If you’re a non-U.S. resident running a global business, forming a U.S. LLC can provide key advantages. It offers personal asset protection, simplified tax structures, and access to U.S. banking systems – all without requiring U.S. citizenship or a Social Security Number. Here’s what you need to know:

- Tax Benefits: U.S. LLCs avoid double taxation through pass-through taxation. Foreign-sourced income (earned outside the U.S.) is often not subject to U.S. federal taxes.

- Asset Protection: Your personal assets remain separate from business liabilities.

- Access to U.S. Systems: Easily open U.S. business bank accounts and use payment processors like Stripe and PayPal.

- Popular States: Wyoming, Delaware, and Nevada are favored for low fees, privacy, and no state income tax.

However, compliance is critical. You’ll need to file specific tax forms (e.g., Form 5472) and meet state-specific requirements. Missteps can lead to penalties. With proper setup and management, a U.S. LLC can streamline your global operations and enhance your business’s reach.

How U.S. LLCs Work for Non-U.S. Persons

What Is a U.S. LLC?

A U.S. Limited Liability Company (LLC) is a type of business entity registered at the state level, designed to safeguard your personal assets from business-related debts and legal claims. It blends the straightforward structure of a sole proprietorship with the liability protection often associated with corporations. You can set up an LLC as a single-member entity (just you) or include multiple partners. Unlike corporations, LLCs don’t require formal governance or extensive paperwork. For non-U.S. residents, this setup offers a practical way to protect assets without dealing with complex administrative hurdles.

Tax Classifications for Foreign Owners

For federal tax purposes, a U.S. LLC owned by non-U.S. persons is classified as a pass-through entity. This means the profits and losses flow directly to the owner’s personal tax return. If you’re the sole owner, the LLC is considered a "disregarded entity", while multi-member LLCs are treated as partnerships. Alternatively, you can elect for the LLC to be taxed as a C corporation if that suits your financial goals better. Here’s an important detail: if your income isn’t tied to a U.S. trade or business, you generally won’t owe federal taxes on income earned outside the United States. This tax setup is especially relevant when determining whether your U.S.-sourced income is taxable.

ECI and U.S. Trade or Business Rules

Your U.S. tax obligations depend on two key factors: whether your income qualifies as Effectively Connected Income (ECI) and whether you’re actively engaged in a U.S. trade or business. These considerations are essential when organizing your LLC’s activities, whether in the U.S. or abroad.

For example, if your LLC generates income from services provided entirely outside the U.S. or from selling products to international customers without having a physical presence in the country, that income is typically not classified as ECI. As a result, you wouldn’t owe U.S. taxes on it. On the other hand, if your business has a U.S. presence – like an office – or serves U.S. clients, the IRS may categorize that income as effectively connected with a U.S. trade or business, making it subject to U.S. taxes. To illustrate, a designer working remotely with European clients wouldn’t face U.S. taxes, but running a studio based in the U.S. would trigger tax liability.

Why Global Entrepreneurs Use U.S. LLCs

Entrepreneurs around the world often turn to U.S. LLCs for their legal protections, tax advantages, and access to the American financial system. These benefits make U.S. LLCs especially appealing for those running international businesses from abroad. The U.S. offers a stable and trusted business environment that few other countries can rival. Let’s dive into the key benefits related to asset protection, taxation, and banking.

Asset Protection and Liability Limits

One of the biggest perks of a U.S. LLC is the clear separation it provides between personal and business liabilities. If your LLC faces lawsuits or debt, your personal assets remain shielded. States like Wyoming, Nevada, and South Dakota offer even stronger protections through charging order provisions. These provisions prevent creditors from seizing your LLC membership interest or dissolving the company. Instead, creditors can only claim distributions if and when you choose to make them.

In May 2025, Ahmed, a real estate investor from Dubai, established a Wyoming LLC to manage his U.S. investment properties. When a tenant sued after an accident on one of his properties, the lawsuit targeted only the LLC, leaving Ahmed’s personal assets in both the U.S. and UAE untouched. Wyoming’s robust charging order protections ensured that creditors couldn’t force liquidation or take control of the LLC. (Source: armenian-lawyer.com, May 1, 2025)

Pass-Through Taxation Benefits

U.S. LLCs are structured to avoid double taxation. Instead of being taxed at the corporate level, the profits “pass through” to your personal tax return. If your LLC generates foreign-sourced income – such as providing remote services without a U.S. physical presence – you may not owe U.S. federal income tax. On top of that, tax treaties between the U.S. and over 60 countries can help reduce withholding taxes.

Certain states also offer cost-effective options. For example, Wyoming’s LLC filing fees are about $150, and Delaware stands out with no sales tax and lower franchise taxes. It’s no surprise that Delaware is home to more than 60% of Fortune 500 companies. This flexibility allows entrepreneurs to tailor their tax strategies to fit their unique situations.

Access to U.S. Banking and Payment Systems

A U.S. LLC also makes it easier to tap into the American financial system. With an LLC, opening a U.S. business bank account becomes straightforward, giving you direct access to U.S. banking services. This simplifies receiving payments from American clients – who often prefer working with domestic entities – and makes international transactions smoother.

Additionally, a U.S. LLC unlocks full functionality with major payment processors like Stripe, PayPal, and Square, many of which require a U.S. entity. This access not only boosts operational convenience but also enhances your business’s credibility.

According to Edelman’s Trust Barometer, 60% of people worldwide trust U.S.-based brands. With U.S. consumer spending topping $18 trillion annually and online retail sales exceeding $1 trillion in 2022, having a U.S. LLC positions your business to tap into one of the world’s most lucrative markets.

Tax and Legal Requirements for Foreign LLC Owners

Running a U.S. LLC while living abroad comes with specific federal and state compliance rules that you must follow to avoid penalties. Recent regulatory updates have streamlined some reporting obligations, particularly around beneficial ownership. Here’s a closer look at what you need to know.

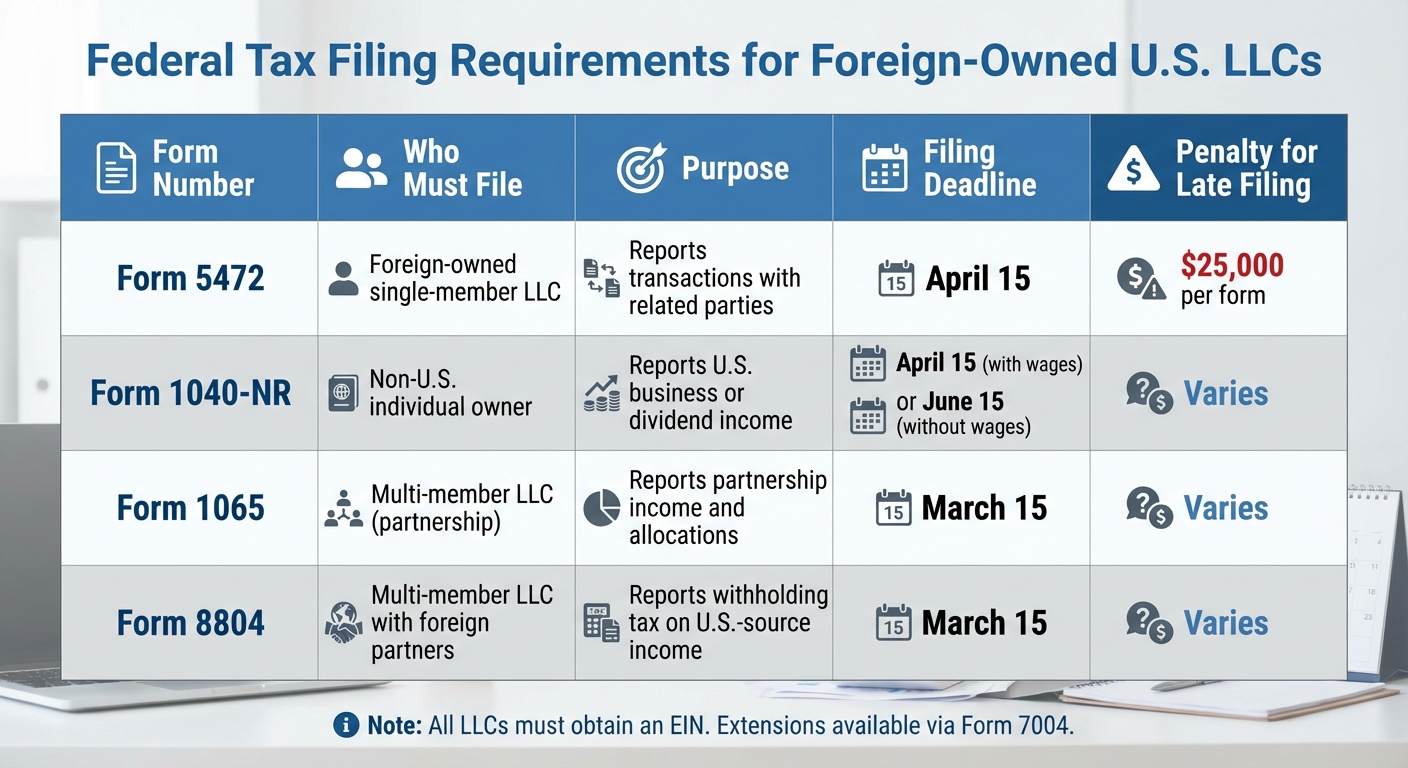

Federal Tax Forms and Filing Deadlines

Your federal tax responsibilities depend on your LLC’s structure. For a single-member LLC owned by a non-U.S. person, the entity is usually treated as a disregarded entity for tax purposes. This means the LLC itself doesn’t file an income tax return, but you’re still required to file Form 5472 along with a pro forma Form 1120 by April 15 each year. This form details transactions like loans, payments, or contributions between your LLC and related parties. Missing this deadline can result in a hefty $25,000 penalty per form.

If your LLC earns income tied to a U.S. trade or business, you’ll also need to file Form 1040-NR to report that income. The filing deadline is April 15 if you have wages subject to withholding or June 15 if you don’t. To file Form 1040-NR, non-U.S. individuals must first obtain an Individual Tax Identification Number (ITIN). Additionally, every LLC must have an Employer Identification Number (EIN) to file Form 5472 or request an extension using Form 7004.

For multi-member LLCs, which are treated as partnerships by default, the partnership files Form 1065 by March 15, and each partner reports their share of income on Form 1040-NR. Partnerships with foreign partners may also need to withhold federal income tax on U.S.-source income, requiring Forms 8804, 8805, and 8813. If your LLC opts for corporate taxation, it will instead file Form 1120 and, if 25% or more of the LLC is foreign-owned, must also file Form 5472.

| Form Number | Who Files | Purpose | Deadline | Penalty for Late Filing |

|---|---|---|---|---|

| Form 5472 | Foreign-owned single-member LLC | Reports transactions with related parties | April 15 | $25,000 per form |

| Form 1040-NR | Non-U.S. individual owner | Reports U.S. business or dividend income | April 15/June 15 | Varies |

| Form 1065 | Multi-member LLC (partnership) | Reports partnership income and allocations | March 15 | Varies |

| Form 8804 | Multi-member LLC with foreign partners | Reports withholding tax | March 15 | Varies |

Next, let’s explore state-specific registration and reporting obligations that are equally important.

State Registration and Annual Reports

State requirements differ depending on where your LLC is formed. The process typically begins with filing Articles of Organization with the Secretary of State in your chosen state. States like Wyoming, Delaware, and Nevada are popular choices for their business-friendly rules, privacy protections, and cost-effective fee structures.

Once the LLC is formed, most states require annual reports to keep your business in good standing. These reports update your LLC’s information and typically come with a filing fee. In some states, such as Florida, LLCs classified as partnerships or disregarded entities may not owe state income taxes. However, other states may require corporate income tax filings if your LLC has a business nexus – like a physical presence or significant economic activity – in that state.

If your LLC operates outside the state where it was formed, you’ll often need to register as a "foreign LLC" in the new state. This involves additional paperwork and fees. To ensure compliance, consult the specific tax laws, annual reporting requirements, and any necessary permits or licenses with the respective state tax agency.

Now, let’s look at recent updates regarding beneficial ownership reporting.

FinCEN Beneficial Ownership Reporting

As of March 26, 2025, FinCEN has issued an interim rule that exempts U.S.-based entities, including LLCs, from reporting beneficial ownership information (BOI) under the Corporate Transparency Act. This is a major relief for non-U.S. individuals managing U.S. LLCs, as you no longer need to report BOI to FinCEN.

"All entities created in the United States – including those previously known as ‘domestic reporting companies’ – and their beneficial owners are now exempt from the requirement to report beneficial ownership information (BOI) to FinCEN." – FinCEN.gov

This exemption applies only to U.S. entities. "Foreign reporting companies" (entities formed under foreign law but registered to do business in the U.S.) are still required to report non-U.S. beneficial owners. FinCEN is accepting public comments on this interim rule until May 27, 2025, and plans to finalize the rule later that year. Importantly, there is no fee for submitting a BOI report.

These updates make compliance a bit easier for non-U.S. individuals operating U.S. LLCs, helping you focus on expanding your business without the hassle of navigating overly complex reporting obligations. Staying compliant not only protects your LLC’s standing but also strengthens your international business foundation.

sbb-itb-39d39a6

How to Form and Manage a U.S. LLC from Abroad

If you’re looking to form a U.S. LLC while living outside the country, the process is surprisingly straightforward. You don’t need U.S. citizenship, a green card, or even a Social Security Number (SSN). Everything can be done remotely, with processing times varying from a few days to a couple of weeks, depending on the state and required documentation. This setup is particularly appealing for global entrepreneurs who want to take advantage of the asset protection and tax benefits offered by U.S. LLCs.

Choosing the Right State for Your LLC

Your choice of state matters, as costs and privacy protections vary widely. Here are a few popular options:

- Wyoming: Known for its low costs – $100 filing fee and $62 annual fee – Wyoming also provides strong privacy protections and has no state income tax.

- Delaware: A favorite for businesses seeking venture capital, thanks to its business-friendly legal system.

- Nevada and New Mexico: These states offer alternative fee structures and reporting requirements that might better suit your needs.

Filing Your LLC

To officially form your LLC, you’ll need to file the Articles of Organization (or Certificate of Formation) with the Secretary of State in your chosen state. This document includes details such as your LLC’s name, address, purpose, and the contact information for your registered agent. A registered agent (costing $100–$300 annually) is essential – they handle legal and tax notices on your behalf.

Once your LLC is registered, the next step is to apply for an Employer Identification Number (EIN) from the IRS. You’ll use Form SS-4 to apply, which can be submitted by fax or phone if you don’t have an SSN. An EIN is crucial for filing taxes and opening a U.S. business bank account.

Staying Compliant

Managing your LLC requires ongoing compliance. Key steps include:

- Drafting an Operating Agreement to outline ownership shares, profit distribution, and operational rules.

- Keeping personal and business finances separate to maintain liability protection.

- Tracking important deadlines, such as annual reports, tax filings (e.g., Form 5472, due April 15), and any required licenses.

- Establishing a U.S. business address through a virtual office, your registered agent, or a physical location.

These actions are essential to ensure your LLC remains legally protected and operational.

Opening a U.S. Business Bank Account

Opening a U.S. business bank account can be one of the trickier steps, as many banks require in-person visits. However, online banks and fintech platforms like Wise Business, Mercury, and Relay simplify the process. To get started, you’ll need a documentation package that typically includes:

- Articles of Organization

- EIN confirmation letter

- Operating Agreement

- Government-issued ID

- Proof of your residence

Professional Support and Costs

Managing taxes and compliance from abroad can be complex, so hiring a U.S.-based accountant who understands non-resident tax obligations is a smart move. They can handle annual filings and ensure you’re meeting both federal and state requirements.

As for costs, forming an LLC can range from $500 to $1,500, depending on whether you handle the process yourself or use professional services. While this might seem like an investment, it’s a small price to pay for the legal protections and opportunities a U.S. LLC can provide for your global business.

Common Uses for U.S. LLCs in Global Business

A U.S. LLC can be a smart choice for specific types of international business activities. This structure is particularly useful when you’re operating outside the U.S. without establishing a physical presence that might trigger U.S. tax obligations. Whether you’re offering professional services, running an e-commerce business, or managing intellectual property, a U.S. LLC can provide both asset protection and tax advantages. Let’s explore how this structure can transform global business operations in these areas.

Consulting and Freelance Services

For remote professionals offering services like consulting, coaching, or web development from outside the U.S., a U.S. LLC can be a game-changer. It allows you to avoid U.S. taxes when no trade is conducted within the country, while also granting access to American banking and payment systems. As Vincenzo Villamena, CPA and CEO of Entity Inc., puts it:

"In general, you will not need to pay taxes if you offer professional services from outside the US. This includes consulting, coaching, web development, etc."

For example, if you’re a non-U.S. resident providing digital marketing services to U.S.-based clients, your income is likely considered foreign-sourced as long as you don’t employ U.S.-based staff or agents. This structure also boosts your credibility with international clients, who often see a U.S. business entity as a mark of legitimacy.

E-Commerce and Digital Product Sales

U.S. LLCs are also highly beneficial for e-commerce entrepreneurs. By forming a U.S. LLC, online sellers gain access to major payment processors like Stripe, PayPal Business, and Square, which often come with lower transaction fees. Additionally, having a U.S. LLC can make it easier to get approved for selling on American platforms and marketplaces.

If you’re selling digital products – such as software subscriptions, online courses, or downloadable content – a U.S. LLC simplifies your operations. It provides administrative clarity, enhances your credibility, and makes it easier to manage transactions in U.S. dollars. This structure also streamlines global payment processing, making it more efficient to serve customers worldwide.

Intellectual Property Ownership and Licensing

When it comes to intellectual property (IP), a U.S. LLC offers unique advantages. Holding assets like trademarks, patents, or copyrights under a U.S. LLC creates a clear separation between your IP and your operating business. This separation not only strengthens legal protections but also simplifies licensing arrangements. If your business faces litigation or creditor claims, your IP remains safeguarded in a separate entity.

A U.S. LLC also makes it easier to license intellectual property across multiple markets or business units. You can centralize management of your IP portfolio, track licensing costs more effectively, and even take advantage of U.S. tax treaties for favorable royalty income treatment. The robust U.S. legal framework for IP protection can help expand your international presence while mitigating challenges like trade barriers in certain markets.

Conclusion

A U.S. LLC offers non-U.S. individuals a powerful way to manage global business operations with flexibility, asset protection, and tax advantages. Whether it’s gaining access to American banking systems, structuring consulting services, or running e-commerce ventures, this business structure can open doors to a range of opportunities. Key benefits include its pass-through taxation system, which helps avoid double taxation, and its limited liability protection, which shields personal assets from business risks. However, these perks come with a catch – strict compliance is non-negotiable.

As mentioned earlier, the advantages of a U.S. LLC hinge on proper setup and diligent maintenance. The Tax Adviser highlights the importance of careful planning, noting, "Whenever a U.S. LLC comes into play, the interaction of domestic, foreign, and treaty provisions should be carefully reviewed to prevent unintended tax consequences". Even minor compliance missteps can lead to severe penalties.

Navigating the maze of requirements involves handling federal tax forms, state registration processes, and newer regulations like the Beneficial Ownership Information Reporting (BOIR) requirements with FinCEN. Missing a deadline or filing an incorrect form can result in penalties that may outweigh any tax savings. Worse yet, you could lose treaty benefits or face double taxation.

To make the most of your LLC, it’s crucial to work with U.S.-based tax and legal experts. They can guide you in choosing the right state for incorporation, structuring your LLC appropriately, and staying on top of all reporting obligations. Their expertise is especially critical when dealing with the complex interplay of U.S. tax laws, your home country’s regulations, and any applicable tax treaties.

With thorough planning and professional support, a U.S. LLC can be a cornerstone of your global business strategy. It can provide the credibility, operational efficiency, and financial advantages you need to grow and thrive on the international stage.

FAQs

What do non-U.S. persons need to know about compliance when operating a U.S. LLC?

Non-U.S. individuals running a U.S. LLC have some important compliance steps to follow. First, you’ll need to file a Beneficial Ownership Information Report (BOIR) with FinCEN within 30 days of either forming the LLC or making changes to its ownership. If your LLC is classified as a disregarded entity, you’re also required to submit Form 5472 to the IRS each year. On top of that, obtaining an Employer Identification Number (EIN) is a must for handling taxes and opening bank accounts.

State-specific requirements are also part of the process. These typically include appointing a registered agent and keeping up with necessary state filings. Meeting these obligations is crucial to keeping your LLC in good standing and avoiding potential fines.

How does a U.S. LLC protect my personal assets when running a global business?

When you establish a U.S. LLC, you create a legal barrier between your personal finances and your business obligations. This separation means that your personal assets – like your home, savings, or investments – are typically safeguarded against debts or lawsuits tied to your business.

Choosing the right state for your LLC can strengthen these protections. States like Wyoming, known for their strong privacy policies and charging order protections, provide an extra layer of security for your personal assets. This allows you to focus on running your global business with greater confidence and peace of mind.

What are the tax obligations for foreign income earned through a U.S. LLC as a non-U.S. person?

If a U.S. LLC owned by a non-U.S. person earns income from trade or business activities within the United States, it must file a U.S. income tax return and pay federal income tax on what’s known as effectively connected income (ECI). On the other hand, if the LLC does not conduct business in the U.S. and only generates income from foreign sources, it usually needs to file Form 5472 along with a pro forma Form 1120. In such cases, there may not be any U.S. tax liability.

That said, adhering to IRS reporting requirements is non-negotiable, even when no taxes are owed. Additionally, tax treaties between the U.S. and other nations can sometimes reduce or even eliminate tax obligations for foreign owners. To navigate these rules and make the most of any treaty benefits, it’s wise to consult with a qualified tax professional.