Cryptocurrency inheritance is a growing concern as digital assets become more popular. Without a proper plan, your holdings could be permanently lost. Unlike traditional assets, crypto relies on private keys, and losing them means losing access forever. An estimated $140 billion in Bitcoin is already locked away due to forgotten keys or poor estate planning. Here’s what you need to know:

- Private Key Challenges: Crypto operates as a bearer asset. No keys = no access.

- Legal Risks: Including keys in wills can expose them during probate.

- Tax Issues: Market volatility can complicate tax obligations for heirs.

- Solutions: Use multi-signature wallets, smart contracts, and tools like dead man’s switches to ensure secure transfer.

- Trust Options: Offshore trusts offer privacy and legal protection for your crypto assets.

Planning ahead with the right tools and legal strategies ensures your digital wealth reaches your heirs without complications.

Challenges in Securing Wallet Access After Death

The Risks of Lost Private Keys and Seed Phrases

Cryptocurrency works on principles that differ greatly from traditional banking. If a private key or seed phrase is lost, the associated assets become permanently inaccessible. There’s no customer service hotline to call for help. As Fidelity explains:

"Losing the password and private key to your noncustodial digital wallet may mean losing access to your crypto forever, as there is no central customer service team."

The numbers are staggering. Chainalysis estimates that between 17% and 23% of all Bitcoin – roughly 4.2 million BTC – is locked away forever due to lost keys or the death of owners. Other studies suggest that about 7.5% of Bitcoin, or 1.57 million BTC, is completely lost. Even when recovery information is passed down, heirs often face a steep learning curve. The technical complexities of hardware wallets, multi-signature protocols, or decentralized exchanges can lead to errors or even scams. These challenges not only block asset transfer but can also create additional legal and tax hurdles.

Legal and Privacy Concerns

The challenges don’t end with lost keys. Legal and privacy issues further complicate the inheritance process. Including private keys or seed phrases in a will might seem like a straightforward solution, but it’s risky. Wills become public records during probate, potentially exposing sensitive information to bad actors.

Another layer of complexity comes from legal restrictions. Most professional fiduciaries cannot legally manage digital assets unless they hold specific licenses, such as a money transmitter license or a BitLicense. As digital assets lawyer Max Dilendorf explains:

"Attorneys can’t legally be custodians of digital assets. For an attorney to take custody of a client’s tokens or NFTs, this would require them to have both a money transmitter license and a BitLicense."

This legal limitation makes it difficult for traditional executors to handle digital assets effectively. Adding to the problem, some banks now prohibit storing private keys in safety deposit boxes, citing their lack of cryptocurrency licenses. These restrictions can leave heirs navigating murky legal waters while also dealing with complex tax obligations.

Tax Implications and Compliance

Cryptocurrency inheritance comes with some tax advantages. The IRS allows a "step-up" in cost basis, meaning the asset’s value at the time of death becomes the new baseline for calculating capital gains taxes when it’s sold. However, crypto’s notorious price swings can complicate matters. Heirs might owe inheritance taxes based on the value of the asset at the time of death, but if the market crashes before they can sell, they could face a tax bill larger than the asset’s current worth.

Centralized exchanges like Coinbase and Binance introduce further challenges. These platforms require extensive legal documentation – such as court orders, death certificates, or trust certificates – before they’ll release assets to beneficiaries. All these obstacles highlight the urgent need for better systems to ensure secure and seamless crypto inheritance.

Solutions for Secure Cryptocurrency Inheritance

To ensure your cryptocurrency assets don’t vanish into the digital void, several technical solutions address the risks of lost keys, legal complexities, and tax challenges. These methods focus on granting heirs access while maintaining robust security.

Using Multi-Signature Wallets

Multi-signature (multisig) wallets require multiple keys to approve a transaction. Instead of depending on a single private key, you can create a setup like "2-of-3", where you hold one key, your primary heir holds another, and a trusted attorney or service provider holds the third.

This arrangement avoids the vulnerability of a single point of failure. If one key is lost or compromised, the remaining keys still ensure access. As probate lawyer Anthony Park puts it:

"The whole point… is to distribute control."

This approach also sidesteps a common legal issue: attorneys usually cannot legally take custody of private keys, but they can securely hold one key in a multisig setup without gaining full control.

To put the stakes into perspective, about 20% of all Bitcoin – valued at roughly $140 billion – is estimated to be permanently lost, often due to poor estate planning. A multisig wallet allows heirs to keep their keys while you’re alive, ensuring smooth access later. Nick Neuman, cofounder and CEO of Casa, emphasizes:

"A multisig cold wallet remains the gold standard… it can automatically share the keys with recipients in an encrypted form upon your demise."

For added security, automated digital agreements can further streamline asset transfers.

Smart Contracts for Automated Transfers

Smart contracts take automation a step further. These self-executing agreements, encoded on blockchain platforms like Ethereum, release assets when specific conditions – such as verified death or extended inactivity – are met.

Because smart contracts operate on decentralized blockchain systems, they remove the need for intermediaries like banks, which can introduce errors or bias. This ensures a "trustless" execution process. You can even design these contracts to distribute assets gradually over time rather than all at once. When paired with legal documents, smart contracts provide a seamless inheritance solution.

Dead Man’s Switch and Social Recovery Tools

A dead man’s switch (DMS) is a time-triggered mechanism that releases your private keys or seed phrases if you fail to check in by a set deadline – say, six months. For example, you might receive periodic emails asking you to confirm your status. If you don’t respond in time, the system automatically sends recovery details to your designated heirs.

Social recovery offers an alternative approach. Instead of relying on a timer, it involves appointing trusted "guardians" (family members, friends, or advisors) who can collectively verify your death and help recover access to your wallet. This method reduces the risk of accidental triggers from temporary issues like illness or short-term internet outages.

While a DMS provides full automation, it carries the risk of premature activation. Social recovery, though slower due to the need for coordination, offers stronger verification. Combining these tools with multisig wallets and smart contracts creates a layered system of protection. The key is to thoroughly test your setup while you’re alive and ensure your heirs know how to access and use the recovery information.

Using Offshore Trusts for Asset Protection

Offshore trusts offer a powerful legal framework to safeguard cryptocurrency inheritance. These structures provide privacy, stronger legal protections, and tax benefits that domestic options often lack.

One of the key advantages is that they legally separate you from direct ownership of your assets. As Craig Parker, Assistant General Counsel at Trust & Will, explains:

"With an Asset Protection Trust… that tether between you and the coin itself is legally severed, meaning it stays protected against any third-party seizure."

This separation is particularly important because the IRS classifies cryptocurrency as personal property, making it vulnerable to seizure for tax debts or legal judgments. Offshore jurisdictions like the Cook Islands and Nevis offer an additional layer of protection by not recognizing foreign court orders. Creditors would need to refile lawsuits locally, meeting strict "beyond a reasonable doubt" standards.

Privacy is another major benefit. Unlike wills, which become public during probate, trust documents remain confidential. Attorney Erin de Cespedes highlights this advantage:

"Any public information about your cryptocurrency will make it easier for hackers and scammers to target your loved ones."

By combining these legal safeguards with earlier technical solutions, offshore trusts create a well-rounded strategy for protecting your digital assets.

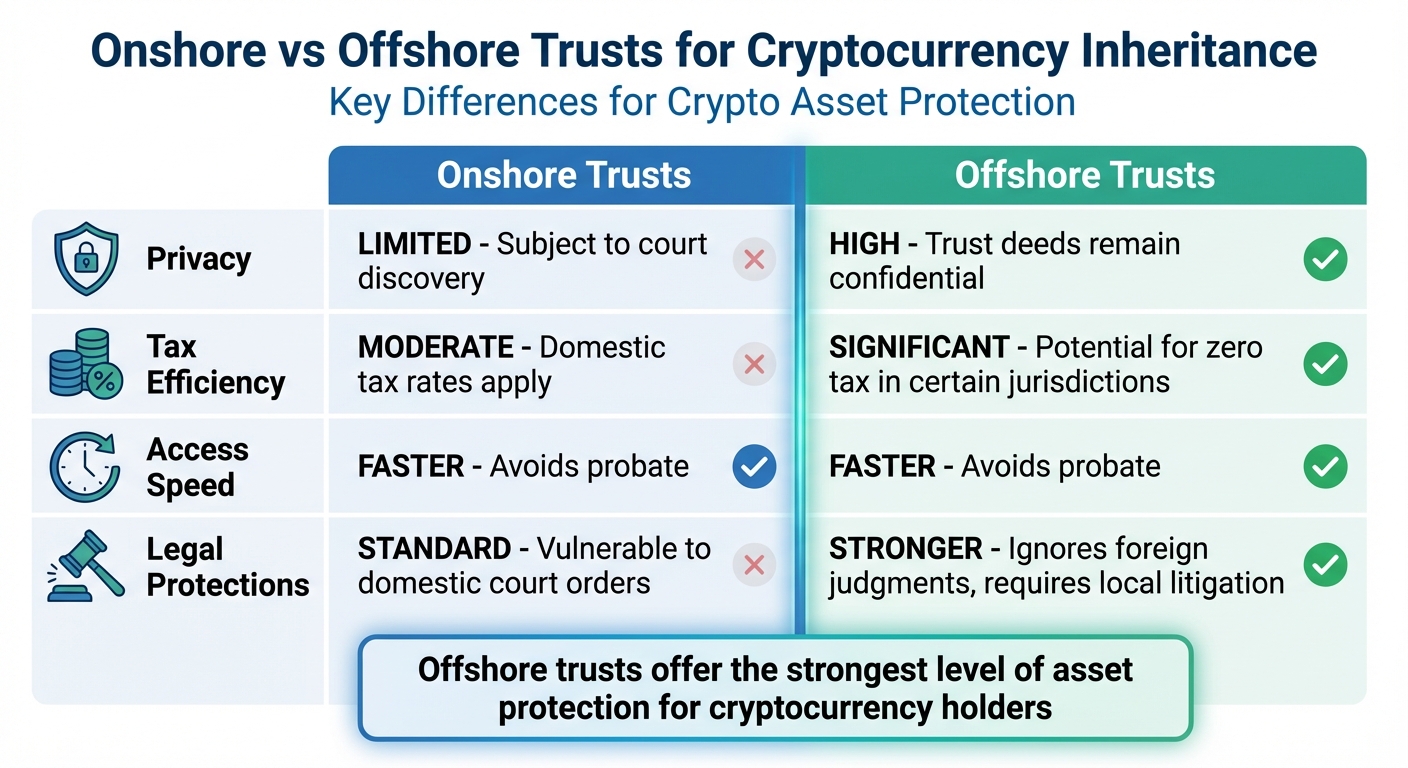

Onshore vs. Offshore Trusts: A Comparison

To understand why offshore trusts are often a better choice for cryptocurrency holders, consider the key differences between domestic and offshore options:

| Feature | Onshore Trusts | Offshore Trusts |

|---|---|---|

| Privacy | Limited; subject to court discovery | High; trust deeds remain confidential |

| Tax Efficiency | Moderate; domestic tax rates apply | Significant; potential for zero tax in certain jurisdictions |

| Access Speed | Faster; avoids probate | Faster; avoids probate |

| Legal Protections | Standard; vulnerable to domestic court orders | Stronger; ignores foreign judgments, requires local litigation |

Offshore trusts often include special clauses to enhance protection. For instance, an "Event of Distress" clause directs trustees to disregard instructions made under legal pressure, while a "Flight" clause allows assets to be moved to another jurisdiction if creditor threats arise. As Nomad Capitalist puts it:

"If you are looking for the strongest possible level of asset protection, an offshore trust is the only way to go."

Setting Up an Offshore Trust for Cryptocurrency

Incorporating an offshore trust into your inheritance plan adds legal protection and ensures a smooth transfer of assets, complementing earlier technical measures.

Start by selecting a jurisdiction like the Cook Islands, known for its strong asset protection laws and allowance of cryptocurrency in trust structures. Appoint a trustee with blockchain expertise, and for larger estates, consider professional custodial services like Anchorage Digital to ensure technical security and compliance. Adding a trust protector can provide oversight and accountability for the trustee’s actions.

For technical security, use multi-signature protocols that require multiple parties to approve transactions, reducing the risk of unauthorized access. "Key sharding", which divides private keys among trustees, adds another layer of protection.

Prepare a separate digital asset memorandum for the trustee. This document should outline wallet locations and access instructions but exclude sensitive private keys from the main trust deed . Include an exception to the "prudent investor rule" in your trust document so trustees can hold volatile cryptocurrencies without liability.

Finally, formally transfer ownership of your digital assets to the trust, ensuring all transfers are documented with valuations for tax purposes . Keep in mind that U.S. citizens must still report offshore trust holdings to the IRS. While these trusts don’t eliminate federal tax obligations, inherited cryptocurrency typically benefits from a step-up in cost basis to its fair market value at the time of death, potentially reducing capital gains taxes for heirs.

Global Wealth Protection offers expertise in setting up offshore trusts, particularly for high-net-worth clients managing cryptocurrency assets, with a focus on jurisdictions like Anguilla.

sbb-itb-39d39a6

Steps to Plan Your Cryptocurrency Inheritance

Securing your digital assets for the next generation requires careful planning that combines technical safeguards with legal precision. By taking proactive steps now, you can help ensure your heirs avoid unnecessary complications when accessing your cryptocurrency holdings. Here’s a detailed guide to help you get started.

7-Step Inheritance Planning Checklist

1. Create a Detailed Asset Inventory

Start by documenting all your digital assets. This includes listing each cryptocurrency you own – whether it’s Bitcoin, Ethereum, or NFTs – along with where they’re stored. Note the type of wallet (hardware, software, or exchange account) and the devices used to access them. Don’t forget to include details about DeFi investments, staking positions, and whether assets are in hot wallets (online), cold wallets (offline), or custodial accounts. For physical items like hardware wallets, record their exact location to prevent accidental loss or disposal by your heirs.

2. Set Up Security Measures

Choose security tools that align with the complexity of your portfolio. For example, multi-signature wallets can add an extra layer of protection, requiring multiple keys to authorize transactions. If you’re safeguarding recovery phrases, consider using Shamir’s Secret Sharing, which divides the seed phrase into several parts stored in different secure locations – such as bank deposit boxes or with trusted family members. For larger portfolios, you might explore services like a "dead man’s switch", which automatically sends access instructions to beneficiaries if you fail to check in over a preset timeframe.

3. Prepare Legal Documentation

Legal documents are just as important as technical measures. Reference your digital holdings in your will or trust, but keep private keys separate in a secure "Letter of Instruction." This letter should include clear, step-by-step directions for accessing your wallets and must be stored safely, such as in a fireproof safe. Additionally, your will or trust should include a clause exempting your executor or trustee from the "Prudent Investor Rule", which could otherwise hold them liable for managing volatile crypto assets.

4. Test Recovery Procedures Regularly

It’s crucial to test your recovery methods to ensure they work. At least once a year – or whenever you update wallet software – verify that your backup seed phrases are accurate and linked to the correct wallets. For added durability, consider storing seed phrases on steel wallets or engraved metal plates, which are more resistant to fire, water damage, and physical wear than paper backups.

5. Choose a Tech-Savvy Executor

Your executor or trustee should have a solid understanding of blockchain technology, or you may need to hire a crypto-savvy consultant. Be sure they have the legal authority to manage digital assets, as traditional estate documents often don’t account for this. For custodial exchange accounts, take advantage of "legacy contact" features offered by some platforms, though these typically still require probate documentation.

6. Update Your Plan Annually

Review your inheritance plan at least once a year or after major life changes, such as marriage, divorce, or the birth of a child. Update your asset inventory whenever you acquire new cryptocurrencies, switch wallet providers, or modify your storage methods. Technology evolves quickly, and wallet software that works today may not be reliable in the future. Keep detailed records of any changes to your cost basis for tax purposes, as cryptocurrency inherited by your beneficiaries usually gets a step-up in value to the market rate at the time of your passing.

7. Stay Informed About Legal and Technological Changes

Cryptocurrency regulations and tax laws are constantly evolving, so it’s essential to stay up to date. As of January 2024, 40% of Americans own cryptocurrency, and some platforms now offer inheritance features – though requirements differ depending on jurisdiction. Work with estate attorneys and tax professionals who specialize in cryptocurrency, as general practitioners may not have the latest insights on IRS reporting for digital assets.

For those managing large or complex cryptocurrency portfolios, services like Global Wealth Protection offer tailored advice on integrating offshore trusts with advanced security protocols.

Conclusion

Planning for cryptocurrency inheritance is crucial to safeguard your digital assets. Without a clear plan, your heirs could face overwhelming technical and legal hurdles, potentially leading to the permanent loss of your holdings.

These obstacles highlight the need for a well-structured approach. Working with expert advisors can simplify compliance and enhance the security of your digital wealth. They can help implement advanced tools like multi-signature wallets, establish trusts to bypass probate, and address legal considerations such as the Prudent Investor Rule, ensuring your executor has the proper authority over your assets.

For entrepreneurs and investors managing significant cryptocurrency portfolios, Global Wealth Protection provides tailored consulting services. Their expertise includes integrating offshore trusts into comprehensive inheritance plans, offering solutions for a seamless transition of your digital wealth.

Taking action now is vital. With 40% of Americans owning cryptocurrency, delaying these preparations puts your assets at unnecessary risk. By adopting these strategies, you can ensure your crypto holdings remain secure and accessible to the people you trust most.

FAQs

How can I make sure my heirs can access my cryptocurrency after I pass away?

To make sure your heirs can access your cryptocurrency, it’s crucial to store your private keys or seed phrases in a secure and easily retrievable place. Options like a secure vault or encrypted digital storage work well. Along with this, include clear instructions on how to access and manage these assets in a legally binding document, such as a will or revocable trust.

It’s equally important to educate your beneficiaries about cryptocurrencies – how they work and how to use the keys properly. For an added layer of security, consider using a trusted inheritance service that can transfer the assets to your heirs after verifying proof of death. These steps can help ensure your digital assets are passed on without complications or risks.

What are the dangers of including private keys in a will?

Including private keys in a will might seem like a straightforward way to pass on your cryptocurrency, but it comes with serious risks. Wills often become part of public probate records, which means your private keys could be exposed, leaving your assets vulnerable to theft. On top of that, if the private key is misplaced or becomes outdated during the probate process, your heirs might lose access to the funds entirely.

To better safeguard your cryptocurrency inheritance, explore more secure options. These could include using specialized storage solutions or estate planning tools designed to keep your private keys protected while ensuring your heirs have clear, secure access instructions.

How can an offshore trust protect my cryptocurrency inheritance?

An offshore asset-protection trust (APT) serves as a legal shield for cryptocurrency, keeping your digital assets out of reach from U.S. creditors, probate courts, and foreign judgments. These trusts are often set up in places like the Cayman Islands, Nevis, or the Cook Islands, where local laws don’t enforce U.S. creditor claims. When you transfer ownership of your cryptocurrency to the trust, it becomes a separate legal entity, protecting it from lawsuits and debt collection efforts.

These trusts come with powerful features, such as trust protectors, who can step in to block creditors from accessing assets, and flight clauses, which automatically transfer assets to another jurisdiction if a legal threat arises. To ensure security, private keys or access details can be managed by a trustee or a multi-signature custodian, guaranteeing that your heirs receive the assets only under the trust’s terms. This setup also bypasses probate, keeping your holdings private and reducing the risk of theft or public exposure.

In addition to asset protection, offshore trusts offer privacy and potential tax advantages. Many jurisdictions provide confidentiality for ownership records and may offer tax benefits for non-U.S. residents. By combining creditor protection, probate avoidance, and controlled access, offshore trusts offer a secure way to manage and pass on cryptocurrency to future generations.