Staying compliant with offshore regulations in 2025 is non-negotiable. Governments worldwide have introduced stricter rules targeting tax avoidance, beneficial ownership transparency, and anti-money laundering (AML). Over 100 jurisdictions now participate in the OECD‘s Common Reporting Standard (CRS), making it harder to hide offshore assets. Non-compliance can lead to severe penalties like fines, account freezes, or even company dissolution.

To ensure compliance, focus on these key areas:

- Annual Renewals: Pay fees and update details like directors and shareholders on time to avoid penalties or strike-offs.

- Economic Substance Rules: Demonstrate real business activity in your jurisdiction, including local employees and offices.

- KYC/AML Compliance: Maintain updated records for all beneficial owners and follow strict anti-money laundering procedures.

- Financial Record-Keeping: Keep accurate records for at least seven years, aligning with CRS and tax reporting standards.

- Banking Compliance: Update bank KYC details annually and monitor transactions to avoid sanctions or account closures.

- Jurisdiction-Specific Deadlines: Track filing dates for renewals, substance reports, and beneficial ownership disclosures.

Proactive compliance reduces risks of audits, penalties, or banking disruptions. Tools like compliance calendars, digital KYC repositories, and regular internal audits can help you stay ahead of evolving regulations. For expert guidance, consult professionals who specialize in offshore compliance and asset protection.

Annual Renewal and Registered Agent Requirements

To keep an offshore company in good standing, renewing its business license every year is a must. This renewal process ensures your company remains on the corporate register and avoids penalties like administrative strike-offs or dissolution. Typically, the renewal involves paying the government’s annual license fee, registry filing fees, and fees for your registered agent or office. In some jurisdictions, additional charges like economic substance or annual return filing fees might also be included in the invoice. During renewal, you’ll need to verify basic company details – such as directors, shareholders, beneficial owners, and registered office address – and submit compliance declarations confirming that accounting records are maintained and local laws are followed.

Renewal Deadlines and Procedures

Deadlines for renewals depend on the jurisdiction. In many cases, the deadline aligns with your company’s incorporation anniversary, meaning you’ll need to renew on or before that date each year. Other jurisdictions use fixed dates, like June 30 or December 31, for all companies. Missing the deadline can lead to late fees, loss of good standing, and eventually, strike-off if the issue isn’t resolved during the grace period. If your company is struck off, reinstating it can be an expensive and time-sensitive process. You’d need to pay all overdue fees, restoration penalties, and possibly file court or registrar approvals – costs that can quickly add up to several years’ worth of standard fees.

For U.S.-based owners, it’s smart to use a centralized compliance calendar (formatted as MM/DD/YYYY) with reminders set 60 to 90 days before deadlines. Assigning a single person or service provider to manage compliance is also essential. This person should document procedures, track reminders, and reconcile them with invoices from your registered agent to catch any discrepancies early.

Make sure your registered agent details are up to date to avoid any compliance issues.

Updating Registered Agent Information

A registered agent acts as the official point of contact between your company, the corporate registry, and local authorities. They handle legal notices, government communications, and maintain statutory records and Know Your Customer (KYC) files as required by law. Most offshore jurisdictions mandate that every company appoint and maintain a licensed registered agent and office in the jurisdiction to stay compliant. If your agent resigns or loses their license, your company could face penalties and may even be unable to file required documents.

When updating registered agent information, ensure the legal name, registered office address, and any other necessary contact details are accurate and properly documented. Keep records of the agent’s appointment, invoices, notices, and confirmation letters. Some jurisdictions require you to notify them of any changes to directors, officers, or beneficial owners within a specific timeframe, typically 14 to 30 days. To stay ahead, set an internal policy to report corporate changes to your compliance officer within the same week they’re approved, and forward this information to your registered agent immediately along with supporting documents.

Switching to a new registered agent involves passing a board resolution, signing engagement documents with the new agent, and filing a change-of-agent form with the corporate registry. The new agent will conduct KYC and Anti-Money Laundering (AML) checks on your company and its beneficial owners before accepting the role. Each year, confirm that the registered office address and agent name match the information on your bank’s KYC records, tax filings, and major contracts. Request updated confirmation from your agent, verify that all invoices are paid, and ensure the agent still holds an active license in the jurisdiction.

For specialized assistance with managing annual renewals and coordinating registered agents across various jurisdictions, consider consulting Global Wealth Protection. They provide centralized compliance support, offshore company formation services, and strategic advice on tax optimization, asset protection, and privacy.

Economic Substance and Reporting Obligations

Several offshore jurisdictions, such as BVI, Cayman Islands, UAE, Jersey, and Seychelles, have introduced Economic Substance Rules (ESR) to tackle the issue of "shell companies" that exist only on paper to gain tax advantages. These rules demand that companies engaged in specific business activities demonstrate a genuine economic presence in their jurisdiction of incorporation. This means having actual employees, a physical office, and local decision-making processes, rather than merely maintaining a registered address.

As we approach 2025, ESR compliance has become increasingly critical. Tax authorities in high-tax countries are actively scrutinizing ESR filings to identify and challenge artificial structures, which could lead to audits or reclassification of income. Banks and service providers are also requiring proof of ESR compliance during their annual Know Your Customer (KYC) reviews. Non-compliance can result in frozen accounts, penalties, company strike-offs, and loss of tax benefits. If your offshore company falls under ESR, you’ll need to submit annual notifications and detailed reports to prove local substance. The next step is determining whether your company’s activities require ESR compliance.

Determining Economic Substance Applicability

Not all offshore companies are subject to ESR rules – it depends on whether your entity engages in a "relevant activity" and earns income from it. Common relevant activities include holding company business (pure equity holding), headquarters operations, distribution and service centers, financing and leasing, fund management, intellectual property business, shipping, and insurance. To determine if ESR applies to your company, examine your actual income sources and contracts rather than relying solely on your incorporation documents.

A practical way to assess this is by creating a simple matrix that aligns your business activities with ESR definitions specific to your jurisdiction. For instance, if you own a BVI company that only holds shares in subsidiaries and earns dividends without offering management services, it might qualify as a pure equity holding company, which has reduced substance requirements. However, if the same company also provides treasury services, strategic advice, or administrative support to group entities, it could be classified as a headquarters business, requiring full compliance with substance rules. Additionally, companies that can prove tax residency in another country through tax residency certificates may be exempt from ESR in certain jurisdictions.

It’s also important to consider whether your company benefits from a low or zero corporate tax rate in its offshore jurisdiction. If you pay full corporate tax in another country and can provide documentation, you might fall outside the scope of ESR. Even if your company hasn’t earned relevant income, you should still file a notification confirming this status. To stay ahead, work with an offshore tax advisor to review your classification annually, especially if your business model or income streams change. Once you’ve clarified your classification, you can move forward with filing the necessary ESR reports.

Filing Economic Substance Reports

Filing ESR reports is a critical part of compliance, and deadlines must not be missed. Once you’ve established that ESR applies to your company, you’ll need to complete two submissions: an ESR notification and, if applicable, a more detailed ESR report.

The notification is a brief annual filing that includes basic details such as your company’s name, registration number, financial year, whether relevant activities were conducted, whether income was earned from those activities, and whether you claim tax residency elsewhere. Deadlines vary by jurisdiction but typically fall six to nine months after the end of your financial year. For example, BVI companies must file within nine months of their financial year-end.

The full ESR report requires greater detail, including documentation of your core income-generating activities (CIGAs) – the specific tasks that produce your company’s income. For example, a distribution business might list activities such as negotiating contracts, managing inventory, and overseeing logistics. A financing company might report tasks like agreeing on loan terms, managing credit risk, and processing payments. The report must also include data on the number of full-time employees (or outsourced staff) working locally, total operating expenses in the jurisdiction, descriptions of physical premises, and details of any outsourcing arrangements with oversight mechanisms.

To streamline this process, maintain an organized "ESR file" throughout the year. This should include:

- Board meeting minutes with attendance records and proof (e.g., passport stamps) that directors were physically present

- Local employment or service contracts

- Office lease agreements and photos of the workspace

- Utility bills and general ledger entries showing local expenses

- Bank statements documenting payments to local suppliers

- Copies of major contracts negotiated in the jurisdiction

Having these documents ready simplifies filing and ensures you’re prepared for potential regulatory audits. Coordinate with your registered agent to submit filings through the jurisdiction’s online portal, and retain all records for future reference.

Common mistakes that raise ESR red flags include reporting relevant activities but showing minimal local costs or employees, inconsistencies between ESR filings and payroll records, outsourcing core activities to providers outside the jurisdiction (which most regimes don’t accept), and missing filing deadlines. Keeping thorough documentation strengthens your overall compliance and reduces risks. If you’re uncertain about your substance requirements or need help managing filings across multiple jurisdictions, Global Wealth Protection offers expert support for ESR compliance, offshore company formation, and tax strategies.

KYC and AML Compliance

After addressing economic substance requirements, it’s crucial to ensure your KYC (Know Your Customer) and AML (Anti-Money Laundering) protocols align with evolving global standards. These measures are essential for maintaining banking relationships and operational legitimacy. By 2025, offshore companies will face heightened scrutiny from banks, payment processors, and regulators, all demanding complete transparency in ownership and transactions. Failing to comply can lead to frozen accounts, blacklisting by financial institutions, and hefty regulatory penalties.

The regulatory environment has changed significantly. Offshore jurisdictions that once prioritized anonymity now adhere to FATF recommendations and OECD transparency initiatives. This means detailed disclosures of beneficial owners, comprehensive customer due diligence, and continuous monitoring are now standard. Banks and service providers conduct rigorous multi-level checks, including identity verification, source-of-funds analysis, sanctions screenings, and PEP (Politically Exposed Person) checks. In many reputable offshore centers, non-compliance with KYC and AML rules can be a more immediate threat to operations than tax issues – banks can freeze accounts in days, while tax authorities typically take much longer to act.

Keeping KYC Documentation Current

Your offshore company must maintain a complete KYC file for all directors, shareholders, and beneficial owners – generally anyone with a 25% or greater ownership stake. Standard requirements include certified copies of passports, proof of address dated within the last three months (such as utility bills or bank statements), government-issued IDs, and source-of-funds declarations explaining the origin of your capital. For corporate shareholders, additional documents like corporate structure charts, certificates of incorporation, and UBO (Ultimate Beneficial Owner) affidavits tracing ownership back to individuals are necessary.

KYC compliance isn’t a one-time task. These records must be reviewed and updated annually. Banks have become stricter with their yearly recertification processes, and delays in updating documents can result in account freezes.

To stay organized, consider creating a centralized digital repository for all KYC files using encrypted platforms that meet high-security standards. Set automated reminders to update documents before they expire. Many companies also schedule quarterly self-audits to ensure all records are current and properly apostilled where required. Synchronizing annual KYC updates with registered agent service renewals can streamline the process and reduce the risk of banking disruptions.

Establishing AML Procedures

Beyond maintaining accurate KYC records, your offshore company needs a written AML framework to demonstrate active efforts to prevent money laundering and terrorist financing. Regulators, banks, and counterparties expect to see formal policies addressing risk assessment, customer onboarding, transaction monitoring, and reporting of suspicious activities.

An effective AML policy should mandate customer due diligence (CDD) to verify client identities and classify relationships by risk – low, medium, or high. Risk factors include geographic location, industry type, transaction volume, and whether the party is a PEP. For higher-risk relationships, enhanced due diligence (EDD) is required. This involves additional steps like obtaining detailed source-of-wealth documentation (e.g., tax returns, sale agreements, or financial statements), conducting adverse media checks, and implementing more frequent monitoring.

Your AML policy should also require beneficial owner disclosures for anyone holding a 10% to 25% interest, depending on the jurisdiction. These disclosures must be documented through notarized declarations. Screening tools that automatically check names against global sanctions lists, such as those maintained by OFAC, the EU, or the UN, are essential to avoid violations.

Transaction monitoring is another critical element. Use automated software or manual checks to flag unusual activities, such as large cash transfers exceeding $10,000, rapid fund movements without a clear business purpose, or transactions involving sanctioned countries. Regularly review monthly wire transfer reports and document any flagged activity with detailed notes explaining its legitimacy or steps taken to escalate concerns. Recent data shows that AI-powered monitoring tools can reduce false positives by about 40%.

Retain all KYC, transaction, and AML records for five to seven years, as required by regulations. Common red flags include incomplete UBO disclosures, frequent changes of address without explanation, and transactions concentrated in high-risk regions. In 2024 audits, 35% of flagged cases involved gaps in UBO documentation. To address these risks, conduct bi-annual internal audits, testing your AML controls with mock suspicious activity reports and scenario-based evaluations. This is especially important as new challenges, like cryptocurrency integration, emerge.

If your company operates in multiple jurisdictions, remember that KYC and AML requirements can vary. For instance:

- The British Virgin Islands requires annual KYC filings through registered agents linked to economic substance documentation.

- The Cayman Islands recently introduced stricter enhanced due diligence requirements following 2024 updates.

- Seychelles emphasizes PEP screenings and mandates seven-year record retention but imposes lighter reporting requirements for low-risk entities.

Using jurisdiction-specific compliance checklists can help ensure you meet local standards. For companies navigating complex multi-jurisdictional compliance or seeking expert advice on AML policy development, Global Wealth Protection offers specialized support to help you establish and maintain strong compliance frameworks.

Financial Record-Keeping and Tax Reporting

Once you’ve aligned with operational and banking standards, the next critical step in your offshore compliance strategy is maintaining detailed financial records and ensuring accurate tax reporting. Proper record-keeping not only supports Know Your Customer (KYC) and Anti-Money Laundering (AML) efforts but also ensures you’re ready for audits by clearly connecting income, expenses, and transactions to actual business operations. By 2025, regulators and financial institutions will expect documentation that substantiates your substance claims and tax positions. Neglecting this can quickly lead to account freezes or increased scrutiny from tax authorities.

Accounting and Record Retention

Keep essential financial documents – like general ledgers, journals, trial balances, invoices, bank statements, contracts, payroll records, and management accounts – organized and in USD. Arrange them by financial year, ensure monthly reconciliations, and hold onto these records for at least seven years. This retention period is crucial for meeting requirements under the Common Reporting Standard (CRS) and for handling extended limitation periods or transfer pricing reviews. Every transaction should be backed by invoices, receipts, wire confirmations, or contracts.

Under CRS, financial institutions share account information of non-resident beneficial owners with tax authorities, who then exchange this data with other participating countries. To avoid discrepancies that could trigger audits, your records must align with what banks report.

Using cloud-based accounting tools like Xero or QuickBooks Online can simplify this process. These platforms allow you to attach documents directly to transactions and securely archive records with role-based access. Establish a written retention schedule that specifies what to keep, the format (e.g., PDF, CSV, system backups), storage locations, and who is responsible for periodic checks. Conduct annual reviews to ensure records are accessible, readable, and properly backed up.

Your chart of accounts should clearly separate operating income and expenses, financing items, related-party transactions, and tax accounts. For businesses operating across borders, set up dedicated intercompany accounts for each related entity, document transfer pricing methods, and reconcile balances regularly. This approach minimizes mismatches that could attract tax authority attention and strengthens your economic substance claims by linking income to real activities, personnel, and assets within your jurisdiction. These practices also ensure compliance with CRS requirements and streamline tax reporting.

Tax Registration and Reporting

Start by confirming your tax residency and registering for corporate income tax along with any other applicable taxes, such as VAT, GST, or withholding tax. If your jurisdiction offers tax exemptions, file any required "zero-tax" or "exempt" declarations and store these documents with board resolutions and legal opinions for easy access.

Prepare for year-end by aligning financial statements with tax rules. This includes creating schedules for depreciation, categorizing deductible and non-deductible expenses, and addressing interest limitations. If you’re carrying forward losses, document them thoroughly with schedules and evidence of regular business operations. Deductions for management fees, royalties, or service charges need to be backed by contracts, invoices, and proof of substance to avoid recharacterization. For cross-border payments, keep treaty documentation and reconcile gross and net transaction amounts.

U.S. persons face additional compliance requirements, including FBAR, Form 8938, Forms 3520/3520-A, and Form 5471. Meeting these obligations is essential to avoid penalties.

Set internal deadlines 30 to 45 days before statutory due dates to prevent late filings. Strengthen controls by segregating financial duties, requiring dual authorizations for bank transfers, and conducting regular independent reviews of reconciliations and journal entries. A documented review process – where a senior finance officer or external advisor checks draft returns against financial statements – can help catch errors before submission. For companies dealing with complex multi-jurisdictional tax reporting or U.S. owner-level compliance, Global Wealth Protection offers specialized advisory services to help establish compliant structures and effective record-keeping systems.

sbb-itb-39d39a6

Banking and Transaction Compliance

Building and maintaining stable offshore banking relationships requires more than just opening an account. It involves ensuring transparent cash flows, keeping Know Your Customer (KYC) details up to date, and implementing strong systems for monitoring transactions and screening for sanctions violations. Without these measures, you could face account freezes, sudden closures, or even being "de-risked" – a situation where banks sever ties without evidence of wrongdoing, simply because your documentation doesn’t meet their heightened standards.

Updating Bank KYC Annually

Banks typically review your account annually to assess your risk profile. To stay ahead, prepare a comprehensive KYC package that includes updated corporate documents, proof of beneficial ownership, financial statements, and a concise business description.

This business description should clearly outline your operations, key clients and suppliers, the countries where you operate, and any changes to your business model. Increasingly, banks also request an "expected activity profile" that details your typical monthly and annual transaction volumes, average and maximum transaction sizes, core currencies used, and key counterparties categorized by country and type. This profile should align with your internal budgets and be supported by sample contracts or invoices for major relationships. If you anticipate significant changes to your business activities, notify your bank in writing beforehand. Proactive communication can help prevent automated alerts from triggering unnecessary investigations or account freezes.

To streamline this process, maintain a central compliance file for each banking relationship. This ensures you can respond quickly and consistently to periodic reviews. What you share with your bank should match the information in your contracts, invoices, tax filings, and economic substance reports. Any inconsistencies could lead to enhanced scrutiny or restrictions on your account.

In addition to keeping your bank records in order, staying vigilant about sanctions and monitoring risks is equally critical.

Avoiding Sanctions and Monitoring Risks

Screening counterparties against major sanctions lists is a key step in managing risk. This includes checking against the U.S. OFAC lists (especially the Specially Designated Nationals list), United Nations sanctions lists, and, where applicable, EU and UK consolidated lists. Many banks also assess jurisdictional risk by referencing FATF black and gray lists.

Set up internal transaction monitoring rules with clear thresholds for manual review. For instance, flag high-value payments, transactions involving unusual counterparties, or any activity that deviates from the norm. Transactions involving offshore chains or multiple intermediaries with unclear beneficial ownership should be carefully reviewed, and additional information should be obtained before proceeding. Keep audit-ready records of all screening decisions, and ensure your staff receives annual training on sanctions compliance and how to identify suspicious activity.

For businesses navigating complex cross-border banking, U.S. dollar transactions, or higher-risk sectors, Global Wealth Protection offers tailored advisory services. These services help design banking and transaction frameworks that align with your tax optimization and asset protection strategies, minimizing the risk of sudden account closures or de-risking.

Jurisdiction-Specific Filing Deadlines and Requirements

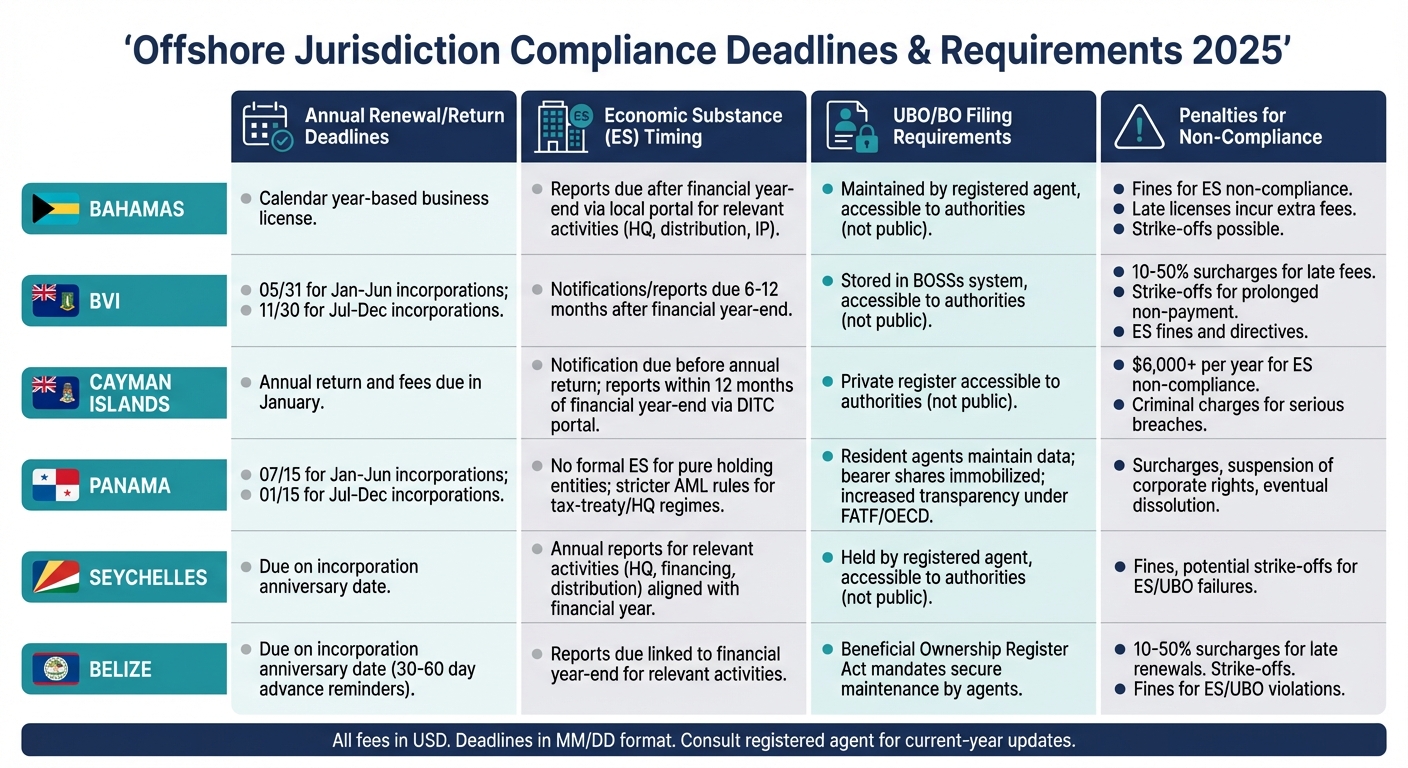

Every jurisdiction has its own set of compliance deadlines and filing rules. Missing these deadlines can lead to penalties, company strike-offs, and complications with U.S. tax reporting or banking. Popular jurisdictions like the Bahamas, British Virgin Islands (BVI), Cayman Islands, Panama, Seychelles, and Belize each have unique annual renewal dates, economic substance (ES) reporting schedules, and Ultimate Beneficial Owner (UBO) filing requirements. These timelines are not interchangeable. Some jurisdictions align deadlines with incorporation dates, while others use fixed dates or financial year-ends. To stay on track, it’s essential to maintain a master compliance calendar in U.S. Eastern Time, including local deadlines and internal cutoffs set 30–60 days ahead.

Synchronizing offshore deadlines with the U.S. tax year (January 1–December 31) is equally important. Offshore filings must be completed well in advance to ensure timely preparation of U.S. tax forms like Form 5471, Form 8965, Form 8938, and FBAR. For instance, if your offshore entity’s financial year ends in December and its ES report is due by June, you’ll need to close your books and prepare the necessary documentation long before June to meet U.S. filing deadlines. Proper coordination can prevent delays in obtaining crucial documents, such as certificates of incumbency or good-standing letters, which might be withheld if your company falls behind on its obligations. These timelines highlight the importance of managing renewals, filings, and record-keeping as part of a comprehensive offshore compliance strategy.

Key Jurisdiction Comparison Table

The table below outlines key deadlines and filing requirements for some of the most commonly used offshore jurisdictions. All government fees are listed in U.S. dollars (USD) for consistency, though amounts may vary based on exchange rates. Deadlines are presented in the month/day format and reflect local time unless otherwise noted.

| Jurisdiction | Annual Renewal / Return | Economic Substance Timing | UBO / BO Filing Requirements | Penalties for Non-Compliance |

|---|---|---|---|---|

| Bahamas | Annual business license and company renewal tied to the calendar year, depending on license type and registry regulations. | ES applies to "relevant activities" like headquarters, distribution, and IP; reports are due after the financial year ends via the local portal. | UBO data is maintained by the registered agent and accessible to authorities, though it’s not public. | Fines for ES non-compliance and sanctions for late licenses; missed renewals lead to extra fees and possible strike-offs. |

| BVI | Annual government fee due by 05/31 for January–June incorporations and 11/30 for July–December incorporations. | ES notifications and reports are required for relevant activities, with deadlines tied to the financial year (6–12 months after year-end). | UBO data is stored in the Beneficial Ownership Secure Search (BOSSs) system, accessible to authorities but not public. | Late annual fee incurs escalating surcharges (10–50%); prolonged non-payment results in strike-offs. ES failures lead to fines and potential directives. |

| Cayman Islands | Exempted companies must file their annual return and pay fees in January. | ES notification is due before the annual return, and ES reports must be submitted within 12 months of the financial year-end via the DITC portal. | UBO data is kept in a private register accessible to authorities but not public. | Penalties for ES non-compliance start at $6,000 per year and increase for repeat offenses; serious breaches may result in criminal charges. |

| Panama | Annual franchise tax is due by 07/15 for January–June incorporations and 01/15 for July–December incorporations. Late payments incur fees. | No formal ES regime for pure holding entities, but transparency and anti-money laundering (AML) rules are stricter for tax-treaty and HQ regimes. | Resident agents maintain shareholder and officer data; bearer shares must be immobilized. BO transparency has increased under FATF/OECD pressure. | Non-payment leads to surcharges, suspension of corporate rights, and eventual dissolution if unresolved. |

| Seychelles | International Business Companies (IBCs) must pay their annual renewal fee by their incorporation anniversary date. | ES rules apply to entities conducting relevant activities like headquarters, financing, and distribution. Reports are due annually, aligned with the financial year. | UBO data is held by the registered agent and accessible to authorities but not public. | Penalties for ES and UBO failures include fines, potential strike-offs, and other sanctions for ongoing defaults. |

| Belize | Annual renewal fees are due on the incorporation anniversary date, with reminders sent 30–60 days in advance by registered agents. | ES reporting applies to relevant activities, with deadlines linked to the financial year-end. | The Beneficial Ownership Register Act mandates that UBO data be securely maintained by registered agents, with fines for late or inaccurate filings. | Late renewals incur surcharges (10–50%); non-payment can lead to strike-offs. ES and UBO violations result in fines and administrative penalties. |

Work closely with your registered agent to confirm current-year government fees, filing forms, and any regulatory updates. Request penalty schedules for late submissions and clarify any grace periods. For U.S. owners managing multiple entities, firms like Global Wealth Protection can assist with offshore company formation, maintenance, and compliance. They can help you align filing deadlines with your U.S. tax year and streamline your asset protection strategies.

Risk Monitoring and Internal Audits

Building on earlier discussions about economic substance and KYC/AML, maintaining a strong compliance framework hinges on effective risk monitoring through internal audits. Waiting for a regulator or bank to flag issues is a risky gamble. By conducting audits proactively, you can identify and address gaps in areas like economic substance, ownership records, KYC files, and tax reporting before they escalate into penalties or trigger automatic data exchanges with your home tax authority. Many offshore jurisdictions now share information automatically when companies fail substance tests, making early detection critical to safeguard both your entity and personal tax position. Regulatory expectations are rising, with boards and senior management required to implement risk-based compliance programs that include documented policies and independent testing, rather than relying on one-off checklists.

Conducting Internal Compliance Audits

To strengthen your compliance strategy, incorporate regular internal audits to monitor risks effectively. Start by creating a compliance risk register that outlines key focus areas such as economic substance, UBO (Ultimate Beneficial Ownership) transparency, KYC/AML, tax filings, and governance. For each area, document associated risks, controls, responsible parties, and review schedules. Conduct an annual internal audit covering these critical areas, and for higher-risk aspects, consider quarterly reviews. Document your findings, address any issues promptly, and track progress using a remediation tracker. Assign clear responsibilities and deadlines for resolving problems, and verify during the next audit cycle that corrections have been implemented.

Ensure you maintain audit-ready documentation, such as board resolutions, meeting minutes, service agreements, office leases, payroll records, and key contracts. Common pitfalls include poor record-keeping and failing to file economic substance or tax reports on time. For U.S. persons, cross-check offshore accounting records against U.S. reporting obligations to avoid discrepancies that could draw attention from the IRS. These internal audit practices complement broader compliance efforts and significantly reduce the risk of regulatory missteps.

Staying Ahead of 2025 Trends

Compliance requirements are constantly evolving, and staying ahead of emerging trends is essential. For fintech and crypto-related entities, internal audits should include checks for virtual asset licensing, transaction monitoring, and adherence to the travel rule. Use automated tools to monitor high-risk clients, large or unusual transactions, and sanctions lists. Segment clients by risk level, gather detailed source-of-funds documentation for blockchain transactions, and conduct regular counterparty investigations. High-risk clients, such as crypto operators, should undergo semi-annual reviews to ensure compliance.

Beyond the crypto space, expect stricter enforcement of UBO disclosure rules, more rigorous substance requirements tied to spontaneous information exchanges, and the increased use of AI-driven sanctions screening by banks and payment processors. Organizations with formal compliance risk assessments and regular internal audits tend to face fewer regulatory issues and lower penalties. Provide board-level compliance reports at least annually, summarizing key risks, audit findings, remediation progress, and regulatory developments impacting offshore and digital asset sectors.

If you manage multiple entities or complex structures, consider working with firms like Global Wealth Protection. They offer periodic reviews of offshore structures, banking and KYC strategies, and ongoing company maintenance to help align your operations with tax optimization, asset protection, and privacy objectives.

Conclusion

Staying compliant with offshore company regulations is critical for protecting your assets, safeguarding privacy, and ensuring smooth operations. Missing deadlines for annual renewals or economic substance filings can lead to serious consequences, such as hefty penalties, dissolution of your entity, or automatic information sharing with tax authorities. The IRS has ramped up enforcement on foreign reporting forms like FBAR, FATCA, and Forms 3520, 5471, and 8938 as of 2025, making compliance even more essential.

Taking a proactive approach to compliance not only helps you avoid penalties but also strengthens your operational stability. It can also significantly reduce the risk of audits while enabling lawful tax strategies that may lower your tax liability by as much as 50-100%. Consider Ronald’s situation: he owned a foreign trust established before becoming a U.S. resident and mistakenly believed, based on poor CPA advice, that no distributions meant no filing requirements. His late filings resulted in steep penalties, which were only mitigated with the help of expert legal counsel. This case highlights the importance of timely filings and expert guidance to avoid costly errors.

To ensure compliance, focus on maintaining all key elements: annual renewals, economic substance filings, KYC/AML procedures, accurate financial records, updated banking details, and regular internal audits. These components together form a robust compliance framework capable of withstanding regulatory scrutiny. Set reminders for jurisdiction-specific deadlines, conduct a Q1 2025 audit to assess your current compliance status, and address any gaps immediately. For entrepreneurs managing complex offshore structures, Global Wealth Protection offers services for company formation, ongoing maintenance, and compliance strategies tailored to asset protection and tax optimization goals.

In an era of tightening global regulations and increased enforcement, dedicated compliance is essential for long-term asset protection and business continuity. Companies that treat compliance as a strategic advantage, rather than a burden, will be better positioned for success in 2025 and beyond. Taking action now ensures your offshore structure remains secure and fully compliant moving forward.

FAQs

How can I ensure my offshore company complies with Economic Substance Rules in 2025?

To meet the Economic Substance Rules in 2025, here’s what you need to focus on:

- Establish a physical presence: This means having an office or staff in the jurisdiction where your offshore company is registered.

- Conduct core income-generating activities locally: Ensure these activities align with your company’s business type and take place within the jurisdiction.

- Maintain detailed records: This includes keeping accurate financial statements and operational documents to prove compliance.

- Submit reports promptly: File all required reports with the relevant authorities on time to avoid penalties.

Taking these steps seriously will help your company stay compliant with the regulations.

What are the best practices for managing offshore company renewal deadlines to avoid penalties?

To steer clear of penalties, offshore companies need a solid system for tracking renewal deadlines. Start by setting up a comprehensive calendar that lists all filing and renewal dates. Pair this with automated reminders to ensure you’re always ahead of schedule. Staying on top of your company’s paperwork and keeping it well-organized is a must for maintaining compliance.

Another key step is to routinely check for updates to local regulations, as deadlines and requirements can shift unexpectedly. If you want extra reassurance, teaming up with a professional service provider can be a smart move. They can keep you informed about regulatory changes and take care of compliance tasks, saving you time and effort.

How can I ensure my KYC and AML documentation stays up to date?

To maintain up-to-date KYC (Know Your Customer) and AML (Anti-Money Laundering) documentation, make it a habit to verify client identities using valid, government-issued IDs and recently updated proof of address documents. Regularly review these records to ensure they are accurate and align with evolving regulations.

It’s also crucial to monitor transactions continuously to spot and report any unusual activity. By staying on top of updates and conducting regular audits, you can remain compliant with regulations and uphold trust with regulatory authorities.