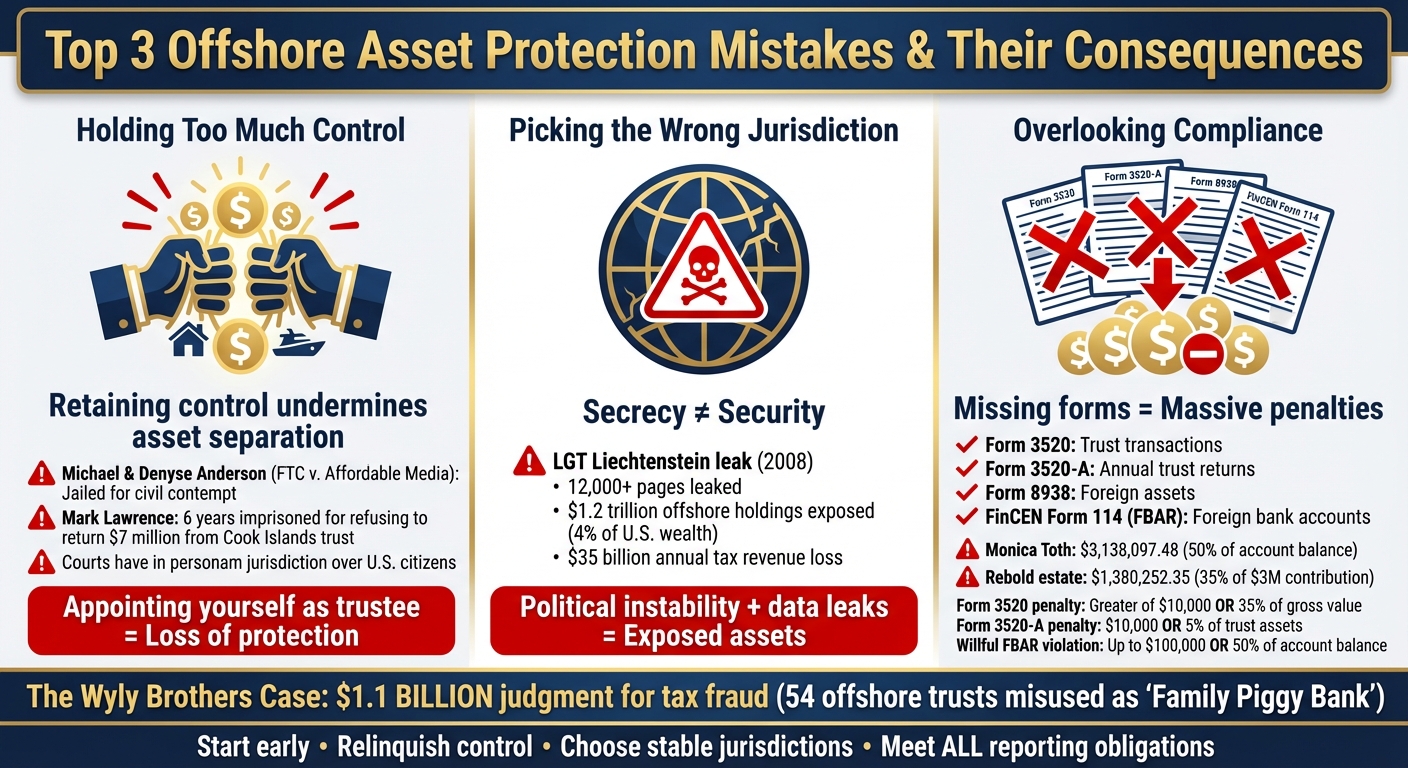

Offshore asset protection can safeguard wealth from creditors and legal claims, but poor execution often leads to failure. Common mistakes include retaining too much control, poor timing, and neglecting compliance. High-profile cases like Samuel Wyly’s $1.1 billion judgment and the IRS seizure in U.S. v. Balice highlight these pitfalls. Key takeaways:

- Control Issues: Courts disregard trusts when individuals maintain direct authority.

- Timing Matters: Last-minute setups are often seen as fraudulent.

- Compliance Failures: Missing IRS forms (e.g., FBAR, Form 3520) results in steep penalties.

- Jurisdiction Risks: Political instability or leaks can expose assets.

To succeed, start early, relinquish control, choose stable jurisdictions, and meet all reporting obligations. Work with experienced professionals to avoid costly errors.

Case Studies: When Offshore Asset Protection Fails

Case Study 1: Documentation Errors and Invalid Trusts

The case of U.S. v. Balice highlights how poor documentation and retained control can render offshore asset protection ineffective. In September 2017, Michael Balice transferred his residence to a trust using a quitclaim deed valued at $0, but he failed to properly record the deed as required. Despite transferring the property, Balice maintained control over the asset – continuing to live in the home and paying bills from the trust’s checking account. These actions led the court to conclude that the trust was simply a nominee for Balice, invalidating its protection. Consequently, the IRS was able to foreclose on the property to satisfy tax liens.

This case demonstrates that without proper consideration, thorough documentation, and a clear relinquishment of control, asset protection structures can fail. Similar pitfalls have been observed in other cases involving offshore strategies.

Case Study 2: Fraudulent Transfer Allegations

One of the most expensive offshore asset protection failures in U.S. history involves the Wyly brothers. In May 2016, a U.S. Bankruptcy Court issued a staggering $1.1 billion judgment against billionaire Samuel Wyly for tax fraud tied to offshore structures in the Isle of Man. Beginning in the 1990s, Samuel and Charles Wyly created 54 offshore trusts and corporations. Judge Barbara J. Houser criticized their misuse of these structures:

"The Wylys treated the offshore system as the Wyly Family Piggy Bank." – Barbara J. Houser, U.S. Bankruptcy Judge

Separately, the IRS pursued Charles Wyly’s estate for $249 million in penalties for failing to report offshore trusts. The court rejected Samuel Wyly’s defense that he relied on promoters instead of independent tax professionals, emphasizing that such reliance does not excuse fraudulent transfers. This case underscores how fraudulent intent and poor professional guidance can lead to catastrophic financial consequences.

Case Study 3: Jurisdictional Instability

The 2008 Liechtenstein Global Trust (LGT) leak revealed how jurisdictional stability can collapse overnight. Heinrich Kieber, a former LGT employee, leaked over 12,000 pages of sensitive documents to the U.S. Senate Permanent Subcommittee on Investigations. The leak exposed clients like Steven and Harvey Greenfield, revealing a $2.2 million Maverick Foundation account and a $30 million Hong Kong trust. Internal communications showed clients scrambling to sever ties with the Bank of Bermuda.

The fallout was immense. The IRS issued an extensive summons for records covering 2001–2013, leading to enforcement actions worldwide. The scandal also shed light on the sheer scale of offshore holdings – approximately $1.2 trillion, or 4% of U.S. wealth – resulting in an estimated $35 billion annual loss in tax revenue. This case highlights the risks of relying on a jurisdiction’s promise of secrecy. International agreements like FATCA and the Common Reporting Standard have dismantled the era of secret offshore accounts. Political shifts, data leaks, and whistleblowers can expose assets, regardless of a jurisdiction’s historical reputation for discretion.

Recurring Mistakes in Offshore Failures

The examples above highlight three recurring missteps that often derail offshore asset protection efforts: holding onto too much control, choosing unstable jurisdictions, and neglecting compliance requirements. Let’s break down how each of these issues weakens asset protection.

Holding Too Much Control Over Assets

Keeping excessive control over offshore assets can backfire, as it undermines the separation between you and the assets. U.S. courts have what’s called in personam jurisdiction, meaning they can compel U.S. citizens to repatriate funds, no matter where those funds are located. When individuals appoint themselves as trustees, trust protectors, or co-trustees, courts often interpret this as retaining control rather than creating a legitimate separation.

For instance, in FTC v. Affordable Media, Michael and Denyse Anderson were jailed for civil contempt after transferring investor funds to a Cook Islands trust while naming themselves as trustees and protectors. Similarly, Mark Lawrence spent nearly six years behind bars for refusing to return over $7 million from a Cook Islands trust. Even using trust assets for personal purposes – like living in a trust-owned property without a formal lease – can lead courts to dismiss the trust as a mere extension of the individual.

This brings us to the next major issue: selecting the wrong jurisdiction.

Picking the Wrong Jurisdiction

Relying solely on secrecy when choosing a jurisdiction can be a costly mistake. Jurisdictions with weak legal systems or political instability introduce significant risks. Some countries may fail to uphold the asset protection features they advertise, especially under pressure from U.S. authorities. Others might change their laws unexpectedly, freezing assets or cooperating with foreign enforcement actions.

The goal isn’t to hide assets – it’s to place them in jurisdictions with strong legal protections and stable political systems that respect legitimate asset protection structures. A poor choice of jurisdiction can leave assets vulnerable to seizure or legal challenges.

Overlooking Regulatory and Reporting Obligations

Failure to comply with reporting requirements can lead to severe penalties and legal trouble. The IRS mandates several forms for offshore trusts, including:

- Form 3520: For trust transactions

- Form 3520-A: For annual trust information returns

- Form 8938: For reporting specified foreign assets

- FinCEN Form 114 (FBAR): For foreign bank accounts

The penalties for non-compliance are steep. For example, failing to file Form 3520 can result in fines of either $10,000 or 35% of the gross value contributed to the trust, whichever is greater. Missing Form 3520-A filings typically incurs penalties of at least $10,000 or 5% of the trust’s assets. Willful FBAR violations can lead to penalties as high as $100,000 or 50% of the account balance.

Consider the case of Monica Toth. In September 2020, a federal court ordered her to pay $3,138,097.48 for willfully failing to file an FBAR for her Swiss UBS account. This included a base penalty of $2,173,703.00, which represented 50% of the account balance. Similarly, the Rebold estate faced penalties of $1,380,252.35 – 35% of the $3 million contributed to a Liechtenstein foundation – for failing to file required IRS forms.

Courts are unsympathetic to defenses based on unclear rules or reliance on promoters. Ignorance won’t shield you from penalties, and failing to meet compliance requirements can cost far more than the assets you’re trying to protect.

sbb-itb-39d39a6

How to Avoid Offshore Asset Protection Mistakes

Offshore asset protection often fails due to poor planning, lack of professional guidance, and noncompliance. To build a plan that truly works, you need a strategic approach and attention to detail.

Working with Qualified Professionals

The cornerstone of a solid offshore asset protection plan is working with experienced professionals who understand both U.S. law and the laws of your chosen offshore jurisdiction. You should seek attorneys who can provide legal opinions in both jurisdictions, not just promoters offering pre-packaged solutions.

"A good offshore practitioner should never allow the client to be put in this position [of appearing to control the trust]."

- Gallet, Dreyer & Berkey, LLP

Qualified advisors ensure you avoid roles like trustee, co-trustee, or trust protector, which U.S. courts may interpret as maintaining control over the trust. These professionals also help you meet IRS reporting requirements, reducing the risk of costly penalties. Once you have the right team in place, it’s time to implement the essential components of an effective offshore strategy.

Core Elements of a Secure Offshore Strategy

A successful offshore asset protection plan depends on several critical elements working in harmony.

- Establish the trust early: Set up your trust well before facing any litigation risks. Use an independent foreign trustee with no U.S. ties to avoid the appearance of control. The trust should be irrevocable and include discretionary distribution provisions, meaning you cannot dictate how funds are distributed. If you use trust-owned property – like living in a house owned by the trust – sign a formal lease agreement and pay fair market rent to maintain legal separation.

- Maintain thorough documentation: Keep detailed records, including a balance sheet showing you remained solvent after transferring assets to the trust. Document legitimate business or estate planning reasons for creating the structure. Using IRS Form 8275 to disclose uncertain tax positions can also protect you from fraud accusations.

- Layer your protection: Combine offshore trusts with domestic entities like LLCs, Private Retirement Plans, or other structures. This multi-layered approach creates a complex barrier, making it more difficult and expensive for creditors to pursue your assets.

Building a strong foundation is just the beginning. Regular oversight is essential to keep your plan effective.

Regular Monitoring and Updates

Offshore structures are not "set it and forget it" arrangements. Changes in U.S. and offshore laws, as well as shifts in your personal circumstances, can weaken your plan over time.

Schedule annual reviews with your advisors to stay compliant with reporting requirements, such as filing Forms 3520, 3520-A, FBAR, and Form 8938. Regularly review trust documents to ensure they align with current laws, and update beneficiary designations, trustee appointments, and distribution provisions as your family or financial situation evolves.

Additionally, keep an eye on the political and legal stability of your chosen jurisdiction. If conditions in that location change for the worse, work with your advisors to move your assets to a more secure jurisdiction. The goal is to ensure your protection remains effective not just today but for the long haul.

Conclusion: What These Failures Teach Us

Main Lessons from the Case Studies

Offshore planning mistakes tend to follow predictable patterns. Take the Wyly brothers, for example – their direct involvement in managing 54 offshore entities resulted in a staggering $1.1 billion tax fraud judgment. Similarly, Zhang Lan lost the protection of her trust after withdrawing $35 million from its accounts to buy a New York apartment.

Timing is just as critical as the structure itself. Transfers made during financial turbulence – when "dark clouds are closing in" – often fail to hold up in court. The Balice case highlights this issue: the IRS successfully seized a property held in trust because the transfer was poorly executed. The taxpayers retained control over the trust’s finances and continued living on the property, which undermined the trust’s legitimacy. These examples underline the importance of proper timing and execution in offshore planning.

Why Planning Matters

The takeaway? Start early and plan carefully. Offshore asset protection works best when established proactively, during times of financial stability. Waiting until creditors or the IRS are at your doorstep is a recipe for failure. The structures that succeeded in withstanding legal scrutiny were those set up well in advance, with clear boundaries between personal and trust affairs, and strict adherence to legal formalities.

Seeking professional advice is equally important. The Wyly brothers’ costly mistake could have been avoided if they had sought independent guidance rather than relying on promoters who created overly complex schemes aimed at hiding assets instead of protecting them.

Taking Action on Asset Protection

Before diving into offshore asset protection, take a step back and evaluate your situation. Are you facing immediate legal challenges? If so, offshore solutions may not be suitable, as courts often view last-minute transfers as fraudulent. A sound strategy involves maintaining clear boundaries between personal finances and trust assets, along with strict compliance with all legal and reporting requirements.

To navigate these complexities, work with seasoned professionals who understand both U.S. and offshore regulations. Firms like Global Wealth Protection specialize in helping entrepreneurs and investors create compliant asset protection strategies. Whether it’s setting up offshore trusts or forming companies, the goal is to secure your wealth while staying within the bounds of the law. Remember, there are no shortcuts – only well-structured and expertly managed plans can provide lasting protection.

FAQs

What are the biggest mistakes people make with offshore asset protection?

The most frequent mistakes in offshore asset protection often stem from missteps in control, compliance, and execution. Here’s a closer look at what can go wrong:

- Holding onto too much control: If you continue acting as the trustee, protector, or otherwise directly benefit from the assets, courts may view the structure as a "nominee" rather than a legitimate separation. This could lead to the arrangement being invalidated.

- Improper setup or funding: Skipping legal formalities or failing to adequately fund the trust or entity can make it easy for courts to disregard the structure entirely.

- Neglecting U.S. reporting requirements: Missing mandatory filings like FBAR, FATCA, or IRS Forms 3520/3520-A can lead to hefty penalties and weaken your asset protection.

- Fraudulent intent: Using offshore entities to hide assets or evade creditors can backfire, often resulting in fraudulent-transfer claims that leave your structure exposed.

To steer clear of these traps, it’s essential to comply with all legal requirements, fully release control of the assets, and align offshore strategies with domestic tools like estate planning and insurance. Careful planning and proper execution are the foundation of a solid asset protection strategy.

What impact can political instability have on offshore asset protection?

Political instability – whether it’s civil unrest, abrupt regulatory changes, or government-imposed capital controls – can seriously undermine offshore asset protection structures. In the worst scenarios, assets might be frozen, seized, or subjected to new creditor-friendly laws, leaving your wealth vulnerable.

This kind of instability often triggers tighter banking compliance and heightened regulatory scrutiny. The result? Account closures, restricted access to funds, or even forced repatriation. These disruptions don’t just threaten your liquidity; they also erode the privacy and flexibility that offshore strategies are meant to provide.

To help navigate these challenges, Global Wealth Protection works with clients to spread their assets across stable jurisdictions and create contingency plans. This ensures your wealth remains protected, even in the face of political upheaval.

Why should I work with experienced professionals for offshore asset protection?

Working with seasoned professionals is essential when dealing with offshore asset structures, as these arrangements face intense scrutiny from tax authorities and courts. Even small mistakes in setup or documentation can lead to serious legal and financial repercussions, including hefty fines, penalties, or even criminal charges. There have been high-profile cases where individuals faced significant judgments or prosecution because of poorly executed strategies.

Experts like attorneys, accountants, and trust specialists play a critical role in ensuring your offshore entities are structured and funded correctly while staying compliant with U.S. reporting requirements and international laws. Their expertise helps protect your assets, maintain your privacy, and avoid expensive legal complications. Taking a professional approach reduces risks and offers peace of mind, ensuring your wealth is safeguarded for the future.