Want more financial freedom and security? A "Freedom Stack" might be your solution. This strategy involves setting up an offshore company, securing residency abroad, and opening international bank accounts – all legally and efficiently. Here’s how it works:

- Offshore Company in Anguilla: Zero corporate tax, strong privacy, and simple setup make Anguilla a top choice for entrepreneurs.

- Residency in Latin America: Countries like Panama, Mexico, and Paraguay offer tax-friendly programs for digital nomads, retirees, and investors.

- Banking in Stable Jurisdictions: Options like Switzerland, Singapore, and Panama provide financial stability, asset protection, and global access.

Setting Up an Offshore Company in Anguilla

Why Choose Anguilla for Your Offshore Company?

Anguilla is an attractive option for entrepreneurs seeking a tax-neutral environment. With a 0% corporate tax rate, the territory eliminates personal income, capital gains, inheritance, gift, estate, and wealth taxes entirely. On top of that, there are no withholding taxes on dividends, interest, or royalties paid to non-residents.

Privacy is another key advantage. The names of directors and shareholders are not publicly disclosed in Anguilla’s Registers office, offering a level of confidentiality that many business owners appreciate. Additionally, the jurisdiction has minimal reporting requirements, which helps reduce administrative efforts. While Anguilla ranks 35th on the Corporate Tax Haven Index and does not have tax treaties in place, tax obligations may still arise depending on your country of residence or where your income is sourced, especially under FATCA and CRS regulations. These favorable conditions make Anguilla an appealing choice for offshore company formation.

How to Form an Anguilla Offshore Company

Starting an offshore company in Anguilla is a straightforward and efficient process. The territory provides two primary corporate structures: International Business Companies (IBCs), also referred to as Business Companies (BCs), and Limited Liability Companies (LLCs). These entities allow for 100% foreign ownership and do not impose residency requirements for directors or shareholders.

The cost of setting up an offshore company in Anguilla typically begins at EUR 1,199 (around $1,275) when working with service providers, making it a slightly more budget-friendly option compared to the British Virgin Islands. Incorporation requires a registered agent, who files the necessary documents and maintains a registered office, ensuring that beneficial ownership details remain confidential. Once all required paperwork is submitted, the process generally takes only a few business days.

Compliance and Legal Requirements

After your company is established, staying compliant in Anguilla is relatively simple, provided you meet local reporting and economic substance standards. Annual maintenance fees are based on the number of issued shares in your company. Additionally, you must maintain a registered agent and office throughout your company’s lifespan.

Since 2016, Anguilla has adopted economic substance legislation in line with OECD and EU guidelines. Companies engaging in regulated activities – such as banking, insurance, fund management, intellectual property, or holding company operations – must meet local substance requirements. This includes demonstrating a management presence, having office space, and incurring operating expenses. Pure equity holding companies, on the other hand, face reduced substance requirements, typically limited to maintaining a registered office and meeting basic compliance standards.

Anguilla also participates in the Automatic Exchange of Information (AEOI) under the CRS framework and implements FATCA reporting for U.S. citizens. Understanding these obligations is essential for managing compliance with both Anguilla’s regulations and those of your home country.

Getting Residency in Latin America

Best Residency Programs in Latin America

Latin America has become a popular destination for Americans looking to establish residency abroad. Since 2020, tens of thousands have made the move, drawn by the region’s tax advantages and appealing lifestyle options. Whether you’re a retiree, digital nomad, or investor, there are programs tailored to meet your needs.

For U.S. citizens, Panama’s Friendly Nations Visa stands out as a straightforward choice. By showing economic ties – such as a bank deposit or property investment – you can secure permanent residency. Panama’s territorial tax system, which excludes foreign-sourced income from taxation, adds to its appeal.

Mexico offers a Temporary Residency program that’s ideal for those who want to try living abroad before committing. You can qualify by demonstrating sufficient income or savings, making it a flexible and affordable option. After meeting the temporary residency requirements, you may be eligible for permanent status.

Paraguay’s Permanent Residency program is another notable option. Known for its simplicity and low financial thresholds, it’s particularly attractive for entrepreneurs and digital workers.

Costa Rica has also made strides with its Digital Nomad Visa, introduced between 2021 and 2023. This visa provides tax exemptions on foreign-earned income for remote workers. For U.S. pensioners, Costa Rica has streamlined its document verification process, making it easier to establish residency.

When deciding which program suits you, it’s essential to evaluate the specific requirements and benefits to align with your personal and financial goals.

Application Requirements and Costs

Residency programs in Latin America generally fall into four categories: Pensionado (retiree), Rentista (passive income), Inversionista (investor), and Digital Nomad visas. Each has unique criteria, so understanding these differences is key to avoiding unnecessary delays or expenses.

Income requirements vary significantly by program. For instance, some require proof of a steady pension, while others look for evidence of passive income. U.S. documents like identity proofs and financial statements will need to be prepared, apostilled, and translated into Spanish before submission.

Be prepared for additional costs, including attorney fees, document translations, and travel for appointments. Legal systems in the region can be inconsistent, and frequent changes in regulations might complicate the process. Hiring a reliable local attorney can help you navigate these hurdles more effectively.

Why Latin American Residency Makes Sense

Establishing residency in Latin America isn’t just about a change of scenery – it can be a strategic move for diversifying your legal and tax profile. When paired with an offshore company structure, it offers geographic diversification and the chance to create a legitimate tax residence outside the U.S.. This setup can provide flexibility in managing taxes and structuring your income.

Another advantage is the lower cost of living in many Latin American countries compared to U.S. cities. This allows you to maintain a comfortable lifestyle while keeping expenses in check – an appealing factor for entrepreneurs and investors alike.

Many countries in the region also allow dual citizenship, and some even offer citizenship by birth. Seven of the eight Latin American nations with golden visa programs provide clear paths to citizenship within two to five years. This opens up the possibility of additional passports, enhancing your global mobility and serving as a valuable backup plan.

Travel within the region is another perk. Many Latin American countries have visa-free agreements with their neighbors, and some residency permits even function as travel documents. This is especially useful if you plan to explore business opportunities or divide your time between multiple countries.

Finally, the territorial tax systems common in countries like Panama, Paraguay, and Costa Rica mean foreign-sourced income isn’t taxed locally. When combined with an offshore company, this can help optimize your tax strategy. However, U.S. citizens are still required to file with the IRS and report worldwide income. Establishing a legitimate tax residence abroad can further strengthen your international financial plan.

Opening a Bank Account in a Stable Jurisdiction

Selecting the Right Banking Jurisdiction

Once your Anguilla company is set up and you’ve secured residency in Latin America, the next step in completing your financial strategy is choosing a banking jurisdiction that protects your assets and provides reliable global access. A well-chosen banking partner is essential for supporting your multi-jurisdictional approach. Ideally, the jurisdiction you select should have stable governance and a strong economy, shielding your wealth from sudden policy shifts or financial instability.

Switzerland is often considered the benchmark for financial security, privacy, and asset protection. Its reliable regulatory framework, strong currency, and neutral stance make it a top choice for international banking. In Asia, Singapore shines with its AAA-rated economy, advanced digital infrastructure, and transparent regulatory environment. Over in Europe, Luxembourg provides excellent privacy and asset protection while granting access to the EU market.

Other jurisdictions also bring unique advantages. The Cayman Islands benefit from political stability, English common law protections, and high liquidity, making them a favorite for wealth management and investment holding. Panama offers USD-based banking, a territorial tax system, and a business-friendly climate. Its removal from the European Union’s blacklist on July 9, 2025, has further enhanced its appeal. Among emerging markets, the United Arab Emirates is gaining recognition as a financial hub with modern financial laws, zero personal income tax, and political stability. Meanwhile, Mauritius is becoming popular for its low taxes, straightforward account-opening process for non-residents, and overall stability.

How to Evaluate Banks

After choosing a jurisdiction, it’s crucial to evaluate banks carefully. Start by examining independent credit ratings from agencies like S&P Global and Moody’s. For example, OCBC Bank holds an Aa1 rating from Moody’s and an A+ from S&P Global, while DBS Bank is frequently ranked among the world’s safest banks by Global Finance.

"Prioritize institutions with strong balance sheets, high liquidity ratios, and a record of being compliant with regulations. You can do this by checking independent ratings (such as S&P Global and Moody’s) and reviews for added assurance."

Look for banks with international expertise. HSBC Holdings plc, ranked #8 globally by assets with over US$3 trillion, operates in more than 60 countries and has a solid track record in helping clients comply with FATCA and CRS requirements. Similarly, Standard Chartered Bank, which manages approximately US$800 billion in assets, is well-regarded for its cross-border wealth management services across Asia, Africa, and the Middle East.

Minimum deposit requirements can vary widely depending on the bank and jurisdiction. If you plan to manage your finances remotely, check whether the bank offers remote account opening. Many banks in Singapore and select Swiss institutions now provide digital onboarding, though their compliance standards can be stringent.

Customer service is another critical factor. Opt for banks that provide dedicated relationship managers, multilingual support, and 24/7 online banking tools. DBS Bank, for instance, is praised for its user-friendly digital platform.

"Avoid banks with negative media coverage, regulatory sanctions, or histories of misconduct."

- Global Citizen Solutions

Keep in mind that deposit insurance may be limited when banking offshore, so it’s even more important to assess a bank’s financial strength and reputation. Also, banks that fail to comply with international anti-money laundering (AML) and know-your-customer (KYC) standards could expose your funds to unnecessary risks.

Banking Options Comparison

Here’s a quick comparison of banking options across key jurisdictions, highlighting their strengths and availability of remote account opening:

| Jurisdiction/Bank | Key Strengths | Remote Opening Availability |

|---|---|---|

| Switzerland (e.g., Credit Suisse) | Asset protection, strong privacy, investment advisory | Varies |

| Singapore (DBS Bank) | Advanced digital banking, regulatory compliance, multi-currency services | Yes |

| Singapore (OCBC Bank) | High credit ratings, expertise in trade finance and private banking | Yes |

| Cayman Islands | USD-based banking, English common law framework, wealth management focus | Varies |

| Panama | USD accounts, territorial tax benefits, business-friendly policies | Yes |

| United Arab Emirates | Modern infrastructure, 0% income tax, business-friendly environment | Yes |

| Luxembourg | EU market access, strong privacy measures, asset protection | Varies |

Diversifying your banking relationships across multiple jurisdictions and institutions can significantly reduce risk. For instance, your Anguilla company could maintain accounts in several countries, offering both flexibility and redundancy. At the same time, staying transparent with U.S. tax authorities about your offshore accounts can help avoid complications and build trust over time.

sbb-itb-39d39a6

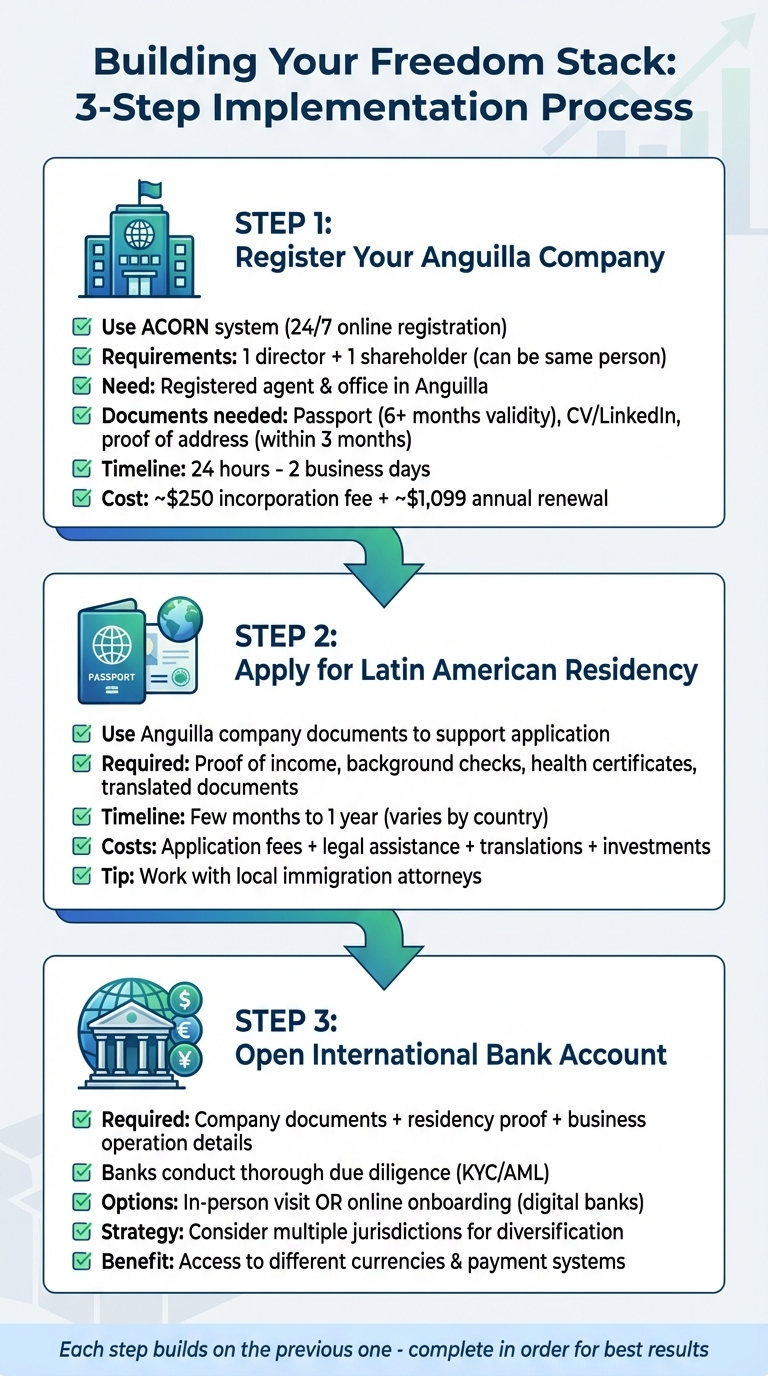

How to Build Your Freedom Stack

Creating a strong freedom stack means carefully assembling the pieces of your international financial strategy in a logical sequence. By doing this step-by-step, each part supports the next, creating a well-rounded and secure setup. Start with forming your Anguilla company, then move on to securing residency in Latin America, and finally, establish your international banking relationships. This order isn’t random – it’s designed to make each step easier and more effective. For example, your company structure can influence your residency application, and both of these can play a role in how banks view your account application.

Step 1: Register Your Anguilla Company

The first step is to register your company in Anguilla. Use the Commercial Online Registration Network (ACORN), which operates 24/7, to choose a unique name for your business. To meet the requirements, your company needs at least one director and one shareholder. These roles can be filled by the same person, and neither needs to be a resident of Anguilla. If privacy is a concern, nominee services are available to keep your identity confidential.

You’ll also need to appoint a registered agent and set up a registered office in Anguilla. Corporate service providers typically handle these requirements for you. Additionally, you’ll prepare your Memorandum and Articles of Association, which outline your company’s structure.

Documentation is a key part of this process. If you’re registering as an individual, you’ll need to provide a valid passport (with at least six months remaining), an updated CV or LinkedIn profile, and a recent proof of address (dated within the last three months). For companies, you’ll need incorporation documents, the Memorandum and Articles of Association, a Register of Directors and Shareholders, and recent company extracts (dated within six months).

Once you’ve submitted your application and paid the incorporation fee of about $250, you can expect to receive your Certificate of Incorporation within 24 hours to two business days. Keep in mind that annual renewal fees are typically around $1,099. Depending on the service provider, you can choose from basic packages or more comprehensive options that may include services like bank introductions. These incorporation documents will also come in handy when applying for residency in Latin America.

Step 2: Apply for Latin American Residency

With your Anguilla company set up, the next step is to apply for residency in a Latin American country of your choice. The documents from your Anguilla company can play a vital role in supporting your residency application. While the exact requirements and timelines vary by country, being organized with your paperwork can make the process much smoother.

Residency applications generally require proof of income, background checks, health certificates, and translated documents. Processing times can range from a few months to a year, depending on the country and type of visa. Be sure to budget for application fees, legal assistance, document translations, and any required investments. Working with local immigration attorneys who understand the specific rules of the country you’re applying to can help prevent unnecessary delays or denials. Once your residency is approved or in progress, you’ll be ready to move on to the final step: setting up your international banking.

Step 3: Open Your International Bank Account

Opening an international bank account is the final piece of your freedom stack. This step ensures that your financial setup is both secure and functional. Banks typically require a complete structure before approving your account, so having your Anguilla company and Latin American residency in place is essential. You’ll need to provide your company documents, proof of residency (or evidence that your application is underway), and detailed information about your business operations. Banks will also conduct thorough due diligence, including verifying the identities of company owners and directors.

Some traditional banks may require you to visit in person, while many digital banking providers now offer online onboarding processes. If you’re working with a corporate service provider, they can often leverage their existing relationships with banks to help you secure an account more easily. Be prepared to explain your business model, expected transaction volumes, and the sources of your funds.

For added security and flexibility, it’s worth considering opening accounts in multiple jurisdictions. This strategy provides access to different currencies and payment systems, helping protect your financial structure from unexpected disruptions or policy changes. By diversifying your banking setup, you’ll be better equipped to handle any challenges that come your way.

Compliance, Risks, and Maintenance

Building and maintaining a freedom stack isn’t a set-it-and-forget-it process. It requires consistent attention to compliance and regular upkeep. As regulations shift, staying informed about your obligations and avoiding common missteps is essential to keeping your structure secure and legitimate.

FATCA and CRS Reporting Requirements

If you’re a U.S. citizen, your tax reporting responsibilities follow you, no matter where your money is held. Under FATCA (Foreign Account Tax Compliance Act), you must disclose foreign financial assets to the IRS if they exceed certain thresholds – about $50,000 for single filers living in the U.S., with higher limits for joint filers or those living abroad. This involves filing Form 8938 (Statement of Specified Foreign Financial Assets) and FinCEN Form 114 (FBAR) to report foreign bank accounts, even if the Form 8938 thresholds don’t apply.

Failing to comply can lead to steep penalties. As Katelynn Minott, CPA & CEO of Bright!Tax, explains:

"Your bank is practically CC’ing the IRS – and its international cousins – before you’ve even filed your own taxes".

CRS (Common Reporting Standard), on the other hand, is adopted by over 100 countries and focuses on tax residence rather than citizenship. Under CRS, financial institutions report account details to local tax authorities, which then share the information with the taxpayer’s country of residence. This means offshore accounts, Latin American banking, and other holdings are likely reported to multiple jurisdictions.

The key distinction is that FATCA targets U.S. citizens specifically, while CRS is a global framework based on tax residence. Both systems require financial institutions to identify accounts, collect self-certifications, and report details like balances, interest, dividends, and sales proceeds. Non-compliance with CRS can result in fines exceeding €50,000 for institutions and severe penalties for individuals.

To stay ahead, provide accurate tax residency information to financial institutions, keep meticulous records of your income and business activities, and ensure all required forms are filed on time. Holding accounts through an Anguilla company won’t exempt you from reporting – it could even draw extra scrutiny.

Now that reporting obligations are clear, let’s look at common mistakes that can derail your compliance efforts.

Mistakes to Avoid

Even small missteps in compliance or maintenance can lead to penalties and disrupt the integrity of your freedom stack.

- Economic Substance Requirements: Ensure your Anguilla company meets these standards to avoid penalties.

- Missed Renewals: Overlooking renewal fees or failing to update documentation can result in your company being removed from the register, complicating banking and residency arrangements. Keep track of deadlines to avoid lapses.

- Misaligned Residency and Banking Choices: Select residency programs and banking jurisdictions that align with your business needs, lifestyle, and compliance requirements. Your freedom stack should reflect your personal and professional realities.

- Underestimating Maintenance Costs: Beyond setup fees, account for ongoing costs like registered agents, renewals, accounting, tax preparation, legal advice, and audits. Budgeting for these recurring expenses is crucial.

- Inadequate Documentation: Keep comprehensive records of company documents, residency applications, bank communications, financial statements, and tax filings. When authorities request information, having everything organized can prevent unnecessary investigations.

Adjusting Your Freedom Stack Over Time

Building your freedom stack is just the beginning. Regular reviews and adjustments are necessary to keep it aligned with changing regulations and your personal circumstances.

Life events like marriage, children, new business ventures, or extended stays in different countries can all impact your optimal structure. Spending significant time in a high-tax country, for instance, could unintentionally trigger tax residency, requiring adjustments.

Regulations evolve, too. Tax treaties can be renegotiated, economic substance rules updated, and banking requirements revised. For example, in August 2022, the OECD expanded CRS to cover electronic money products, central bank digital currencies, and indirect crypto-asset investments. Staying informed about such changes is critical, and professional advisors can help you navigate these developments.

Banking relationships may also require diversification. If one jurisdiction tightens regulations or a bank changes its policies, having backup accounts can help you avoid disruptions. Periodically evaluate your accounts based on transaction volumes, currency needs, and regulatory stability.

Residency programs demand attention as well. Some Latin American programs have minimum stay requirements or periodic renewals. Missing these can affect your overall structure. On the flip side, naturalization through residency could open new opportunities but might also bring new tax obligations, requiring further adjustments.

Make it a habit to review your freedom stack annually with international tax, legal, and banking experts. This proactive approach can help you anticipate issues before they arise and ensure your structure continues to work effectively.

Conclusion: Getting Started with Your Freedom Stack

Creating a freedom stack is about crafting a framework that safeguards your wealth, minimizes tax burdens, and allows for greater global mobility. The three-part strategy outlined here – establishing an Anguilla company, securing residency in Latin America, and building stable banking relationships – works because each piece complements the others, addressing different aspects of your financial strategy. Together, they form a cohesive system designed to support your goals.

The process begins with setting up your company, followed by obtaining residency, and finally, establishing reliable banking connections. While these steps may seem straightforward, navigating the complexities of international tax regulations like FATCA and CRS, along with compliance standards and economic substance requirements, requires specialized expertise. As Offshore Circle aptly puts it:

"As the international business panorama continues to evolve, organizations looking to set up an offshore company need expert guidance to manage the complexities of tax laws, offshore banks and offshore tax havens jurisdictions".

Seeking professional advice is not just helpful – it’s essential. Missteps in this area can lead to costly consequences, far outweighing the investment in proper guidance. Global Wealth Protection offers tailored offshore solutions, handling everything from Anguilla company formation to banking introductions, while ensuring your structure remains effective and compliant over time.

Your freedom stack isn’t a one-time setup – it should grow and adapt as your personal and business circumstances evolve. Start with a strong foundation, stay diligent about compliance, and be ready to adjust as needed. With the right structure and expert support, you can achieve the financial freedom and asset protection you’re aiming for.

FAQs

What tax responsibilities do U.S. citizens have when setting up a company in Anguilla?

U.S. citizens are obligated to report their worldwide income to the IRS, no matter where their company operates. Even though Anguilla provides a zero-tax environment for businesses, U.S. citizens remain subject to U.S. tax laws, including the Foreign Account Tax Compliance Act (FATCA) and Controlled Foreign Corporation (CFC) rules. This means that income earned through an Anguilla-based company could still face U.S. taxation.

Keep in mind, forming an offshore company doesn’t exempt you from U.S. tax responsibilities. To stay compliant and avoid penalties, it’s crucial to properly plan and file the necessary forms with the IRS.

What are the benefits of Latin American residency programs for digital nomads and retirees?

Latin American residency programs come with plenty of perks for digital nomads and retirees. From affordable living costs to flexible visa options, they provide a practical solution for those looking to live or work abroad. On top of that, the region boasts access to high-quality healthcare and tax policies that are often more favorable than those in the United States. This means you can stretch your income or savings further while enjoying a comfortable lifestyle.

Many countries in Latin America also offer pathways to permanent residency or citizenship, giving you long-term stability and the freedom to travel internationally without restrictions. Plus, the region is known for its vibrant expat communities, which can make settling in and building a social network much easier. Whether you’re drawn by the warm climate, rich cultural experiences, or financial benefits, Latin America offers plenty of reasons to consider it for your next chapter abroad.

What factors should I evaluate when selecting a banking jurisdiction for my offshore company?

When selecting a banking jurisdiction for your offshore company, focus on regions with strong political and economic stability. This helps protect your assets and minimizes potential risks. Take a close look at the jurisdiction’s privacy laws to ensure your financial details remain confidential. Additionally, explore the banking services available, such as multi-currency accounts and online banking, to determine if they meet your needs.

Make sure to review the compliance requirements to confirm the jurisdiction aligns with your company’s legal and tax responsibilities. Consider the ease of access to banking services, the associated fees, and the overall regulatory framework to ensure it supports your long-term financial objectives.