Looking to reduce taxes while enjoying tropical living? The Caribbean offers tax-free residency and citizenship programs that eliminate personal income, capital gains, inheritance, and wealth taxes. Here’s a quick overview of the top destinations:

- Bahamas: No income or capital gains taxes. Residency starts at $500,000 real estate investment.

- Cayman Islands: Zero taxes, with options like a 25-year residence certificate ($1.2M real estate) or permanent residence ($2.4M real estate).

- St. Kitts and Nevis: Citizenship-by-investment with $250,000 donation or $400,000 real estate.

- Dominica: Affordable citizenship starting at $200,000 with no physical presence required.

- Antigua and Barbuda: Citizenship through $100,000 donation or $300,000 real estate, with minimal stay requirements.

- Anguilla: Tax residency via $400,000 property investment and $75,000 annual fee.

- British Virgin Islands: Residency through real estate or business investment, with no personal income taxes.

These programs are ideal for investors, entrepreneurs, and high-net-worth individuals seeking tax efficiency, global mobility, and lifestyle perks. Options vary by investment threshold, residency requirements, and benefits like visa-free travel or rental income potential. Choose the one that aligns with your financial goals.

Cayman Islands Residency Programs

The Cayman Islands is a haven for those seeking a tax-free environment, offering no personal, corporate, capital gains, or estate taxes. On top of that, the government provides a 25-year tax guarantee, ensuring certificate holders won’t face direct taxes during this period. This combination of zero taxation and long-term stability makes it an appealing choice for high-net-worth individuals looking to establish residency.

There are three primary pathways for obtaining tax-free residency in the Cayman Islands, each designed to suit different investment goals and lifestyles.

25-Year Residence Certificate

The 25-Year Residence Certificate for Persons of Independent Means is perfect for those seeking minimal residency requirements. To qualify, applicants must make a $1.2 million investment in local real estate, with at least 50% – or $600,000 – allocated to developed residential property. Additionally, applicants must maintain either a $500,000 bank deposit or demonstrate $144,200 in annual passive income.

This certificate requires only 30 days of physical presence per year and is renewable after 25 years. While it doesn’t provide work rights or a path to citizenship, it does grant tax-free status on worldwide income for those meeting the residency conditions. It’s a low-maintenance option for long-term residency without the need for full-time relocation.

Permanent Residence

The Permanent Residence program is ideal for those seeking indefinite status and comes with a higher investment requirement of $2.4 million in local real estate. Properties purchased under this program can be rented out tax-free, allowing investors to generate passive income without worrying about capital gains taxes.

After holding permanent residence for five years, individuals can apply for naturalization, which includes eligibility for a British Overseas Territories passport. This passport provides visa-free access to approximately 150 countries and allows visits of up to six months in the United Kingdom. Permanent residence also includes the option to apply for work permits, making it the most secure and flexible long-term residency option. Additional costs include a 0.45% vendor fee, a $1,000 government fee, and annual dependent fees of $1,200 per family member.

Certificate of Direct Investment

The Certificate of Direct Investment caters to business owners who invest $1 million or more in ventures employing Caymanians. This 25-year renewable certificate includes work rights, enabling investors to actively manage their businesses. However, it requires 90 days of physical presence per year.

Application fees start at $600, with a $6,000 post-approval fee. There are also annual fees of $1,200 per dependent, plus additional costs for work permits. This pathway is ideal for entrepreneurs looking to combine residency with business opportunities in the Cayman Islands.

Bahamas Residency Options

The Bahamas offers a tax-friendly environment with no personal income, capital gains, inheritance, or wealth taxes. Located just 50 miles from Florida, the country uses both the U.S. dollar and the Bahamian dollar (pegged 1:1 to USD) and operates under an English-speaking, common-law system. Investor residency applications are typically processed within 3 to 6 months. Below, we explore the three main residency options available.

Permanent Residence

The Permanent Residence program requires a real estate investment of at least $500,000, with applications receiving faster processing for investments of $750,000 or more. This option provides indefinite residency, making it a solid choice for long-term planning, including estate and succession strategies. Investors can purchase properties in prime locations, such as waterfront or resort areas, which may also generate rental income. Importantly, any appreciation in property value is not subject to capital gains tax. The program also covers spouses and dependent children, making it family-friendly. Be prepared for additional expenses like property transfer taxes, stamp duties, legal fees, and due diligence charges, which can add roughly 5–10% to the property’s cost.

Economic Residence

The Economic Residence option is ideal for those looking for a tax-efficient base without committing to permanent settlement. It generally requires a real estate investment of around $500,000 and is well-suited for individuals who split their time between the Bahamas and other locations. To maintain a credible tax residency, investors should plan to spend at least 183 days per year in the Bahamas. This pathway is particularly appealing to those managing business interests abroad while enjoying the benefits of a tropical retreat.

Annual Residence

For those who prefer flexibility without purchasing property, the Annual Residence program offers a renewable permit. Applicants need to demonstrate an annual spending level of at least $100,000 within the Bahamas, covering housing, living costs, and other local activities. This option is popular among seasonal residents ("snowbirds"), executives testing a relocation, or investors establishing a presence before committing to a more permanent arrangement. To renew the permit each year, applicants must provide updated documentation, such as bank statements, lease agreements, and invoices, to verify their economic activity within the country.

Anguilla Tax Residency Program

Anguilla, a British Overseas Territory, offers an attractive tax haven with complete tax exemption. In 2019, the island launched its Tax Residency by Investment (TRI) program, designed to provide high-net-worth individuals with residency certificates while adhering to international transparency standards.

Tax Residency by Investment

To qualify for the TRI program, applicants must make a minimum property investment of US$400,000 and pay a fixed annual fee of US$75,000. This fee replaces traditional taxes like income, capital gains, and inheritance taxes, making it especially appealing for investors with significant returns.

Participants are required to spend at least 45 days per year in Anguilla and must avoid staying more than 183 days in any other single country to establish credible tax residency. The application process involves submitting proof of funds, documentation of wealth sources, a clean criminal record, and health insurance. Once approved, applicants receive official documentation confirming Anguilla as their primary tax residence. This certification can be used for bank compliance, CRS/FATCA reporting, and defending tax residency during audits.

The program is particularly popular among tech entrepreneurs after an exit, fund managers, global traders, and family-office heads. These individuals seek to reduce taxes on their investment returns and business profits while maintaining proximity to North America. Anguilla’s convenient location, with flight connections through Miami and San Juan, allows investors to maintain business ties while benefiting from its tax advantages. The program also aligns with the region’s broader focus on tax efficiency and asset protection strategies.

Asset Protection Trusts

Anguilla complements its tax residency program with strong asset protection trust options. These trusts include spendthrift provisions that shield assets from creditors and restrict both voluntary and involuntary transfers by beneficiaries. Legal ownership of assets is separated from the settlor through a trustee, and challenges to asset transfers are limited by short statutes of limitation, typically one to two years after the transfer.

Anguilla also ensures confidentiality – there is no public register of trust beneficiaries, and trust deeds are not publicly filed. This makes these structures ideal for estate and asset protection planning. Many investors pair their Anguilla tax residency with discretionary trusts to hold assets like investment portfolios, real estate, or operating companies. Trust income and capital growth are tax-free locally, and distributions can be timed to fit beneficiaries’ individual tax situations. Setting up a trust typically costs a few thousand dollars, with annual maintenance fees ranging from US$3,000 to over US$10,000.

St Kitts and Nevis Investment Pathways

St. Kitts and Nevis is home to the world’s longest-running citizenship-by-investment program, established back in 1984. This twin-island nation is particularly appealing to high-net-worth individuals, thanks to its lack of personal income tax, capital gains tax, inheritance tax, and wealth tax. Once you secure citizenship through investment, you can establish tax residency by spending at least 183 days per year in the country.

There are two primary investment options to access these benefits: making a contribution to a government fund or investing in approved real estate. Let’s break down each pathway.

Citizenship-by-Investment: Donation Pathway

The Donation Pathway involves a contribution of $250,000 to the Sustainable Growth Fund for a single applicant. This fund supports critical infrastructure, healthcare, and education initiatives in St. Kitts and Nevis. The process typically results in full citizenship and a passport within 3–6 months, offering a fast route to establishing tax residency without the need to manage property.

The application process includes due diligence checks, background verification, and submitting documents like proof of funds, medical records, and passports. Government approval usually takes about 60 days. There’s no interview or language test required, and you can include family members such as your spouse, children under 30, and parents over 55. This option is ideal for those who value speed and simplicity while seeking to optimize their tax situation.

Citizenship-by-Investment: Real Estate Pathway

The Real Estate Pathway caters to investors who prefer owning property. It requires a minimum investment of $400,000 to $430,000 – or more – in government-approved real estate projects, such as luxury resorts. Investors must hold the property for at least seven years before selling, which is a longer commitment compared to some other Caribbean programs. Additional costs, including government fees (around $25,000 for the main applicant), due diligence fees, and closing costs like legal and transfer fees, can add 10–15% to the overall investment.

The application steps are similar to the donation route: due diligence checks, document submission, and background verification, with processing times of 3–6 months. Investors select an approved property, sign agreements, and make installment payments while waiting for approval. They must also prove the source of funds and maintain ownership for the full seven-year period. This pathway is appealing to those interested in property ownership, potential rental income of 3–5% annually, and long-term property appreciation. After the holding period, selling the property can potentially provide tax-free capital gains, adding another layer of tax benefits.

Antigua and Barbuda Tax Benefits

Antigua and Barbuda stands out with its zero-tax regime – no personal income, capital gains, wealth, or estate taxes. Income earned abroad is also untaxed, making it an appealing destination for investors seeking efficient global tax strategies. Alongside these tax perks, the country offers flexible routes to residency and citizenship, catering to diverse investor preferences.

Residency by Physical Presence

This pathway focuses on establishing genuine tax residency by spending at least 183 days per year in Antigua and Barbuda. Unlike other programs, it doesn’t require significant upfront investments. Instead, you’ll need to arrange long-term accommodations, open local bank accounts, and set up utilities to demonstrate your intent to reside.

This option is particularly attractive to tech entrepreneurs managing remote businesses, investors with substantial portfolio income, and retirees looking for a tax-friendly, relaxed island lifestyle. Antigua’s warm weather, English-speaking environment, developed tourism infrastructure, and strong connections to North America and Europe make it a practical choice for globally mobile professionals. However, maintaining thorough documentation – such as entry and exit stamps, boarding passes, lease agreements, utility bills, and bank statements – is crucial to proving your tax residency to authorities.

It’s worth noting that U.S. citizens are still subject to federal taxes due to the United States’ citizenship-based taxation system. However, obtaining tax residency in Antigua can complement strategies like the Foreign Earned Income Exclusion and help optimize international business structures.

For those seeking a faster process with fewer residency requirements, the Citizenship-by-Investment program offers an alternative solution.

Citizenship-by-Investment Program

Antigua and Barbuda’s Citizenship-by-Investment (CBI) program provides a streamlined path to a second passport with minimal residency obligations. The program requires a minimum total investment of about $230,000, including fees. Applicants can choose between two main options:

- A non-refundable donation to the National Development Fund (starting at $100,000 for a single applicant, plus fees)

- Investment in government-approved real estate, with a minimum amount of $300,000 and a five-year holding period.

The application process typically takes 3–6 months and involves working with a licensed agent, selecting your investment option, submitting due diligence documents, undergoing government screening, and completing your investment. Once approved, you’ll receive citizenship and your passport. The program also allows you to include immediate family members, such as your spouse, dependent children, and even parents or siblings.

Antigua’s CBI program has one of the lowest physical-stay requirements globally – citizens only need to spend five days in the country within the first five years. Additionally, citizenship grants visa-free or visa-on-arrival access to around 150–157 countries, including the Schengen Area and the UK. This makes it an attractive option for those seeking greater mobility and global opportunities.

sbb-itb-39d39a6

British Virgin Islands Zero-Tax Residency

The British Virgin Islands (BVI) is widely recognized as a zero-tax jurisdiction, meaning there are no direct taxes like income or capital gains taxes. Instead, the government funds its operations primarily through indirect sources, such as import duties, payroll taxes on local employment, stamp duties, and various licensing fees.

With a strong legal foundation, the BVI provides a tax-free environment that also supports sophisticated asset protection and wealth management strategies. Unlike jurisdictions that focus on real estate-based citizenship programs, the BVI highlights business residency and company formation, making it a preferred choice for location-independent investors and fund managers.

Residency via Investment

There are two main ways to establish long-term residency in the BVI:

Property Investment Route

Investors can qualify for residency by purchasing real estate and showing a genuine intent to live in the territory. Foreign buyers must obtain a Non-Belonger Land Holding License (NBLHL) and pay applicable local fees. While there’s no official minimum investment amount, typical purchases fall in the mid- to high-six-figure range. However, maintaining residency requires a significant physical presence in the BVI.

Business Investment Pathway

This option focuses on creating active local businesses rather than passive international entities. Investors can secure residency by setting up and licensing a local operating company. This requires a meaningful financial commitment, usually in the low- to mid-six-figure range, to establish real operations such as an office, professional services firm, or tourism-related business. Additionally, investors must hire local employees and comply with payroll tax, social security, and labor regulations. Demonstrating “real economic substance” is crucial, which includes having dedicated office space, local management, and active decision-making processes that meet both BVI and international standards.

Comparison to Other Islands

When comparing the BVI to its Caribbean neighbors, some unique distinctions emerge. The BVI offers a quieter, boutique lifestyle, especially appealing to sailing and yachting enthusiasts. In contrast, the Cayman Islands are known for their well-developed financial and expat infrastructure, while the Bahamas attract residents with a broader island network and high-end communities.

Access to the BVI from the U.S. can be slightly less convenient. While the Bahamas and Cayman Islands benefit from direct flights from many major U.S. cities, travel to the BVI often requires a connection through hubs like San Juan, Puerto Rico. Living costs in all three jurisdictions are high, with the Cayman Islands and Bahamas typically on the pricier side. The BVI may offer some areas where costs are slightly lower, but overall, living expenses remain well above the U.S. average.

In terms of residency options, the BVI’s approach is more flexible and case-by-case compared to its neighbors. For example, Anguilla offers defined Residence-by-Investment programs with clear thresholds, while Antigua and Barbuda and St. Kitts and Nevis focus on citizenship-by-investment programs with set minimums, typically ranging from $200,000 to $400,000. The BVI, however, appeals to those who value its strong legal framework, established financial services sector, and tranquil lifestyle over standardized investment-for-citizenship models.

Dominica Low-Tax Advantages

Dominica stands out as one of the most affordable Caribbean Citizenship by Investment (CBI) programs, with entry points starting at $200,000 and ranging between $200,000 and $400,000 [2,4,5]. For investors who live outside the island, Dominica offers a tax-free or low-tax environment. There’s no tax on foreign income, no capital gains tax for non-residents, and no wealth, inheritance, or gift taxes. Residents are typically taxed only on income earned within Dominica, meaning structuring investments to generate income elsewhere can significantly reduce overall tax obligations [6,7].

For real estate investors, Dominica provides additional tax perks, such as no capital gains tax on property appreciation and relatively low stamp duties on transactions. This makes buying and selling property more cost-effective [2,6]. Combined with lower investment thresholds and a straightforward application process, Dominica offers a practical path to obtaining a second passport while helping U.S.-based investors manage their global tax exposure [4,5]. Investors can choose the option that best aligns with their financial strategies. Below, we’ll explore Dominica’s Fund and Real Estate CBI options in detail.

Citizenship-by-Investment: Fund Option

The Economic Diversification Fund (EDF) option requires a $200,000 non-refundable contribution to the state fund for a single applicant, making it the least expensive choice [5,8]. Additional government and due diligence fees apply for each applicant and dependent, but the overall costs remain lower than many competing programs. The application process involves working with an approved agent, gathering necessary documents for due diligence, submitting the application, undergoing background checks, and, upon approval, making the EDF contribution. Citizenship and a passport are typically granted within a few months [4,5].

From a tax-planning perspective, the Fund option is low-commitment. It allows investors to gain citizenship – and the flexibility that comes with it – without tying up capital in a specific property or project, which is ideal for those wanting to diversify their investments across multiple locations [4,5]. The process is efficient, with no residency requirements, making it perfect for remote workers or global entrepreneurs. Additionally, the program allows for family inclusion, enabling spouses, children, and sometimes dependent parents or siblings to be added for an extra fee, making it a comprehensive solution for family mobility. However, one downside is that the contribution is non-recoverable, meaning there’s no potential for financial returns. Any tax benefits depend on how investors structure their global residency and corporate arrangements rather than the citizenship itself [4,5].

Citizenship-by-Investment: Real Estate Option

The real estate route requires a $200,000 investment in government-approved real estate projects [2,5]. These projects often include resorts or hotels, and the investment must be held for a set period (usually several years) before it can be resold. This approach supports Dominica’s economic growth [2,5]. Like the Fund option, additional government and due diligence fees apply.

This option offers the added advantage of acquiring citizenship while owning a tangible asset. Real estate investments can generate rental income and potential property appreciation, especially in tourism-related developments [2,5]. Investors in similar Caribbean markets often see annual returns of 3–5% on resort properties, though actual yields depend on the specific project and operator. Once the holding period is complete, properties can typically be resold, sometimes even to other CBI applicants, providing a clear exit strategy and potential profit. Non-residents also benefit from no capital gains tax on these transactions [2,6]. Importantly, citizenship is permanent, even if the property is sold after the holding period, allowing investors to reallocate their capital while retaining their Dominica passport [4,5].

Comparison of Caribbean Residency Programs

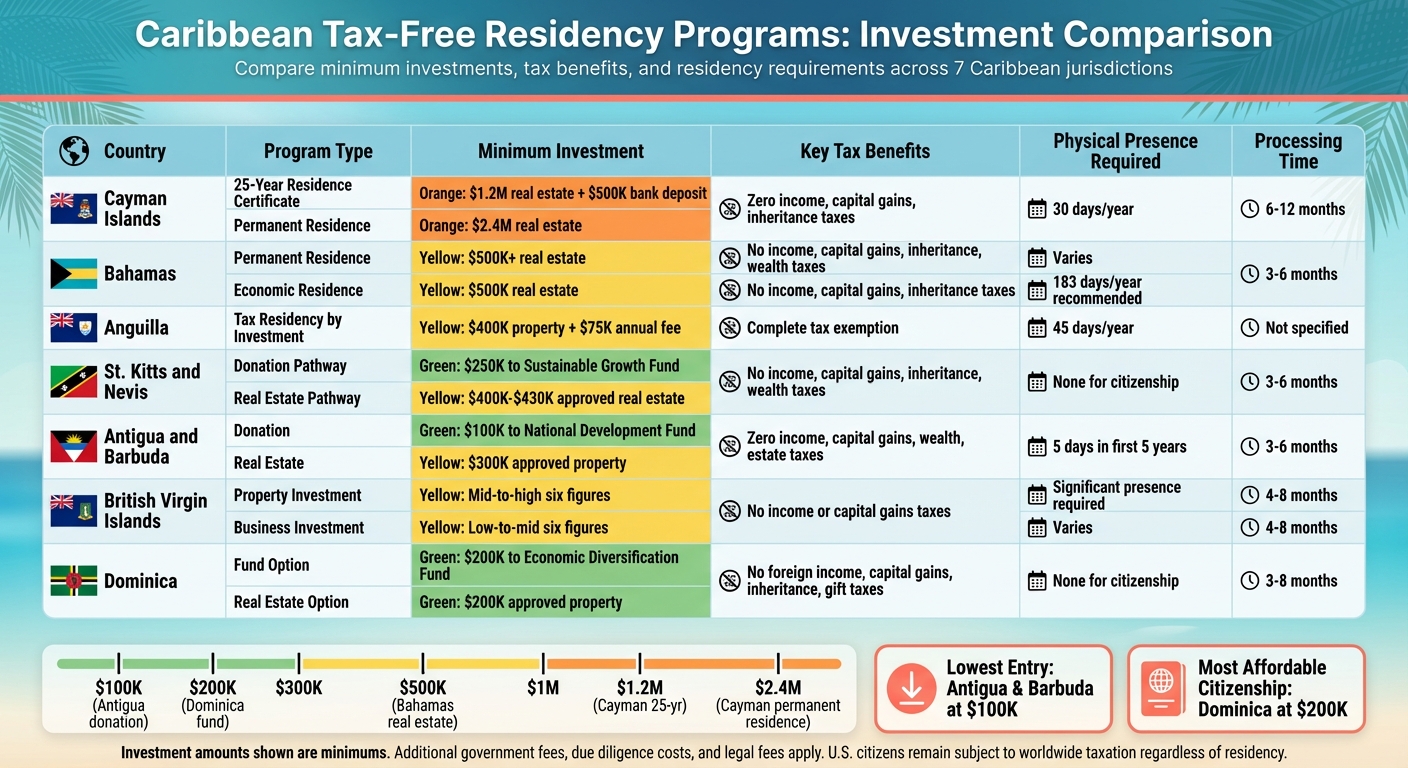

Comparison Table

When considering Caribbean residency or citizenship programs, there’s a lot to weigh: investment requirements, tax breaks, and physical presence rules vary significantly. The table below provides a side-by-side look at the essential details for each program, making it easier to compare costs, tax perks, and the path to permanent status or citizenship.

| Country | Program Type | Minimum Investment | Key Taxes Eliminated | Physical Presence Requirement | Status Granted | Typical Processing Time |

|---|---|---|---|---|---|---|

| Cayman Islands | 25-Year Residence Certificate | $1,200,000 (real estate) + $500,000 (bank deposit) | Income, capital gains, property, inheritance | 30 days per year | 25-year residence certificate | 6–12 months |

| Cayman Islands | Permanent Residence | $2,400,000 (real estate) | Income, capital gains, property, inheritance | 90 days per year (with work rights after 5 years) | Permanent residence | 6–12 months |

| Bahamas | Permanent Residence | $500,000 investment | Income, capital gains, inheritance | Varies by option | Permanent residence | 3–6 months |

| Bahamas | Economic Residence | Property purchase (amount varies) | Income, capital gains, inheritance | Minimal requirement | Annual residence | 3–6 months |

| Anguilla | Tax Residency by Investment | Amount varies | Virtually all taxes | 183+ days per year for full tax residency | Residency-by-investment | Not specified |

| St. Kitts and Nevis | Citizenship-by-Investment (Real Estate) | $200,000–$400,000 (real estate) | Income, capital gains | No physical presence required for citizenship | Citizenship (visa-free access to over 156 countries) | 4–8 months |

| Antigua & Barbuda | Citizenship-by-Investment (Donation) | $100,000 donation | Income | 5 days of residence in the first 5 years | Citizenship (visa-free access to over 150 countries) | 4–8 months |

| Antigua & Barbuda | Citizenship-by-Investment (Real Estate) | $300,000 (real estate) | Income | 5 days of residence in the first 5 years | Citizenship (visa-free access to over 150 countries) | 4–8 months |

| British Virgin Islands | Residency via Investment | $400,000+ (property) | Income, capital gains | Varies by option | Residency | 4–8 months |

| Dominica | Citizenship-by-Investment (Fund) | $200,000 donation | Income (foreign), capital gains, inheritance, gift | No physical presence required for citizenship | Citizenship (visa-free access to over 150 countries) | 3–8 months |

| Dominica | Citizenship-by-Investment (Real Estate) | $200,000 (real estate) | Income (foreign), capital gains, inheritance, gift | No physical presence required for citizenship | Citizenship (visa-free access to over 150 countries) | 3–8 months |

This table highlights the wide range of investment levels and residency rules across the Caribbean. Some programs, like those in Dominica and Antigua & Barbuda, are more budget-friendly, while others, like the Cayman Islands and Bahamas, demand larger investments but come with strong infrastructure and proximity to the U.S.

It’s worth noting that many citizenship-by-investment (CBI) programs don’t require physical residency, but acquiring citizenship doesn’t automatically make you a tax resident – especially for U.S. citizens, who remain taxed on worldwide income.

Other considerations, like double tax treaties, OECD transparency requirements, and CRS/FATCA compliance, can affect the actual benefits of these programs. For U.S. citizens, working with professionals to set up offshore entities, trusts, and residency strategies can help navigate regulations and maximize tax efficiency.

How Caribbean Residency Works with Global Wealth Protection Services

Caribbean residency offers a strategic foundation for tax and legal planning. When combined with Global Wealth Protection‘s (GWP) services – like offshore companies, private US LLCs, and asset protection trusts – it creates a seamless global tax strategy. GWP ensures all elements, from residency to banking and trust planning, work together to support wealth management that complies with legal requirements.

Expanding on the Caribbean programs mentioned earlier, Global Wealth Protection customizes solutions to leverage the unique benefits of each jurisdiction. A GWP advisor evaluates your priorities – such as tax obligations, travel preferences, lifestyle, budget, and risk tolerance – and matches them with the strengths of specific locations:

- Cayman Islands: Perfect for high-net-worth individuals who value a prestigious financial hub with no income, company, or property taxes, though it comes with higher real estate investment thresholds.

- Bahamas and BVI: Ideal for those seeking zero personal income tax, proximity to the United States, or access to a strong corporate services ecosystem.

- St. Kitts & Nevis, Antigua, and Dominica: Great options for citizenship-by-investment seekers, offering lower entry costs (ranging from $200,000 to $400,000) and flexible residency requirements.

- Anguilla: A strong choice if you need both tax residency and asset protection trusts.

For non-US individuals, GWP can structure a private US LLC to facilitate client billing and access to US banking and payment systems. Profits from these LLCs can flow to the owner’s Caribbean tax residency, where there’s no local income or capital gains tax. Meanwhile, asset protection trusts in places like Anguilla and Nevis provide strong legal safeguards by separating asset ownership from your personal name, reducing vulnerability to lawsuits or creditor claims.

GWP also offers a membership program called GWP Insiders, which includes strategy calls, jurisdiction recommendations, and model structures. This membership helps clients understand how relocating to a Caribbean jurisdiction interacts with US tax rules, exit tax exposure, and existing business entities. Members stay informed about regulatory updates, such as changes in citizenship-by-investment programs or residency requirements, and receive practical advice on banking, compliance risks, and KYC (Know Your Customer) expectations. After securing residency, GWP Insiders supports ongoing optimization through annual reviews, adjustments to corporate and trust setups, and planning for major financial events like business sales or liquidity events.

A private consultation brings everything together – residency, entity selection, and trust planning – into a comprehensive, actionable strategy. This approach integrates Caribbean residency or citizenship with factors like existing passports, home-country tax rules, corporate ownership, banking, and personal goals. GWP also examines critical issues, including CFC rules, substance requirements, anti-avoidance laws, and US reporting obligations, ensuring your plan is both effective and compliant. The consultation provides clear timelines, cost estimates, and guidance on the best order to implement steps, such as whether to start with residency, restructure entities, or establish trusts.

Conclusion

Caribbean tax-free residency programs offer a compelling mix of financial and lifestyle advantages. With no income, capital gains, inheritance, or wealth taxes, these programs allow investors to safeguard and grow their wealth while enjoying perks like English-speaking communities and close proximity to the United States. Depending on the jurisdiction, investment thresholds vary, offering options such as citizenship-by-investment, residency-by-investment, or establishing a business presence – each catering to different financial goals and personal circumstances.

However, taking full advantage of these benefits requires more than just obtaining tax residency. Success hinges on aligning your residency choice with a broader wealth management strategy. This includes meeting physical presence requirements, properly exiting high-tax jurisdictions, and leveraging tools like offshore entities and asset protection trusts. For instance, real estate investors can often see annual returns of 3–5% tax-free while building equity in approved properties – provided ownership structures are compliant with CRS and FATCA regulations.

The choice of jurisdiction ultimately depends on your priorities. The Cayman Islands, for example, is ideal for high-net-worth individuals seeking a prestigious financial hub with a 25-year tax guarantee. Dominica, on the other hand, offers affordable citizenship options starting at approximately $200,000. Antigua and Barbuda stand out with low investment thresholds and visa-free travel to over 150 countries. For those prioritizing lifestyle and business opportunities, the Bahamas and the British Virgin Islands offer a blend of proximity to the U.S. and strong corporate ecosystems. Anguilla is particularly appealing for those seeking tax residency benefits paired with robust asset protection.

To navigate these opportunities effectively, consider partnering with Global Wealth Protection advisors. They can help integrate Caribbean residency with strategies like entity structuring, trust planning, banking solutions, and exit strategies. This ensures compliance with economic substance requirements, anti-avoidance rules, and reporting obligations, while also minimizing global tax liabilities. Ultimately, the most effective plans treat residency as just one piece of a broader, multi-jurisdictional wealth management approach that adapts to regulatory changes and personal needs.

FAQs

What tax advantages can investors gain by becoming residents in Caribbean countries?

Investors have the opportunity to enjoy major tax advantages by securing residency in Caribbean nations. These countries often boast little to no income tax, no capital gains tax, and no inheritance tax, making them appealing for those looking to safeguard and grow their wealth.

Beyond tax benefits, Caribbean residency offers greater financial privacy and strong asset protection thanks to investor-friendly regulations. With the right strategies in place, individuals can lower their global tax obligations while taking full advantage of the region’s lively culture and expanding business prospects.

What are the investment requirements for Caribbean residency programs?

Investment requirements for Caribbean residency programs differ significantly from one country to another. Some countries set high financial thresholds, often requiring applicants to invest in real estate or contribute to government-approved funds. On the other hand, certain nations provide more affordable pathways, focusing on economic contributions, business ventures, or lower minimum investment amounts.

These programs aim to draw investors by offering perks like tax incentives, enhanced global mobility, and a simplified route to residency. To find the best fit, it’s essential to carefully examine the unique criteria of each program and match them with your financial capabilities and personal objectives.

Can I work or start a business if I obtain Caribbean residency or citizenship?

Yes, securing Caribbean residency or citizenship often opens the door to working or starting a business, though the specifics depend on the country and program you choose. Many Caribbean nations have policies designed to encourage investment, making it easier for entrepreneurs to establish or grow their businesses, as long as they comply with the legal and regulatory frameworks.

These programs can be especially appealing for investors looking to reduce tax burdens or broaden their global footprint. To maximize these opportunities, it’s essential to understand local laws and plan carefully.