Digital nomad visas make living and working abroad easier, but they often create unexpected tax problems. While these visas offer legal residency, they rarely come with tax advantages. For U.S. citizens, the challenges are even greater due to worldwide taxation laws. Here’s what you need to know:

- U.S. Tax Rules: Americans must report all income, no matter where they live. The Foreign Earned Income Exclusion (FEIE) helps, but it has limits.

- Local Tax Residency: Spending 183+ days in a country may make you a tax resident there, exposing your income to local taxes.

- Double Taxation Risks: You could owe taxes to both the U.S. and your host country without proper planning.

- Unclear Tax Rules: Some countries don’t have clear tax policies for digital nomads, leading to surprise obligations.

To avoid issues, choose countries with favorable tax policies, like the UAE or Malta, and seek professional tax advice. A dreamy lifestyle abroad is possible, but only with proper planning.

How Nomad Visas Affect Tax Residency and Obligations

How Tax Residency Is Determined

Having a nomad visa grants you legal residency but doesn’t automatically decide your tax status. In most countries, tax residency is based on the 183-day rule – if you spend 183 days or more in a year within a country, you’re likely considered a tax resident, no matter your visa type. Beyond that, some countries use tie-breaker rules, looking at where your strongest personal and financial connections are, like family, property, or business activities. Since tax residency rules differ by country, holding a nomad visa doesn’t mean you’re exempt from local tax laws. It’s important to understand these rules because they directly impact your financial obligations.

Common Tax Obligations for Digital Nomads

If you’re classified as a tax resident, you’re typically required to pay personal income tax on your worldwide earnings. This includes all sources of income – salary, freelance work, business profits, dividends, interest, and even rental income. For self-employed people, U.S. Social Security and Medicare taxes still apply. If you’re running a business abroad, there’s another layer to consider: in some cases, your business activities might create a "permanent establishment" in the host country, which could lead to local corporate taxes.

Tax Considerations for U.S. Citizens

For U.S. citizens, the rules are stricter. You must report worldwide income on your federal tax return, no matter where you live. The Foreign Earned Income Exclusion provides some relief, allowing you to exclude up to $130,000 of foreign-earned income in 2025, but anything above that is taxable. Even if you qualify for this exclusion, you’re still required to file a tax return. On top of federal taxes, maintaining ties like a U.S. driver’s license or property could trigger state tax obligations. These overlapping responsibilities make it essential to choose visas that fit your financial goals and long-term plans.

Why Some Nomad Visas Create Tax Problems

Digital nomad visas might promise a dream lifestyle, but their tax implications can throw a wrench into your long-term financial plans.

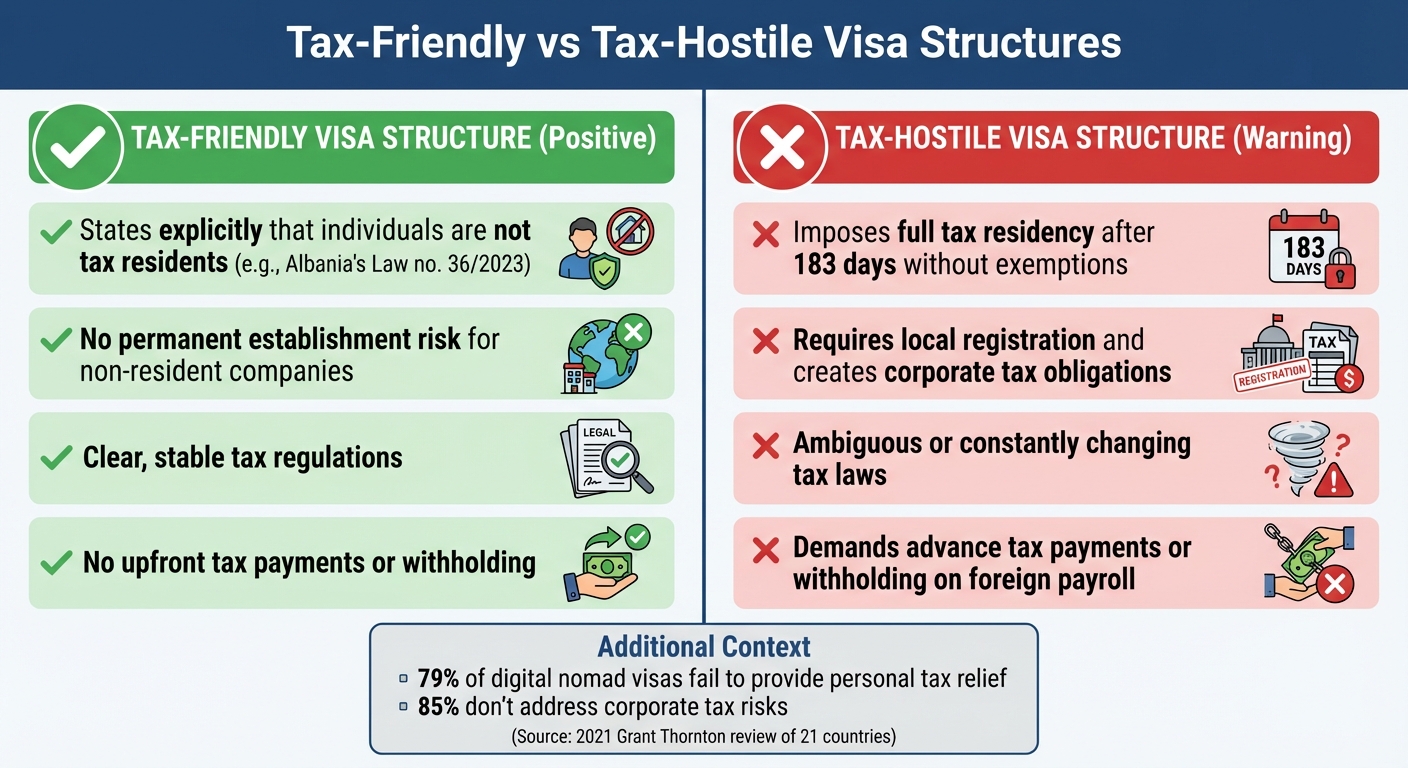

Visas That Impose Full Tax Residency Without Benefits

Not all digital nomad visas are created equal. Some grant you legal residency but also classify you as a full tax resident. This means you could be taxed on your entire worldwide income – not just what you earn locally. What’s worse, many of these visas don’t offer tax relief, credits, or exemptions to soften the blow. According to a 2021 Grant Thornton review of 21 countries, 79% of digital nomad visas fail to provide personal tax relief, and 85% don’t address corporate tax risks. For U.S. citizens, this situation is even trickier because of existing double-taxation issues. Add to that the confusion caused by unclear tax rules in some countries, and you’ve got a recipe for financial headaches.

Countries With Unclear or Changing Tax Rules

Some countries roll out nomad visas without a solid tax framework, leaving you to figure out unclear and ever-changing rules. This can lead to surprise tax bills, penalties, and compliance challenges. As Grant Thornton pointed out, many assume digital nomad arrangements mean minimal tax exposure, but the reality is far more complicated. Take Brazil and Argentina, for example. These countries might require you to make advance tax payments or deal with withholding obligations – even if you’re still on your home country’s payroll. This can cause cash flow problems and make compliance a nightmare. When tax laws are unstable or poorly defined, planning for the future becomes nearly impossible.

Main Tax Risks for Digital Nomads

Digital nomads face three primary tax risks: double taxation, withholding requirements, and permanent establishment issues. Double taxation happens when both your home country and your host country tax the same income. Withholding rules can mean paying taxes upfront before you even file your returns. And if you’re running a business, staying too long in one country could create a permanent establishment risk, making you liable for local corporate taxes and additional filings. As Fidelity aptly puts it:

"If taxes are one of the certainties in life, so are tax‐law changes. Each year, you – and your CPA – will have to determine if and how filing requirements have changed in states and countries you visit".

| Tax-Friendly Visa Structure | Tax-Hostile Visa Structure |

|---|---|

| States explicitly that individuals are not tax residents (e.g., Albania’s Law no. 36/2023) | Imposes full tax residency after 183 days without exemptions |

| No permanent establishment risk for non-resident companies | Requires local registration and creates corporate tax obligations |

| Clear, stable tax regulations | Ambiguous or constantly changing tax laws |

| No upfront tax payments or withholding | Demands advance tax payments or withholding on foreign payroll |

Common Tax Mistakes US Nomads Make

Navigating tax obligations can be tricky for U.S. nomads, and many find themselves making errors that complicate their financial situation. Below are some of the most common mistakes and tips to steer clear of them.

Believing No Local Tax Means No Tax Liability

A "no local tax" promise on a digital nomad visa might sound appealing, but it doesn’t mean you’re off the hook entirely. U.S. citizens are required to file federal taxes on their worldwide income, regardless of where they live or earn. Spending 183 days or more in another country can also trigger local tax residency. As Vincenzo Villamena, CPA and CEO of Online Taxman, points out:

"Many digital nomads assume that because they don’t live in the US or earn US-sourced income, the IRS doesn’t apply. That’s a costly mistake".

For example, if you’re a single filer earning over $15,750 – or just $400 in self-employment income – you need to file a federal tax return. Keep in mind that "no local tax" often refers to visa fees, not income tax responsibilities. This makes thorough tax planning essential when choosing a destination.

Missing Tax Residency Certificates

Skipping the step of obtaining a tax residency certificate can result in being taxed twice on the same income. These certificates are crucial for claiming benefits under tax treaties or using the Foreign Tax Credit to offset U.S. tax liability. Unfortunately, many digital nomad visas don’t provide clear guidance on how to secure these documents.

For self-employed nomads, the risks are even greater. Without a "Certificate of Coverage" from countries that have Totalization Agreements with the U.S., you could end up paying both U.S. self-employment tax (15.3%) and local social security taxes. Popular destinations like Thailand, Mexico, and most of Central America don’t have these agreements, making it even more important to maintain detailed records of foreign tax payments and residency.

Triggering Tax Obligations in Multiple Countries

Moving frequently might feel liberating, but it can lead to unexpected tax responsibilities in more than one country. Richard Leach, EA and Managing Director at GTN, cautions:

"Many fail to realize that digital nomad visas are solely an immigration tool. Too often, HR departments, corporate leaders and employees assume these visas cover taxes abroad – and that mistake can be troublesome for all parties involved".

Frequent relocations don’t exempt you from tax residency; in fact, they can create obligations in several jurisdictions. Self-employed nomads face added challenges, like potential corporate tax liabilities and payroll compliance across borders. Even U.S. state tax residency can persist if you don’t officially cut ties – this includes surrendering your driver’s license, updating voter registration, and selling any local property.

The table below highlights common assumptions versus the actual tax implications for nomads:

| What Nomads Assume | What Actually Happens |

|---|---|

| Digital nomad visa exempts me from all taxes | U.S. citizenship-based taxation still applies; host country may impose taxes after 183 days |

| No local income means no filing requirement | Self-employment income as low as $400 requires filing |

| My employer handles all tax compliance | You’re still personally responsible for income taxes, regardless of employer actions |

| Moving frequently prevents tax residency anywhere | Frequent moves can trigger obligations in multiple countries; U.S. state residency may persist unless formally terminated |

sbb-itb-39d39a6

How to Choose Nomad Visas That Support Tax Planning

Navigating tax planning as a digital nomad can feel tricky, but choosing the right visa and strategy can make a big difference.

Picking Countries with Tax Perks

Start by focusing on countries that only tax local income, not worldwide earnings. For instance, the UAE’s one-year remote work visa doesn’t impose personal income tax, making it a hotspot for high earners and crypto traders. Malta’s Nomad Residence Permit is another great option – it allows you to stay tax-free on foreign income as long as you don’t transfer it into the country. Countries like Albania (via its digital nomad visa) and Barbados (with its Welcome Stamp) also avoid classifying visa holders as tax residents, keeping foreign-sourced income exempt. Similarly, Panama, Costa Rica, and Georgia often provide tax exemptions for foreign-sourced income under their digital nomad visa programs.

However, keep the 183-day rule in mind: staying in a country for more than 183 days often triggers tax residency. For example, Portugal’s D8 visa can spare many U.S. citizens from Portuguese taxes on foreign income, but exceeding that threshold could bring worldwide income under Portuguese tax laws. Croatia also offers up to a year with exemptions on foreign-earned income.

Once you’ve chosen a tax-friendly destination, structuring your business the right way can further reduce tax obligations.

Setting Up International Business Structures

Beyond selecting the right country, how you structure your business plays a big role in tax planning. A well-thought-out setup can lower your tax liabilities and protect your assets. For example, a U.S. LLC provides flexibility and credibility, while offshore companies in places like Anguilla or tools like trusts and private interest foundations add layers of asset protection and tax benefits. Starting with the right structure can save you from expensive adjustments later.

Consulting Tax Professionals

Given the complexities of international tax laws, consulting a qualified tax professional is a smart move. Vincenzo Villamena, CPA and Founder of Online Taxman, explains:

"Filing US taxes as an American abroad is complex. We help make it easy for you".

Tax experts ensure you file the necessary forms on time, avoiding penalties. They can also help you optimize income structures and take advantage of tax treaties or totalization agreements to avoid double taxation between your home and host countries. Before applying for a nomad visa or setting up a business, get professional advice to fully understand the tax implications. The potential savings often far exceed the cost of consultation.

Conclusion

That dreamy beachside office may look stunning on Instagram, but unexpected tax bills or penalties can quickly dampen the allure of the digital nomad lifestyle. While digital nomad visas grant legal residency, they rarely come with tax advantages, a reality that often clashes with the glamorous image portrayed online.

For U.S. citizens, the challenges are even more pronounced. These visas generally don’t offer individual or corporate tax relief, and Americans remain subject to worldwide taxation and domestic filing requirements. Navigating the complexities of the 183-day rule, self-employment taxes, and strict reporting obligations is no small feat.

The good news? With thoughtful planning, these hurdles can be managed. Choosing countries with favorable tax policies, structuring your business strategically, and seeking professional guidance can help. In fact, about two-thirds of American expats owe no U.S. federal income tax after leveraging available exclusions and credits.

Ultimately, your choice of visa should align with a well-thought-out tax strategy. Exotic destinations are enticing, but financial realities can’t be ignored. Starting with smart tax planning, keeping meticulous records, and consulting experts can help ensure that your nomadic journey remains financially sustainable – and free from costly surprises.

FAQs

How can digital nomads prevent being taxed twice while living abroad?

To steer clear of double taxation, digital nomads should start by checking whether their home country has a tax treaty with the country they’re residing in. These agreements are designed to minimize or even eliminate overlapping tax responsibilities. Additionally, U.S. citizens may qualify for the Foreign Earned Income Exclusion (FEIE), which lets eligible individuals exclude a portion of their income from U.S. taxes.

Another key step is to establish clear tax residency in one country. This helps avoid confusion or potential taxation by multiple jurisdictions. Working with a qualified tax professional is highly recommended – they can guide you through the complexities, ensure compliance with regulations, and help you avoid pitfalls like triggering permanent establishment rules, which could result in unexpected tax obligations.

What factors should U.S. citizens keep in mind when selecting a nomad visa for effective tax planning?

When selecting a nomad visa, U.S. citizens need to think about how it fits with their tax responsibilities. Important factors to weigh include the Foreign Earned Income Exclusion (FEIE) limits, how the visa might affect your tax residency, and whether the destination country has a tax treaty with the U.S. to help you avoid being taxed twice on the same income.

You should also look into any local tax rules tied to the visa, such as required contributions or income taxes. Having a clear understanding of these elements can help you make choices that align with both your lifestyle and your financial plans.

Which countries have digital nomad visas with tax advantages?

Several countries now offer digital nomad visas, often paired with tax perks that can make managing your finances much easier. For instance, Portugal has its Non-Habitual Resident (NHR) program, which includes enticing tax breaks. Panama stands out by exempting foreign-sourced income from taxation, while Estonia boasts a simple and transparent tax system that remote workers may find appealing.

Before choosing a visa, it’s crucial to dig into the details. Does the country provide clear tax residency benefits? Will you be protected from double taxation? And does it fit with your financial plans for the future? Answering these questions ahead of time can help you sidestep unexpected tax surprises.