hands out to the government and employees are putting their hands out to their employers. No longer are employers and employees allowed to negotiate their own compensatory packages, but rather governments are becoming the union thugs that collectively bargain for benefits I never asked for while scaring away the jobs I did ask for.

As the publisher, I’m not very well versed in the technicalities, costs or benefits involved with moving a business offshore. But you don’t have to be a tax attorney or a CPA to notice all the businesses leaving the US and parts of Western Europe in favor of Asia or Eastern Europe either. There’s a reason for that, and that reason is tightly linked to the business’ pocketbooks.

Everyone has their threshold for nonsense. As someone once said, “Everyone is a socialist until they get their first paycheck and see all the taxes taken out”. For some, that’s enough to knock some sense into them. For others, they need their health insurance to be tampered with. And for others still, they need a few more regulations and taxes before they start looking for alternatives to where they are now.

Wherever you are in that journey, it’s worth at least asking about your offshore options, and the ever important question no one else can ask for you: “What’s in it for me?”

I think many people would MUCH rather have a job or start a small biz. That was what made the US great FREEDOM you could start with nothing, a rag and a bucket of water, and work you way out of poverty by washing windows. Now you have to be licensed, bonded and insured. A man in Eugene OR lost his job (idiots passed a retroactive tax on gross receipts) so he posted an ad on craigslst to do odd jobs clean rain gutters, take loads to dump, do yards. He was fined $600 no license. Our tax dollars pay for internet trolls galore. When I ran for Congress I had so many people calling me to tell me the same story. They lost their job working for a small business or theirs went bankrupt after the passage of the aforementioned bill and they can not find another one. They have no money and can not start a biz or tried and got shut down by gov for lack of proper documentation. Oregon is famous for shutting down kids lemonade stands, an obvious health risk!

They pay big companies to come and bring in “jobs”. Taking money from the small businesses costing more jobs than they bring in. When Gov is intertwined with the corporations you have Fascism. The police are killing an increasing number of innocent people every day, at least two per day, that is not counting the ones that are shot but do not die or those beaten. Cops are shooting a family pet every 98 minutes, we are spied on, whistle blowers are severely punished, the corruption is off the charts.

Look around. I have written on the shut down of the logging industry (just the small biz) over the false environmental issues. Same for small farmers, ranchers etc. it is massive. I see no way out of the economic malaise and if you count unemployment, GDP or inflation accurately (you know the gov cooks the books) the new Fascist Police State is going down the toilet.

Pingback: Business Crowded Out by Mandates | Alternative Risk Investment News Trends on Gold, Money, Currency Markets and Financial Freedom

Hi Kelly,

Great piece. One comment on that “If you don’t like it, leave” irritating argument (which I have had many, many times in the US) from others. My response (depending on how they put it to me) is “Give me a good reason to stay” or “Make me believe I should stay.” Then when they attempt to give you the typical BS reasoning it is truly satisfying to say “I already left and I am loving every minute of it” (which I have done). I then say that ” I am now just a tourist visiting now.” You should see their faces when I then say “You can pay for Obamacare, but not me!”