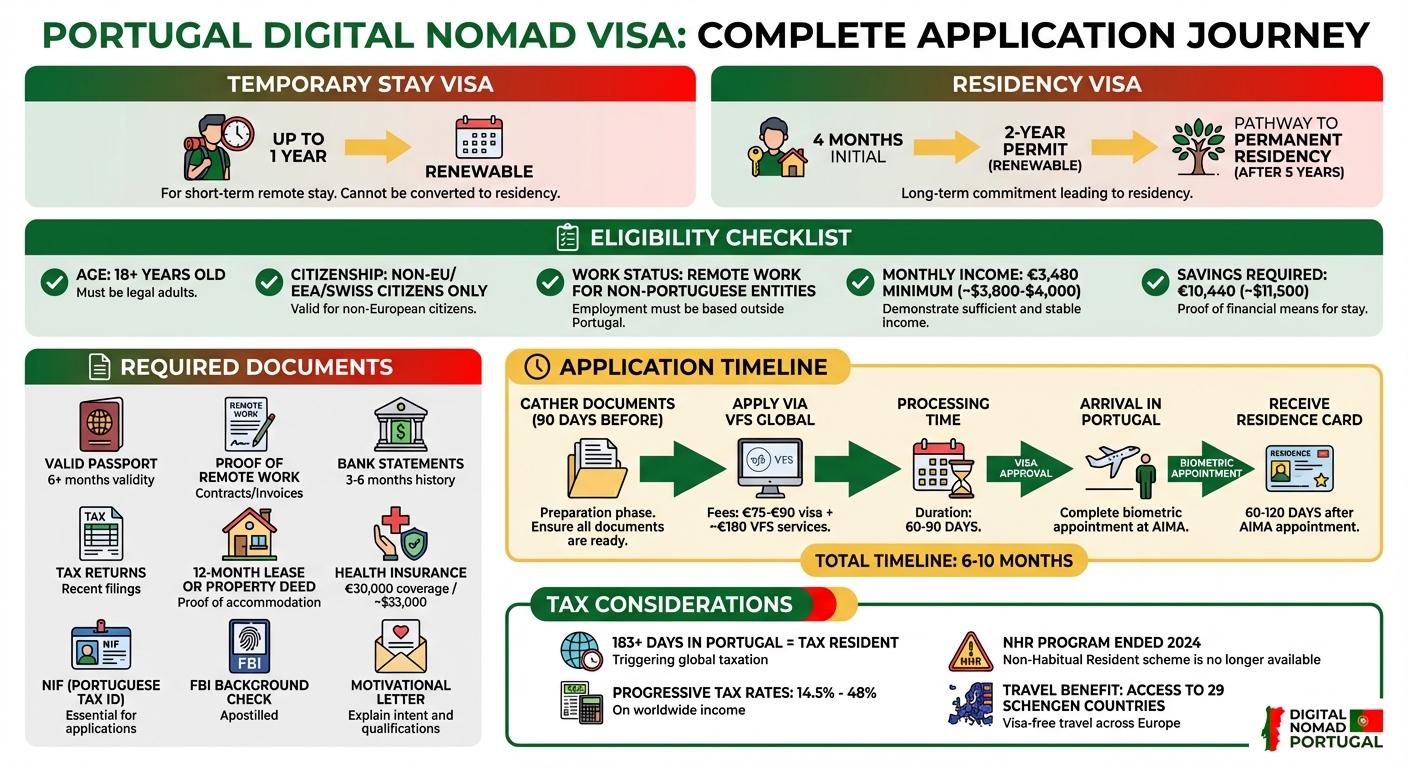

Portugal’s Digital Nomad Visa, launched in October 2022, is designed for remote workers, freelancers, and entrepreneurs earning income outside Portugal. It offers two options: a Temporary Stay Visa (valid for up to 1 year) and a Residency Visa (initial 4-month stay leading to a renewable 2-year permit). Here’s what you need to know:

- Eligibility: Open to non-EU/EEA/Swiss citizens aged 18+ who work remotely for non-Portuguese entities.

- Income Requirements (2025):

- Monthly income: At least €3,480 (~$3,800–$4,000).

- Savings: €10,440 minimum (~$11,500).

- Required Documents:

- Proof of remote work (contracts, invoices, etc.).

- Bank statements (3–6 months) and tax returns.

- Proof of accommodation (12-month lease or property deed).

- Health insurance covering €30,000 (~$33,000).

- Valid passport, NIF (Portuguese Tax ID), and FBI background check.

- Motivational letter explaining your move to Portugal.

- Application Process:

- Apply through VFS Global in the U.S.

- Fees: €75–€90 for the visa, ~€180 for VFS services.

- Processing time: 60–90 days.

- After arrival in Portugal, finalize residency with a biometric appointment and local bank account.

Key Considerations:

- Spending over 183 days in Portugal makes you a tax resident, subject to progressive tax rates (14.5%–48%) on worldwide income.

- The Non-Habitual Resident (NHR) tax program ended in 2024, replaced by a new Incentivized Tax Status Program.

The visa also allows travel across 29 Schengen countries and offers a pathway to permanent residency or citizenship after 5 years.

Who Can Apply for the Portugal Digital Nomad Visa

Here’s a breakdown of who qualifies for Portugal’s Digital Nomad Visa and what you’ll need to meet the eligibility criteria.

Citizenship and Age Requirements

This visa is available exclusively to non-EU, non-EEA, and non-Swiss citizens. If you’re a citizen of any European Union country, European Economic Area nation, or Switzerland, you already have the right to live and work in Portugal, so this visa isn’t for you. Additionally, all applicants must be at least 18 years old.

Remote Work Status

To qualify, your work must be entirely remote, and your income must come from employers or clients based outside of Portugal. This applies whether you’re a salaried employee, freelancer, or self-employed.

- For employees: You’ll need a contract or a formal letter from your employer confirming that you’re authorized to work remotely from Portugal.

- For freelancers or independent contractors: Submit service contracts, partnership agreements, or recent invoices from your clients to demonstrate your work and income.

Minimum Income Threshold

Applicants must meet a specific income requirement to qualify. For single applicants, the minimum monthly active income is €3,480 in 2025, which is four times the Portuguese minimum wage of €870. It’s important to note that this must be active income – such as a salary or freelance fees – rather than passive income.

You’ll also need to show proof of savings equivalent to 12 months of the minimum wage, totaling €10,440. If you’re applying with family, additional savings are necessary: an extra 50% per spouse/parent and 30% per dependent child.

To verify your income, you’ll need to provide:

- Bank statements from the last three months

- Supporting documents like tax returns or receipts

Other Requirements

In addition to income and work documentation, you’ll need to prepare several other items for your application:

- Proof of accommodation: A 12-month lease agreement or property deed is required; short-term rentals won’t be accepted.

- Valid passport: Ensure your passport is valid for at least six months beyond your intended stay.

- Criminal background check: For U.S. citizens, this means an FBI background check that’s less than 90 days old and apostilled.

- Health insurance: You’ll need coverage for medical emergencies and repatriation, with a minimum coverage of €30,000 (around $33,000 USD). Plans typically cost between $20 and $110 USD per month.

- Portuguese Tax Identification Number (NIF): This is essential for opening a bank account and signing lease agreements.

- Motivational letter: Write a letter in English or Portuguese explaining your reasons for moving to Portugal and detailing your remote work setup.

Documents You Need to Apply

Getting all your paperwork together is often the most time-consuming step in the application process. You’ll need to organize your documents into two main categories: proof of income and employment and personal and legal paperwork. To avoid delays, start gathering these at least 90 days before applying. Here’s a clear breakdown of what you’ll need.

Income and Employment Documents

Your financial paperwork must confirm your remote work status and show you meet the required income threshold. If you’re an employee, provide either your work contract or a letter from your employer confirming you’re authorized to work remotely. Freelancers and self-employed applicants should include service contracts with clients, recent invoices, or proof of business ownership, such as business tax returns. If you’re part of a business partnership, partnership agreements are also acceptable.

In addition, all applicants must submit pay stubs and 3–6 months of bank statements showing consistent income deposits. You’ll also need tax return documents from your home country. Bank statements should clearly reflect savings of at least €10,440 (about $11,500 USD), which equals 12 months of Portugal’s minimum wage.

Personal and Legal Documents

The next step is gathering the necessary personal and legal documents. Start with a completed and signed National Visa application form, which you’ll receive from the Portuguese consulate. Make sure your passport is valid for at least six months beyond your intended stay and include notarized color copies of its main pages.

You’ll also need an FBI background check issued within the last 90 days. This document must be apostilled and translated into Portuguese. Any other documents not originally in Portuguese will also require official translations, though your motivational letter can be submitted in English.

Other required documents include proof of health insurance with coverage of at least €30,000 (approximately $33,000 USD), your 12-month lease agreement or property deed, your Portuguese Tax Identification Number (NIF) registration certificate, two passport-sized color photos (3.5 x 4.5 cm or about 1.4 x 1.8 inches), and a flight itinerary to Portugal. The visa application fee is €75 (about $83 USD) for a Temporary Stay visa or €90 (about $99 USD) for a Residency visa.

If you’re bringing family, any foreign government-issued documents like marriage or birth certificates must be apostilled and professionally translated. Keep in mind that submitting unverified or unofficial translations is one of the most common reasons visa applications are rejected. Attention to detail here is key!

How to Apply from the United States

Applying through a VFS Global Visa Application Center

If you’re applying for a Portugal Digital Nomad Visa from the U.S., your application will be handled through specific VFS Global centers. You’ll need to visit the center assigned to your state of residence, which is determined by the address on your driver’s license or state ID.

To get started, head to the VFS Global portal at https://www.vfsvisaonline.com/portugal-usa/ and schedule an appointment. Make sure to bring both the originals and copies of all required documents. During your appointment, you’ll submit your application, pay the visa fee (€75 for a Temporary Stay or €90 for Residency, roughly $83 and $99 USD), and cover VFS service fees of about €180 (approximately $195 USD). You’ll also need to provide biometric data, such as fingerprints and a photo.

Once submitted, the processing time typically ranges from 60 to 90 days. However, the full timeline – from gathering documents to receiving your residence card – can take anywhere from 6 to 10 months. Once approved, your passport will be returned with a visa sticker. This sticker, valid for four months, often includes a pre-scheduled date and location for your mandatory AIMA (Agency for Integration, Migrations, and Asylum) appointment in Portugal.

Completing the Process in Portugal

After your application is approved in the U.S., there are a few key steps to complete once you’re in Portugal to finalize your residency. If you haven’t already obtained a NIF (Tax Identification Number) before leaving the U.S., securing one should be your first priority. A NIF is essential for opening a bank account, signing rental agreements, and attending your AIMA appointment. Opening a Portuguese bank account is also a required step to complete the residency process.

Your AIMA biometric appointment is typically scheduled 2 to 6 months after your arrival. If your visa sticker does not include a pre-scheduled appointment, you’ll need to contact AIMA directly at (+351) 217 115 000 or (+351) 965 903 700 to arrange one as soon as possible. During this appointment, you’ll provide biometric data and finalize your residence permit application. The processing fee for this step is at least €80, and the residence card itself costs an additional €70.

After your AIMA appointment, it may take 60 to 90 days – or sometimes even longer, up to 120 days – for your residence card to be produced. The card will be mailed to the Portuguese address you provided. While you wait, you’ll receive temporary documentation that allows you to legally live and work in Portugal.

sbb-itb-39d39a6

Tax and Financial Planning for U.S. Applicants

Understanding Portuguese Tax Residency

If you’re a U.S. applicant planning to spend time in Portugal, here’s a key rule to keep in mind: the 183-day rule. Spending more than 183 days in Portugal within any 12-month period makes you a Portuguese tax resident. Once you’re classified as a resident, Portugal will tax your worldwide income – not just what you earn locally.

Portugal operates on a progressive tax system, with rates for 2024 ranging from 14.5% to 48%. For example, income up to €7,479 (about $8,200) is taxed at the lowest rate of 14.5%, while income exceeding €78,834 (roughly $86,500) is taxed at the top rate of 48%. Non-residents, on the other hand, face a flat 25% tax rate on income sourced within Portugal.

Thanks to a double taxation treaty between Portugal and the United States, you can avoid being taxed twice on the same income. However, you’re still required to file U.S. tax returns. It’s also worth noting that Portugal’s Non-Habitual Resident (NHR) program, which previously offered tax benefits, ended for most new applicants as of January 1, 2024. This program is being replaced by the Incentivised Tax Status Program, though its details are still being finalized.

These tax rules are essential to consider when planning your finances abroad.

Managing Your Banking and Assets

Opening a Portuguese bank account is a must for completing your residency permit. Beyond that, it’s a practical tool for managing your assets and handling cross-border finances. Popular banks among expats include Millennium BCP, ActivoBank, Caixa Geral de Depósitos, Santander Totta, and Novo Banco. To open an account, you’ll generally need the same documents you used for your visa application, and most banks require an in-person visit to finalize the process.

Many U.S. digital nomads opt to maintain both Portuguese and U.S. bank accounts to handle income in different currencies. If your income structure is more complex or you hold significant assets, setting up offshore companies or trusts can provide added layers of asset protection and tax efficiency.

For more intricate financial planning and ensuring compliance across borders, consulting specialized advisory services is highly recommended.

How Global Wealth Protection Can Help

Navigating the maze of international tax and financial regulations can be overwhelming. That’s where Global Wealth Protection steps in. They specialize in helping entrepreneurs and investors – especially those with location-independent lifestyles – organize their finances for tax efficiency and asset security. Their services include forming private U.S. LLCs, establishing offshore companies (primarily in Anguilla), and setting up offshore trusts for high-net-worth individuals.

In addition to these services, Global Wealth Protection offers private consultations tailored to your specific needs. Whether you’re figuring out how to structure your business income, ensuring compliance with U.S. tax laws while living abroad, or protecting your assets across borders, their expertise can make a big difference. They also offer a GWP Insiders membership program, which provides ongoing access to strategies for internationalization, tax planning, and choosing the right jurisdictions. For Americans relocating to Portugal, this guidance can help you set up your financial framework the right way from the start.

Conclusion

Portugal’s Digital Nomad Visa presents an exciting pathway for remote professionals looking to settle in Europe. To qualify, applicants must meet several requirements: be at least 18 years old, earn a minimum of €3,480 per month, demonstrate savings of €10,440, work exclusively for non-Portuguese entities, obtain a NIF (Portuguese tax identification number), open a local bank account, and provide proof of accommodation and health insurance with coverage of at least €30,000.

The application process typically takes 60 to 90 days to complete. Applicants can opt for either a Temporary Stay Visa, valid for up to one year, or a Residency Visa, which is renewable every two years and offers a pathway to permanent residency.

Tax obligations are another key consideration. Spending more than 183 days in Portugal makes you a tax resident, subjecting your income to progressive tax rates that can climb as high as 48%. With the Non-Habitual Resident program ending on January 1, 2024, careful financial planning has become even more essential.

Given the complexity of these tax regulations, seeking expert advice is highly recommended. Managing cross-border taxes and finances requires strategic planning. Global Wealth Protection offers personalized services, including offshore company formation, private consultations, and membership programs, to help location-independent professionals navigate their international lifestyles with confidence from the very beginning.

FAQs

What income and savings do I need to qualify for Portugal’s Digital Nomad Visa?

To be eligible for Portugal’s Digital Nomad Visa, you need to show a monthly income of at least €3,480 – this is about four times the country’s minimum wage. Along with that, you’ll need to submit a recent bank statement proving you have enough savings to meet this requirement. These documents are essential to confirm you can financially sustain yourself while residing in Portugal.

How does Portugal’s tax residency rule impact digital nomads?

If you spend more than 183 days in a year living in Portugal, you’ll be classified as a tax resident. This means you might need to pay Portuguese personal income tax on your worldwide earnings. However, there’s good news: you could qualify for the Non-Habitual Resident (NHR) program, which provides attractive tax incentives. With NHR, foreign-sourced income is often tax-exempt, and income from specific high-value professions within Portugal is taxed at a flat 20% rate. For digital nomads, grasping these tax rules is essential for managing finances efficiently while enjoying life in Portugal.

What documents do I need to apply for Portugal’s Digital Nomad Visa?

To apply for Portugal’s Digital Nomad Visa, you’ll generally need to gather a few key documents. These include proof of income, a valid passport, and evidence that you work remotely or are self-employed. Additionally, you’ll likely need a criminal background check, health insurance, and a completed visa application form.

It’s always a good idea to double-check the exact requirements with the Portuguese consulate or embassy in your area. Specific documentation may vary depending on your country of residence and personal situation.