Stricter banking rules are reshaping how location-independent entrepreneurs manage finances. Global KYC (Know Your Customer) regulations now demand more documentation, longer onboarding, and higher compliance costs. For entrepreneurs handling international operations or cryptocurrencies, banks often impose Enhanced Due Diligence (EDD), requiring detailed proof of financial activities.

Key takeaways for 2025 banking trends:

- Transparency is mandatory: Offshore banking secrecy has been replaced by global standards like FATCA and CRS, ensuring cross-border data sharing.

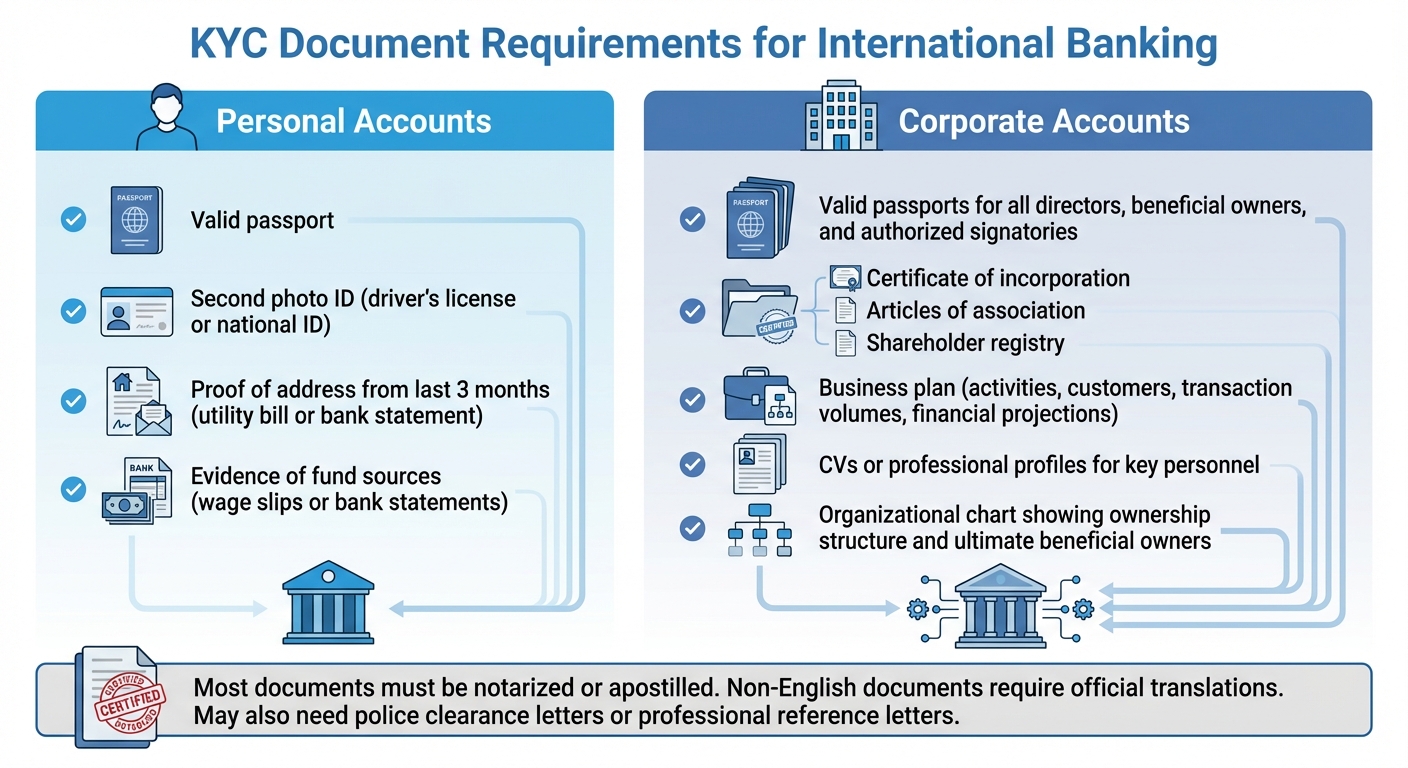

- KYC essentials: Personal accounts require ID, proof of address, and income evidence. Corporate accounts need additional paperwork like incorporation documents and ownership details.

- Cryptocurrency scrutiny: Banks demand transaction histories, blockchain analytics, and proof of legitimate sources for crypto income.

- Jurisdiction matters: Popular offshore hubs (e.g., Singapore, Switzerland) now emphasize real business operations over paper connections.

- Compliance risks: Non-compliance with tax reporting (FBAR, FATCA) or banking rules can result in account freezes, closures, or penalties.

Building a compliant, multi-jurisdictional banking structure is key to avoiding disruptions. By maintaining accurate records, adhering to regulations, and consulting experts, entrepreneurs can safeguard their global operations.

KYC and AML Basics for Entrepreneurs

How KYC and AML Affect Your Banking

KYC, or Know Your Customer, is the process banks use to confirm your identity and assess your risk level. It’s the first step when opening an international bank account. On the other hand, AML, or Anti-Money Laundering, refers to the broader set of laws and procedures aimed at spotting, stopping, and reporting suspicious financial activities.

While KYC focuses on verifying your identity during onboarding, AML involves ongoing monitoring of your transactions. For location-independent entrepreneurs, this means banks don’t just stop at the initial application – they’ll also review your transaction history, the sources of your funds, and the nature of your business over time. If your business operates in higher-risk sectors, deals in large transaction volumes, or spans multiple jurisdictions, you may face stricter scrutiny or even limited access to banking services. Stricter regulations have also made the onboarding process more time-consuming, with added paperwork and higher costs becoming the norm.

Standard KYC Requirements and Documents

To open an international bank account, you’ll need to provide some basic documents. For personal accounts, this typically includes a government-issued photo ID, such as a passport or driver’s license, along with proof of address. If you’re a U.S.-based entrepreneur, you’ll also need to provide your Social Security Number. For businesses, an Employer Identification Number (EIN) is required.

Corporate accounts demand additional paperwork. Banks usually request articles of incorporation, a board resolution authorizing the account, and proof of who has signing authority. Under regulations like the Corporate Transparency Act, financial institutions are also required to identify beneficial owners – those owning at least 25% of the business – and key decision-makers. You’ll need to explain your business’s purpose, expected transaction volumes, and the countries where you operate. Banks must keep these records, along with their customer due diligence efforts, for at least five years after the account is closed.

If standard documentation isn’t enough, you may be asked to undergo Enhanced Due Diligence.

When Banks Require Enhanced Due Diligence

Enhanced Due Diligence (EDD) is a deeper dive into your financial background. This is common if you’re considered a Politically Exposed Person (PEP), operate in higher-risk regions, or have a complex ownership structure.

Cryptocurrency transactions are a frequent trigger for EDD, as banks often require detailed proof of where your funds come from. AML regulations have expanded to cover industries like cryptocurrency exchanges, real estate, and professional services, making compliance a priority for a broader range of businesses.

To manage these risks, many banks now use automated systems powered by AI and machine learning. These systems monitor account activity in real time and can flag changes in your risk profile. If something unusual is detected, you might face account restrictions or be asked to provide additional documents.

Setting Up Your Banking Structure

Personal Accounts vs. Corporate Accounts

Deciding between a personal account and a corporate account depends largely on how you plan to manage your finances and structure your business. Personal accounts are straightforward, designed for individual use, and typically easier to set up. On the other hand, corporate accounts are specifically created for business needs, offering a clear separation between personal and company finances, which can be a significant advantage.

Corporate accounts come with stricter Know Your Customer (KYC) and Know Your Business (KYB) requirements. These involve verifying not just your identity but also your company’s legitimacy, ownership, and structure. While this process involves more paperwork and longer approval times, the benefits include liability protection and simplified tax reporting. For businesses with employees, clients, or substantial revenue, a corporate account is often the more practical choice, even if it means navigating additional compliance steps.

Once you’ve chosen the type of account, the next step is deciding on the right banking jurisdiction.

Selecting Jurisdictions for Offshore Banking

With stricter KYC standards in place, picking the right jurisdiction for offshore banking is more important than ever. Popular offshore banking hubs include Singapore, Hong Kong, Switzerland, Belize, Mauritius, and Georgia. Other locations, such as the British Virgin Islands, Cayman Islands, UAE, Seychelles, and Panama, also provide advantages, though they may face closer regulatory scrutiny.

When evaluating jurisdictions, consider factors like the bank’s reputation, minimum deposit requirements, ease of opening accounts remotely, and whether the country has tax treaties with your home country. Keep in mind that banks in these regions now perform regular account reviews and are obligated to report suspicious transactions as part of their KYC responsibilities.

Creating a Multi-Jurisdiction Banking Plan

After choosing your account type and jurisdiction, consider setting up a multi-country banking structure to reduce risks and improve flexibility. Between 2008 and 2022, banks faced $55 billion in fines related to anti-money laundering (AML) and KYC violations. This has led to stricter account management practices and heightened caution from financial institutions.

Banks are particularly wary of businesses operating across multiple regulatory frameworks due to concerns about complex fund flows, regulatory loopholes, and unclear corporate structures. To address these issues, provide detailed documentation, such as organizational charts, jurisdictional maps, and flow-of-funds diagrams. Highlighting licenses from well-respected regulators, like those in the UK or Malta, can also help improve your risk profile.

For a balanced strategy, you might maintain one account in a jurisdiction with low fees and easy access for daily operations, while keeping another in a more stable, privacy-oriented jurisdiction for long-term savings. Regulators now emphasize the need for "economic substance, genuine presence, and transparency across borders". Ensure that your banking relationships are tied to real operations in each jurisdiction, rather than just serving as paper connections.

Preparing Your KYC Documentation

Having your KYC (Know Your Customer) documents in order can make the account approval process much smoother and help you avoid unnecessary delays. Banks today require clear proof of your identity, business structure, and the sources of your funds. These documents are the foundation of the KYC process discussed earlier. Below, you’ll find the specific requirements for personal and corporate accounts.

Required Documents for Account Opening

For personal accounts, you’ll need the following:

- A valid passport

- A second photo ID, such as a driver’s license or national ID

- Proof of address from the last three months (e.g., a utility bill or bank statement)

- Evidence of fund sources, such as recent wage slips or bank statements covering a few months.

For corporate accounts, the list is more extensive. Here’s what you’ll typically need:

- Valid passports for all directors, beneficial owners, and authorized signatories

- Certified copies (often apostilled) of key company documents, including the certificate of incorporation, articles of association, and shareholder registry

- A business plan outlining activities, target customers, transaction volumes, and financial projections

- CVs or professional profiles for key personnel

- An organizational chart showing ownership structure, including ultimate beneficial owners.

Most documents must be notarized or apostilled, especially if you’re dealing with foreign jurisdictions. If any documents are not in English, you’ll need official translations. Banks may also request additional items like police clearance letters or professional reference letters from attorneys.

Remote Account Opening and Economic Substance

If you’re opening an account remotely, banks will closely examine whether your business has an actual presence in the jurisdiction where you’re banking. A simple registered address isn’t enough. You’ll need to provide evidence of real operations, such as:

- Lease agreements

- Local staff contracts

- Utility bills

- Records of in-person transactions

For frequent travelers, it’s important to maintain records showing where you conduct business. These might include contracts with local service providers, receipts for business expenses, and documentation of client relationships.

Emerging asset classes, like cryptocurrency, add another layer of complexity to the documentation process.

Documenting Cryptocurrency Income

If your income comes from cryptocurrency, you’ll need to meet stricter KYC standards. Banks will want to verify the legitimacy of your digital assets and trace their origins. To do this, gather the following:

- Comprehensive exchange statements showing your trading history, deposits, and withdrawals

- Records of how you acquired your initial cryptocurrency holdings, whether through mining, employment payments, business revenue, or investments

For more complex crypto portfolios, banks might ask for blockchain analytics reports. In May 2025, TRM Labs issued guidance recommending on-chain tracing, document verification, and risk scoring to ensure your blockchain activity aligns with your stated business purpose and expected transaction volumes. Some banks are now actively using blockchain analytics tools to monitor wallet addresses and transaction histories in real time.

To stay compliant, keep detailed records of wallet addresses, transaction IDs, and the purposes of your transactions. If you’re receiving crypto payments for services, make sure to keep invoices and contracts that show the legitimacy of the business relationship. Be cautious about engaging in transactions with mixers, privacy coins, or sanctioned entities, as these can lead to heightened scrutiny. As TRM Labs emphasizes:

The biggest risk isn’t exposure to crypto – it’s not knowing you’re exposed at all.

sbb-itb-39d39a6

Maintaining Compliance and Managing Risk

Once your banking setup is complete and your documentation is in order, the next step is ensuring ongoing compliance. This involves staying on top of tax reporting, adhering to transparent banking practices, and carefully selecting jurisdictions to minimize risks.

Tax Reporting Requirements

For U.S. citizens and residents, offshore accounts bring specific reporting obligations. If the combined value of your foreign financial accounts exceeds $10,000 at any point during the year, you must file FinCEN Form 114 (FBAR). Additionally, FATCA reporting (via Form 8938) may apply, depending on your filing status and the value of your overseas assets. For non-U.S. individuals, the Common Reporting Standard (CRS) enables automatic information sharing between participating countries.

As one compliance expert explains:

Your entire strategy must be fully compliant with all international regulations. That includes global transparency standards such as the Foreign Account Tax Compliance Act (FATCA), the Common Reporting Standard (CRS), and strict Anti-Money Laundering (AML) requirements. – Nomad Capitalist, J.Rotbart & Co

Accurate tax reporting is not just about meeting legal requirements – it also helps ensure smooth banking operations without unnecessary disruptions.

Preventing Account Freezes and Closures

Bank accounts can be frozen or closed if compliance issues arise, so staying vigilant is crucial. To avoid such setbacks:

- Stick to the business activities you disclosed when opening the account.

- Notify your bank immediately if there are material changes to your business operations.

- Avoid transactions involving sanctioned entities or jurisdictions. Tools like the U.S. Department of the Treasury’s lists on treasury.gov and the OFAC website can help you verify sanctioned parties.

- Maintain thorough and accurate financial records.

As Silicon Valley Bank advises:

By being thorough upfront, founders can minimize the risk of future account restrictions or freezes that could severely disrupt operations. – Silicon Valley Bank

For businesses operating in jurisdictions with economic substance requirements, ensure that your local presence is verifiable through actual business activity, not just a registered address.

Evaluating Jurisdiction Risk

When choosing banking locations, assess the political and economic stability of each jurisdiction. Factors like currency stability, government debt levels, and adherence to the rule of law can significantly impact your banking experience. Jurisdictions prone to capital controls or abrupt regulatory changes pose higher risks.

The regulatory framework is another important consideration. Locations that adhere to international standards like CRS and FATCA tend to prioritize transparency and compliance. However, jurisdictions with frequent regulatory changes can create uncertainty, so prioritize those with stable legal systems and clear rules.

For instance, in 2025, the Bank of Russia extended restrictions on outbound money transfers, affecting both residents and non-residents. This highlights the importance of diversifying your banking setup across multiple jurisdictions and maintaining backup funds in domestic accounts to cushion against regional disruptions.

Lastly, evaluate the financial health of the bank itself. In many offshore locations, deposit insurance may be limited or nonexistent. Choosing banks with strong reputations and sound financial practices can help reduce both operational and reputational risks.

Conclusion

Offshore banking requires strict compliance with regulations like FBAR, FATCA, and CRS. Failing to meet these standards can lead to penalties, account closures, or even legal troubles that might disrupt your business operations.

Choosing the right jurisdiction is just as critical. Focus on politically stable regions with well-defined legal systems. Opt for locations that offer clear deposit insurance protections and avoid those prone to sudden regulatory changes. The goal is to ensure stability and security for the long term.

Keeping detailed, verifiable records is non-negotiable. Document every transaction, maintain accurate proof of your business activities, and ensure you meet economic substance requirements through actual operations. These records are essential for demonstrating legitimacy during bank reviews and preventing account freezes.

Navigating this complex landscape is no small task, so consulting international tax advisors and compliance experts is highly recommended. With constant changes in transparency requirements and reporting standards, expert advice can help you stay ahead and ensure your operations remain fully compliant.

When done right, offshore banking becomes a strategic tool. By building a transparent and compliant structure, you can protect your assets, support global operations, and secure your financial future – all while maintaining the flexibility of a location-independent lifestyle.

FAQs

What are the main KYC and AML requirements for global entrepreneurs working remotely?

Location-independent entrepreneurs have to navigate several Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements to ensure compliance with international regulations. These typically involve:

- Submitting a valid government-issued ID along with proof of residence.

- Disclosing all beneficial owners of their business entities.

- Completing enhanced due diligence if deemed high-risk.

- Maintaining thorough records of financial transactions and related documentation.

- Keeping an eye on transactions to flag any unusual or suspicious activity.

Adherence to global standards, such as the FATF recommendations and U.S. regulations enforced by FinCEN, is crucial. Staying on top of documentation and partnering with institutions that specialize in working with global entrepreneurs can make this process far more manageable.

How does earning income from cryptocurrency impact my banking compliance?

Earning income through cryptocurrency can make navigating banking compliance trickier, thanks to stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) rules. Many banks see crypto-related transactions as higher risk, often asking for extra documentation to confirm the source of funds.

To avoid issues, it’s essential to be transparent about your crypto earnings, keep detailed records, and stay informed about changing regulations around digital assets. Without proper documentation or adherence to reporting requirements, you could face account restrictions or other compliance hurdles.

What factors should I consider when selecting a jurisdiction for offshore banking?

When selecting a jurisdiction for offshore banking, there are several critical factors to consider to ensure it meets your financial objectives and compliance requirements. Start with political and economic stability – a stable region minimizes risks to your assets. Unstable areas can lead to uncertainty, which is the last thing you want when managing your finances.

Next, examine the jurisdiction’s privacy laws and regulatory framework. Strong privacy protections can safeguard your financial information, but they should also align with international regulations like FATCA and CRS to keep you on the right side of compliance.

Don’t overlook the tax advantages a jurisdiction might offer. At the same time, factor in the costs of setting up and maintaining an account. Some jurisdictions might offer appealing tax structures but come with higher fees, so balancing these aspects is essential.

Finally, think about accessibility. Does the jurisdiction provide banking services that match your needs, especially if you lead a location-independent lifestyle? Convenience matters, whether it’s online banking options or customer service that operates in your time zone.

By carefully evaluating these elements, you can find a jurisdiction that balances flexibility with legal compliance, helping you manage your financial operations effectively.