Tax residency can be tricky for families with different travel patterns. Here’s what you need to know:

- Tax Residency Basics: Residency determines which country can tax your income. It’s not tied to citizenship or visas but based on factors like time spent, where you live, and your financial or personal ties.

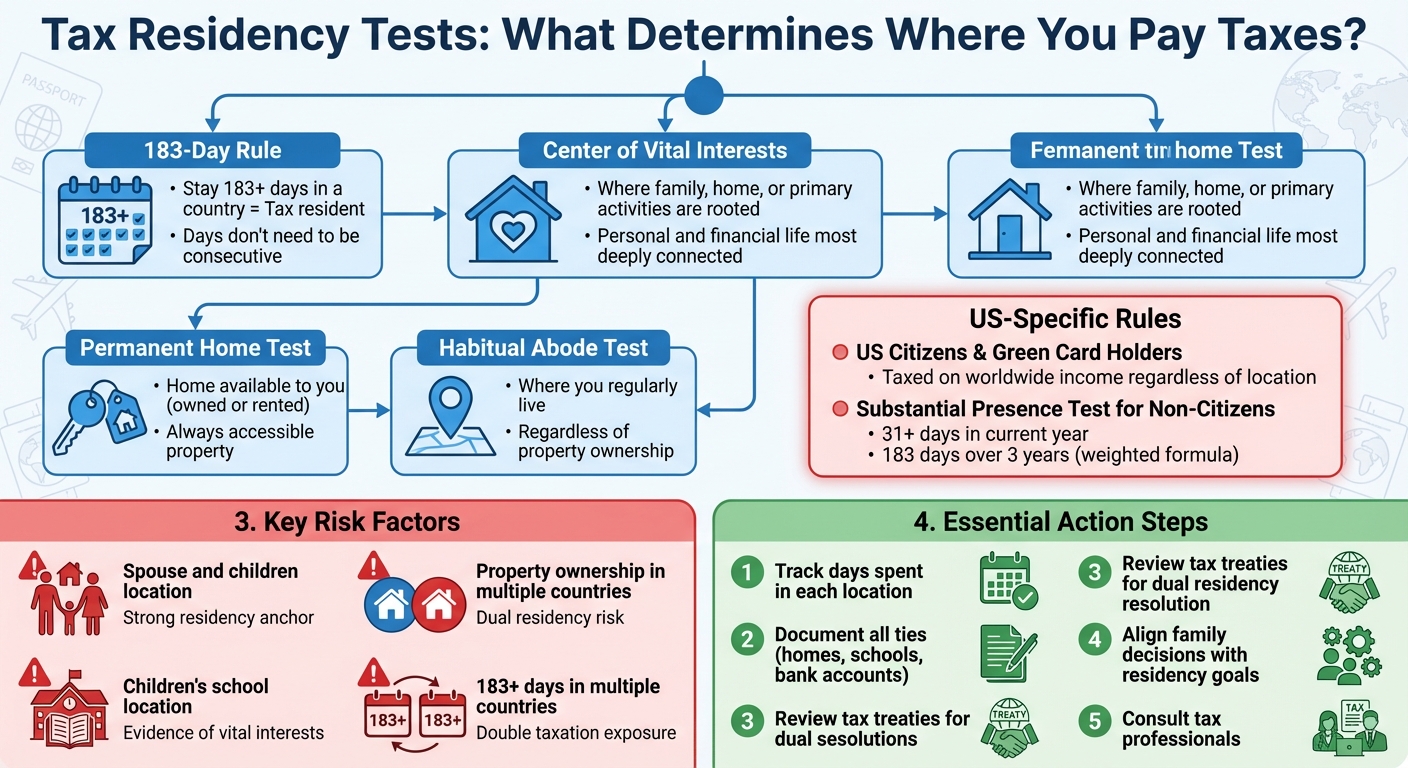

- Common Residency Tests:

- 183-Day Rule: Stay 183+ days in a country, and you’re likely a tax resident.

- Center of Vital Interests: Where your family, home, or primary activities are rooted.

- Permanent Home Test: Ownership or availability of a home in a country.

- Habitual Abode Test: Where you regularly live.

- Family Impacts: Spouses and children often anchor tax residency. For instance, if your family stays in one country while you travel, that country may still claim you as a resident.

- U.S. Tax Rules: U.S. citizens and green card holders are taxed on worldwide income, regardless of where they live. Non-citizens can also trigger U.S. tax residency under the Substantial Presence Test.

- Dual Residency Risks: Spending significant time in multiple countries can lead to dual residency, requiring tax filings in both places and risking double taxation.

- Key Strategies:

- Track time spent in each location and document ties (e.g., homes, schools, bank accounts).

- Use tax treaties to resolve dual residency conflicts.

- Plan family decisions, like children’s schooling, to align with desired residency.

- For U.S. taxpayers, consider tools like the Foreign Earned Income Exclusion or Foreign Tax Credit to reduce burdens.

Proper planning, documentation, and professional advice are essential to avoid costly mistakes and manage your family’s tax obligations effectively.

How Tax Residency Rules Work for Families

Tax residency determines which country has the right to tax your income – it’s not about your passport or visa. Countries use different tests to figure out residency, and when family members live across multiple countries, these tests can lead to conflicting outcomes. Let’s explore how these rules work and what they mean for families.

Common Tax Residency Tests

Most countries rely on four main tests to decide tax residency. The simplest is the 183-day rule: if you spend 183 days or more in a country within a calendar year, you’re considered a tax resident there. These days don’t have to be consecutive, though there are exceptions in certain cases.

When the day-count doesn’t settle the matter, tax authorities turn to the center of vital interests test. This looks at where your personal and financial life is most deeply rooted. Unlike the 183-day rule, this is more about judgment than strict numbers.

The permanent home test examines whether you have a home in the country that’s always available to you, whether it’s owned or rented. Meanwhile, the habitual abode test focuses on where you regularly live, regardless of property ownership. These tests are often used to resolve disputes when two countries both claim you as a tax resident.

How Family Ties Affect Residency Decisions

Where your family lives plays a big role in determining your tax residency. Tax authorities often see the location of your spouse and children as a clear sign of your center of vital interests. For instance, if your spouse and kids stay in Minnesota while you claim to have moved to Florida for tax purposes, Minnesota may still consider you a resident.

"If your family, job, and primary home stay in Minnesota while you claim residency elsewhere, you remain a Minnesota resident for tax purposes."

– Redpath and Company

Many jurisdictions also follow a spousal presumption, meaning your spouse’s residency status is assumed to match yours unless you’re legally separated, divorced, or one of you is in the military. This can make it harder for families to split their tax residency, as leaving a spouse or dependents in one state often triggers audits. These family ties complicate matters when members spend time in different locations.

US Tax Rules for Citizens and Green Card Holders

The U.S. has unique tax obligations that apply to its citizens and green card holders, no matter where they live.

U.S. citizens and green card holders are subject to worldwide taxation. This means the IRS requires you to report your global income, regardless of where you reside. These rules apply independently of your immigration or visa status.

For non-citizens, the Substantial Presence Test comes into play. You meet this test if you’re in the U.S. for at least 31 days during the current year and accumulate 183 days over three years. This total includes all days in the current year, one-third of the days from the previous year, and one-sixth of the days from the year before that.

The Green Card Test applies if you hold Lawful Permanent Resident status at any point during the year. In this case, your tax residency begins on the first day you’re physically present in the U.S..

There’s also a closer connection exception for non-citizens who meet the Substantial Presence Test but want to avoid U.S. tax residency. To qualify, you must have spent fewer than 183 days in the U.S. during the current year, maintain a tax home in another country, and not have applied for permanent residency.

Identifying Your Family’s Tax Residency Risks

Understanding your family’s tax residency status is crucial for managing potential risks. These risks can be surprisingly complex, especially when family members split their time across different countries or states. It’s important to assess how travel patterns might expose your family to unique tax obligations.

Typical Family Travel Patterns and Their Tax Risks

Different travel scenarios can lead to unexpected tax residency issues. For instance, if one spouse frequently travels while the other stays home, the traveling spouse might unintentionally trigger tax residency in countries where they spend significant time – particularly if they cross the 183-day threshold. Meanwhile, the spouse and children who remain at home establish the family’s "center of vital interests", anchoring residency in the home country.

Another common situation arises when both parents travel while children remain in the home country. Even if the parents spend most of the year abroad, tax authorities often view the children’s location as evidence of the family’s true center of vital interests. Factors like schools, pediatricians, and the children’s permanent residence can tie the family back to their home jurisdiction. This can make it challenging to claim non-residency, especially in jurisdictions like California or countries with strict family-tie rules.

The distinction between domicile and statutory residency is also important. Domicile refers to your permanent home – the place you intend to return to – while statutory residency can be triggered in multiple locations based on physical presence and maintaining a home. For example, a family with their primary residence in Texas but spending summers in Colorado could face statutory residency claims from Colorado if they exceed day-count thresholds and maintain property there.

How to Document Your Current and Potential Tax Residencies

Once you’ve identified potential risks, thorough documentation becomes key. Start by tracking each family member’s time spent in each jurisdiction. For U.S. tax purposes, the Substantial Presence Test requires at least 31 days in the current year and 183 days over a three-year period, calculated using a weighted formula. Other countries, like the UAE, follow simpler thresholds, such as 183 days in a year or 90 days combined with other ties. Keep a detailed log of arrival and departure dates for every country and state.

Next, evaluate your strongest connections to each jurisdiction. Document where your spouse and children live, where you own or rent property, and where your vehicles are registered. Note which state issued your driver’s license, where you maintain bank accounts, and where your doctors, accountants, or professional advisors are based. These factors often carry more weight than day counts when tax authorities determine your center of vital interests.

Gather supporting documents as soon as possible. These might include passports, utility bills, bank statements, school records for children, and medical records. If you’re claiming non-residency in a particular location, avoid using that address on tax forms, W-2s, or professional service bills, as these can raise red flags during audits.

Finally, consult official resources for detailed rules in each jurisdiction. For example, the IRS provides guidance in Publication 519 for U.S. residency, while California’s Franchise Tax Board offers Publication 1031 for state residency rules. The UAE outlines residency criteria in its Tax Procedures Guide TPGTR1. These resources provide the specific tests and thresholds needed to assess your family’s tax exposure accurately.

Tax Residency Strategies for Families with Different Travel Patterns

Once you’ve pinpointed the tax residency risks your family might face, the next step is crafting strategies to manage those obligations effectively. The best approach will depend on your citizenship, how often your family travels, and your long-term financial objectives.

Managing US Tax Status for Cross-Border Couples

For US citizens and green card holders, the rules around citizenship-based taxation mean you’re taxed on your worldwide income, no matter where you live. But there are ways to reduce the tax burden, especially if one spouse frequently travels while the other stays in the US.

One popular method is establishing domicile in a state without income tax. States like Florida, Texas, Nevada, and Wyoming don’t impose state income taxes, which can simplify the tax situation for any family members who remain in the US.

If you’re a US citizen living abroad, the Foreign Earned Income Exclusion (FEIE) allows you to exclude up to $126,500 of foreign income in 2024, provided you meet either the Physical Presence Test (spending at least 330 days outside the US over 12 months) or the Bona Fide Residence Test. Additionally, the Foreign Tax Credit (FTC) lets you offset your US tax liability dollar-for-dollar with foreign taxes paid – this is especially helpful when the FEIE doesn’t fully eliminate the risk of double taxation.

When it comes to filing taxes, choosing between Married Filing Jointly and Married Filing Separately requires careful consideration. Filing jointly may offer better rates and deductions but requires reporting worldwide income. Filing separately, on the other hand, can shield the non-traveling spouse from international reporting requirements. There’s also an option to treat a nonresident alien spouse as a US resident for tax purposes, enabling joint filing but subjecting the foreign spouse to US taxes on their worldwide income. Each choice has trade-offs that require thorough analysis.

These domestic strategies lay the groundwork for tackling dual residency challenges in other countries.

Using Tax Treaties to Resolve Dual Residency

Tax treaties can help resolve dual residency issues by applying tie-breaker rules. These rules first look at where you have a permanent home, then your center of vital interests, followed by your habitual abode, and finally, your citizenship. This process works hand-in-hand with domestic strategies, ensuring consistency across jurisdictions.

Dual residency happens when two countries claim you as a tax resident under their domestic laws. This might occur if one spouse spends enough time in multiple countries to meet physical presence criteria or if family ties establish residency in one country while work obligations create another.

Tax treaties provide a structured way to determine which country has the primary right to tax your income. Even after applying these rules, you may still need to file tax returns in both countries, but treaty provisions ensure you aren’t taxed twice on the same income.

If disputes arise, the Mutual Agreement Procedure (MAP) allows tax authorities from the involved countries to negotiate a resolution. While this process can take time, it offers a practical way to address conflicts and avoid double taxation.

Matching Family Decisions with Residency Goals

To make the most of domestic and treaty-based strategies, aligning your family’s everyday decisions with your residency goals is essential. Understanding the difference between domicile (your permanent home) and residence (where you live temporarily) is key. While you can have multiple residences, you can only have one domicile.

For instance, where your children attend school can significantly impact your tax residency claims. Tax authorities often consider this as evidence of your family’s "center of vital interests." If you’re trying to establish non-residency in a particular jurisdiction but your children are still attending school there, your claim could be weakened. On the flip side, aligning your children’s education with your desired tax residency can strengthen your case for a new domicile.

Beyond documentation, lifestyle choices play a big role in proving your intent to change domicile. This includes cutting ties with your previous location – selling property, closing local bank accounts, canceling memberships, and updating voter registration – while establishing new connections in your target jurisdiction. Half-hearted efforts can leave you vulnerable to dual residency claims.

Immigration and visa status also come into play. In some countries, holding a residence permit doesn’t automatically make you a tax resident, while in others, the two are closely linked. For example, getting a residence visa in Portugal won’t make you a tax resident unless you spend more than 183 days there or make it your habitual residence.

Families with diverse travel patterns need to coordinate their decisions thoughtfully to avoid dual residency and the risk of double taxation. Regular discussions about travel plans, relocations, and lifestyle adjustments can help reinforce a solid residency strategy.

sbb-itb-39d39a6

Tools and Structures for Managing Family Tax Residency

These strategies integrate into your broader residency plan, helping minimize the risk of dual taxation.

Using Legal Entities and Trusts

Legal structures play a key role in managing income, safeguarding assets, and planning for cross-border inheritance. For example, US LLCs and partnerships offer flexible tax treatment and can shield nonresident alien interests from US gift tax if classified as intangible assets.

Foreign corporations are another option, often used to protect US-situs property from US estate tax – especially for nonresident aliens from countries without domicile-based treaties. A foreign corporation can hold US property through a subsidiary, but this approach can trigger holding company rules, double taxation risks (such as a 30% withholding tax on dividends, unless reduced by treaty), and limited capital gains advantages.

For mixed-nationality couples, Qualified Domestic Trusts (QDOTs) are a practical solution to address US federal estate tax when one spouse is not a US citizen. These trusts allow property to transfer to the surviving spouse while deferring estate taxes until distributions occur or the surviving spouse passes away. Additionally, US tax resident family members should steer clear of Passive Foreign Investment Company (PFIC) investments – such as non-US mutual funds, ETFs, hedge funds, or private equity – because these can lead to complex tax reporting and compliance challenges in the United States.

Building Systems to Stay Compliant

While legal structures provide asset security, having effective systems in place ensures ongoing compliance. Tools like residency-tracking apps – such as Monaeo, TaxDay, or TaxBird – are invaluable for monitoring day counts to meet statutory residency rules. These apps are particularly useful for managing the 183-day threshold or substantiating a change in domicile. They simplify the process and deliver audit-ready records in case tax authorities question your residency claims.

Maintaining organized records is equally important. Keep travel receipts, canceled checks, bank statements, and property documents in audit-ready condition. When changing domicile, document every step meticulously: update voter registration, driver’s license, IRS address records, and USPS mail forwarding. Regularly review and update your documentation to ensure compliance with regulatory changes.

How Global Wealth Protection Can Help

In addition to legal structures and thorough documentation, specialized services can simplify tax residency management even further.

Global Wealth Protection offers private US LLC formation services, designed to provide asset protection and privacy for families managing business income or real estate. Their packages include all required filings, registered agent services, and consultations to tailor the structure to your residency needs.

For families considering offshore company formation, Global Wealth Protection provides comprehensive packages, primarily in Anguilla, with options for other jurisdictions. These services cover filings, certifications, and introductions to banking partners for managing cross-border assets. For high-net-worth families, offshore trusts and private interest foundations offer advanced estate planning and asset protection solutions that can accommodate varying travel patterns within the family.

The GWP Insiders membership program offers ongoing access to internationalization strategies, including tax optimization techniques, jurisdiction selection advice, and personal consultations. For families with more intricate residency challenges, private consultations deliver tailored, step-by-step guidance based on your citizenship, travel habits, and financial goals.

Conclusion

Navigating tax residency for families with diverse travel patterns requires careful planning, meticulous record-keeping, and regular reassessment. The difference between domicile and residency is crucial – tax authorities focus on your actions rather than your stated intentions. When family members move at different speeds or maintain connections to multiple countries, the risk of dual taxation and unexpected bills increases without proper coordination.

Take Robert and Linda, for example – clients of Gatewood Tax & Accounting. They faced a looming $487,000 Illinois state income tax bill after selling their business in early 2025. However, by starting a detailed, two-year plan in late 2024, they completely avoided this liability. Their strategy included purchasing a home in Florida, spending over 200 days there in 2025, and documenting every step to establish Florida residency. When they finalized the sale in February 2026 as Florida residents, the tax burden disappeared.

Staying compliant as tax laws evolve requires strong systems and expert advice. Implementing robust tracking and documentation practices can help families keep up with shifting regulations and avoid costly mistakes.

Aligning residency decisions with long-term wealth protection is equally important. Whether it’s managing U.S. citizenship obligations, using tax treaties, or leveraging tools like trusts and offshore entities, the foundation for success lies in intentional planning and thorough documentation. Regular reviews ensure your approach stays effective as family travel habits and goals change over time. These strategies tie back to the broader goal of aligning legal residency with asset protection.

"When done right, the tax savings can be transformational. When done wrong, the audits can be devastating."

- Gatewood Wealth Solutions

FAQs

How can couples with different travel schedules manage their tax residency effectively?

To navigate tax residency smoothly, couples with differing travel schedules should maintain thorough records of their travel dates, financial activities, and personal connections to each country. These records are essential to avoid accidentally creating dual tax residency or being subject to higher tax rates in certain jurisdictions.

Understanding the residency rules of each country is equally crucial, especially since some nations have agreements in place to prevent double taxation. Working with a knowledgeable tax professional can provide clarity, ensure compliance, and help tailor a tax strategy that fits your specific lifestyle.

How do family relationships and travel patterns affect tax residency?

Family connections play a big role in determining tax residency, especially when family members live in different countries or have varying travel routines. Tax authorities often look at where your immediate family – like your spouse or dependents – primarily resides to establish your main tax residency.

If your family is scattered across multiple countries, managing your residency status becomes more complex. This can lead to challenges like dual taxation or other compliance concerns. To navigate these issues, it’s essential to understand local tax laws and consult a professional who can help align your tax responsibilities with your family’s unique living and travel situations.

How can U.S. citizens living abroad legally lower their tax obligations?

U.S. citizens living abroad have opportunities to legally lower their tax responsibilities by using certain provisions in the U.S. tax code. Two primary options include the Foreign Earned Income Exclusion (FEIE) and the Foreign Tax Credit:

- Foreign Earned Income Exclusion (FEIE): This allows qualifying individuals to exclude up to a specific amount of foreign-earned income from U.S. taxes.

- Foreign Tax Credit: This provides a dollar-for-dollar credit for income taxes paid to a foreign government.

To take advantage of these benefits, you’ll need to meet specific requirements, such as passing the physical presence test or qualifying under the bona fide residence test for the FEIE. Understanding these rules and planning carefully can help reduce the risk of double taxation while ensuring you stay compliant with U.S. tax laws. For personalized guidance, it’s a good idea to consult with a qualified tax professional.