If you’re a U.S. taxpayer with foreign financial assets, Form 8938 is a key requirement under FATCA (Foreign Account Tax Compliance Act). This form helps the IRS track foreign assets exceeding specific thresholds based on your residency and filing status. Here’s what you need to know:

- Who Needs to File: U.S. citizens, resident aliens, certain nonresident aliens, and domestic entities with foreign financial assets above IRS thresholds.

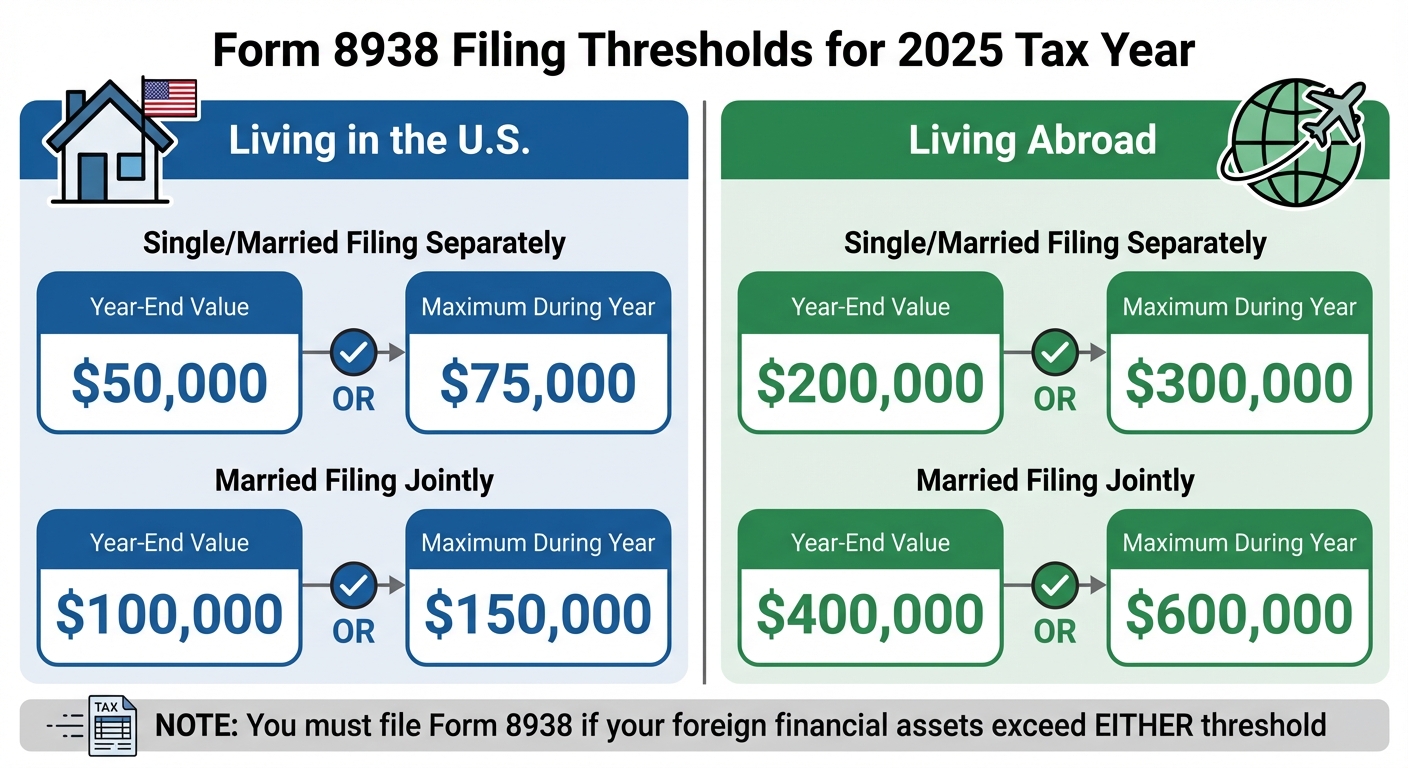

- 2025 Thresholds:

- Living in the U.S.: Single/married filing separately ($50,000 year-end/$75,000 max during the year). Married filing jointly ($100,000 year-end/$150,000 max).

- Living Abroad: Single/married filing separately ($200,000 year-end/$300,000 max). Married filing jointly ($400,000 year-end/$600,000 max).

- Assets to Report: Includes foreign bank accounts, securities, pensions, partnerships, and trusts. Excludes direct ownership of foreign real estate or personal property.

Key Steps:

- Confirm your status as a "specified person."

- Check if your foreign assets exceed thresholds.

- Gather detailed documentation for each asset, including values converted to USD.

- Complete Form 8938 and attach it to your Form 1040 by April 15, 2026 (or with an extension by October 15, 2026).

Failing to file can lead to steep penalties starting at $10,000. Double-check for overlaps with FBAR (FinCEN Form 114), as both may apply. Proper recordkeeping and accurate reporting are critical to avoid compliance issues.

How to Determine If You Need to File

To figure out if you’re required to file, start by addressing three essential questions: Are you classified as a "specified person" under IRS guidelines? Do you hold specified foreign financial assets? And do those assets surpass the thresholds relevant to your situation? Answering these questions will help ensure you’re reporting accurately.

Specified Individuals and Entities Explained

In addition to the general categories mentioned earlier, the IRS also mandates that "specified domestic entities" file Form 8938. These entities include closely held U.S. corporations, partnerships, or specific trusts that are formed or used to hold foreign financial assets, provided they meet IRS ownership and passive income criteria. This typically applies to U.S.-based holding companies or family investment entities managing offshore portfolios. Starting with tax years after December 31, 2015, these entities must file Form 8938 if they meet the filing requirements.

If you don’t fall into the specified categories – or if you’re not required to file a U.S. income tax return – then Form 8938 is not necessary. The next step is to determine how your tax residency status impacts the filing thresholds.

The Role of Tax Residency in Filing Thresholds

Your tax residency status is a key factor in determining whether you need to file. The IRS considers you to be living abroad if you meet one of two criteria: you’re a U.S. citizen who qualifies as a bona fide resident of a foreign country for an uninterrupted tax year, or you’re a U.S. citizen or resident who spends at least 330 full days in a foreign country during a 12-month period that includes the tax year. These are the same standards used for the foreign earned income exclusion.

If you qualify as living abroad, you benefit from higher reporting thresholds. For single filers, the thresholds are more than $200,000 on December 31 or $300,000 at any point during the year. For married couples filing jointly, the limits are more than $400,000 on December 31 or $600,000 at any time during the year. On the other hand, if you’re considered to be living in the U.S., the thresholds are lower: more than $50,000 on December 31 or $75,000 at any time during the year for single filers, and more than $100,000 on December 31 or $150,000 at any time for married couples filing jointly.

For instance, if you meet the criteria for living abroad, you’ll benefit from the higher thresholds, making it less likely that you’ll need to file. Once you’ve clarified your residency status and identified your assets, use the checklist below to confirm your filing requirements.

Filing Eligibility Checklist

To determine if you need to file Form 8938, follow these steps:

- Confirm your status as a specified person. This includes U.S. citizens, resident aliens, certain nonresident aliens, or specified domestic entities.

- Determine your tax residency. Use the bona fide residence or 330‑day tests to establish whether you qualify as living abroad.

- Compile a list of your foreign financial assets. Include foreign bank and brokerage accounts, pensions, interests in foreign corporations or partnerships, mutual funds, and similar holdings. Exclude non-reportable items like directly owned foreign real estate.

- Calculate the value of each asset. Determine both the maximum value during the year and the year-end value in the local currency, then convert these figures to U.S. dollars using a consistent method.

- Add up your totals. Compare the aggregated value of your assets to the applicable thresholds based on your residency and filing status.

- Check for FBAR filing requirements. Remember, FBAR reporting is separate from Form 8938.

One common mistake is assuming that small individual accounts don’t matter if their combined value exceeds the thresholds. Another is thinking that filing an FBAR alone satisfies all reporting obligations. Additionally, jointly held foreign accounts are generally included in each joint owner’s total, which can easily push a couple over the married filing jointly thresholds.

If you meet all three conditions – being a specified person, owning specified foreign financial assets, and exceeding the relevant thresholds – you’re required to file Form 8938 with your 2025 federal income tax return.

Collecting and Valuing Your Foreign Assets

Once you’ve confirmed your filing eligibility, the next step is to gather details and determine the value of your foreign financial assets. The IRS requires specific information for each asset, such as descriptions, account numbers, institution names, the country of origin, the asset’s highest value during the year, and whether it generated income. This information is essential for accurately completing Form 8938.

Documentation Needed for Each Asset Type

The documentation required depends on the type of asset. Here’s a breakdown of what you’ll need:

- Foreign bank accounts: Collect year-end and periodic bank statements that include the account number, institution name and address, currency used, ownership type, and the highest balance during the year.

- Brokerage or securities accounts: Obtain account statements showing all securities held, transaction histories, the highest fair market value during the year, and any identifying numbers like CUSIP or ISIN codes.

- Interests in foreign partnerships or corporations: Secure partnership or corporate financial statements, K-1 equivalents, documentation of your ownership percentage (e.g., capital account or equity statements), and acquisition agreements.

- Foreign trusts: If you’re a beneficiary or grantor, gather the trust deed, trustee statements detailing the value of your interest, distribution records, and documents describing your role.

- Foreign pensions and retirement accounts: Obtain annual benefit statements, plan documents showing your vested balance or cash value, and records of employer contributions.

- Life insurance or annuity contracts with cash value: Collect policy documents, annual statements showing cash surrender value, and details about the contract’s currency.

- Other financial instruments: For items like foreign notes, derivatives, or loans to foreign persons, gather contracts, valuation schedules, and statements from counterparties confirming principal and fair market value on key dates.

How to Calculate Asset Values

The IRS requires you to report the maximum value of each asset during the year, not just the year-end balance. Use U.S. Treasury exchange rates consistently. For bank and brokerage accounts, review monthly or quarterly statements to identify the highest recorded balance. If daily balances are unavailable, the highest month-end balance is acceptable with proper documentation.

For publicly traded securities, calculate the maximum value by multiplying the highest market price during the year by the number of units held. Convert this amount to U.S. dollars using the exchange rate on the date the maximum value was reached.

For assets like interests in entities, trusts, or pensions – where regular valuations may not exist – provide a reasonable fair market value (FMV) estimate using audited financial statements, net asset values, or actuarial valuations. If no market price is available, rely on independent appraisals or consistent internal valuation methods. Document your assumptions and data sources to address potential IRS inquiries.

All values reported on Form 8938 must be in U.S. dollars. Use the U.S. Treasury’s year-end exchange rate for assets valued as of the last day of the tax year or the applicable rate for the date the maximum value occurred. The IRS allows the use of other reliable exchange rates, provided you apply the same rate consistently across all assets. Keep copies of exchange rate tables and note the rate and date for each asset.

Example: A foreign bank account with month-end balances of €10,000, €18,000, €22,000, and €19,000 has a maximum balance of €22,000 in July. At an exchange rate of 1.10, report $24,200. Similarly, a foreign brokerage account holding 1,000 shares that peaked at £30 per share on May 15, plus £2,000 in cash, totals £32,000. At an exchange rate of 1.25, report $40,000. Keep statements showing the balance on the maximum-value date and document the exchange rate source.

Assets You Don’t Need to Report

Some assets are exempt from reporting unless held in a qualifying financial account. These include:

- Directly held foreign real estate and cash currency (unless held in a financial account).

- Tangible personal property, like foreign cars, artwork, gold bullion stored privately, or vacation homes, unless owned through a financial institution or entity that qualifies as a specified foreign financial asset.

- Foreign social security benefits without an individual account balance.

However, private foreign pensions, retirement accounts, and employer stock plans held in a foreign account or trust may need to be reported. Unexercised stock options without a funded account might not be reportable, depending on the plan structure. In uncertain cases, document your analysis thoroughly or seek professional advice.

For those managing complex international holdings, such as offshore companies or trusts, it’s crucial to align Form 8938 reporting with your broader financial and tax planning strategies. Specialized services, like those offered by Global Wealth Protection, can assist in gathering necessary documentation and ensuring compliance, especially for intricate structures involving foreign entities or trusts.

How to Complete Form 8938 for 2025

Form 8938 Structure and Sections

Form 8938 is divided into six parts, each designed to capture details about your foreign financial assets. The header section identifies you, the taxpayer, by including your name, taxpayer identification number (TIN), the tax year, and whether you’re filing as a specified individual or a specified domestic entity.

- Part I covers foreign deposit and custodial accounts, such as bank or brokerage accounts held with foreign financial institutions.

- Part II focuses on other foreign assets outside of accounts, like directly held foreign stocks, partnership interests, foreign retirement plans, or life insurance policies with cash value.

- Part III summarizes tax-related details from your reported assets, breaking down income into categories like interest, dividends, royalties, gains, and other income.

- Part IV is for summarizing the maximum values of your assets.

- Part V is used to provide details about assets already reported on other IRS forms (like Forms 3520, 5471, 8621, or 8865).

- Part VI offers extra space for listing additional assets if Parts I and II don’t have enough room.

Remember, Form 8938 must be attached to your Form 1040 – it cannot be filed on its own. Let’s go over what information you’ll need to complete each section.

Required Information for Each Section

In Part I, you’ll need to provide the financial institution’s name, address, account number, and the account type. Include the account’s highest U.S. dollar value during the year, and note whether the account was opened or closed during the year. If it’s a joint account, make sure to indicate that as well.

For Part II, list each asset along with a description, the issuer or counterparty’s name and address, any identifying numbers, and the asset’s highest fair market value during the year. Include the dates if you acquired or disposed of the asset, and specify the ownership type (e.g., individual, joint, or through an entity).

In Part III, report all income from these assets in U.S. dollars, using the correct exchange rate. The totals here should match the corresponding amounts reported on your Form 1040 schedules, such as Schedule B (for interest and dividends) or Schedule D (for capital gains).

Example:

A single U.S. resident with a Swiss bank account that peaked at $60,000 would complete Part I by listing "Swiss Bank Deposit Account #12345, maximum value $60,000", and noting any FBAR reporting if applicable. If they also held a Swiss equity mutual fund with a maximum value of $40,000, they would report it in Part II as "Swiss Equity Fund, issuer [address], max $40,000." In Part III, they would record $2,000 in interest and $1,500 in dividends. With a combined total of $100,000, this exceeds the filing threshold for a single filer living in the U.S. (e.g., $75,000).

Common Filing Issues and Solutions

A common issue is the overlap between Form 8938 and the FBAR. While both forms may cover the same accounts, Form 8938 includes additional assets – like foreign pensions or life insurance policies – that the FBAR doesn’t require. To avoid duplication, cross-reference your FBAR filing in Part I and note that Form 8938 captures a broader range of assets.

For joint accounts, report the full maximum value in Part I but only include your share of the income in Part III. For example, if a jointly held account has a maximum value of $100,000 and is equally shared, you would report the full $100,000 in Part I (if it meets the threshold) but only 50% of the income in Part III.

Make sure to disclose indirect interests held through foreign entities. Fully report any disregarded entities to avoid compliance issues, and ensure your asset valuations align with what you report on your tax return.

Discrepancies often arise between Form 8938 and Form 1040 due to inconsistent exchange rates or mismatched income totals. To avoid this, double-check your calculations and use the same exchange rate across all filings. If you have more than 20 assets, attach continuation sheets and clearly label the number of additional pages included.

sbb-itb-39d39a6

Filing Form 8938 and Staying Compliant

When and How to Submit Form 8938

Once you’ve completed Form 8938 and documented your assets, it’s time to file. Form 8938 must be attached to your Form 1040 and submitted together. For the 2025 tax year, the deadline is April 15, 2026. If you request an automatic extension by filing Form 4868, the deadline moves to October 15, 2026. For U.S. taxpayers living abroad, there’s an automatic two-month extension to June 15, even without filing Form 4868. However, Form 8938 must still be included with the extended return.

You can file Form 8938 electronically using IRS e-file or mail it to the appropriate IRS address for your location. Most taxpayers are required to file electronically, which speeds up processing. If you realize you failed to file Form 8938 for a prior year, you can amend your return to include it. Be sure to attach a reasonable cause statement to request penalty relief.

How to Organize and Keep Records

To stay prepared for potential IRS audits, keep all relevant records for at least three years from the filing date. Create a dedicated folder – either digital or physical – for each foreign asset. Include documents such as bank statements, account summaries, valuation reports, ownership proofs, and transaction records, all converted to U.S. dollars. Use reliable digital storage to keep these records secure and easily accessible.

For foreign brokerage accounts, maintain monthly statements showing the highest value during 2025. If you own interests in foreign trusts or partnerships, include equivalent forms to K-1 and fair market value calculations. Cross-check your records with FBAR filings to ensure consistency across both forms and avoid duplication. Label folders by tax year and asset type – e.g., "8938-2025-AccountXYZ" – to simplify audit preparation. Staying organized not only helps with timely filings but also reduces the risk of penalties.

Penalties for Non-Compliance

Filing accurately and maintaining thorough records is essential, as non-compliance can lead to severe financial consequences. Failing to file Form 8938 results in a $10,000 penalty per year. If you don’t file within 90 days of receiving an IRS notice, the penalty increases by $50,000. Continued non-filing incurs an additional $10,000 per month, up to a maximum of $500,000. Underreporting tax due to unreported assets can also result in a 40% accuracy-related penalty. In cases of willful non-compliance, criminal penalties can reach $250,000 in fines and up to five years in prison.

You may be able to avoid penalties by proving reasonable cause, such as relying on incorrect advice from a tax advisor or facing unavoidable obstacles in accessing records abroad. For non-willful cases, the IRS offers Streamlined Filing Compliance Procedures, which can reduce penalties to 5% or even 0% for U.S. residents. If your assets exceed $400,000 (for joint filers abroad) or involve complex entities like offshore trusts, it’s wise to consult a CPA or tax attorney. For location-independent investors, Global Wealth Protection offers strategies for asset protection and tax optimization tailored to your needs.

Conclusion

If your foreign financial assets surpass the applicable thresholds, you’ll need to file Form 8938 under FATCA. Filing requirements depend on your tax status and residency, with U.S. residents facing lower thresholds compared to those living abroad. Be sure to attach Form 8938 to your Form 1040 by April 15, 2026, or October 15, 2026, if you file for an extension.

This form goes beyond just foreign bank accounts, capturing a variety of financial assets. Many taxpayers find themselves filing both Form 8938 and FBAR in the same year since the two forms differ in thresholds, the types of assets they cover, and where they’re filed. Missing the filing deadline can lead to penalties starting at $10,000 and climbing as high as $500,000 for prolonged non-compliance. In cases of willful neglect, criminal charges may also apply.

Staying compliant starts with solid recordkeeping. Keep detailed annual records of all foreign financial accounts and assets, including account statements, ownership documents, and year-end or highest-balance values converted into U.S. dollars. Track currency conversion rates and document how you calculated fair market values. To stay organized, consider creating an annual checklist that outlines each account, entity interest, or policy – along with whether it needs to be reported on Form 8938, FBAR, or both.

For more complicated situations, seeking professional advice is a smart move. A U.S. tax professional familiar with international tax laws can help navigate overlapping reporting requirements and complex holdings. For entrepreneurs and investors with global interests, Global Wealth Protection offers customized strategies to optimize taxes, protect assets, and ensure compliance, all while incorporating required reporting into a cohesive wealth management plan.

FAQs

What are the consequences of missing the Form 8938 filing deadline?

If you miss the deadline for filing Form 8938, the IRS can hit you with hefty penalties. The initial penalty starts at $10,000 for failing to file, and it can climb higher if the delay continues. In more serious situations, you might face additional penalties of up to 40% of the value of underreported foreign assets.

On top of that, missing the deadline could lead to interest charges on any unpaid taxes tied to your foreign assets. To steer clear of these financial setbacks, it’s essential to file correctly and on time. If the process feels overwhelming or unclear, it’s a smart move to consult a professional who can help you stay in line with IRS requirements.

How do I calculate the value of my foreign financial assets for Form 8938?

To figure out the value of your foreign financial assets for Form 8938, rely on the fair market value of each asset as of December 31 of the tax year. If you sold the asset during the year, use its value on the sale date instead. Make sure to maintain detailed records – like bank statements, appraisals, or other relevant documents – to back up your valuations. Precision is key to meeting IRS standards.

Do Form 8938 and FBAR report the same foreign assets?

While Form 8938 and FBAR might cover some of the same foreign assets, they serve different roles and have unique filing requirements. Form 8938 is part of your tax return and covers a wider range of foreign financial assets. On the other hand, FBAR is strictly for reporting foreign bank accounts and is filed separately with the Financial Crimes Enforcement Network (FinCEN).